Compliance Updates

EGBA Supports Changes to Poland’s Tax Base for Online Sports Betting

According to a new opinion paper by Professor Konrad Raczkowski, Poland’s former finance minister, replacing Poland’s high turnover-based tax for online sports betting with a tax based on gross gaming revenue (GGR) would contribute to a more viable and attractive online gambling market for the country’s sports bettors and raise more tax revenues for the state.

The EGBA supports changes to Poland’s tax base for online sports betting and the introduction of a sensible GGR-based tax in the country.

Poland’s current 12% turnover tax on online sports betting, equal to a 55-65% GGR tax, is one of the highest online sports betting taxes in the EU. According to Professor Raczkowski, only 2 out of the 20 companies which hold online sports betting licenses in the country turn a profit. As a result, over 20% of Polish bettors use websites which are neither licensed, regulated nor taxed in Poland, which is one of the lowest channelisation rates in Europe.

To correct this, Professor Rackowski recommends a GGR tax of around 20% to “achieve a real decrease in the size of the shadow economy [grey market] in Poland’s bookmaking industry”. The EGBA believes that such a GGR tax rate is sensible, in line with other European countries, would reduce offshore gambling, by providing Polish sports bettors with more choice locally and incentivising most of them to play with Poland’s regulated sports betting websites, and consequently generate more tax revenues for the state.

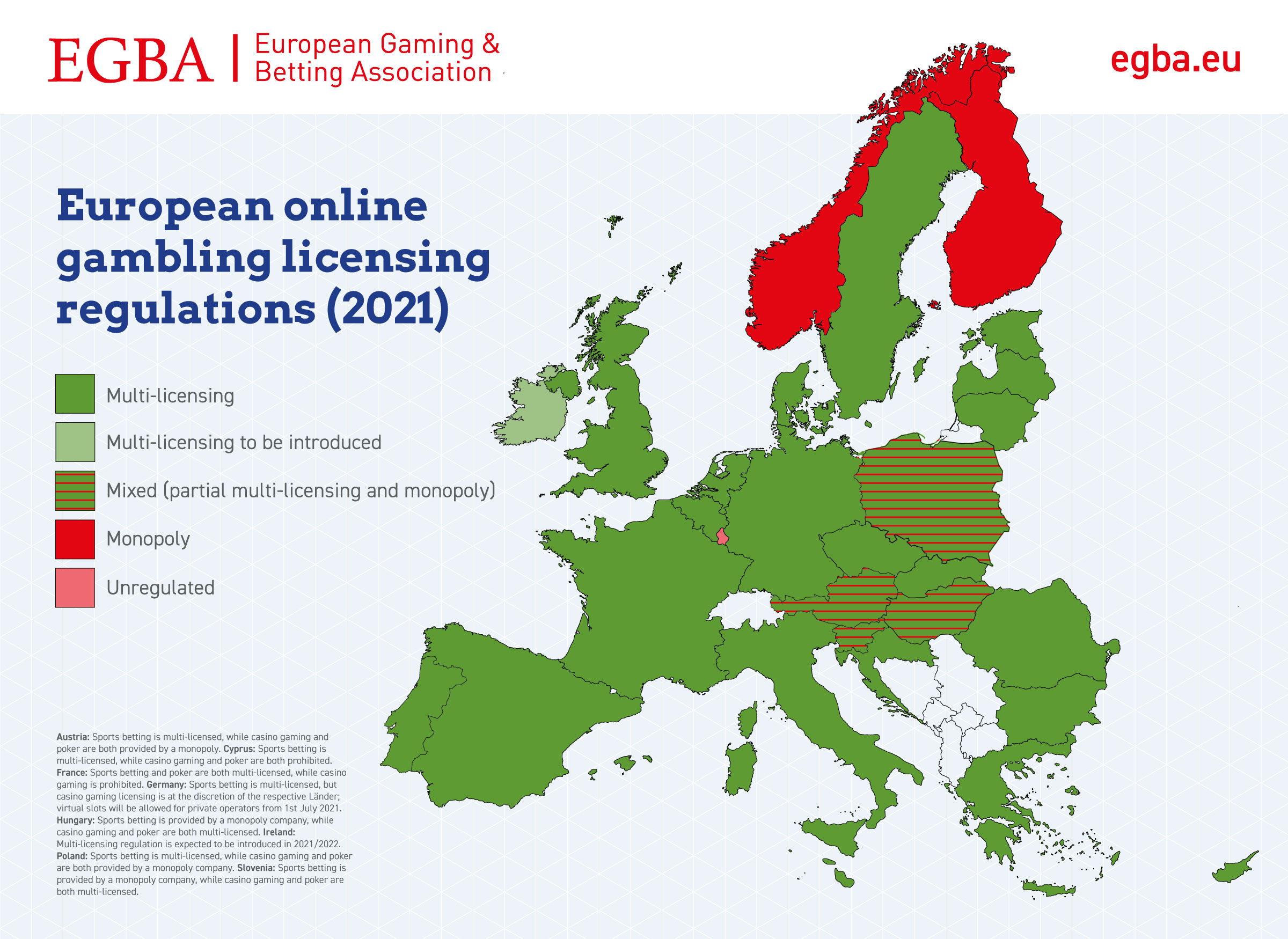

Evidence from other European countries (and the US) shows that a sensible GGR-based tax of around 20% is a pre-requisite to ensure that an online gambling market is viable: that most of a country’s bettors play within the regulated environment, on websites which are licensed in that country, and apply its consumer protection measures for online gambling. EGBA also believes that a multi-licensing regime for online casino and poker in Poland, which is currently provided by a monopoly, would also help better meet the needs and expectations of Poland’s bettors.

“EGBA welcomes the ongoing discussions on the future of Poland’s online gambling regulation and supports changes to the tax base for online sports betting. The current turnover tax is punitively high and not conducive to a viable online gambling market which meets the needs and expectations of Polish players. Poland is a large gambling market and has a great love for sports, and a sensible GGR-based tax would be an incentive for virtually all Polish players to play with regulated websites and for more of Europe’s betting companies, including EGBA members, to consider applying for an online sports betting license. These companies would not only support Polish sports through sponsorships and other revenues, but also pay gaming taxes and contribute to a more viable market which is attractive to Polish bettors and offers them a safe and regulated environment to play in,” Maarten Haijer, Secretary-General of EGBA, said.

Powered by WPeMatico

Baltics

Estonia to Reinstate 5.5% Online Gambling Tax From March 1

Lawmakers in Estonia are set to approve a technical fix restoring the gambling tax to online casinos, closing a legislative error that briefly left remote gambling exempt.

The Riigikogu will hold a final vote on an amendment to the Gambling Tax Act introduced by MP Tanel Tein (Eesti 200). The latest change corrects wording adopted late last year that inadvertently exempted online casinos from Estonia’s gambling tax.

The amendment clarifies that both games of chance and games of skill offered as remote gambling are taxed on the same basis. By deleting the term “game of skill” from one provision in the legislation, a uniform 5.5% gambling tax will apply to both categories.

The Riigikogu’s Finance Committee adjusted the timeline initially set out in the amendment, setting March 1, 2026, as the effective date.

Under current law, gambling taxes are assessed on a monthly basis, making the start of a new calendar month the standard point for changes to take effect.

This aligns with the current IT systems and operating practices of both market participants and the Estonian Tax and Customs Board (MTA).

The fix is linked to legislation passed in December and effective since January 1 that was intended to boost funding for sports and culture through gambling tax revenues. Restoring equal taxation is expected to reestablish legal clarity for both operators and the tax authority.

The post Estonia to Reinstate 5.5% Online Gambling Tax From March 1 appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Compliance Updates

NCPG Board of Directors Calls on Prediction Market Operators to Promote the National Problem Gambling Helpline

The Board of Directors of the National Council on Problem Gambling (NCPG) has passed a resolution on February 9, calling on prediction markets to promote the National Problem Gambling Helpline, arguing that event contract trading is similar to other types of betting and poses the same risks for consumers.

In the resolution, the NCPG urged “all Prediction Market Operators serving U.S. consumers” to add “clear, prominent, and ongoing promotion” of the helpline number 1-800-MY-RESET across both “marketing and on-platform user experience.”

The organization said prediction market operators should display the messaging “in a manner that is comparable to practices in regulated mobile sports betting.”

The NCPG said the helpline offers “nationwide free, confidential, and 24/7 support and resources” for people experiencing gambling-related harm. The group also said it maintains a neutral stance on legalized gambling.

The post NCPG Board of Directors Calls on Prediction Market Operators to Promote the National Problem Gambling Helpline appeared first on Americas iGaming & Sports Betting News.

Andrew Rhodes

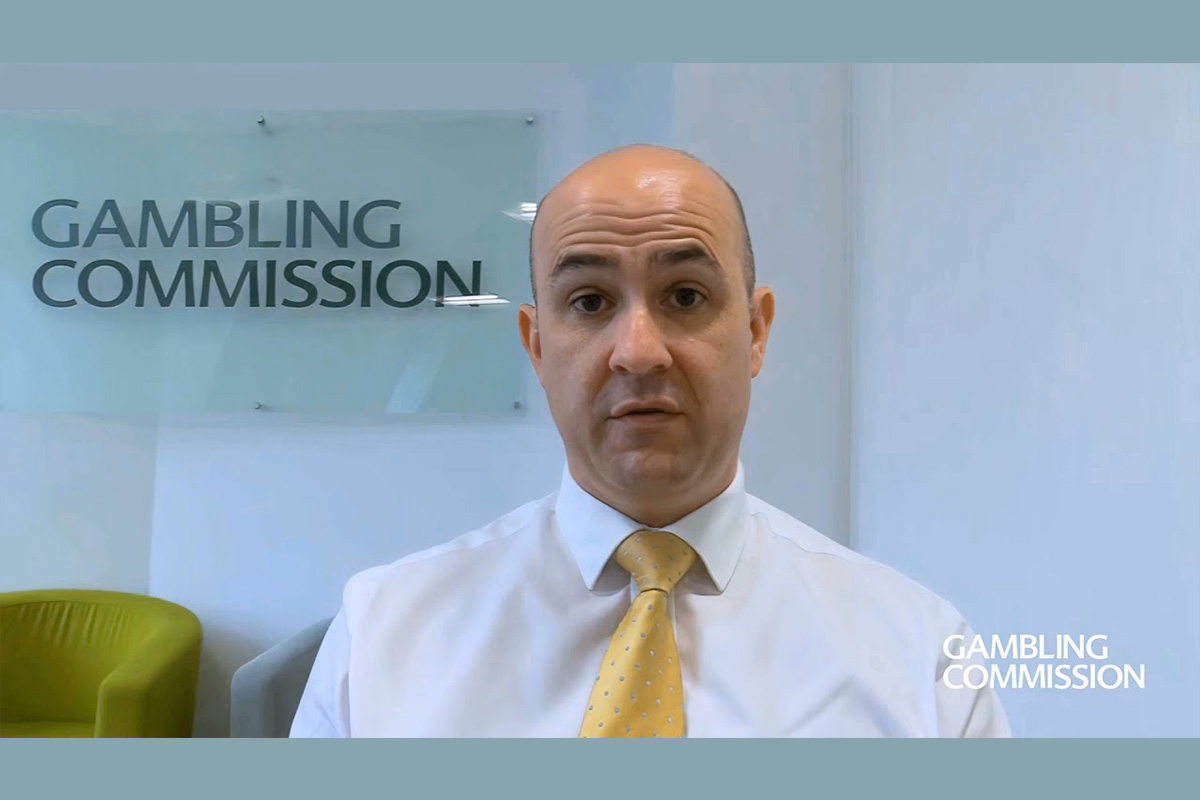

Andrew Rhodes to Step Down as CEO of UK Gambling Commission

The UK Gambling Commission has announced that Andrew Rhodes has decided to leave the Commission on 30 April 2026, to take up a new role, which will be announced in due course.

Andrew has provided outstanding leadership of the Commission for almost five years and has overseen a transformation of the Commission and how it regulates the gambling Industry.

Andrew has led the work required from the Commission to implement the Gambling Act Review, with a strong focus on consumer safeguards. This has included the introduction of financial vulnerability checks, reducing the intensity of online games, and banning potentially harmful marketing offers. He has also overseen the introduction of the Gambling Survey for Great Britain, now one of the largest surveys of gambling behaviour in the world.

Amongst his other achievements, Andrew oversaw the successful implementation of the Fourth National Lottery licence and transformed the Commission’s approach to regulation through more robust and outcome-focused strategies.

He said: “It has been a privilege to lead the Gambling Commission through such an important period of change. I am proud of the progress we have made to strengthen regulation, improve consumer protections, and ensure gambling is safer and fairer. I leave with confidence in the organisation, its people, and the work still to come.”

Charles Counsell, Interim Chair of the Gambling Commission, said: “Andrew has provided outstanding leadership for nearly five years and leaves a strong legacy. He has led the Commission through major reform, strengthened our regulatory approach, and ensured consumer protection has remained at the heart of our work. On behalf of the Board, I would like to thank Andrew for his dedication and wish him every success in the future.”

The Commission will shortly begin the process of recruiting a Chief Executive for an interim period. Deputy Chief Executive Sarah Gardner will step up as Acting Chief Executive to cover the areas of work that Andrew will step back from during this transitional period.

The post Andrew Rhodes to Step Down as CEO of UK Gambling Commission appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Amusnet6 days ago

Amusnet6 days agoWeek 6/2026 slot games releases

-

Arshak Muradyan7 days ago

Arshak Muradyan7 days agoDigitain Secures UKGC Certification for Sportsbook and Platform

-

Latest News6 days ago

Latest News6 days agoHyper Gems — A New Cosmic Adrenaline Release from Dream Play

-

Compliance Updates3 days ago

Compliance Updates3 days agoIllinois Gaming Board and Attorney General’s Office Issue more than 60 Cease-and-Desist Letters to Illegal Online Casino and Sweepstakes Operators

-

Latest News3 days ago

Latest News3 days agoLaunch Of A Fresh Online Casino Guide 2026

-

Compliance Updates7 days ago

Compliance Updates7 days agoDutch Regulator Urges Online Gambling Providers to Stop Using “Share Your Bet” Feature

-

Canada3 days ago

Canada3 days agoINCENTIVE GAMES PARTNERS WITH LOTO-QUÉBEC TO LAUNCH REAL-MONEY GAMES IN THE PROVINCE OF QUÉBEC, CANADA

-

Always Up! x100003 days ago

Always Up! x100003 days agoRing in the Chinese New Year with BGaming’s Seasonal Promotion