blask

When LATAM gambles: Blask reveals seasonality patterns across six countries

blask

When LATAM gambles: Blask reveals seasonality patterns across six countries

Brazil, Argentina, Mexico, Chile, Peru, and Colombia — six markets, six regulatory environments, six distinct player bases. Yet they share the same underlying drivers: domestic football leagues wrapping up in Q4, mandatory year-end bonuses injecting billions into the economy, and national holidays that can stretch into week-long celebrations.

The regional patterns are clear, the local nuances — less so. Peru’s players favor daytime weekend sessions while Mexico sees peak activity at 2 AM. Chile’s biggest month isn’t December but September. Colombia’s engagement follows primetime TV schedules almost exactly.

We used Blask’s Seasonality feature to analyze player activity across all six markets and map when engagement peaks — by month, by day, and by hour. Here’s what the data shows.

Brazil: Q4 convergence

Three factors converge at year’s end to make November–December the peak season. The Brasileirão wraps up in early December, with title races and relegation battles driving betting interest through the final matchdays. Copa Libertadores semis and final fall in October–November — and Brazilian clubs have won seven straight editions, keeping local engagement at maximum.

The timing also aligns with the décimo terceiro, Brazil’s mandatory 13th salary paid in two installments by November 30 and December 20. In 2024, this injected R$321 billion into the economy, part of which flows into entertainment spending, including betting.

Saturday edges out Sunday as the peak day, driven primarily by the Brasileirão match schedule — most fixtures are concentrated on Saturday evenings, creating a natural betting window around live games.

Weekends see the highest activity, with a notable spike between 1 AM and 5 AM on Friday-to-Saturday nights. After a long workweek, players unwind with casino games and place bets on upcoming weekend fixtures.

Argentina: Aguinaldo season

December stands out as the peak month, driven by the same mechanics as Brazil: the Liga Profesional wraps up in mid-December, and the aguinaldo (Argentina’s mandatory 13th salary) lands in two installments — by June 30 and December 18. The year-end payout coincides with league finales and playoff drama, creating a natural surge in betting activity.

Sunday leads the weekly cycle, with Saturday close behind — both days see concentrated Liga Profesional fixtures.

The peak window of midnight to 3 AM on Saturday-to-Sunday nights reflects pre-match anticipation. Players stay up late placing bets on Sunday’s fixtures and unwinding with casino games after the week ends.

Mexico: Liguilla time

December marks the peak month, coinciding with the Liga MX Apertura playoffs (Liguilla) that culminate in the championship final in mid-December. The aguinaldo — Mexico’s mandatory Christmas bonus equivalent to at least 15 days’ salary — must be paid by December 20, injecting extra disposable income right as the league crowns its champion.

Sunday leads the weekly cycle, with Saturday close behind. Liga MX spreads fixtures across the week, but weekend evenings remain prime time, with regulations requiring final-round matches to be played on Sunday prime time to maximize TV audiences.

The consistent 2–3 AM peak across all days — amplified on weekends — points to a strong late-night gambling culture. This suggests casino verticals (slots, crash games, live dealer) drive the pattern as much as sports betting, with players staying up late regardless of whether matches are on.

Chile: Fiestas Patrias peak

September dominates the calendar thanks to Fiestas Patrias — Chile’s most important national holiday, celebrated more intensely than Christmas. The festivities center on September 18-19 but often stretch into a full week when dates align favorably. Fondas (temporary festival venues) stay open late with music, dancing, and drinking, creating a nationwide party atmosphere that naturally spills over into online gambling.

Saturday is the clear leader, with activity elevated throughout the entire day. The strongest peaks hit around midnight on Friday-to-Saturday nights and again during Saturday afternoon (3–5 PM local time) — a pattern that suggests both late-night casino sessions and daytime sports betting on weekend fixtures.

Peru: Purple month

October–November emerges as the peak period, with November slightly ahead. The timing aligns with the Clausura tournament’s decisive final stretch — Liga 1 wraps up its regular season in early November before playoffs. October is also Peru’s “purple month” dominated by Señor de los Milagros, the country’s largest religious festival with massive processions on October 18, 19, and 28. The celebrations flow directly into All Saints’ Day (November 1) and Day of the Dead (November 2), creating an extended festive atmosphere across both months.

Saturday and Sunday share the spotlight, with Liga 1 fixtures spread across both weekend days. The emphasis on morning and afternoon hours — rather than late night — distinguishes Peru from its neighbors.

The daytime activity pattern on weekends (morning to afternoon) likely reflects match kick-off times and a cultural preference for daytime leisure. Unlike Brazil or Mexico where late-night casino sessions drive activity, Peru’s peak hours suggest sports betting around live Liga 1 fixtures takes precedence over casino play.

Colombia: Cuadrangulares and prima de servicios

November takes the lead as peak month, with October close behind. The Torneo Finalización enters its decisive phase during these months — the cuadrangulares (semifinal groups) typically run through late October and November, with the championship final in mid-December. This playoff intensity coincides with anticipation of the prima de servicios, Colombia’s mandatory service bonus equivalent to half a month’s salary, due by December 20.

Sunday dominates the weekly cycle, with Saturday as a secondary peak. Liga BetPlay fixtures are spread across the weekend, but Sunday consistently draws the largest TV audiences and betting interest.

The evening peak on Sunday stands out — activity concentrates in prime time when Liga BetPlay matches are broadcast, suggesting sports betting drives the pattern more than casino play. Unlike markets with strong late-night casino cultures, Colombian players appear to time their gambling around live football action rather than after-hours sessions.

The bigger picture

The Q4 bonus cycle — décimo terceiro, aguinaldo, prima de servicios, gratificaciones — isn’t just a regional quirk. It’s a predictable liquidity event that hits six major markets within the same eight-week window, right as domestic football seasons reach their climax.

But timing isn’t uniform. A campaign that lands at 2 AM in Mexico might miss Peru’s daytime crowd entirely. September matters more than December in Chile. Sunday primetime drives Colombia, while Brazil peaks on Saturday nights.

The pattern is regional, but the execution has to be local.

The post When LATAM gambles: Blask reveals seasonality patterns across six countries appeared first on Americas iGaming & Sports Betting News.

Best AI Solution 2026

Blask Crowned Best AI Solution at SiGMA Eurasia Awards 2026

Blask, a market intelligence ecosystem powered by AI for the iGaming sector, has been awarded Best AI Solution 2026 at the SiGMA Eurasia Awards, which took place yesterday in Dubai.

The accolade honors Blask for utilizing artificial intelligence to address a persistent issue in iGaming: the absence of dependable, prompt, and comparable market data in both regulated and offshore markets. Blask provides hourly updated AI-generated market intelligence instead of depending on slow reports and surveys.

The platform integrates computer vision, natural language processing, and predictive modeling to autonomously identify iGaming brands globally, assess market size and revenue potential, and monitor competitive trends in almost real-time.

Operators, affiliates, game providers, regulators, and investors utilize its exclusive metrics, such as the Blask Index, BAP, APS, and CEB, to aid in making strategic and operational choices.

“This award is a strong validation of the approach we’ve taken from day one,” said Max Tesla, co-founder and CEO of Blask. “We didn’t want to build another analytics dashboard. We wanted to build AI infrastructure that shows what’s really happening in the market, especially in places where data simply doesn’t exist.”

The SiGMA Eurasia win marks Blask’s fifth major industry award. Previous recognitions include Best Tech at the iGB Affiliate Awards 2025, Rising Star in Casino Innovation at the SBC Awards, Startup of the Year at the Starlet Awards, and SiGMA Asia Startup Pitch 2024.

The post Blask Crowned Best AI Solution at SiGMA Eurasia Awards 2026 appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

blask

Greece Led Europe’s iGaming Growth in 2025 — Now the Drivers Are Fully Explained

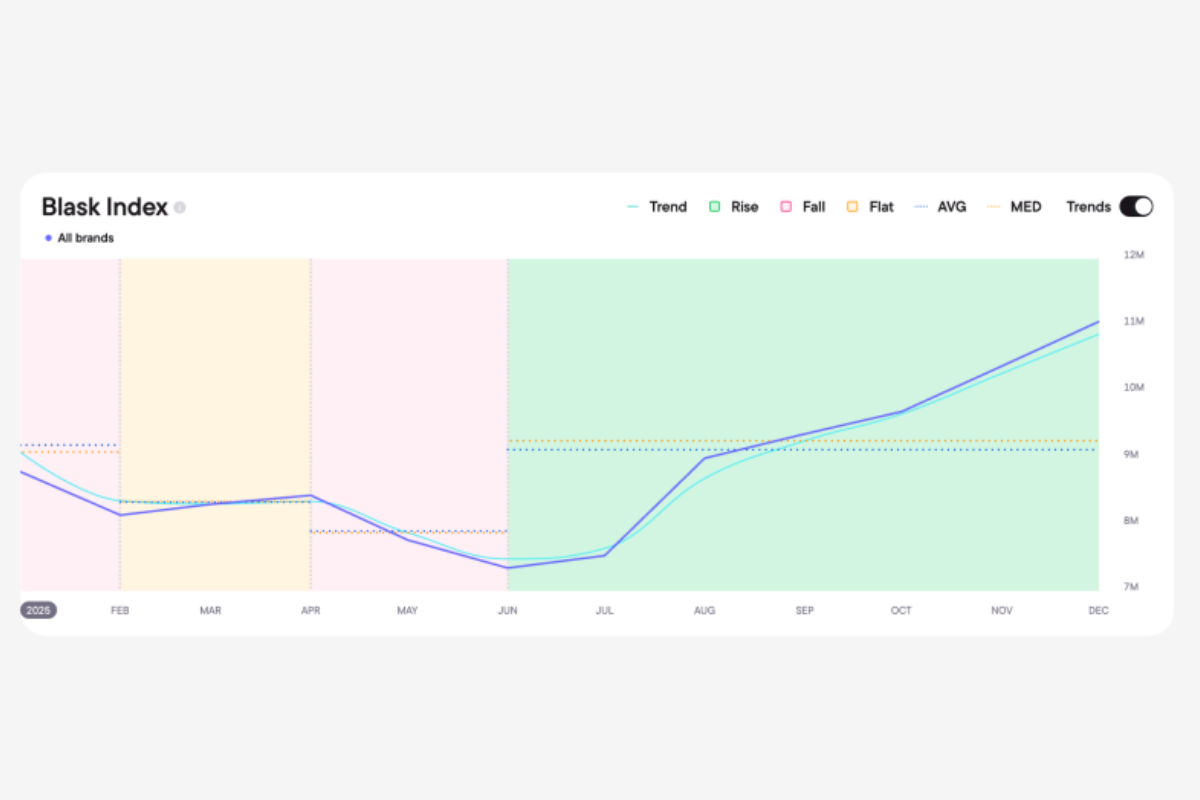

In the second half of 2025, Greece emerged as Europe’s fastest-growing iGaming market. While several major jurisdictions slowed or declined, Greek market demand rose by more than 50% between June and December, standing out as one of the year’s clearest growth stories.

According to data from Blask, the surge was not the result of a single tournament or seasonal spike. Instead, it reflected a structural shift driven by a combination of sports momentum, regulatory reform and casino market dynamics — factors that can now be traced in detail through Blask’s newly released Market Explanation feature.

Continuous sports momentum without demand gaps

Greece’s growth was underpinned by a tightly stacked sports calendar that sustained engagement across multiple months. EuroBasket 2025 in late August, the kickoff of the Stoiximan Super League, UEFA Champions League matchdays under the new league-phase format, and the EuroLeague season featuring Greek clubs created a continuous rhythm of high-interest betting cycles throughout autumn.

Rather than short-lived peaks followed by sharp declines, demand remained elevated well beyond individual events. This is a pattern clearly visible on the Blask Index trend line.

Casino reform reshaped demand behavior

One of the most significant contributors came from the casino segment. Greece’s decision to raise RNG stake limits from €2 to €20 altered the mechanics of the market, allowing online casinos to absorb demand during sports off-peak periods.

As sports-led acquisition increasingly converted into casino play, operators reported double-digit iGaming growth. Market Explanation analysis shows that this effect persisted over time, confirming the shift as structural rather than seasonal.

Enforcement redirected demand to licensed operators

Regulatory action further reinforced the upward trend. In December, Greek authorities blocked approximately 11,000 illegal gambling domains. Instead of suppressing demand, the move redirected player interest toward licensed platforms, strengthening regulated market performance.

The impact was amplified by the adoption of IRIS instant payments, which reduced deposit friction and improved conversion from interest to activity.

From tracking trends to understanding causes

To surface these drivers, Blask has introduced Market Explanation — an AI-powered layer within the Blask Index that allows users to click on any country’s trend line and instantly see a sourced breakdown of the forces behind the movement. Sports calendars, regulatory changes, casino dynamics and macro factors are analyzed together, turning raw demand signals into actionable market context.

Greece’s 2025 performance illustrates how this approach changes market analysis. Rather than simply observing that demand is rising, operators, suppliers and investors can now see why it is happening — and which levers are shaping the trajectory of a market in real time.

The post Greece Led Europe’s iGaming Growth in 2025 — Now the Drivers Are Fully Explained appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Amusnet6 days ago

Amusnet6 days agoWeek 6/2026 slot games releases

-

Arshak Muradyan6 days ago

Arshak Muradyan6 days agoDigitain Secures UKGC Certification for Sportsbook and Platform

-

Latest News6 days ago

Latest News6 days agoHyper Gems — A New Cosmic Adrenaline Release from Dream Play

-

Compliance Updates3 days ago

Compliance Updates3 days agoIllinois Gaming Board and Attorney General’s Office Issue more than 60 Cease-and-Desist Letters to Illegal Online Casino and Sweepstakes Operators

-

Latest News3 days ago

Latest News3 days agoLaunch Of A Fresh Online Casino Guide 2026

-

Compliance Updates6 days ago

Compliance Updates6 days agoDutch Regulator Urges Online Gambling Providers to Stop Using “Share Your Bet” Feature

-

Canada3 days ago

Canada3 days agoINCENTIVE GAMES PARTNERS WITH LOTO-QUÉBEC TO LAUNCH REAL-MONEY GAMES IN THE PROVINCE OF QUÉBEC, CANADA

-

Always Up! x100003 days ago

Always Up! x100003 days agoRing in the Chinese New Year with BGaming’s Seasonal Promotion