Latest News

Kindred partners with EPIC Risk Management to test human intervention mechanisms on its Journey towards Zero

In the third quarter of 2022, Kindred Group’s share of revenue from harmful gambling was 3.8 per cent and the improvement effect was 82.6 per cent. During the quarter, efforts have been placed on further developing automated technological solutions to detect and engage with customers at risk. Looking to enhance strategic partnerships to propel early intervention, Kindred Group has entered a new collaboration with EPIC Risk Management.

In the third quarter of 2022, Kindred Group plc’s (Kindred) share of revenue from harmful gambling was 3.8 (3.3) per cent and the improvement effect after interventions decreased slightly to 82.6 per cent. During the past three quarters, the number has fluctuated between 3.3 and now 3.8 per cent. Focus continues to be on improving internal processes and utilising technological capacity to automate interventions and thereby improve close to real time capability to further engage with the customer at an earlier stage.

Reaching the ambition by the end of the fourth quarter next year is challenging, however Kindred remains fully dedicated on achieving its ambition of zero per cent revenue from high-risk customers. The Group has identified four critical areas to keep working on:

1. Shortening the time from detection to intervention as it is proven that raising awareness to customers early on is an effective way to stay in control

2. Continued investment in and collaboration with researchers to further understand gambling behaviours

3. Ensuring control tools are visible, understood and used in the right way

4. Improving transparency and knowledge sharing within the industry, customers, researchers, regulators and partners

|

Global statistics from Kindred Group |

Q4 2021 |

Q1 2022 |

Q2 2022 |

Q3 2022* |

|

Share of gross winnings revenue from high-risk players |

4.0 % |

3.3 % |

3.3 % |

3.8 % |

|

Improvement effect after interventions |

79.2 % |

83.1 % |

84.7 % |

82.6 % |

* 90 days rolling period between 21 June and 19 September 2022

“We have not seen a desired sequential development this quarter, however we have taken significant steps forward since launching our ambition in 2021. We have strengthened internal processes and aligned operations to continue our Journey towards Zero revenue from harmful gambling. We will continue to improve our technology and processes so that we increase our efficiency and speed in detecting and engaging with customers at risk. We know this has a positive effect. For the third quarter almost 83 per cent of detected customers improved their behaviour after we reached out to them”, says Henrik Tjärnström, CEO Kindred Group.

During the third quarter, Kindred has once again partnered with EPIC Risk Management to analyse and improve human intervention mechanisms. Through the collaboration, Kindred aims to ensure that manual interventions are better placed and motivate customers into healthier betting behaviour through the extensive knowledge and lived experience that EPIC offers. Partnerships are central to Kindred’s Journey towards Zero, as further collaboration between industry, regulators, researchers, and other key stakeholder groups is key to reach the ambition.

“I am delighted to be renewing and extending our partnership with Kindred over the next three years. Kindred were the first operator that we worked with, and they continue to show their commitment towards player protection by placing value in lived experience voices. Kindred have shown great ambition in reducing revenue from high-risk players and this partnership will ensure that EPIC remain part of that journey by providing industry leading consultation services”, says Dan Spencer, Director of Safer Gambling, EPIC Risk Management.

“We are on a long-term journey and our commitment goes beyond the end of 2023, but collaborations here and now like the one with EPIC are crucial for our future progress. They provide unique insights from which we can learn the best approach to manage gambling related harm from an individual perspective. We have always emphasized how important our work with stakeholders from research, treatment centers, and lived experience is. The collaboration with EPIC continues to highlight how these collaborations can help us reach our customers in a better way. I am grateful and proud to have this long-term collaboration with EPIC Risk Management”, concludes Henrik Tjärnström.

Powered by WPeMatico

Dota 2 esports

Esports Nations Cup 2026 Announces $45 Million Prize Fund for Players, Clubs, and National Teams

The Esports World Cup Foundation (EWCF) has officially announced the inaugural Esports Nations Cup (ENC) 2026, bringing a new national team-focused layer to the global esports calendar.

Set to debut in Riyadh, Saudi Arabia from November 2–29, 2026, the ENC will feature elite competition across 16 esports titles, emphasizing national pride, iconic rivalries, and global fan engagement.

The ENC 2026 introduces a $45 million funding commitment to empower players, coaches, clubs, and national teams through a structured and sustainable prize model. This investment supports the growth of esports globally and ensures fair, performance-based rewards for all participants.

Three-Part Prize Model: Players, Clubs, and National Teams

The ENC 2026 prize framework is designed to promote equality, transparency, and long-term growth across the esports ecosystem:

- $20 million directly awarded to players and coaches across 16 esports titles

- $5 million in club incentives for teams releasing players to participate, tied to player performance

- $20 million via the ENC Development Fund to support national team operations, logistics, travel, marketing, and program development

“National teams add a compelling layer to esports, rooted in identity and pride,” said Ralf Reichert, CEO of EWCF. “Our prize model rewards performance, supports clubs, and strengthens the long-term pathways for players and national programs.”

Player-Centric and Transparent Prize Structure

ENC 2026 guarantees all qualified participants at least three matches, with equal placement earning equal pay across all titles. Coaches are rewarded alongside players for the same placement. Key prizes include:

- First place: $50,000 per player

- Second place: $30,000 per player

- Third place: $15,000 per player

For team titles, payouts scale with roster size, ensuring consistent and fair distribution.

Global Growth and Rotating Host Cities

The ENC will rotate to major international cities after the Riyadh debut, establishing a biennial esports tournament that provides reliable structure for long-term planning by players, partners, and national federations.

Confirmed titles for ENC 2026 include Mobile Legends: Bang Bang, Trackmania, and Dota 2, with additional games to be announced soon.

A New Era for National Esports

By combining national representation with global esports professionalism, the ENC offers players a chance to compete for national pride while connecting fans to elite-level esports. Clubs benefit from performance-linked incentives, and national teams receive long-term support to expand development pathways and enhance competitiveness.

For updates and further information on the Esports Nations Cup 2026, visit esportsnationscup.com and follow ENC on X, Facebook, Instagram, TikTok, and YouTube, and the Esports World Cup Foundation on LinkedIn.

The post Esports Nations Cup 2026 Announces $45 Million Prize Fund for Players, Clubs, and National Teams appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

casino operator growth

Groove Shines at ICE Barcelona 2026 as the Go-To Growth Partner for iGaming Operators

Groove, the award-winning iGaming platform and aggregator, has emerged from ICE Barcelona 2026 as the definitive growth partner for ambitious operators in 2026.

The event marked a milestone for the brand, generating high-value partnerships and demonstrating strong market demand for an integrated, scalable, and commercially strategic platform.

Over the three-day summit, Groove positioned itself at the heart of strategic conversations with operators and providers seeking solutions for sustainable growth, market diversification, and deeper player engagement. With an unprecedented volume of meetings, a clear trend emerged: operators are moving beyond basic content access, seeking a collaborative, technology-driven partner to navigate global expansion.

“The energy and focus at ICE 2026 validated our core why: aggregation has evolved into a strategic growth discipline,” said Yahale Meltzer, Co-Founder and COO of Groove.

“Operators aren’t coming to us just for games—they are looking for a roadmap. They want a partner who can provide content, technology frameworks, and commercial tools, like Instant Tournaments, as a seamless growth engine. In a fragmented market, Groove’s integrated approach is not just an advantage—it’s a necessity for serious operators in 2026.”

Groove’s Strategic Edge: Global Content and Localized Growth

Groove’s unique ability to act as a single conduit for global content and localized strategy was a central theme at ICE. The platform’s agility enables operators to thrive in established regulated markets while tapping into high-potential verticals such as Sweepstakes and Crypto gaming. This differentiation empowers operators to diversify portfolios, increase revenue, and streamline operational efficiency.

“We engaged with operators who have concrete 2026 plans, from new entries in Latin America to strategic European expansions,” explained Giusy Campo, Business Development Director at Groove.

“My role is to translate platform capabilities into commercial velocity. At ICE, we moved decisively from concept to pipeline execution. The market recognizes Groove as a partner that delivers with precision.”

Partnerships and Collaboration: Driving Innovation

Groove strengthened its global network by connecting with game studios and exploring exclusive content and technical collaborations designed to deliver innovative gaming experiences faster.

“ICE is ultimately about partnership in its truest sense,” said Rachel Tourgeman, Head of Partnerships at Groove.

“The quality of dialogue with existing and potential partners was exceptional, covering hyper-localized game curation, tournament tools, and strategies for player retention. Groove’s model of acting as an extension of our partners’ teams—providing tools and strategic insight—is exactly what the market needs now.”

Looking Ahead: Defining Growth for 2026

Groove exits ICE Barcelona 2026 not merely as a platform provider, but as the go-to growth partner for the iGaming industry. With a fortified pipeline, strategic market mandate, and a focus on turning aggregation into accelerated growth, Groove is set to define the iGaming landscape in 2026, helping operators expand globally and engage players meaningfully.

For more information, visit groovetech.com.

The post Groove Shines at ICE Barcelona 2026 as the Go-To Growth Partner for iGaming Operators appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

betting app engagement

Inside NFL Stadiums: How Fans Are Driving Record Sports Betting Engagement During Live Games

During the latest NFL season, one of the most valuable arenas for sports betting engagement wasn’t online or at home—it was inside the stadium itself. Using insights from GeoComply Edge Stadium Data, analysts examined how fans interacted with betting apps while attending live NFL games, revealing a powerful convergence of fandom, technology, and real-time wagering.

Stadium Data, analysts examined how fans interacted with betting apps while attending live NFL games, revealing a powerful convergence of fandom, technology, and real-time wagering.

From the season opener at Lincoln Financial Field in Philadelphia to the final Wildcard Weekend matchup at Acrisure Stadium in Pittsburgh on January 12, GeoComply analyzed in-stadium activity across every NFL venue located in US states with legal sports betting. The findings provide a clear, data-driven picture of how live attendance influences digital betting behavior.

The result is a uniquely detailed view into in-stadium engagement, customer acquisition, and long-term bettor value, offering operators critical insight into where and when fans are most likely to engage.

GeoComply Edge Stadium Data: Visibility Others Don’t Have

GeoComply Edge is purpose-built to measure fan acquisition and betting engagement within precise stadium-level geofences. This advanced location intelligence allows sportsbooks and operators to identify which teams, games, and venues generate the strongest engagement, turning live events into actionable growth opportunities.

Rather than tracking generic app usage, GeoComply Edge delivers insights into:

- Which NFL games drive the highest in-stadium betting activity

- How frequently fans check betting apps during live action

- Where new sportsbook accounts are created inside stadiums

- How engagement varies by venue, team performance, and market maturity

This season-long data view highlights how in-person fandom directly translates into digital wagering behavior, offering a deeper understanding of the customer journey.

Growth Leaders: Stadiums Where Betting Engagement Is Accelerating

Five NFL stadiums stood out for year-over-year growth in geolocation checks and active betting accounts—two strong indicators of in-stadium betting engagement.

In many cases, increased engagement closely followed on-field success. Teams such as the Denver Broncos, Pittsburgh Steelers, New England Patriots, and Carolina Panthers returned to playoff contention after turnaround seasons, reigniting fan excitement and digital interaction.

The Las Vegas Raiders emerged as a notable outlier. Allegiant Stadium continues to function as a destination venue, attracting traveling fans from across the country and creating a uniquely strong in-stadium betting environment, independent of team performance.

Engagement Rate Leaders: Quality Over Volume

While total geolocation volume remains important, the most telling metric this season was engagement rate—the percentage of fans inside the stadium actively using betting apps during games.

Top-performing venues recorded 10% to 13% engagement, meaning nearly one in every eight fans accessed a sports betting app at least once while attending a live NFL game. This highlights the growing normalization of in-game wagering as part of the live sports experience.

New User Acquisition: Stadiums as Sportsbook Growth Engines

One of the most compelling insights from GeoComply Edge data is the consistent creation of brand-new betting customers inside NFL stadiums.

Leading venues generated new sportsbook sign-ups at rates between 0.2% and 0.7% of total attendance per game. For a typical 65,000-seat stadium, that translates to 130 to 450 new accounts per game.

GEHA Field, home of the Kansas City Chiefs, led all venues in new customer creation, benefiting from Missouri’s launch of mobile sports betting on December 1, 2025, during the Chiefs’ final three home games.

Reducing Friction with Compliant Onboarding

GeoComply supports operators at every stage of the customer journey. Through IDComply®, the company enables a fully compliant KYC process that delivers 95%+ onboarding success rates, while GeoComply Edge pinpoints where and when these high-value acquisition moments occur.

This dual approach allows sportsbooks to engage fans in a way that is timely, targeted, and non-intrusive, enhancing both compliance and customer experience.

Doing More With “Where” at Live Sporting Events

NFL stadiums have evolved into digital engagement hubs, where live entertainment, mobile technology, and sports betting intersect in real time.

GeoComply Edge Stadium Data brings clarity to this intersection by providing:

- Actionable insights into in-stadium betting behavior

- Clear visibility into acquisition and engagement trends

- A season-long perspective beyond single-game analysis

As the NFL continues to grow and fan experiences become increasingly digital, one conclusion is unmistakable: the future of sports betting is already unfolding inside the stadium.

The post Inside NFL Stadiums: How Fans Are Driving Record Sports Betting Engagement During Live Games appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Latest News6 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Games Global7 days ago

Games Global7 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Amusnet7 days ago

Amusnet7 days agoWeek 4/2026 slot games releases

-

affiliate marketing6 days ago

affiliate marketing6 days agoN1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Compliance Updates7 days ago

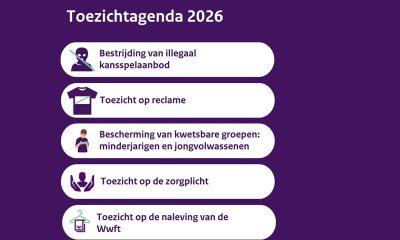

Compliance Updates7 days agoDutch Regulator Outlines 5 Key Supervisory Priorities for 2026 Agenda

-

BetPlay4 days ago

BetPlay4 days agoBlask Awards 2025: Betano, Caliente, BetPlay, Betsson and others define Latin America’s iGaming landscape

-

Latest News7 days ago

Latest News7 days agoALL THE ACTION, ALL THE DATES, POKERSTARS OPEN PHILADELPHIA SCHEDULE RELEASED

-

AI gaming platforms6 days ago

AI gaming platforms6 days agoBetConstruct AI Sets the Tone for 2026 iGaming with Harmony Choice Event in Barcelona