Canada

United States Addiction Rehab Industry Report 2020

The “The U.S. Addiction Rehab Industry – 5th Edition” report has been added to ResearchAndMarkets.com’s offering.

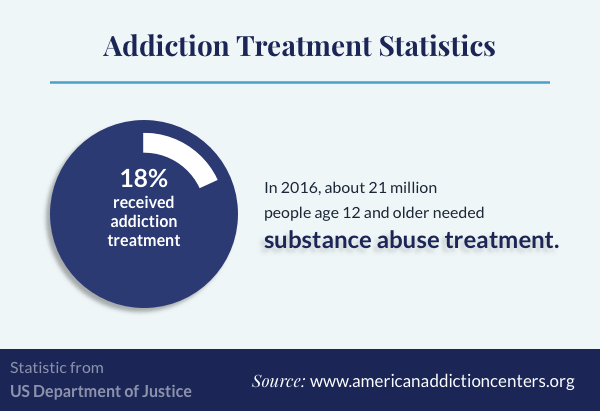

Drug, alcohol and other addiction rehab in the United States is big business – $42 billion this year.

There are now 14,000+ treatment facilities and growing. A total of 3.7 million persons received treatment, but many more need it and facilities are filled to capacity. Insurance coverage for rehab has increased, but scandals abound as shoddy facilities opened and patient brokering, overbilling and deceptive marketing became common. Reforms are pending. Private equity firms are investing.

This new study examines the nature of the business, types of rehab, reasons for the renewed growth of addiction rehab services since the Great Recession and the opioid crisis, national receipts/growth from 1983-2018, 2020 and 2025 forecasts, average facility revenues and operating ratios, industry structure and participation by non-profit, for-profit, inpatient and outpatient programs, extensive drug/alcohol abuser demographics. Discussion of the Florida Model, destination markets in FL and CA, effects of increased volume due to the Affordable Care Act, industry history and evolution, and discussion of all major industry trends.

Includes all the pertinent data compiled by SAMHSA’s latest government survey, data from the NIDA, NAATP, state agencies, and more.

9 in-depth company profiles are provided for: Hazelden Betty Ford Foundation, CRC Health Group, Promises Behavioral Health, Passage Malibu, American Addiction Centers, The Caron Foundation, Comprehensive Care Corp., Malibu Horizon Rehab Center, and Behavioral Health of The Palm Beaches.

COVID-19 Update July 2020:

The publisher has issued a free July 2020 update for this report, analyzing the probable impacts of the Covid-19 pandemic on drug & alcohol addiction treatment centers.

It discusses: operational changes, the shift to virtual visits, a shift to more outpatient care, impact on federal state and local program funding, findings of recent industry surveys, examples of reduced caseloads and state actions, potential facility closures, how the industry may actually benefit from the pandemic, and revised 2020 and 2025 market growth forecasts.

Key Topics Covered:

Introduction, Sources & Methodology Used

Executive Overview of Major Findings

Discussion of scope of U.S. alcohol and drug addiction problem, cost to society, impact of treatment, structure of treatment providers industry (no. of facilities by type), major industry trends and issue, industry size, growth and forecasts (1983-2025 F), effects of recessions and Affordable Care Act, outlook for 2020, list of leading treatment organizations/companies, user demographic highlights of 2019 SAMSHA government survey regarding scope of drug & alcohol abuse/usage/persons in treatment, client & facility characteristics – highlights of all report chapters.

Nature and Structure of the Industry

- Discussion of different types of centers (% for-profit, non-profit, private/government, by primary focus), typical programs offered, treatment programs by type site

- Discussion of indicators of program quality

- Inpatient vs. outpatient care, etc. (no. of facilities, patients served, occupancy rate, industry revenues, average revenues per facility, mean no. of clients per facility,

- Typical cost of rehab

- Demand for care: no. of persons that need treatment

- Discussion of the industry’s major problems and scandals (deceptive marketing, overbilling, patient brokering, fraud, etc.)

- Various types of rehab (drug, alcohol, sex addiction, gambling, Internet, post-traumatic stress),

- The 6 major types of rehab (philosophies – faith-based, evidence-based, 12-step, etc.)

Demographics -SAMHSA Survey Findings – Data on Substance Abusers

- Key statistics about national costs of drug & alcohol abuse, hospitalizations, opioid use

- Discussion of trends in illicit drug use, persons age 12 or older: (usage of marijuana, cocaine, heroin, hallucinogens, methamphetamine, nonmedical use of prescription drugs – number and percent of persons)

- Discuss trends in alcohol use, persons age 12 or older: (heavy drinking, binge drinking, current use – number and % of persons)

- Marijuana use – discussion, number and % of persons

- Cocaine use – discussion, number and % of persons

- Heroin use – discussion, number and % of persons

- Methamphetamine use – discussion, number and % of persons

- Inhalants use – discussion, number and % of persons:

- Hallucinogens use – discussion, number and % of persons:

- Psychotherapeutics use – discussion, number and % of persons:

- The Opioid epidemic: discussion, number and % of persons

Major Industry Trends & Issues

- Discussion of insurance fraud and overbilling, patient brokering, deceptive marketing

- Discussion of The Affordable Care Act and the Mental Health Parity and Addiction Equity

- Act and how it has upended the industry’s business model

- Compliance with evidence-based practices is spotty

- Private equity investors pour money into addiction treatment

- Attempts at reform: actions by Google, The Federal Support Act

- Discussion of The Opioid Crisis & Treatment, medically assisted treatment.

Industry Size, Growth, Segments, Forecasts

- Summary: Total industry size, estimates by government vs. other mkt. research firms, public vs. private spending/funding

- The treatment population: no. and % of people actually receiving treatment: 2018, payment by source of funds

- Number of treatment facilities in U.S., % treated by type facility, median no. of clients (total and by outpatient, residential, hospital, detox)

- Estimates of industry size ($ revenues): 2019 SAMHSA report, growth of private, public, out-of-pocket spending 2020 outlook and effect of Affordable Care Act, projected increase of persons in treatment, effects of recessions

- 2025 Forecast: major trends discussion: reliance on public financing, Medicaid, increased private insurance coverage, E-health, effect of recessions

- Discussion of Medicaid and Other State and Local Financing.

- The high-end market segment: discussion of the private pay marketplace, $ value

- Destination markets: discussion of the South Florida market, the “Florida Model”, history

- Discussion of the gambling addiction market: no. of problem gamblers, amount spent per year

- Sex addiction: discussion of why it has come into the mainstream, Tiger Woods and other celebrity publicity, types of treatment programs, list of top treatment centers.

Treatment Facility Operating Ratios

- U.S. Census Bureau ratios for mental health & substance abuse facilities (2017, 2012, 2007) – no. of facilities, revenues, avg. revenues per center, payroll costs, no. of employees (outpatient vs. inpatient centers) – summary

- Discussion of no. of clients per facility, mean cost of care, cost to treat per person, outpatient care

Competitor Profiles of the Leading Treatment Organizations and Multi-Center Chains

(For each organization, a discussion of: history/founding, description of major programs, services, estimated/actual revenues, no. of centers, fees, facilities operated, mergers, sold facilities, recent developments.)

- Hazelden Betty Ford Foundation

- CRC Health Group

- American Addiction Centers

- Promises Behavioral Health

- Passage Malibu

- The Caron Foundation

- Comprehensive Care Corp.

- Malibu Horizon Rehab Center

- Behavioral Health of The Palm Beaches

Directory of Industry Reference Sources

- Name/address/phone of drug & alcohol abuse-related industry trade associations, government reports, major EAP industry trade journals, hotline phone numbers, etc.

- List of state substance abuse agencies

For more information about this report visit https://www.researchandmarkets.com/r/lnnm5i

Powered by WPeMatico

AGCO

AGCO Fines Great Canadian Casino Resort Toronto $350,000 for Serious Regulatory Violations Linked to Impromptu After-Party on Gaming Floor

The Alcohol and Gaming Commission of Ontario (AGCO) has issued monetary penalties totaling $350,000 against Great Canadian Casino Resort Toronto for multiple violations of provincial gaming standards. The penalties follow an impromptu after-party that was permitted to take place in the pre-dawn hours directly on the casino’s gaming floor.

On September 27, 2024, an electronic dance music event attended by thousands of people was hosted in the theatre adjacent to the casino at Great Canadian Casino Resort Toronto. The event was marked by widespread intoxication, disorderly behavior, and numerous criminal and medical incidents – both inside and outside the venue – including alleged assaults, drug overdoses, and acts of public indecency. Although paid duty officers were present, additional police and emergency services were required to manage the situation.

In the midst of this high-risk environment, casino management approved an unscheduled request by the performing artist to host an after-party on the active gaming floor. The artist and more than 400 guests were permitted onto the gaming floor where the artist was allowed to perform amidst operational table games and gaming machines – without any prior risk assessment or planning.

As a result, security personnel were unable to effectively control the casino floor, including witness reports that an attendee was seen climbing onto slot machines. Failure to maintain appropriate control compromises the security, safety, and integrity of the casino floor. Following the conclusion of the event, the operator failed to promptly report these incidents to the AGCO as required.

Based on the findings of its review, the AGCO’s Registrar has issued an Order of Monetary Penalty (OMP) totaling $350,000 against Great Canadian Casino Resort Toronto. These penalties address critical failures in their operations, incident reporting, employee training, and the management of disturbances.

A gaming operator served with an OMP has 15 days to appeal the Registrar’s decision to the Licence Appeal Tribunal (LAT), an adjudicative tribunal that is part of Tribunals Ontario and independent of the AGCO.

“Casino operators have a fundamental duty to control their gaming environment. Great Canadian Casino Resort Toronto’s lapses in this incident compromised the safety of patrons and the security and integrity of the gaming floor,” Dr. Karin Schnarr, Chief Executive Officer and Registrar of AGCO, said.

The post AGCO Fines Great Canadian Casino Resort Toronto $350,000 for Serious Regulatory Violations Linked to Impromptu After-Party on Gaming Floor appeared first on Gaming and Gambling Industry in the Americas.

Canada

IGT and Atlantic Lottery Sign Eight-Year Video Lottery Central System Technology Agreement

International Game Technology PLC announced that its subsidiary, IGT Canada Solutions ULC (hereinafter “IGT”), signed an eight-year agreement with Atlantic Lottery to supply its IntelligenEVO video lottery central system technology across Atlantic Canada. The agreement includes the option for multiple extensions and positions the Atlantic Lottery to become the first World Lottery Association (WLA)-affiliated lottery operator to deploy IGT’s next-generation central management system in a game-to-system (G2S) distributed market.

“By leveraging IGT’s IntelligenEVO technology, Atlantic Lottery will power its video lottery network with the industry’s best-in-class central system and position itself to maximize future contributions to good causes. As an organization that prioritizes system security and exceptional player experiences, Atlantic Lottery believes that IGT’s IntelliegnEVO solution will help generate high player satisfaction and optimal network performance,” said Michael MacKinnon, Atlantic Lottery VP, Product.

“As a long-time supplier to Atlantic Lottery, IGT looks forward to helping the Lottery achieve its growth and player engagement goals with our leading-edge IntelligenEVO video lottery central system. IGT’s IntelligenEVO is a scalable technology for the WLA market that is backed by decades of experience and operator feedback, and maximizes the benefits of real-time data, cloud-based technologies and in-depth analytics,” said David Flinn, IGT SVP Canada, EMEA and LATAM, Gaming Sales.

With peak system security, network availability and responsible gaming functionalities, IntelligenEVO is a reliable, scalable solution that can meet the needs of today and in the future. The solution will accelerate time-to-market and enables the Atlantic Lottery to benefit from the system’s suite of player-focused functionality. The technology’s G2S and open API design optimizes data collection and delivery and will enable Atlantic Lottery to customize their program for evolving player needs.

The post IGT and Atlantic Lottery Sign Eight-Year Video Lottery Central System Technology Agreement appeared first on Gaming and Gambling Industry in the Americas.

BetRivers

NetGaming Goes Live in Ontario with Rush Street Interactive via BetRivers Platform

NetGaming, a fast-growing online casino content supplier, is proud to announce its launch in Ontario with Rush Street Interactive, Inc., a leading online casino and sports betting company in the United States, Canada and Latin America. This strategic collaboration marks a significant milestone for NetGaming as it continues to expand its footprint across regulated North American markets.

As part of the launch, Ontario players on BetRivers can now enjoy a diverse portfolio of NetGaming titles, known for their high-quality graphics, immersive gameplay, and unique themes. Standout games such as Zeus’s Thunderbolt, Bison Gold, and Fireball Inferno are among the first to go live, with additional titles set to follow soon.

This partnership is just the beginning. NetGaming plans to extend its collaboration with Rush Street Interactive into Michigan, New Jersey, Pennsylvania, Delaware, and Mexico over the coming months.

Pallavi Deshmukh, CEO of NetGaming, commented: “We are thrilled to go live with Rush Street Interactive, a powerhouse operator with a strong presence and loyal player base. This launch marks a significant milestone in our

North American expansion strategy and underscores our commitment to delivering exceptional gaming experiences tailored to local player preferences across the region.”

Richard Schwartz, CEO of Rush Street Interactive, commented: “We are pleased to partner with NetGaming to bring innovative, premium games to our players in Ontario. This collaboration aligns with our strategy to offer world-class

entertainment through engaging, action-packed online casino games. We look forward to expanding this partnership into additional regulated markets in the months ahead.”

This strategic partnership highlights both companies’ dedication to providing high- quality, innovative, and responsible entertainment to players in regulated markets.

The post NetGaming Goes Live in Ontario with Rush Street Interactive via BetRivers Platform appeared first on Gaming and Gambling Industry in the Americas.

-

Central Europe7 days ago

Central Europe7 days agoGerman Federal Government Significantly Increases the Budget for Games Funding

-

California State Assemblymember Avelino Valencia7 days ago

California State Assemblymember Avelino Valencia7 days agoNew Bill in California Could End Online Sweepstakes Gaming

-

Compliance Updates7 days ago

Compliance Updates7 days agoNew Initiative from DI Council Aims to Enable Betting on Professional Sports

-

Conference7 days ago

Conference7 days agoAmatic Industries Showcased its Latest Innovations at Peru Gaming Show 2025

-

Africa7 days ago

Africa7 days agoNew Governing Board of the Gaming Commission of Ghana Sworn in

-

Assist6 days ago

Assist6 days agoOdds Assist Launches Redesigned & Rebuilt Odds Assist Pro Providing +EV Bets, Arbitrage Bets, & Odds Comparison Tools for Sports Bettors

-

Latest News7 days ago

Latest News7 days agoWeek 26/2025 slot games releases

-

Compliance Updates7 days ago

Compliance Updates7 days agoNick Rust to Step Down as Chair of UKGC’s Industry Forum