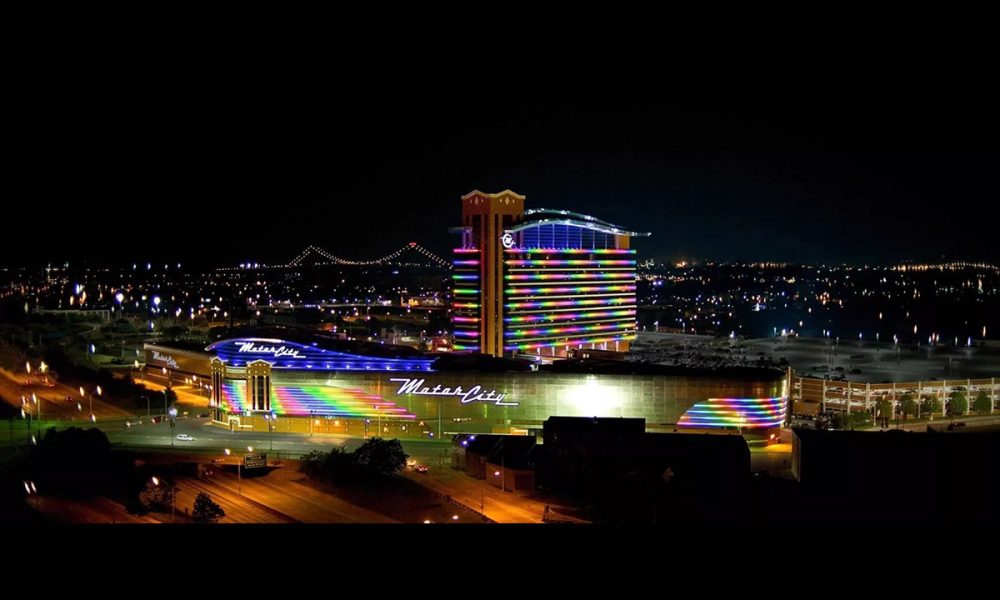

Detroit casinos

Detroit Casinos Report $104.9M in August Revenue

The three Detroit casinos reported $104.9 million in monthly aggregate revenue for the month of August 2023, of which $104.6 million was generated from table games and slots, and $322,186 from retail sports betting.

The August market shares were:

- MGM, 47%

- MotorCity, 30%

- Hollywood Casino at Greektown, 23%

Table Games and Slot Revenue and Taxes

August table games and slot revenue decreased 2.0% when compared to July 2023 results. August monthly revenue was 0.1% higher than August 2022. From January 1 through August 31, the casinos’ table games and slots revenue increased by 0.8% compared to the same period last year.

The casinos’ monthly gaming revenue results were mixed compared to August 2022:

- Hollywood Casino at Greektown, up 11.7% to $24.4 million

- MGM, down 1.7% to $49.5 million

- MotorCity, down 5.0% to $30.7 million

During August, the three Detroit casinos paid $8.47 million in taxes to the State of Michigan. They paid $8.46 million for the same month last year.

The casinos reported submitting $16.5 million in wagering taxes and development agreement payments to the City of Detroit in August.

Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported $10.0 million in total retail sports betting handle, and total gross receipts were $327,291.

Retail sports betting qualified adjusted gross receipts (QAGR) were down by 80.6% compared to August 2022. August QAGR was down by 32.5% compared to July 2023.

August QAGR by casino was:

- MGM: $85,644

- MotorCity: $195,955

- Hollywood Casino at Greektown: $40,587

During August, the casinos paid $12,179 in gaming taxes to the state and reported submitting $14,885 in wagering taxes to the City of Detroit based on retail sports betting revenue.

Fantasy Contests

For July, fantasy contest operators reported total adjusted revenues of $1.2 million and paid taxes of $101,324.

From January 1 through July 31, fantasy contest operators reported $13.4 million in aggregate fantasy contest adjusted revenues and paid $1.1 million in taxes.

Detroit casinos

Detroit Casinos Report $105.44M in June Revenue

The three Detroit casinos reported $105.44 million in monthly aggregate revenue (AGR) for the month of June 2024, of which $104.55 million was generated from table games and slots, and $889,014 from retail sports betting.

The June market shares were:

- MGM, 46%

- MotorCity, 30%

- Hollywood Casino at Greektown, 24%

Monthly Table Games, Slot Revenue, and Taxes

The casinos’ revenue for table games and slots for the month of June 2024 increased 2.6% when compared to the same month last year. June’s monthly revenue was 6.1% lower when compared to the previous month, May 2024. From Jan. 1 through June 30, the Detroit casinos’ table games and slots revenue increased by 0.4% compared to the same period last year.

The casinos’ monthly gaming revenue results were mixed compared to June of last year:

- MGM, up 3.6% to $48.71 million

- MotorCity, down 3.1% to $31.47 million

- Hollywood Casino at Greektown, up 9.0% to $24.37 million

In June 2024, the three Detroit casinos paid $8.5 million in gaming taxes to the State of Michigan. They paid $8.3 million for the same month last year. The casinos also reported submitting $12.4 million in wagering taxes and development agreement payments to the City of Detroit in June.

Monthly Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported $8.4 million in total retail sports betting handle, and total gross receipts were $894,867 for the month of June. Retail sports betting qualified adjusted gross receipts (QAGR) were down by 52.2% in June when compared to the previous month, May 2024.

June QAGR by casino was:

- MGM: $154,265

- MotorCity: $460,693

- Hollywood Casino at Greektown: $274,056

During June, the casinos paid $33,605 in gaming taxes to the state and reported submitting $41,072 in wagering taxes to the City of Detroit based on their retail sports betting revenue.

Fantasy Contests

For May 2024, fantasy contest operators reported total adjusted revenues of $806,636 and paid taxes of $67,757.

Detroit casinos

Michigan iGaming and Sports Betting Operators Report $234.8M in April Revenue

Michigan commercial and tribal operators reported a combined $234.8 million total internet gaming (iGaming) gross receipts and gross sports betting receipts in April. Gross receipts decreased 8.7% compared to last month.

Monthly Gross Receipts

April iGaming gross receipts totaled $192.9 million and gross sports betting receipts totaled $41.9 million. In March, gross sports betting receipts were $215.15 million and gross sports betting receipts were $41.93 million.

Monthly Adjusted Gross Receipts

Combined total iGaming and internet sports betting adjusted gross receipts (AGR) for April were $201.93 million, including $174.16 million from iGaming and $27.77 million from internet sports betting — representing an iGaming decrease of 10.4% and a sports betting increase of 4.1% when compared to last month. Compared to a year ago, in April 2023, iGaming AGR was up by 21.4% and sports betting was up by 13.3%.

Monthly Handle

Total April internet sports betting handle at $399.1 million was down by 16.9% from the $480.4 million handle recorded in March 2024.

Monthly State Taxes/Payments

The operators reported submitting $37.6 million in taxes and payments to the State of Michigan during April, of which:

iGaming taxes and fees = $35.8 million

Internet sports betting taxes and fees = $1.8 million

Monthly City of Detroit Taxes/Payments

The three Detroit casinos reported paying the City of Detroit $9.82 million in wagering taxes and municipal services fees during April, of which:

iGaming taxes and fees = $9.1 million

Internet sports betting taxes and fees = $724,986

Monthly Tribal Operators’ Payments

Tribal operators reported making $4.3 million in payments to governing bodies in April.

Detroit casinos

Detroit Casinos Report $109.44M in April Revenue

The three Detroit casinos reported $109.44 million in monthly aggregate revenue (AGR) for the month of April 2024, of which $107.87 million was generated from table games and slots, and $1.57 million from retail sports betting.

The April market shares were:

- MGM, 46%

- MotorCity, 30%

- Hollywood Casino at Greektown, 24%

Monthly Table Games, Slot Revenue, and Taxes

The casinos’ revenue for table games and slots for the month of April 2024 decreased 1.6% when compared to the same month last year. April’s monthly revenue was 11.8% lower when compared to the previous month, March 2024. From Jan. 1 through April 30, the Detroit casinos’ table games and slots revenue decreased by 1.6% compared to the same period last year.

The casinos’ monthly gaming revenue results were mixed compared to April of last year:

- MGM, down 0.7% to $49.86 million

- MotorCity, down 4.5% to $32.68 million

- Hollywood Casino at Greektown, up 0.6% to $25.33 million

In April 2024, the three Detroit casinos paid $8.74 million in gaming taxes to the State of Michigan. They paid $8.88 million for the same month last year. The casinos also reported submitting $12.8 million in wagering taxes and development agreement payments to the City of Detroit in April.

Monthly Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported $15.28 million in total retail sports betting handle, and total gross receipts were $1.57 million for the month of April. Retail sports betting qualified adjusted gross receipts (QAGR) were up by $1.5 million in April when compared to the same month last year. Compared to March 2024, April QAGR was down by 1.7%.

April QAGR by casino was:

- MGM: $475,492

- MotorCity: $516,812

- Hollywood Casino at Greektown: $578,131

During April, the casinos paid $59,362 in gaming taxes to the state and reported submitting $72,554 in wagering taxes to the City of Detroit based on their retail sports betting revenue.

Fantasy Contests

For March 2024, fantasy contest operators reported total adjusted revenues of $494,162 and paid taxes of $41,510.

-

Uncategorized3 days ago

Musburger Media Purchases VSiN, The Sports Betting Network

-

Uncategorized2 days ago

GGPoker & Triton Poker Offer High-Roller And Super-High-Roller Events At 2024 WSOP Paradise

-

Uncategorized3 days ago

Betmotion unveils ‘Jogos do Betmotion’ competition to celebrate 2024 Olympics

-

Uncategorized2 days ago

Arizona Department of Gaming Releases May Sports Betting Figures

-

Uncategorized2 days ago

QTech Games recruits David Camacho to take the lead for LatAm markets

-

Uncategorized3 days ago

GGPoker & Triton Poker Offer High-Roller And Super-High-Roller Events At 2024 WSOP Paradise

-

Uncategorized1 day ago

QTech Games recruits David Camacho to take the lead for LatAm markets

-

Uncategorized1 day ago

QTech Games recruits David Camacho to take the lead for LatAm markets