Gaming

Fish Games in Latin America: a Real Catch

With their roots in the Asian iGaming market and a long history of success in the region, fish games have now found a new wave of popularity in Latin America. Thanks to their easy-to-learn gameplay, the chance to catch a big win while playing something other than slots, these games have quickly become a favourite pastime for many LatAm players. The SOFTSWISS Game Aggregator, with its partner, game provider KA Gaming, have been observing their rise of popularity and are ready to cover this trend in detail in this article.

FISH GAMES PHENOMENON

Fish games are RNG games for online casinos. These games are based on the concept of fishing, where players use virtual fishing nets or guns to catch fish or other aquatic creatures on the screen. Each shot or reel accounts for a bet, and every fish or character has its ‘value’. When the shot hits the fish, the winning prize is awarded to the players.

These games often have colourful graphics, lively sound effects, a variety of characters with different point values, and, consequently, the potential for big payouts. Players can win prizes by catching fish and accumulating points for this, and some games even offer bonus rounds or jackpots for particularly skilled players.

FROM ASIA TO LATIN AMERICA

Diving back into the history of fish games, they grew from simple arcade video games in China in the 2000s. Over time, the games became more advanced, with improved graphics, gameplay, and online connectivity, leading them into online casino portfolios. Many Asian iGaming companies now offer players a wide range of fish game options.

KA Gaming is one of the game providers whose portfolio includes around 50 fish games. In partnership with the SOFTSWISS Game Aggregator, they supply these games to operators in different markets via API, including LatAm, where the demand for fish games has increased significantly during the last year.

Argentina, in particular, has emerged as a hotbed for fish games, with KA Gaming’s average number of ‘fish’ bets exceeding 8.5 million a month. This is a significant milestone, especially when compared to Asian countries where fish games have been popular for years.

The popularity of this game type has also spread to other countries in the region, including Brazil, Chile, and Peru. As players across Latin America continue to discover the excitement and potential rewards of fish games, likely, the popularity of these games will only continue to grow.

Mei Tu, Director of Sales and Marketing at KA Gaming, comments: “We are thrilled by the potential for growth that the Latin American market represents for fish games. With an assumed room for growth in this region, the numbers we see from Argentina are auspicious. While fish games have been popular in Asian countries for many years and have already gained a regular audience, the average monthly spins range from 12 to 25 million. In contrast, the figure of 8.5 million spins per month in Argentina alone is an excellent result, especially considering that fish games have only been gaining popularity for the past year and that slot games remain the most preferred option in the region. We’re excited to see how the popularity of fish games will continue to grow in LatAm and beyond.”

REASONS FOR INCREASING POPULARITY IN LATAM

So why have fish games become so popular in LatAm? There are several reasons for this trend. For one, they are easy to learn and play, with simple controls and fast-paced gameplay that keeps players engaged. Additionally, fish games are known for their high payouts, which can attract both casual and serious players alike.

Tatyana Kaminskaya, Head of SOFTSWISS Game Aggregator, has also noted that the easy entry threshold, allowing players to place small bets and still win, is a major factor driving the popularity of fish games in LatAm.

“The trend we’re seeing among players in this region is to place small but regular bets, which sets them apart from players in other regions. Fish games have a high probability of winning due to the ‘frequent catches’ and low betting options.”

Additionally, Tatyana notes that players in LatAm prefer to place bets using mobile devices. Since many fish games offered by operators and gaming providers are mobile-friendly, this is convenient for players in the region, contributing to the increasing popularity of these games.

KA Gaming also highlights the reasons for the rising popularity of fish games in LatAm. Among them, there are the following:

- Fish games have the element of player interaction in the same rooms (usually 4–6) as they compete to ‘hunt the big fish for big rewards, creating much excitement for the players

- There are multiple stages of the game, such as the “big boss” stage, where the players expect big wins once they successfully ‘reel in the ‘big boss’

- The dynamic movement of the fishes and other characters on the screen, the fast pace of the fish hunt coupled with colourful visuals provide a great gamification experience for players

- In addition, the gameplay learning curve is low compared to other games. KA Gaming usually sets the minimum bet lower than a typical slot game, making it easy for players to dive into the game

Summing up the above, Mei Tu adds: “Good games will always be good, regardless of culture and geography. Fish games’ exciting and engaging nature attracts players seeking a unique experience. Physical table fish games have already proven popular in North America, so we believe that with proper exposure and availability in the LatAm market, fish games will also gain popularity. It may take some players a warm-up or educational period, but it will also attract new players to iGaming who originally enjoyed arcade games.”

The SOFTSWISS Game Aggregator and KA Gaming have joined forces to provide top-notch content to operators in various regions, including supplying fish and hunting games to online casinos in LatAm. KA Gaming’s fish games, such as KA Fish Hunter, Poseidon’s Secret, Golden Dragon, Three Head Dragon, and Happy Food Hunter, are among the most popular titles among LatAm players in the content hub’s portfolio.

Tatyana Kaminskaya says: “We will continue to monitor the increasing popularity of fish games in LatAm. We recognise the potential for growth in this region beyond, and recommend operators to add this type of games to their online casinos The surge in popularity of certain game types reinforces this belief. Our portfolio boasts over 16,000 games available to LatAm clients, complete with API integration, exceptional service, and a range of tools that boost player engagement rates in online casinos. Notably, our recently launched Tournament Tool has already been tried out by several clients and has shown great promise.”

Powered by WPeMatico

Gaming

Polemos Announces Partnership With Guinevere Capital to Drive Monetisation and Growth Across Gaming Ecosystems

Polemos, a Web3 gaming infrastructure platform, announces a strategic partnership with Guinevere Capital, a prominent esports and gaming investment firm known for its investments and advisory roles in projects such as GiantX, iTero, Perion, Skybox, and various other projects across the industry. Guinevere Capital has established a strong reputation for its work across global Web2 gaming titles, including League of Legends, Valorant, Rocket League, and many more. This partnership aims to leverage the combined expertise of Polemos.io and Guinevere Capital to enhance and further monetise audiences across publishers, infrastructure players, gaming companies, studios, and platforms.

The collaboration will focus on integrating advanced asset management and engagement tools from Polemos.io’s Forge platform with Guinevere Capital’s extensive network and experience in both Web2 and esports ecosystems. This will create new monetisation opportunities and improve player experiences by bridging traditional gaming with blockchain-enabled innovations.

Carl Wilgenbus, CEO of Polemos.io, stated, “Partnering with Guinevere Capital marks a significant milestone in our mission to expand access to gaming rewards and unlock new revenue streams for the entire gaming industry. Together, we will empower publishers and studios to better engage their audiences and capitalize on the evolving landscape of gaming and esports.”

“Polemos has built an impressive piece of infrastructure that has plugged a huge gap in the gaming sector. We look forward to working with them to commercialise this.” said Dave Harris, a partner at Guinevere Capital. Dave’s previous experience includes investing in and operating top teams and leagues in the Riot Games and Activision Blizzard ecosystems.

Guinevere Capital’s strategic involvement will accelerate the adoption of blockchain gaming infrastructure while supporting the growth of esports and gaming communities worldwide. This alliance underscores a shared vision to drive innovation, education, and monetisation in the gaming sector by combining Web2’s reach with Web3’s potential.

Today, Polemos also started the official Token Generation Event (TGE) for the $PLMS utility token. The TGE began at 5:00 AM UTC on June 23rd, 2025, marking a step in the platform’s development to integrate blockchain technology within the gaming sector. Now available on MEXC and Uniswap, $PLMS gives users entry into the Polemos GameFi ecosystem.

The $PLMS token is designed to serve as the utility and governance token for the Polemos ecosystem. It is intended to facilitate platform functionalities, including asset management, player incentives, and participation in ecosystem governance. The TGE follows prior development phases and strategic partnerships, contributing to the framework of Polemos’ Web3 gaming offerings.

Details of the $PLMS TGE:

- Official TGE Start: June 23rd, 2025, at 5:00 AM UTC.

- Exchanges: MEXC & Uniswap.

The post Polemos Announces Partnership With Guinevere Capital to Drive Monetisation and Growth Across Gaming Ecosystems appeared first on European Gaming Industry News.

Central Europe

German Federal Government Significantly Increases the Budget for Games Funding

Good news for games companies in Germany: the Federal Government’s budget plans provide for the significant increase in the games funding budget long demanded by game – The German Games Industry Association. The Federal Government’s draft budget provides for a total of 125 million euros annually from 2026. The new funds are in line with the calculations made by the game association for the funds required until the introduction of additional tax incentives for games, as announced in the coalition agreement.

“That’s encouraging! The new federal government, and above all Federal Minister for Research and responsible for games Dorothee Bär, is following up its words with action. Following the clear statements in the coalition agreement, the significant increase in games funding less than 50 days after taking office has already set a key course. The funding will ensure growth again and provide the necessary breathing space to implement the additional tax-based games funding planned in the coalition agreement at the same time. This decision is an important and encouraging sign that Germany is creating internationally comparable conditions and wants to catch up quickly in the competition between games locations,” said Felix Falk, Managing Director of game – The German Games Industry Association.

The post German Federal Government Significantly Increases the Budget for Games Funding appeared first on European Gaming Industry News.

Gaming

Optimove US Gaming Pulse Report – May 2025

Executive Summary – Optimove US Gaming Pulse Report (May 2025)

The May 2025 report analyzes data from over 3.2 million U.S. players and 21 million global players to benchmark performance across casino and sports betting.

Key Insights:

U.S. Players Spend More: U.S. bettors consistently outperformed the global average in deposit amounts, averaging $604 in May 2025 marking a 10% year-over-year increase for the US compared to just 2% globally.

Casino Activity Remains Strong: U.S. casino bettors averaged $8,259 over the period, 6.2x the global average of $1,329 — ending at $7,928 in May 2025. Despite a slight slowdown since January, the number of U.S. casino bettors grew 30% year-over-year by May, compared to 14% globally.

Sports Betting Surges, Then Slows: U.S. average monthly sports betting peaked at $1,001 in May 2025, versus $380 globally. However, the number of U.S. sports bettors declined, showing only a 14% year-over-year increase in May — while global numbers remained stable, slightly decreasing to 97% compared to the May 2024 baseline.

Global Players More Engaged: Global players showed consistently higher engagement, averaging 8.9 days per month per active customer in May 2025, compared to 7.9 days in the U.S. — a 12% engagement gap.

Retention Higher Globally: While close, global retention remained stronger, reaching 71% in May 2025, compared to 65% in the U.S.

Conclusion:

While the U.S. market continues to lead in player spend and betting volumes, global markets show superior engagement and retention. U.S. growth remains closely linked to seasonal events and regulatory expansion, with future success tied to boosting long-term customer engagement and retention strategies.

Report Metrics:

- Source: Betting trends in United States compared to the global benchmark in the trailing 12 months (May 2024-2025)

- Database: A 12-month average of over 3.2 million active players per month in the U.S. and over 21.3 million globally.

Category: Average Deposit Amount

Key findings: Average Deposit Amounts Greatest in the US

In terms of monthly average total deposit amounts, the US consistently outpaces the global average, with an average deposit value 2.6 times higher throughout the period.

The U.S. average kept the highest global average in May 2025 with $604 average deposit amount. marking a 10% year-over-year increase, while the 12-month average leading to May 2025 stood at $550.

Global deposit amounts remained relatively stable, reaching $214 in May 2025, representing a 2% increase in May year over year.

Definition of Average Deposit Amount: The average deposit amount is calculated by taking the total sum of all deposits and dividing it by the number of Sports and Casino bettors (players) who have made at least one deposit.

Category: Total Monthly Casino Betting Amount & Number of Casino Bettors Growth

Key findings: The US has been leading in both betting amount and number of casino bettors’ growth

Throughout the period, the US consistently outpaced global averages, with an average of $8,259 per bettor over the period compared to $1,329 globally. US ending at $7,928 in May 2025 while the global average stands on $1344.

The number of casino bettors in the US market showed a slowdown over the past two months following a peak in January. However, the year-over-year growth remains strong, reaching 130% by May 2025 compared to the May 2024 baseline of 100% (a 30% increase). In contrast, global growth was more moderate, rising to 114% over the same period.

Definition of Total Monthly Casino Bet Amount: The average casino bet amount is the total sum of all casino bets and divided by the number of bettors who have placed at least one casino bet.

Definition of Casino Bettors Growth Trend: calculated by dividing the total number of casino bettors each month by the number of casino bettors in May 2024, which serves as the baseline (100%).

Category: Total Monthly Sports Betting Amount & Number of Sport Bettors Growth

Key findings: The US consistently outpaced global averages in monthly average sports bet amounts peaking at $1,150 in March 2025, however with a decrease in number of sport bettors by May 2025.

Throughout the period, the US keeps outpaced global averages in monthly average sports bet amounts. The US average was at $1,001 in May 2025, however with a notable decrease compared to May 2024.

In contrast, the global average remained steady, reaching $380 in May 2025.

In terms of the number of sport bettors, the US market experienced a sharp decrease in May 2025, reaching only 14% increase in May 2025 compared to May 2024.

Global growth remained more stable, changing from 100% to 97% over the same period.

Definition of Total Monthly Sport Bet Amount: The average sport betting amount is the total sum of all sports bets and divided by the number of bettors who have placed in least one sport bet.

The Sport Bettors Growth Trend: calculated by dividing the total number of sport bettors each month by the number of sport bettors in May 2024, which serves as the baseline (100%).

Category: Average Number of Activity Days per Active Customer

Key findings: the global market consistently maintained a higher engagement level than the US.

The global market keeps consistently maintaining a higher engagement level than the US, with 12% more activity days on average per active customer throughout the period. In May 2025 the US average stands at 7.9 days per month per active customer while the global average stands at 8.9.

Definition of Average Activity Days: The average number of activity days is the total number of activity days divided by the number of bettors who have at least one activity day.

Category: Average Active Retention Rate

Key findings: Although retention rates remained relatively close, the global market consistently outperformed the US.

While retention rates between the US and global markets remained close throughout the period, the global rate consistently outperformed the US in most months.

The global average on May 2025 stands at 71% compared to 65% in the US.

Definition of Active Retention Rate: The percentage of bettors who were active in the preceding month and remained active in the current month.

The post Optimove US Gaming Pulse Report – May 2025 appeared first on Gaming and Gambling Industry in the Americas.

-

Latest News7 days ago

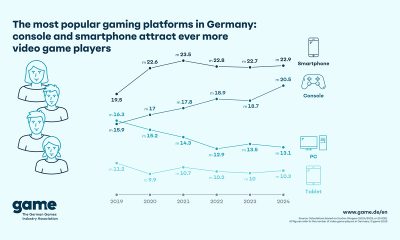

Latest News7 days agoThe Most Popular Gaming Platforms in Germany: Console and Smartphone Attract Ever More Video Game Players

-

Asia7 days ago

Asia7 days agoFIFA, NBA, UFC and More Sports Events Go Live – Crypto Sportsbook BETY Offers Global Sports Betting Coverage 2025

-

Balkans7 days ago

Balkans7 days agoSYNOT Partners with Efbet in Bulgaria

-

Australia6 days ago

Australia6 days agoVGCCC: Minors Exposed to Gambling at ALH Venues

-

EveryMatrix Press Releases7 days ago

EveryMatrix Press Releases7 days agoSlotMatrix unleashes divine riches in Fortuna Gold where gods rule the reels

-

Africa6 days ago

Africa6 days agopawaTech strengthens its integrity commitment with membership of the International Betting Integrity Association

-

Brazil7 days ago

Brazil7 days agoTG Lab unveils new Brazil office to further cement position as market’s most localised platform

-

Baltics7 days ago

Baltics7 days agoEstonian start-up vows to revolutionise iGaming customer support with AI