Gaming

Industry angels back Network Gaming’s new ways to bet with £1.25m investment; judging betting landscape to be “ripe for change”

Progressive betting company Network Gaming attracts core investment from industry angels to power the next phase of its international growth and product development

Network Gaming, a betting technology company innovating the next generation of sports prediction games, has raised £1.25m in strategic funding. Investors include industry icon and Betfair co-founder, Andrew Black, who commented: “I’ve felt for a while now that the betting landscape is ripe for change, and I’m delighted to be working with Network Gaming on a few fresh ideas.”

Black has been joined in this investment round by a host of other industry luminaries. Consequently, Network Gaming now boasts an influential consortium of investors including Robert Markwick (angel investor), David O’Reilly (CEO at Colossus Bets), Einar Knobel (CEO at TX Odds), Gary Otto (LA-based angel investor and owner of Sutton United FC) and Sandford Loudon (Partner at Oakvale Capital).

The company made its name with the success of its first pay-to-play game, the Fantasy Masters golf. The game pitted friends and colleagues against one another and culminated in a dynamic live leaderboard for large cash prizes. Accordingly, this next breed of Network Gaming products takes what was learned from this formative success – namely, putting the customer experience at the centre of both game design and build.

Be it free-to-play or pay-to-play sports prediction games, Network Gaming takes a highly collaborative approach with its partners – designing bespoke, socially responsible games that target their specific needs and audiences. Every game creates an enhanced in-play social experience, complementing the sport that players are watching live.

Network Gaming’s ongoing partnerships comprise operator Fitzdares, The Sun’s fantasy football offering of Dream Team, and talkSPORT whose popular sports news and analysis shows drive audience engagement across a number of live-broadcast platforms. While its product suite showcases games for football, horse racing and golf, this investment round will drive global growth and deliver more proprietary games across NFL, NBA, MLB, and the 2022 FIFA World Cup.

If you want to see what it’s all about, entries are now open for the Fantasy Masters game which returns for this year’s Augusta showpiece from 7-10 April, with record levels of engagement anticipated via partners Fitzdares and talkSPORT. The player who finishes at the top of the leaderboard has walked away with more than £50,000 in recent years.

Harry Collins, CEO at Network Gaming, said: “We give customers the experience of a game, not just a bet. Moving up or down a leaderboard right until the final seconds of an event offers a different type of excitement to betting, one where enjoyment comes from competing against friends or other sports fans in a rollercoaster ride.

“We’re delighted to have an industry trailblazer like Andrew advising us on fresh ideas and to have the support of other experienced innovators for this step-change in Network Gaming’s evolution.”

Powered by WPeMatico

Gaming

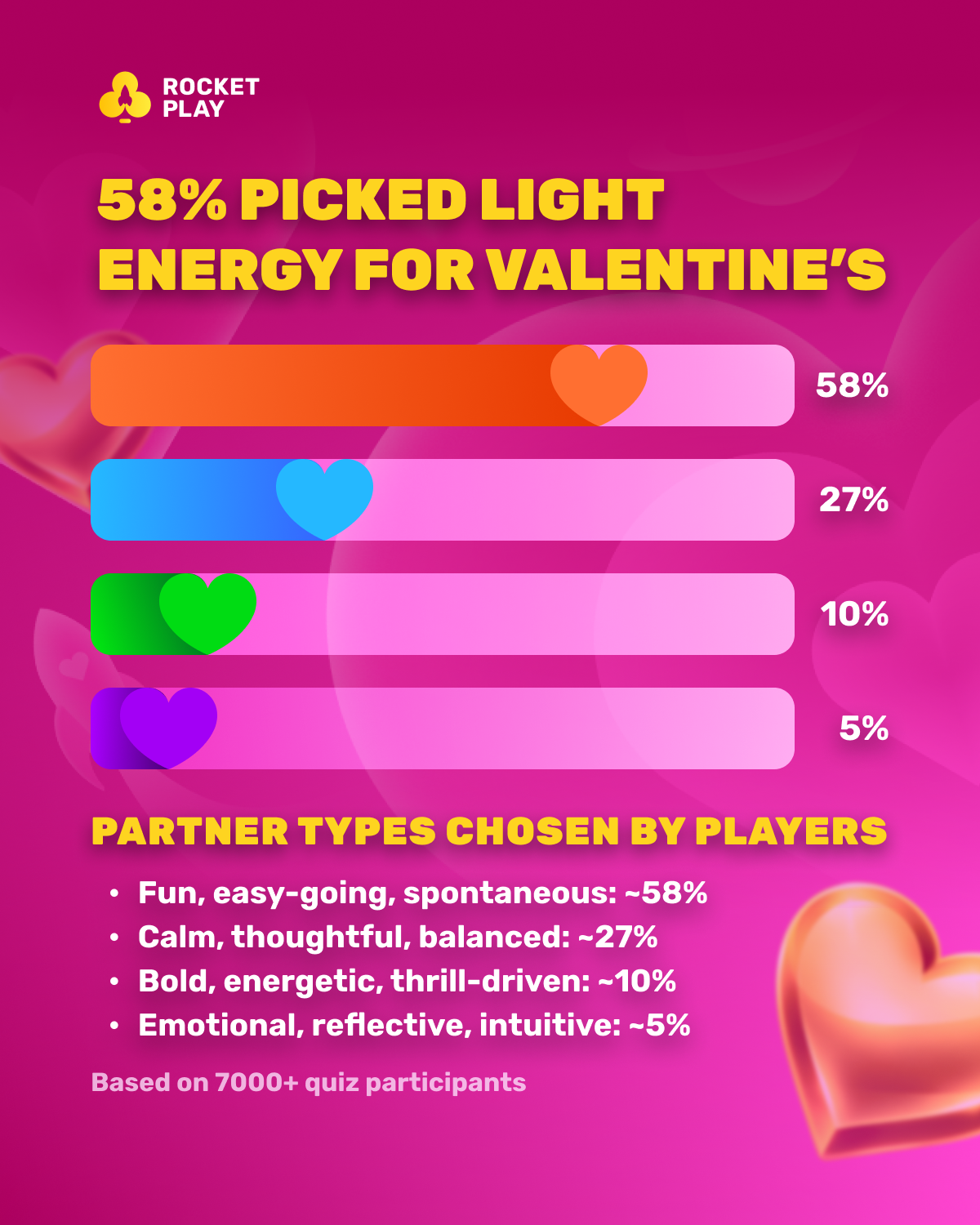

58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”.

This Valentine’s, RocketPlay tested a playful idea: players who seek thrills in gaming don’t necessarily want intensity in everything — including relationships. Instead of asking users to pick a “perfect partner,” RocketPlay launched Rocket Match, a fast, flirty quiz that matches players with a vibe: Bold, Sunny, Dreamy, or Adventurous.

Early Results Flip the Stereotype

Around 58% of participants matched with the Sunny archetype — defined by warmth, charm, and easy-going fun. The experiment suggests that when it comes to Valentine’s, RocketPlay’s community prefers light-hearted connection over drama or high stakes.

What Rocket Match Is

Rocket Match is a Valentine’s matchmaking quiz built inside the RocketPlay Universe. Players answer five simple, no-wrong-answer questions and instantly discover their match vibe.

The goal: move away from typical Valentine’s content that swings between overly serious romance or clichéd tropes. Rocket Match keeps it flirty, playful, and moment-focused, letting players discover a vibe rather than a label.

The four vibes include:

-

Bold – confident, high-energy, loves bigger sparks

-

Sunny – easy-going, playful, social, effortlessly charming

-

Dreamy – soft, romantic, focused on atmosphere and emotion

-

Adventurous – playful risk-taker, spontaneous, curious

Community Insights from Rocket Match

The quiz quickly gained traction, with 7,000+ completions, revealing a strong preference: Sunny, the archetype defined by warmth, lightness, and charm.

Alex Martin, PR Lead at RocketPlay, said:

“What we liked most about Rocket Match is how clearly it captured the mood people actually want on Valentine’s. It wasn’t about labels or big statements — it was about light energy, easy chemistry, and a feel-good kind of connection. That’s the vibe we try to build across the brand: simple to join, fun in the moment, and positive without the drama.”

Why It Matters

Rocket Match was more than a Valentine’s gimmick. It offered a snapshot of what RocketPlay’s community enjoys most: light energy, playful interaction, and feel-good connections. By turning a pop-culture moment into a small experiment, RocketPlay gained insight into player preferences, informing how the brand continues to design engaging, fun, and positive experiences.

The post 58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”. appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Gaming

58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”.

This Valentine’s, RocketPlay tested a simple idea: people who come to iGaming for thrill don’t necessarily want the same intensity in everything — including relationships. Instead of asking players to choose a “perfect partner,” we launched Rocket Match, a fast, playful quiz that matches players with a vibe — bold, sweet, dreamy, or adventurous.

Early results flipped the stereotype. Around 58% of participants matched with the same vibe — built around warmth, charm, and easy fun — suggesting that when it comes to Valentine’s, our community prefers light-hearted connection over drama or risk.

What Rocket Match is

Rocket Match is a Valentine’s matchmaking quiz built as a small cosmic adventure inside the gaming RocketPlay Universe. Players answer 5 light questions — no right or wrong answers — and instantly unlock a Rocket Match that compliments themself. The idea was simple: Valentine’s content online often swings between two extremes — overly serious romance or pure cliché. Rocket Match was created to do something different: keep it flirty, keep it playful, and let players discover a vibe that feels like a moment, not a label.

There were 4 vibes to match with:

Bold — confident, high-energy, loves a bigger spark and bolder choices.

Sunny — easy-going, lighthearted, funny, good communicator

Dreamy — softer, romantic, drawn to atmosphere and emotion.

Adventurous — playful risk-taker energy; spontaneous, curious, and always up for something new.

The lightweight Valentine’s experiment quickly gained traction, with 7,000+ players completing the quiz. The unexpected value came after: the answers revealed a clear preference in what players wanted Valentine’s to feel like — and that insight became the story.

Across responses, around 58% of participants landed on the same Rocket Match vibe — the “sunny” archetype. It’s defined by warmth, lightness, and easy charm: playful, social, and effortless to be around.

What it says about RocketPlay’s community

Rocket Match offered a clear read on the kind of Valentine’s energy players gravitate toward — and it’s lighter than the usual “high-stakes romance” stereotype. As Alex Martin, PR Lead, puts it: “What we liked most about Rocket Match is how clearly it captured the mood people actually want on Valentine’s. It wasn’t about labels or big statements — it was about light energy, easy chemistry, and a feel-good kind of connection. That’s the vibe we try to build across the brand: simple to join, fun in the moment, and positive without the drama.”

What started as a fun Valentine’s experiment quickly became a snapshot of what the community enjoys most: light energy, easy chemistry, and feel-good connection. Valentine’s was simply the right moment to test a playful, pop-culture format — and see what kind of “match” people gravitate toward.

The post 58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”. appeared first on Americas iGaming & Sports Betting News.

CEO of GGBET UA Serhii Mishchenko

GGBET UA kicks off the “Keep it GG” promotional campaign

A leading gaming brand in Ukraine has launched a collection of ads featuring the tagline “Keep it GG” as part of an extensive communications initiative. The videos are currently being broadcast on Ukrainian TV, online platforms, and the brand’s social media accounts.

“GG” (Good Game) started in video game culture, yet its significance has far surpassed the literal meaning of “well played.” Currently, it symbolizes a worldwide sign of honor and gratitude for the feelings exchanged following a match, no matter the outcome. This concept served as the basis for GGBET UA’s latest marketing campaign. The video series embodies a unique GG atmosphere: rather than using a conventional voiceover, it incorporates complete audio tracks; the narrative features both literal and metaphorical allusions to sports and esports terms, alongside in-game and casino aspects; and prominent Ukrainian footballers are among the main characters.

“Every game, every match, every tournament is a moment that brings people together. For us, it’s important that every interaction with GGBET gives users that good game feeling — an experience that outlives the result and leaves vivid emotions behind, just like after watching a match,” comments CEO of GGBET UA, Serhii Mishchenko.

Going beyond the traditional view of GG also signifies a more profound implication — the brand’s strategic focus. The international brand, which has concentrated on esports for several years and attained significant success in esports betting and collaborations, is now adopting best practices to enhance traditional sports in regional markets. GGBET UA showcases a wider strategy for Good Game via collaborations (FC Dynamo Kyiv, FC Polissya, and the Ukrainian Basketball Federation), by organizing its own events and special projects, including initiatives that blend sports with esports, like the Match of LeGGends: Derby showmatch on the server featuring esports athletes and football players.

The brand’s creative team collaborated with a Ukrainian advertising agency and a Ukrainian production company to develop the commercials. GGBET UA made this choice to assist the local creative sector amid the war.

The post GGBET UA kicks off the “Keep it GG” promotional campaign appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Amusnet6 days ago

Amusnet6 days agoWeek 7/2026 slot games releases

-

Aphrodite’s Kiss6 days ago

Aphrodite’s Kiss6 days agoLove on the Reels: Slotland Introduces “Aphrodite’s Kiss”

-

Brino Games6 days ago

Brino Games6 days agoQTech Games integrates more creative content from Brino Games

-

Baltics7 days ago

Baltics7 days agoEstonia to Reinstate 5.5% Online Gambling Tax From March 1

-

Denmark7 days ago

Denmark7 days agoRoyalCasino Partners with ScatterKings for Company’s Danish Launch

-

Booming Games7 days ago

Booming Games7 days agoTreasure Hunt Revival — Booming Games Launches Gold Gold Gold Hold and Win

-

Bet Rite7 days ago

Bet Rite7 days agoSpintec Expands into Canada with Bet Rite

-

ELA Games7 days ago

ELA Games7 days agoELA Games Unveils Tea Party of Fortune — A Magical Multiplier Experience