Compliance Updates

DGA: Three Orders and One Reprimand Issued to Mr. Green Limited for Breach of the Anti-Money Laundering Act

On April 10th, 2024, the Danish Gambling Authority has issued three orders to Mr. Green Limited for breaching the Anti-Money Laundering Act, on risk assessment, on procedures for internal controls and for failing to ensure that controls are carried out.

On April 10th, 2024, the Danish Gambling Authority has also given Mr. Green Limited a reprimand for breaching the rules on notification in the Anti-Money Laundering Act.

The reactions have been given in connection with the Danish Gambling Authority’s inspection of Mr. Green Limited’s materials that Mr. Green Limited has provided for compliance with the Anti-Money Laundering Act.

Order for insufficient risk assessment

Order (a) is issued because Mr. Green’s risk assessment is insufficient, as no separate risk assessment has been made of the individual identified risks associated with Mr. Green’s business model, including payment solutions, and the risk factors associated with it. It follows from section 7(1) of the Anti-Money Laundering Act that undertakings subject to the Act must identify and assess the risk that the undertaking may be misused for money laundering or terrorist financing. The Danish Gambling Authority’s assesses that the risk assessment must include a separate assessment of the risk of the individual payment solutions and delivery channels, as well as a separate risk assessment of the risk factors associated with these. Thus, Mr. Green did not comply with the risk assessment obligation.

Order for insufficient and lack of business procedures

Order (b) is issued because Mr. Green Limited does not have adequate procedures for internal controls, as these do not describe the interval at which controls should be performed. The order has also been given because Mr. Green Limited does not have written procedures on how to monitor that controls are carried out. It follows from section 8(1) of the Anti-Money Laundering Act that undertakings subject to the Act must have adequate written business procedures, which must include internal control. The business procedures should describe how the listed areas are handled in practice. The requirement for internal control also means that there must be controls of whether the controls are being carried out – in other words, that the controls are being checked. Mr. Green Limited has not sufficiently complied with the commitments on business procedures for controls.

Order for lack of documentation of controls

Order (c) is issued because Mr. Green Limited has not documented that controls have been carried out to verify that the internal controls have been performed. It follows from section 8(1) of the Anti-Money Laundering Act that undertakings subject to the Act must document the controls that have been carried out. Thus, Mr. Green Limited has not complied with the obligations to perform controls to ensure that the internal controls are performed.

Reprimand for not making an immediate notification

Reprimand (a) is given because Mr. Green Limited has in two cases not complied with the requirement for immediate notification to the Money Laundering Secretariat. According to section 26(1) of the Anti-Money Laundering Act, an undertaking must immediately notify the Money Laundering Secretariat if the undertaking knows, suspects or has reasonable grounds to suspect that a transaction, funds or activity is or has been related to money laundering or terrorist financing. Mr. Green has not complied with the notification obligations, as there has been no immediate notification.

Duty to act

The orders entail an obligation to act on the part of Mr. Green Limited. Mr. Green Limited must submit a revised risk assessment within June 10th, 2024.

Mr. Green must also within June 10th, 2024, submit a revised business procedure for internal controls and submit prepared business procedures for how the implementation of controls is monitored.

Mr. Green Limited must also submit documentation within October 10th, 2024, that it has been controlled that the controls have been carried out.

The reprimand does not entail any obligation to act on the part of Mr. Green Limited as the breach no longer exists.

The post DGA: Three Orders and One Reprimand Issued to Mr. Green Limited for Breach of the Anti-Money Laundering Act appeared first on European Gaming Industry News.

Compliance Updates

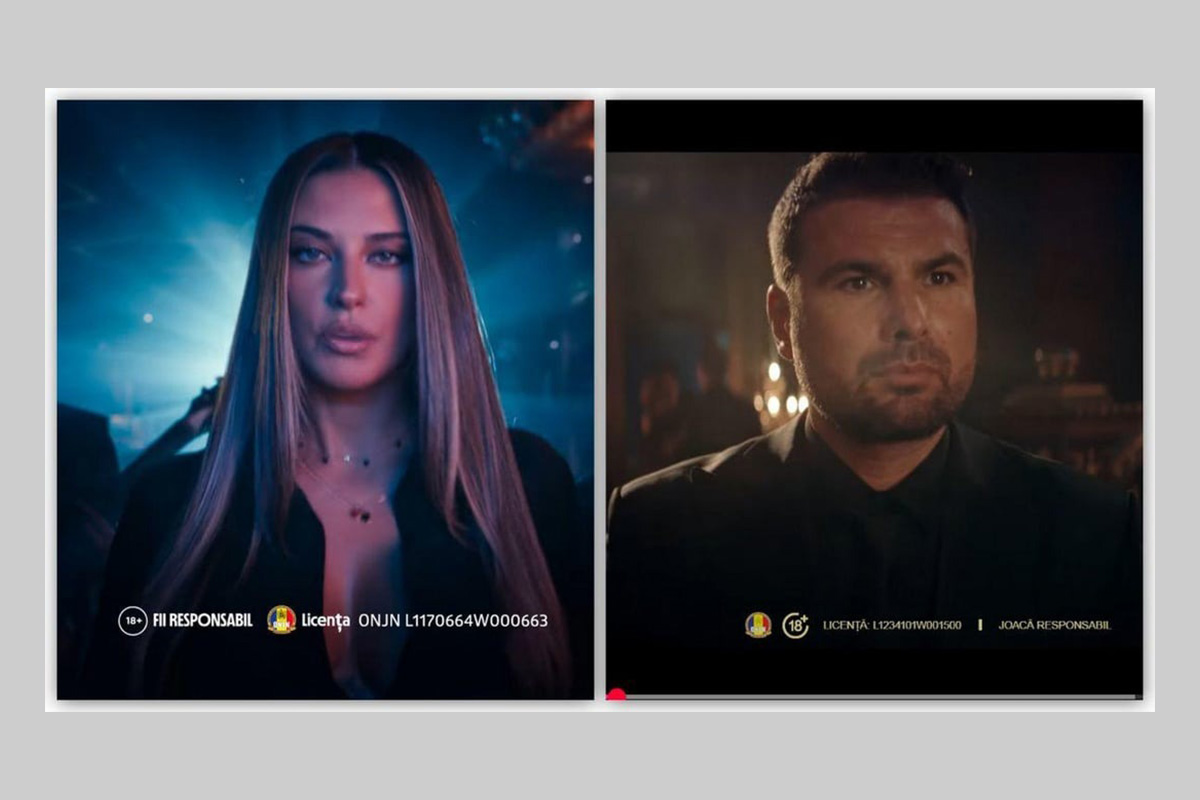

Romania Bans Celebrities from Gambling Ads

Celebrities will no longer be able to appear in gambling ads on TV, radio and online, following a decision voted on Wednesday in a public meeting of the National Audiovisual Council of Romania (CAN). The provision is part of a series of amendments that passed the Code of Broadcasting Regulation, the NAC’s secondary legislation.

“It is forbidden to broadcast advertising for gambling featuring public, cultural, scientific, sports or other personalities who, due to their online notoriety, may encourage participation in such games,” says the new Article 110, paragraph 7 of the newly voted Audiovisual Code.

The new provision will become mandatory in a few months, more precisely 90 days after the Audiovisual Code enters into force.

Several amendments were submitted by institutions or gambling companies in an attempt to stop this provision.

Among the challengers were Winbet, which asked the CNA to allow stars to be used at least in “social responsibility” campaigns. So did the Romanian Football Federation, which proposed that personalities should be allowed to appear in awareness or social responsibility campaigns.

Kaizergaming, the Federation of Gambling Organisers and the Romanian Bureau of Transmedia Audit asked for the deletion of the article.

All amendments were unanimously rejected.

The post Romania Bans Celebrities from Gambling Ads appeared first on European Gaming Industry News.

AGCO

AGCO Fines Great Canadian Casino Resort Toronto $350,000 for Serious Regulatory Violations Linked to Impromptu After-Party on Gaming Floor

The Alcohol and Gaming Commission of Ontario (AGCO) has issued monetary penalties totaling $350,000 against Great Canadian Casino Resort Toronto for multiple violations of provincial gaming standards. The penalties follow an impromptu after-party that was permitted to take place in the pre-dawn hours directly on the casino’s gaming floor.

On September 27, 2024, an electronic dance music event attended by thousands of people was hosted in the theatre adjacent to the casino at Great Canadian Casino Resort Toronto. The event was marked by widespread intoxication, disorderly behavior, and numerous criminal and medical incidents – both inside and outside the venue – including alleged assaults, drug overdoses, and acts of public indecency. Although paid duty officers were present, additional police and emergency services were required to manage the situation.

In the midst of this high-risk environment, casino management approved an unscheduled request by the performing artist to host an after-party on the active gaming floor. The artist and more than 400 guests were permitted onto the gaming floor where the artist was allowed to perform amidst operational table games and gaming machines – without any prior risk assessment or planning.

As a result, security personnel were unable to effectively control the casino floor, including witness reports that an attendee was seen climbing onto slot machines. Failure to maintain appropriate control compromises the security, safety, and integrity of the casino floor. Following the conclusion of the event, the operator failed to promptly report these incidents to the AGCO as required.

Based on the findings of its review, the AGCO’s Registrar has issued an Order of Monetary Penalty (OMP) totaling $350,000 against Great Canadian Casino Resort Toronto. These penalties address critical failures in their operations, incident reporting, employee training, and the management of disturbances.

A gaming operator served with an OMP has 15 days to appeal the Registrar’s decision to the Licence Appeal Tribunal (LAT), an adjudicative tribunal that is part of Tribunals Ontario and independent of the AGCO.

“Casino operators have a fundamental duty to control their gaming environment. Great Canadian Casino Resort Toronto’s lapses in this incident compromised the safety of patrons and the security and integrity of the gaming floor,” Dr. Karin Schnarr, Chief Executive Officer and Registrar of AGCO, said.

The post AGCO Fines Great Canadian Casino Resort Toronto $350,000 for Serious Regulatory Violations Linked to Impromptu After-Party on Gaming Floor appeared first on Gaming and Gambling Industry in the Americas.

Brazil

Esportes da Sorte holds forum on “Integrity in Sports” with Ceará and Náutico

Esportes da Sorte hosted its Match-Fixing Prevention Forum last week at Ceará and Náutico as main sponsor of both clubs. Held in partnership with Sportradar, the initiative is part of a series of in-person workshops, with upcoming sessions planned for Corinthians and Ferroviária.

The project aims to combat illegal practices and reinforce a strong commitment to integrity in sport. Activities were tailored for athletes and members of the technical staff from the men’s and women’s professional teams, as well as the under-20 squads. During the sessions, topics such as the definition of match-fixing, types of fraud, fraudsters’ modus operandi, legal risks, and reputational impacts were covered. Participants were offered practical guidance on how to respond to suspicious approaches.

“This training programme reinforces our commitment to sports integrity and responsible gaming, pillars that guide our actions. We believe education is the best form of prevention, and we want to stand alongside clubs in this joint effort for transparency and the protection of sport,” said Ana Carolina Luna Maçães, Compliance Manager at Esportes Gaming Brasil, the group behind the Esportes da Sorte brand.

“Ceará takes this topic very seriously. The club is an important player in the fight against match-fixing. We act preventively with regular meetings and have a handbook that addresses the topic with our squad. It is our duty to provide these moments of learning for athletes and technical staff. We live in a time when the integrity of sport is being questioned. In this scenario, actions like this are extremely important,” commented Lucas Drubscky, Football Executive at Ceará.

The sessions were led by Felippe Marchetti, Integrity Partnerships Manager at Sportradar, a global sports technology company and recognized authority in sports integrity. In Brazil, Sportradar partners with the Brazilian Football Confederation (CBF) and 17 state federations, monitoring more than 10,000 matches per season. The company recently signed a Technical Cooperation Agreement (TCA) with the Ministry of Finance and the Ministry of Sports.

“Raising awareness among athletes and teams is one of the most effective ways to protect competitions from manipulation. These workshops are designed to equip participants with the knowledge and tools to recognize threats and act responsibly. We are proud to support initiatives like this that strengthen the integrity of Brazilian sports,” said Felippe Marchetti.

The post Esportes da Sorte holds forum on “Integrity in Sports” with Ceará and Náutico appeared first on Gaming and Gambling Industry in the Americas.

-

Latest News7 days ago

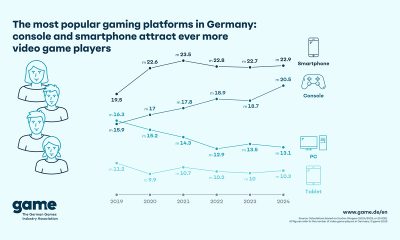

Latest News7 days agoThe Most Popular Gaming Platforms in Germany: Console and Smartphone Attract Ever More Video Game Players

-

Asia7 days ago

Asia7 days agoFIFA, NBA, UFC and More Sports Events Go Live – Crypto Sportsbook BETY Offers Global Sports Betting Coverage 2025

-

Balkans7 days ago

Balkans7 days agoSYNOT Partners with Efbet in Bulgaria

-

Australia6 days ago

Australia6 days agoVGCCC: Minors Exposed to Gambling at ALH Venues

-

EveryMatrix Press Releases7 days ago

EveryMatrix Press Releases7 days agoSlotMatrix unleashes divine riches in Fortuna Gold where gods rule the reels

-

Brazil7 days ago

Brazil7 days agoTG Lab unveils new Brazil office to further cement position as market’s most localised platform

-

Africa6 days ago

Africa6 days agopawaTech strengthens its integrity commitment with membership of the International Betting Integrity Association

-

Baltics7 days ago

Baltics7 days agoEstonian start-up vows to revolutionise iGaming customer support with AI