NFL

Optimove Releases Comprehensive NFL Betting Report: Illuminating 2023-2024 Bettor Intentions; Helping Guide Sports Betting Platforms to Boost Player Engagement and Loyalty While Ensuring a Safer Gambling Environment

Optimove, the leading CRM marketing solution for the iGaming sector, has released its Optimove 2023-2024 Report focused on NFL wagering intentions, brand loyalty and communications preferences.

Surveying 287 United States citizens who wagered on NFL football in August of 2023, the comprehensive report deeply analyzes respondents’ wagering intentions, brand loyalty and communication preferences. By providing insights into the behaviors and preferences of NFL bettors, it acts as a guide to sports gambling platforms to optimize their offerings, nurture player loyalty and promote responsible gambling practices while maintaining a safer gambling environment.

Of particular interest is that NFL bettors show deep engagement in betting as 61% of respondents said they make ‘live bets’ during the game. While NFL bettors have deep engagement while the game is on with 54% using two or more sites per week for betting and 18% use three or more.

This deep engagement in betting may result in the divergence in marketing fatigue between bettors and general online shoppers. Thirty-seven percent (37%) of bettors say they want fewer marketing messages compared to 66% of online shoppers.

Integrating a customer data platform (CDP) with a multichannel marketing hub (MMH) can drive brand loyalty:

The report provides key recommendations to sports gambling sites to enhance customer engagement and loyalty further while promoting responsible gambling practices. The core driver includes integrating a customer data platform (CDP) with a multichannel marketing hub (MMH) to implement highly personalized promotions and optimal delivery timing.

Pini Yakuel, the founder and Chief Executive Officer for Optimove noted that by aligning marketing strategies with these findings, sports gambling sites can effectively attract, engage and retain bettors while promoting responsible gambling behaviors. He added: “This report will help sports betting operators have top-line data on NFL season bettors’ intentions. Starting with data from bettors is the holy grail to assuring that marketing messaging is pertinent and timely. Operators who do not have a customer data platform seamlessly integrated into a multichannel marketing hub will struggle to keep bettors loyal. The survey results around live betting are a prime example of the importance of real-time communications and app updates that dynamically respond to game changes.”

Recommended actions for sports gambling operators:

First and foremost, sites should Integrate a customer data platform (CDP) with a multichannel marketing hub (MMH) for comprehensive insights. With that foundation, sports gambling operators can use artificial intelligence (AI) to automate personalized game recommendations based on historical data and real-time interactions. Plus, they can implement real-time event triggers for timely personalized messages during games. To unify the player experience, sports sites can deliver consistent cross-channel messages for a unified customer experience. These actions can help deepen brand loyalty before, during, and after the game.

Select Data from the report:

Marketing Fatigue: NFL bettors suffer less marketing fatigue – only 37% want fewer messages, in contrast with 66% of online shoppers.

Sixty-one percent (61%) of respondents said they make ‘live bets’ during the game: It underscores that betting platforms have multiple chances to engage betting fans after kick-off and before the final whistle.

Latest News

Optimove Insight Analysis of NFL 2025-2026 Planned v. Actual NFL Wagering Intentions Through the Wild Card Round

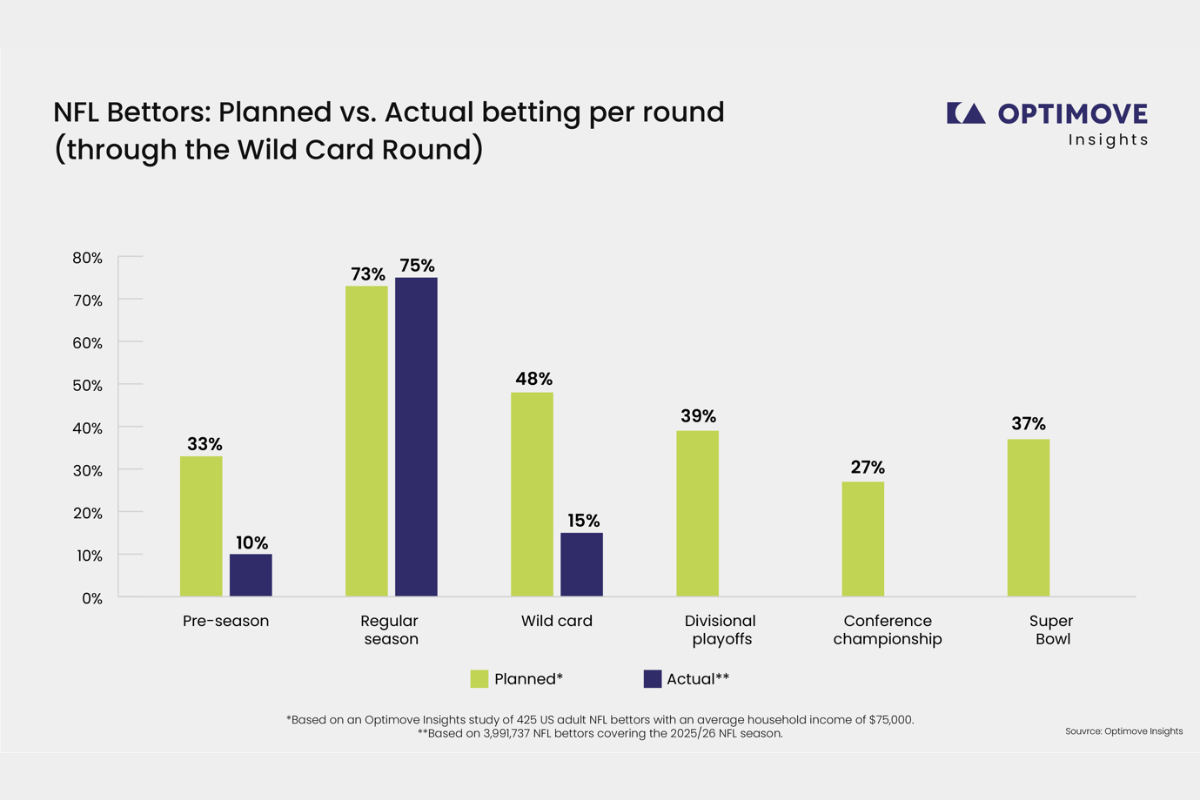

This analysis compares what NFL bettors said they planned to bet before the 2025–26 season with what they actually did through the end of the Wild Card round, using observed behavior from nearly 4.0 million bettors alongside a pre-season survey of 425 bettors. The results show that while high-level intentions broadly align with reality, bettors consistently overestimate how often, how live, and how much they will bet, especially once the season is underway.

The regular season remains the backbone of NFL betting. Both stated intent and actual behavior confirm that most wagering activity is anchored there, accounting for roughly three-quarters of all bets. However, interest in fringe periods is overstated. Pre-season betting and Wild Card betting both sound appealing in theory, but actual participation is far lower than expected. In particular, nearly half of the surveyed bettors anticipated betting during the Wild Card, yet real activity through that round is closer to one-sixth of bettors, underscoring that playoff “excitement” does not automatically translate into betting volume when the window is short.

Live betting is consistently over-promised and under-delivered. While bettors express strong interest in live wagering before the season, actual behavior skews heavily toward pre-game bets. That said, many bettors blend behaviors in practice, moving between pre-game and live depending on context. This suggests opportunity lies less in converting bettors to “live-only” and more in designing experiences that fluidly support both.

Bet structure shows the strongest alignment between intent and reality. Multi-leg bets, particularly parlays, dominate both planned and actual behavior. This confirms that bettors’ appetite for higher-engagement, multi-outcome tickets is real and durable. As the playoff slate narrows, this preference is likely to shift toward same-game parlays rather than traditional multi-game builds.

The largest disconnect appears in stake size. Bettors systematically overestimate how much they expect to wager. In reality, small bets placed frequently dominate observed behavior, with low-stake wagers far more common than survey responses suggest. While $11–$50 emerges as the true “default” stake band, higher stakes are significantly rarer in practice than bettors predict before the season.

Looking ahead, intensity, not volume, is likely to define the later playoff rounds. As the number of games shrinks, total betting volume may not rival the regular season, but engagement among remaining bettors typically deepens. This often manifests as more bets per game, greater use of live betting moments, and heavier reliance on parlays rather than larger single-ticket stakes.

Bottom line:

NFL bettors are directionally honest about how they want to bet, but consistently optimistic about how much and how often they will do so. For operators, the opportunity lies in recognizing where intent reliably converts (regular season, parlays, pre-game betting) and where friction emerges (live betting adoption, playoff participation, higher stakes). Designing experiences that emphasize intensity, flexibility, and frequent low-stake engagement is likely to outperform strategies built on assumed playoff spikes or inflated stake expectations.

Detailed Results:

This report compares the following:

- Actual Bets of 3,991,737 NFL bettors covering the 2025/26 NFL season through the end of the Wild Card round; and

- Planned Bets of 425 NFL Bettors surveyed before the start of the season.

Regular Season, As Expected – Wild Card, Not So Much

This chart compares what NFL bettors said they were most likely to bet on (planned bets) versus bets in the 2025/26 season (actual betting behavior) through the end of the Wild Card round.

A few things jump out immediately:

- The regular season is the clear anchor in both datasets. Survey respondents before the start of the season overwhelmingly pointed to the regular season as their primary betting period (73%), and real behavior supports that, as (75%) of observed betting activity happened during the regular season.

- Pre-season betting is meaningfully lower in reality than in stated intent. While 33% of survey respondents said they’d be likely to bet in the pre-season, real activity through our benchmark is closer to ~10%. Bottom line: pre-season sounds appealing in theory, but far fewer people follow through once games start.

- Wild Card interest is overestimated in the survey before the season. The survey suggests nearly half of bettors (48%) expected to bet during Wild Card, but real behavior in our data is much lower (~15%). That gap is a big signal that “high-stakes playoff excitement” doesn’t automatically translate to volume, especially when the round is short and concentrated.

What we’d expect to see next:

- Because this analysis only includes activity through Wild Card, the later playoff rounds are reported the survey before the NFL season start.

Based on how betting typically behaves as stakes rise, we expect a concentration effect – Fewer days, bigger moments: The Divisional Round, Conference Championships, and Super Bowl have fewer games, so raw volume may not match the regular season but attention is higher, which often shows up as more bets per game, higher average stake, and heavier live-betting mix.

- A “late-stage spike” among engaged bettors: Even if overall volume stays lower than the regular season, the bettors who remain active tend to be more committed, which can make the later rounds disproportionately valuable from a revenue and engagement perspective.

If the regular season is where breadth happens, the next rounds are where intensity can show up.

Bettors Say They Want Make Live Bets; But Primarily Bet Pre-Game

This chart compares stated preference (survey before the season start) with observed behavior across three types of bets: 1) pre-game, 2) live, and 3) both.

Here’s what stands out:

- Pre-game betting is executed as planned. Nearly half of respondents said they typically prefer pre-game (48%), and real behavior comes in slightly higher at 50%. That’s a strong alignment between intent and reality. Pre-game betting remains the default mode for most bettors.

- Live betting is the biggest gap between planned and actual betting. In the survey, 31% said they planned live betting, but in practice only 17% did.

- “Both” is under claimed but over delivered. Only 21% said they have no preference and do both (pre-game and live), yet actual behavior suggests 33% of bettors mix pre-game and live. So even if bettors identify with one style, many still shift modes depending on context.

What we’d expect to see next:

- As the NFL season progresses, this mix between live and pre-game betting can change: Later playoff rounds tend to be more “appointment viewing,” which can naturally lift live betting, especially in close games and high-profile matchups.

- Even if the share of “live only” bettors remain modest, we’d expect live engagement to deepen as games become must watch events.

Intent Matches Reality: Multi Bets Lead the Way

Next, we analyzed how bettors build their tickets: single bets versus multi-leg parlays, comparing survey intent with actual behavior through the end of the Wild Card round.

Unlike other comparisons, this shows minimal gap between what bettors said and what they actually did:

- Multi bets (parlays) dominate in both views. The survey shows 72% planning to primarily place multi bets, and real behavior comes in almost the same at 70%.

- Single bets are only slightly higher in reality. Actual betting shows 30% single vs. 28% in the survey.

What we’d expect to see next:

- Fewer games = fewer traditional parlays. With a smaller slate, multi-game parlays become harder to build.

- More Same-Game Parlays. Bettors who want multi legs still have a clear outlet: stacking outcomes within one matchup.

Where the Money Really Sits: Smaller Bets, More Often

Finally, we compared what bettors said they typically wager in the survey with what we actually observed in the data through the end of the Wild Card round. The pattern is hard to miss: real-world stakes tend to come in lower than the amounts people anticipated before the season.

- Low-stake bets over-index in real behavior. In the data, $1–$5 (26%) and $6–$10 (19%) make up a much larger share than in the survey before the season (8% and 9%, respectively). In practice, bettors place far more “small” bets than they thought.

- The survey overestimates mid-to-higher stakes. The biggest mismatch is in the $51–$100 range: 29% in survey responses vs. only 6% in actual observed behavior. The same pattern shows up again at $101–$499 (19% survey vs. 4% actual).

- The center of gravity shifts downward. Both sources revealed that $11–$50 is the most common range, but actual bets in the data lean even more into it (37% actual vs. 31% survey), suggesting $11-50 is the “true default” stake band.

What we’d expect to see next:

As the playoffs continue, we may likely see:

- More casual bettors enter, which can lower the average stake among those who remain active (lots of people place a bet on the Super Bowl who are “one and done” players)

- As the number of games shrinks, so many bettors may keep stakes conservative and instead express confidence via more legs (parlays) rather than bigger single-ticket amounts.

Conclusion – Why Positionless Marketing Matters

The gap between planned intent and real betting behavior underscores a core reality: player preferences are situational and dynamic, not fixed before the season begins. Bettors shift when they engage, how they bet, and how much they wager based on context, momentum, and the moment.

Meeting players in those moments requires marketing teams to act with speed, flexibility, and precision. That’s where Positionless Marketing becomes essential. By removing dependencies on fixed roles, long planning cycles, and manual handoffs, Positionless Marketing empowers teams to respond immediately to real player behavior, not pre-season assumptions.

Instead of relying on static campaigns built around predicted intent, Positionless Marketing enables marketers to continuously adapt messaging, offers, and journeys as preferences reveal themselves in real time. This ability to move at the player’s speed (and adjust to actual behavior as it unfolds) is what allows operators to stay relevant, personalized, and effective throughout the season.

In an environment where intent rarely matches reality, Positionless Marketing is what turns insight into action at exactly the right moment.

The post Optimove Insight Analysis of NFL 2025-2026 Planned v. Actual NFL Wagering Intentions Through the Wild Card Round appeared first on Americas iGaming & Sports Betting News.

Activision Blizzard

BLAST Appoints Industry Veteran Steve Rossi as Senior Vice President of Brand Partnerships

BLAST, a global leader in competitive entertainment, has officially announced the appointment of Steve Rossi as Senior Vice President of Brand Partnerships. Rossi joins the team at a pivotal moment, following a record-breaking 2025 that saw the company expand its footprint into New York City, Malta, and Mumbai.

With over 20 years of experience in strategic partnerships across sports, media, and gaming, Rossi is set to lead BLAST’s next phase of commercial evolution.

A Proven Leader in Global Commercial Strategy

Rossi’s career is defined by his ability to bridge the gap between iconic intellectual properties and Fortune 100 brands. His previous roles include senior leadership positions at:

-

Activision Blizzard: Where he was instrumental in the commercialization and global expansion of Activision Blizzard Esports.

-

National Football League (NFL): Driving integrated sponsorships across the NFL Network and digital platforms.

-

Univision Communications: Designing and activating media partnerships across live and linear platforms.

-

PlayVS: Focusing on the intersection of youth esports and brand engagement.

Based in the newly established New York office, Rossi will oversee BLAST’s global Sponsorship Sales and Partner Management & Activation.

Building on a Record-Breaking 2025

The appointment comes as BLAST continues to scale at an unprecedented rate. In 2025, the company delivered:

-

15 Arena Events staged across eight different countries.

-

Broadcasts in 30+ Languages reaching fans in over 100 territories.

-

Expanded Portfolio: Continued investment in top-tier titles including Counter-Strike 2, Dota 2, Rainbow Six, PUBG, Rocket League, Fortnite, and Brawl Stars.

“BLAST has built a truly premium proposition at the intersection of entertainment, gaming, sport and culture,” said Steve Rossi. “I’m excited to work with the team to build long-term, high-impact partnerships that deliver real value for brands, publishers and fans alike.”

A Strategic Vision for 2026

Leo Matlock, Chief Business Officer at BLAST, emphasized that Rossi’s leadership will be instrumental as the company evolves its partnership offerings. “Steve brings deep experience across esports, sport, media and entertainment. His ability to scale global commercial partnerships makes him the perfect fit for BLAST at this incredibly exciting time.”

As BLAST enters 2026, the focus remains on delivering fan-first experiences and commercially impactful collaborations that maintain BLAST’s position as a pioneer in the competitive gaming space.

Learn More

To stay updated on BLAST’s upcoming arena events and commercial ventures, visit the official BLAST website.

The post BLAST Appoints Industry Veteran Steve Rossi as Senior Vice President of Brand Partnerships appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Activision Blizzard

BLAST Appoints Steve Rossi as Senior Vice President of Brand Partnerships

-

Rossi joins BLAST following senior commercial leadership roles at Activision Blizzard, the National Football League (NFL) and Univision Communications

-

He will drive BLAST’s next phase of commercial growth following a record-breaking 2025, which included global expansion and new offices in New York City, Malta and Mumbai

BLAST, one of the world’s leading esports and competitive entertainment companies, has appointed Steve Rossi as Senior Vice President of Brand Partnerships, strengthening its commercial leadership team as the business continues to scale globally.

Rossi brings more than 20 years of experience building high-impact strategic partnerships across complex IP rights, sponsorship, and media portfolios. A commercially driven executive and recognised relationship builder, he has led strategic revenue growth initiatives for some of the world’s most iconic brands and IP holders across sport, gaming and entertainment.

In his new role, Rossi will lead BLAST’s global commercial brand partnerships strategy, overseeing Sponsorship Sales and Partner Management & Activation globally. He will be responsible for driving revenue growth and long-term value creation through strategic brand partnerships, as BLAST continues to expand its premium live events, broadcast content and competitive entertainment formats worldwide.

Throughout his career, Rossi has held senior leadership roles at Activision Blizzard, the National Football League (NFL), and Univision Communications, where he helped design, sell, and activate integrated sponsorship and media partnerships across digital, linear, and live platforms. Most recently, he served in a senior partnerships role at PlayVS, operating at the intersection of competitive gaming, youth esports, and brand engagement.

Most notably, at Activision Blizzard, Rossi played a key role in the global expansion of Activision Blizzard Esports, supporting commercialization efforts by working closely with global brand partners, agencies, and regional sales teams across North America, EMEA, and APAC. Earlier in his career, he helped drive integrated sponsorships for the NFL across NFL Network and digital platforms, collaborating with Fortune 100 marketers and leading media agencies.

Based in New York, Rossi will lead BLAST’s global brand partnerships group, supporting the company’s continued growth across key international markets and working closely with publishers, partners, and internal teams to deliver commercially impactful, fan-first experiences and partnerships.

Steve Rossi, Senior Vice President, Brand Partnerships at BLAST, said: “BLAST has built a truly premium proposition at the intersection of entertainment, gaming, sport and culture. The team has established real global momentum, and the opportunity to build on that foundation and lead the next phase of global partnerships strategy at a company with such creative ambition and international scale was incredibly compelling. I’m excited to work with the team to build long-term, high-impact partnerships that deliver real value for brands, publishers and fans alike.”

Leo Matlock, Chief Business Officer at BLAST, added: “Steve brings deep experience across esports, sport, media and entertainment, combined with a proven ability to scale global commercial partnerships. As BLAST continues to grow its international footprint and evolve its partnership offering, Steve’s leadership will be instrumental in driving sustainable revenue growth and long-term value creation. The last 12 months have seen us expand globally while delivering record output in the process, Steve is joining BLAST at an incredibly exciting time.”

The appointment follows a record-breaking year for BLAST in 2025, with increased broadcast hours and more world-class arena events. The company staged 15 arena events across eight countries, broadcast to millions of fans across more than 100 territories and 30 languages, while expanding its global footprint with new offices and studios in key gaming and media hubs including Mumbai, New York City and Malta. Alongside continued investment in core esports titles such as Counter-Strike 2, Dota 2, Rainbow Six, PUBG, Rocket League, Fortnite and Brawl Stars.

The post BLAST Appoints Steve Rossi as Senior Vice President of Brand Partnerships appeared first on Americas iGaming & Sports Betting News.

-

AI6 days ago

AI6 days agoPrimero Games Uses XGENIA for Their First AI-Generated Slot Game

-

Balkans7 days ago

Balkans7 days agoKiril Kirilov takes on new leadership role at CT Interactive

-

Baltic Tech Week6 days ago

Baltic Tech Week6 days agoHIPTHER Baltics Announces Riga Event and Strategic Partnership with LexLegas

-

ALGS 2026 Championship6 days ago

ALGS 2026 Championship6 days agoS8UL Esports secures historic top five finish at ALGS 2026 Championship; bags INR 1 crore in prize money

-

College Sport Prediction Markets7 days ago

College Sport Prediction Markets7 days agoNCAA Urges CFTC to Suspend College Sport Prediction Markets

-

Compliance Updates7 days ago

Compliance Updates7 days agoSEON Launches Identity Verification Built on Real-Time Fraud Intelligence

-

Birgit Wimmer6 days ago

Birgit Wimmer6 days agoBirgit Wimmer Named Chairwoman as NOVOMATIC AG Reshapes Supervisory Board

-

Latest News2 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona