Latest News

LeoVegas AB Q2: Quarterly report 1 April – 30 June 2021

“All-time-high in Sweden and a strong start for Expekt” – Gustaf Hagman, Group CEO

SECOND QUARTER 2021: 1 APRIL – 30 JUNE

- Revenue decreased by 13% to EUR 96.8 m (110.7).

- Excluding Germany, growth was positive 3%.

- Adjusted EBITDA was EUR 10.6 m (23.0), corresponding to a margin of 10.9% (20.8%). Reported EBITDA was EUR 9.8 m (23.0).

- The number of depositing customers was 460,697 (434,453), an increase of 6%.

- Adjusted earnings per share were EUR 0.06 (0.19).

EVENTS DURING THE QUARTER

- The acquisition of Expekt was completed and integrated on 19 May 2021. The start has been a success, and Expekt’s revenue and market share have nearly doubled in Sweden since the acquisition was carried out.

- LeoVegas’ forthcoming expansion to the USA, starting in the state of New Jersey, is on track.

- LeoVegas carried out share repurchases for EUR 4.9 m and paid out of the first out of four quarterly dividends to the Parent Company’s shareholders. The second quarterly dividend payment was made after the end of the period.

- LeoVegas’ framework and routines for ensuring responsible gaming have been assessed by the independent agency eCOGRA. The external assessment shows that LeoVegas is in conformity with all relevant recommendations and requirements for responsible gaming published by the European commission.

EVENTS AFTER THE END OF THE QUARTER

- Preliminary revenue in July amounted to EUR 32.8 m (30.7), corresponding to growth of 7%. Excluding Germany, revenue grew 23%.

COMMENT FROM GUSTAF HAGMAN – GROUP CEO

SECOND QUARTER

Most of our markets have continued to develop well, with high, double-digit growth in key markets like Italy and Spain. The development in Sweden is encouraging, with record-high revenue during the quarter. We are also growing rapidly in North America, which now accounts for 10% of consolidated revenue. However, re-regulation in Germany continued to negatively impact figures during the period. Excluding Germany, Group revenue increased by 3% to a new record level despite tough comparison figures from the start of the pandemic during the second quarter of 2020 and greater competition from other entertainment activities as societies are now opening up again. We expect to see positive growth for the Group on a yearly basis during the third quarter.

Our operating profit decreased compared with the same period a year ago, while we achieved stable earnings compared with the preceding quarter. This is despite a high level of investments and a number of important, strategic ventures, including our forthcoming launch in the USA, a stronger focus on sports with the acquisition of Expekt, and our new game studio. Marketing costs in relation to revenue were higher than the historic average, coupled among other things to the relaunch of Expekt and investments in a number of key markets in which we see high customer growth. Investments in marketing during the quarter weighed down earnings short-term but are driving value long-term and will also enable us to accelerate out of the revenue drop in Germany. As revenues increase, the share of marketing investment will decrease. At the same time, we have maintained good cost control, and our operating expenses have more or less been unchanged over the last three-year period.

THE NEW EXPEKT

In mid-May we consolidated the acquisition of Expekt, and shortly thereafter “the New Expekt” was launched with a large and attention-grabbing marketing campaign ahead of the Euro 2020 football championship. It was a successful start, and in a short time we nearly doubled Expekt’s revenue and market share in Sweden since completion of the acquisition.

GERMANY

The situation in Germany coupled to re-regulation, with strict product limitations, an extremely high gaming tax and a skewed competitive situation, is having a negative effect on the Group. Revenue in Germany decreased by 81% compared with a year ago and accounted for only 4% of Group revenue during the quarter. We believe it will take time to create a balanced and fair market climate and have therefore chosen to shift our investments to other, more profitable markets. Over the long term we still believe that Germany, with Europe’s largest population, offers great opportunities for the Group.

NORTH AMERICA

Our forthcoming expansion to the USA, starting with the state of New Jersey, is on track. We are currently working on adapting and certifying our technical platform, and during the autumn we will also begin establishing a local organisation. We expect to accept our first American customers during the first half of 2022.

The Canadian province of Ontario, which is home to roughly 40% of Canada’s population, is conducting preparations to introduce a local licence system for online gaming. LeoVegas has built up a strong brand along with a large and loyal customer base in Ontario and the rest of Canada, among other things with help from former hockey legend Mats Sundin. According to our assessment LeoVegas is one of the larger and most well-known casino actors in the Canadian market.

During the second quarter, North America accounted for 10% of the Group’s total revenue and grew 33%. In pace with our continued expansion in Canada and forthcoming launch in the USA, revenue from North America will increase. This is in line with the Group’s strategy to diversify our revenues.

COMMENTS ON THE THIRD QUARTER

Revenue for the month of July amounted to EUR 32.8 m (30.7), corresponding to positive growth of 7%. Adjusted for Germany, the Group’s growth in July was 23%.

Powered by WPeMatico

Latest News

Report affirms Ygam’s leading role in gambling harm prevention

The latest Ygam impact report reiterates the integral role that the charity plays in preventing gaming and gambling harms among young people.

Between January 2024 to March 2025, Ygam trained nearly 10,000 delegates and reached and estimated 1.3 million children and young people across the UK – the highest reach figure since its inception in 2014. Recognised as the UK’s leading charity dedicated to prevention gambling harms among young people, Ygam has continued to set the standard in the sector.

The charity has significantly strengthened its focus on data, evaluation, and evidence-based practice, commissioning independent evaluations of four of its flagship programmes. These evaluations have generated robust insights into the long-term effectiveness of Ygam’s approach and are helping to shape the future of prevention education across the UK.

This report brings together a rich body of evidence, including independent evaluations, pre- and post-training feedback, and delegate testimonials – compiled to inform strategic direction and long-term effect.

Ygam’s growing prominence is reflected in its expanding reputation and influence across the youth sector. The charity continues to build strong partnerships with schools, universities, youth organisations, and community groups, ensuring its resources are embedded where they can make the greatest impact. Ygam is now working with esteemed brands including The Scouts, NSPCC, The Children’s Society, TSB Bank, Place2Be, and Barnardo’s.

The charity’s work has also been praised by Gambling Minister Baroness Twycross, who welcomed the publication of the report.

Parliamentary Under-Secretary of State at the Department for Culture, Media and Sport, Baroness Twycross, said: “I welcome this report, which highlights Ygam’s vital role in educating more than one million young people on how to lead safer digital lives.

One of my key priorities as gambling minister is to strengthen protections around those most vulnerable to harmful gambling and I look forward to collaborating with Ygam in future as we continue to build a safer online space for young people.”

Helen Martin, Chief Operating Officer and Interim Chief Executive at Ygam, said: “I’m incredibly proud to present this impact report, which highlights Ygam’s leading role in the prevention field and our recognised expertise in safeguarding children and young people. Central to our success is a strong commitment to collaboration and the transformative power of partnership.

I’m delighted with the strides we’ve made in evaluating our work. While our reach figures are impressive, they represent just one facet of the significant impact we are achieving. By investing time and resources in rigorous evaluation, we ensure our programmes are not only evidence-based but also exemplify best-in-class standards and deliver lasting impact.

Our dedication to thorough evaluation, ongoing learning, and reflective practice empowers us to continually enhance our approach and meet the evolving needs of the communities we support. This commitment will continue to reinforce our position as trusted experts in the field.”

Key findings of the Impact Report 2024/2025:

- 1,324,416 estimated young people reach through delegates trained.

- 9,448 delegates trained in positions of care and influence over young people, including 3,762 teachers and youth workers.

- 1 million social media impressions, marking 322% increase from 2023.

- 97% of delegates would recommend Ygam training to a colleague.

- 97% of delegates felt better equipped to identify and respond to gambling harms following Ygam training.

- 50% of teachers and youth workers said they had implemented the Ygam materials in their classroom within 12 months of completing the training.

- 2,134 volunteer leaders were reached through the Scout Association partnership, safeguarding an estimated 45,000 children and young people.

- 50 universities visited across the UK.

- 115,000 estimated university students reach.

This report reinforces the charity’s commitment to independent evaluation, learning, and reflection, which helps to continuously strengthen their our own portfolio and harm prevention efforts across the wider sector.

You can read Ygam’s full Impact Report 2024-5 here.

The post Report affirms Ygam’s leading role in gambling harm prevention appeared first on European Gaming Industry News.

Latest News

Midnite named principal partner of Sheffield United

- Midnite to be Blades’ front-of-shirt sponsor for 2025-26 season

- Lucky season ticket holders will get VIP seat upgrade for every match thanks to Midnite

- Midnite is among UK’s fastest-growing sportsbooks.

Midnite, one of the UK’s fastest-growing online sportsbooks, has been named as the principal partner of Sheffield United for the 2025-26 season.

Midnite’s logo will be on the front of Blades shirts for the men’s and women’s adult first teams, training kits and adult replica shirts. It will also be displayed around Bramall Lane, on home match team sheets, the matchday programme and across the club’s social media channels.

The partnership also launches Midnite Premium Seat Upgrade. This will see two lucky season ticket holders drawn at random before each men’s home league game to enjoy a premium match experience in the prestigious Tony Currie Suite.

Midnite and Sheffield United will also collaborate to bring Blades fans closer to their club with a series of unique moments and unprecedented opportunities throughout the season.

Midnite was the official betting partner of the 2025 World Snooker Championship, held at the Crucible in Sheffield earlier this year.

Jonathan Shaw, Vice President of Growth at Midnite, said: “It’s a privilege for Midnite to become principal partner of Sheffield United for the coming season. The club has a proud history and a strong connection with its supporters and we’re committed to helping make this a memorable season for Blades fans.

“This partnership continues our efforts to grow Midnite as a challenger brand in the UK market, as we look to build our presence and offer a genuine alternative to the established tier-one operators. We’re looking forward to working with the club and its supporters throughout the season.”

Paul Fielder Head of Commercial for Sheffield United Football Club said: “We’re pleased to welcome Midnite as our principal partner for the 2025-26 season. They’ve shown a clear commitment to working with the club and its supporters and we’ve been impressed by their thoughtful and collaborative approach.

“We look forward to developing the partnership over the season and providing Blades fans with some memorable moments along the way.”

Midnite and Sheffield United’s partnership will operate in accordance with the Gambling Commission’s codes of practice.

The post Midnite named principal partner of Sheffield United appeared first on European Gaming Industry News.

Latest News

Unlock Top-Tier Deals and Careers: Parimatch joins iGB L!VE 2025

Parimatch, the global entertainment company, is set to make a significant impact at iGB L!VE 2025, taking place in London from July 2–3. Located at Stand E34, the Parimatch team will welcome industry leaders, potential partners, and top talent to explore a world of premium entertainment opportunities.

iGB L!VE is a cornerstone event in the iGaming calendar. That is why Parimatch is creating a hub for high-value connections with key decision-makers. The stand will be a must-visit destination for attendees seeking access to a top-tier network of C-level executives and the best deals from an Affiliate program operating globally across the Middle East, Southeast Asia, and Europe. The Parimatch Affiliate team will be on hand to discuss the best deals and hottest offers, designed to drive high performance for partners.

The Parimatch experience at Stand E34 is designed to be unforgettable, going beyond performance to build strong alliances and celebrate shared success. Demonstrating a commitment that goes beyond industry standards, Parimatch Affiliates will host an exclusive side event for its top partners: a trip to the Formula 1 race in Silverstone. This ethos will be reflected at the stand through a dynamic atmosphere where insights and energy converge, complete with engaging activities, prize draws, and limited-edition merchandise drops.

In addition to fostering business objectives, Parimatch is focusing more than ever on its employer brand. The company’s Employer Brand and HR teams will be on-site for open conversations with talented professionals. Visitors can gain direct insights into Parimatch’s vibrant corporate culture, diverse work formats, and significant career opportunities. This provides a transparent look into life at a leading global entertainment company.

The post Unlock Top-Tier Deals and Careers: Parimatch joins iGB L!VE 2025 appeared first on European Gaming Industry News.

-

Latest News7 days ago

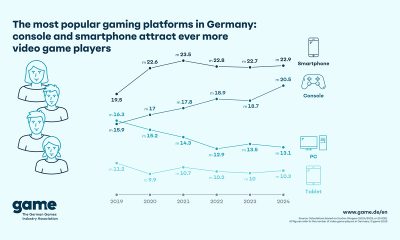

Latest News7 days agoThe Most Popular Gaming Platforms in Germany: Console and Smartphone Attract Ever More Video Game Players

-

Asia7 days ago

Asia7 days agoFIFA, NBA, UFC and More Sports Events Go Live – Crypto Sportsbook BETY Offers Global Sports Betting Coverage 2025

-

Balkans7 days ago

Balkans7 days agoSYNOT Partners with Efbet in Bulgaria

-

Australia6 days ago

Australia6 days agoVGCCC: Minors Exposed to Gambling at ALH Venues

-

EveryMatrix Press Releases7 days ago

EveryMatrix Press Releases7 days agoSlotMatrix unleashes divine riches in Fortuna Gold where gods rule the reels

-

Africa6 days ago

Africa6 days agopawaTech strengthens its integrity commitment with membership of the International Betting Integrity Association

-

Brazil7 days ago

Brazil7 days agoTG Lab unveils new Brazil office to further cement position as market’s most localised platform

-

Africa6 days ago

Africa6 days agoSA Rugby Renews its Partnership with Betway