Asia

FBM takes the slots expansion campaign to the Philippines with a double debut

FBM continues its global expansion campaign in the slots segment with a double entry in the Philippines market. The global gaming brand enters the Dragon Club Casino Filipino Binondo with fresh new games and cabinets. The four gaming adventures of the Easy$Link® pack – Catch the Gold; RacinGo – Wild; Underwater Riches and Kingdom Gems – are now available to play in 20 FBM´s cabinets of the Shadow model.

After conquering the Mexican and Irish nations, FBM slots games arrive in the Philippines. The global gaming brand leads the video bingo segment in the country and starts to diversify its land-based portfolio with the first incursion of Easy$Link®. Besides the debut of these progressive link games with exclusive features, FBM brings the Shadow cabinets for the first time to a casino in the Philippines.

Rui Francisco, FBM´s founder, enhances the importance of this achievement for the brand. “The debuts of the Easy$Link® games pack and the Shadow cabinets in the Philippines are an important chapter of FBM expansion in the slots universe. We are thrilled to grow our presence in this specific game type and especially in the Philippines, a market where we have a long and positive background built by almost 20 years of trustful relations with many industry players”, completes Rui Francisco.

Easy$Link® is a set of four games with a linked progressive jackpot and more chances to get a winning combination. The Sticky Wild, Wild Multiplier, Best Symbols and Super Reels are four exclusive features that build a whole new gaming experience in this collection, but the Mini, Minor, Major or Grand jackpots are the soul of Easy$Link´s joyful gameplay.

These packs of slots games are available to play in the Shadow cabinet. This model brings comfort to the players by combining industry-leading hardware with a modern appearance, a surround sound system and sophisticated technology.

FBM is a global gaming brand that has conquered the land-based casino market since 2001. Established in various Asian, North American and European nations, the brand owns the video bingo market’s leadership and is committed to reinventing the slots segment. FBM´s online market footprint has also grown during the last few years and counts with more than 30 titles, including video bingo, slots, and table games.

Powered by WPeMatico

Asia

Macau Government Extends Lottery Concession of Macau Slot Until 5 June 2026

The Macau government has extended the lottery concession of Macau Slot Co Ltd for one year until 5 June 2026.

The concession renewal was published in the official gazette on Wednesday. Further extensions may be granted, subject to mutual agreement between the Macau government and Macau Slot.

As part of the renewal terms, Macau Slot is required to gradually reduce its number of non-resident employees and actively collaborate with the government to recruit and retain local talent.

Earlier this month, the government held a meeting with Macau Slot representatives to discuss the extension. According to the Gaming Inspection and Coordination Bureau (DICJ), the city’s industry regulator, Macau Slot committed to cutting 35% of its non-local, non-skilled workforce—equivalent to 26 positions—by the first quarter of 2026. The company also pledged to make further reductions to its foreign labour quota in the future. Currently, non-local staff account for 15% of the total workforce at Macau Slot.

“Over the past year, despite fluctuations in the macroeconomic environment and slower economic recovery in neighbouring regions, the local economy has remained relatively stable under the guidance of the Macau SAR government’s policies,” Macau Slot said in a statement.

“Looking ahead, we are committed to further diversifying our sports betting products to meet customer demand, while upgrading our information technology infrastructure to stay current and deliver more comprehensive sports betting services.”

The post Macau Government Extends Lottery Concession of Macau Slot Until 5 June 2026 appeared first on European Gaming Industry News.

Asia

QTech Games strengthens its elite suite with Bigpot Gaming

Emerging-markets leader expands its all-encompassing library with exciting new slots portfolio

The post QTech Games strengthens its elite suite with Bigpot Gaming appeared first on European Gaming Industry News.

Asia

Polemos Announces Partnership with Guinevere Capital

Polemos, a Web3 gaming infrastructure platform, has announced a strategic partnership with Guinevere Capital, a prominent esports and gaming investment firm known for its investments and advisory roles in projects such as GiantX, iTero, Perion, Skybox and various other projects across the industry. Guinevere Capital has established a strong reputation for its work across global Web2 gaming titles, including League of Legends, Valorant, Rocket League and many more. This partnership aims to leverage the combined expertise of Polemos.io and Guinevere Capital to enhance and further monetise audiences across publishers, infrastructure players, gaming companies, studios and platforms.

The collaboration will focus on integrating advanced asset management and engagement tools from Polemos.io’s Forge platform with Guinevere Capital’s extensive network and experience in both Web2 and esports ecosystems. This will create new monetisation opportunities and improve player experiences by bridging traditional gaming with blockchain-enabled innovations.

Carl Wilgenbus, CEO of Polemos.io, said: “Partnering with Guinevere Capital marks a significant milestone in our mission to expand access to gaming rewards and unlock new revenue streams for the entire gaming industry. Together, we will empower publishers and studios to better engage their audiences and capitalize on the evolving landscape of gaming and esports.”

“Polemos has built an impressive piece of infrastructure that has plugged a huge gap in the gaming sector. We look forward to working with them to commercialise this,” said Dave Harris, a partner at Guinevere Capital.

Dave’s previous experience includes investing in and operating top teams and leagues in the Riot Games and Activision Blizzard ecosystems.

Guinevere Capital’s strategic involvement will accelerate the adoption of blockchain gaming infrastructure while supporting the growth of esports and gaming communities worldwide. This alliance underscores a shared vision to drive innovation, education and monetisation in the gaming sector by combining Web2’s reach with Web3’s potential.

The post Polemos Announces Partnership with Guinevere Capital appeared first on European Gaming Industry News.

-

Latest News7 days ago

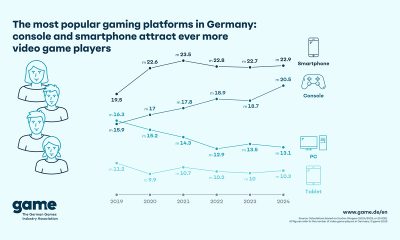

Latest News7 days agoThe Most Popular Gaming Platforms in Germany: Console and Smartphone Attract Ever More Video Game Players

-

Asia7 days ago

Asia7 days agoFIFA, NBA, UFC and More Sports Events Go Live – Crypto Sportsbook BETY Offers Global Sports Betting Coverage 2025

-

Balkans7 days ago

Balkans7 days agoSYNOT Partners with Efbet in Bulgaria

-

Australia6 days ago

Australia6 days agoVGCCC: Minors Exposed to Gambling at ALH Venues

-

EveryMatrix Press Releases7 days ago

EveryMatrix Press Releases7 days agoSlotMatrix unleashes divine riches in Fortuna Gold where gods rule the reels

-

Africa6 days ago

Africa6 days agopawaTech strengthens its integrity commitment with membership of the International Betting Integrity Association

-

Brazil7 days ago

Brazil7 days agoTG Lab unveils new Brazil office to further cement position as market’s most localised platform

-

Baltics7 days ago

Baltics7 days agoEstonian start-up vows to revolutionise iGaming customer support with AI