Canada

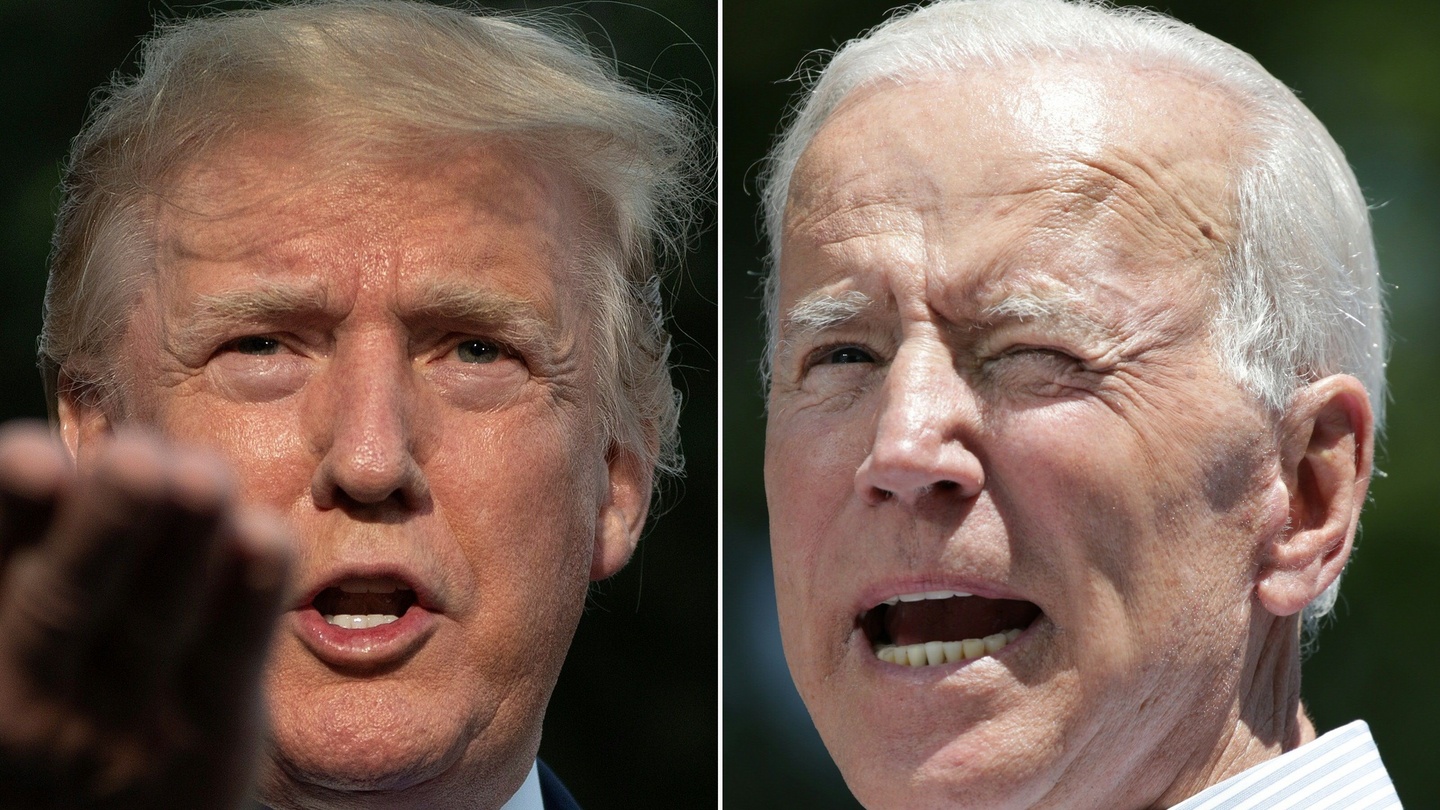

Trump vs Biden odds: An operator’s nightmare

Cloudbet unpacks some of the narratives behind the market moves in a furious and fluctuating betting race for the US presidency

Operators have been offering outrights on the 2020 US election for years, with the market opening immediately after President Donald Trump’s against-the-odds victory over Hillary Clinton four years ago.

On the eve of Election Day, betting pundits are rightly asking if Trump can do it again. There are some obvious similarities to four years ago: While we know much more about him, The Donald is still The Donald, and his Democrat opponent is – once again – a high-profile established Washington lifer in Joe Biden.

The other thing that hasn’t changed are the nightmares that Trump is still giving operators – which is precisely the subject of this article.

To set the stage, some background. Outright markets in the early stages had a diverse array of candidates, and it was really only after Trump and Biden secured their respective parties’ nominations that the field was whittled down to our main protagonists – effectively shutting the door on bettors’ hopes for long-shot candidates (though you can still get a bet on Jo Jorgensen).

Initial odds are formed on presidential candidates by operators in pretty much the same way as a major sporting event: The book takes a view on the chances of each candidate winning, splitting up the 100% quantum of probabilities between the number of candidates left in the race.

In politics betting, that view might be influenced by things like how healthy or mentally sharp a candidate looks, how much relevant experience they can bring to the role, what skeletons are in (or in some case, out of) their closet, how influential they are in galvanising their parties around them, or how influential they could be in galvanising communities within the country. The book distills these factors out into its own view on anticipated investment and liability controls – i.e., how much exposure is it willing to take on any one candidate.

In short – as with a sporting contest – what are the chances of A prevailing over B, what influences those chances, and what price would you charge someone to back those chances (really, it boils down to what’s the price at which a book would be willing to accept the risk of losing a bet)?

Not enough data, captain

But there is a major obstacle when it comes to setting prices for elections: the lack of observable data or analysis. Yes, there are a plethora of polls and more news and rumour than you can swing a cat at for the present election – but it’s all down to one contest – one that has never played out before.

Yes, Trump has contested and won one election, while Biden has two electoral victories to his name, but they were both as Barack Obama’s sidekick. This time, it’s Trump versus Biden – for the first (and probably only) time. Operators don’t know, really, what variables matter in this instance that will ultimately influence the outcome of the contest, because there is no historical experience to go by.

Contrast this with (in a Covid-free era) the number of times Manchester United might face Arsenal in a season – or, to equate this to a US election cycle, across four years. Oddsmakers have millions of data points, yes, but they also have a rock-solid understanding on which of those data points matter most for a particular contest: because they’ve seen it before, dozens of times.

Let’s accept then that prices on the US election will have to be taken with a great dollop of good faith, and are more a vote of trust in the bookmaker setting the odds.

Next, is how bettors respond to those prices based on what influences their perceptions of value and candidate probabilities. And the quantum of bets they place ostensibly is a good safe indicator for operators to shape the prices for either candidate. We say “ostensibly” with good reason…

In polls, we trust

In any election, the polls certainly can sway voting intentions – and betting odds. Current polls can be viewed as a reflection of all that is currently known, or perceived, about a candidate’s ability to win an election. In the absence of any substantive knowledge or ability to predict the future, a poll is the best guide, the “best real-world estimate” of either candidate’s chances of victory.

If you can trust the polls, you can simply equate a reliable poll percentage with an implied probability, and you have a reliable price indicator – right?

Wrong, as anyone who followed betting odds during the 2016 election will tell you. Prices on Trump in the lead up to Election Day had widened as far as 9 (+800) – implying a win probability of 11%.

And we know the result – an improbable victory to The Donald – and surely some very happy punters to boot.

So here then is the second major challenge for bookmakers: Trump has beaten the odds before. Do you really want to expose your business to massive losses by pricing him too far out of the market, whatever the polls are telling you?

Where’s the action?

Bettors are clearly aware of what happened in 2016 – and books are clearly seeing substantial interest on Trump, in spite of what the election polls indicate. More than 85% of the money that Cloudbet has taken on the US election has been on Trump and the Republicans – and it’s a theme evident at other books as well.

While there could be a point made about the predispositions within the bitcoin community that might make them more right-leaning (if not directly Trump-supporting), people are certainly betting that he could do it again.

That being said, why is Biden still favoured to win by every book on the street? Someone must be betting on him, in size. While we can’t speak to their motivations, the point we can make from a pricing standpoint is that it pays to be aware of where the action is, and who has it.

We estimate that betting exchanges are seeing roughly half of the action on the US election, with Betfair clearly taking some sizable Biden bets. We’re not suggesting that exchanges are the key indicator of an event’s outcome – but from a bettor’s perspective, it’s good to know where the action is to form individual views on value in the odds.

And there we have it, ladies and gentlemen. As of this writing, the current odds give Trump a 37% chance of victory.

His opponent is at 63%. Who will win?

We can’t say for sure, but we hope that with this article, you’re better equipped to understand what goes into these odds.

What we CAN say: where Donald J. Trump is concerned, anything is possible.

Powered by WPeMatico

AGCO

AGCO Fines Great Canadian Casino Resort Toronto $350,000 for Serious Regulatory Violations Linked to Impromptu After-Party on Gaming Floor

The Alcohol and Gaming Commission of Ontario (AGCO) has issued monetary penalties totaling $350,000 against Great Canadian Casino Resort Toronto for multiple violations of provincial gaming standards. The penalties follow an impromptu after-party that was permitted to take place in the pre-dawn hours directly on the casino’s gaming floor.

On September 27, 2024, an electronic dance music event attended by thousands of people was hosted in the theatre adjacent to the casino at Great Canadian Casino Resort Toronto. The event was marked by widespread intoxication, disorderly behavior, and numerous criminal and medical incidents – both inside and outside the venue – including alleged assaults, drug overdoses, and acts of public indecency. Although paid duty officers were present, additional police and emergency services were required to manage the situation.

In the midst of this high-risk environment, casino management approved an unscheduled request by the performing artist to host an after-party on the active gaming floor. The artist and more than 400 guests were permitted onto the gaming floor where the artist was allowed to perform amidst operational table games and gaming machines – without any prior risk assessment or planning.

As a result, security personnel were unable to effectively control the casino floor, including witness reports that an attendee was seen climbing onto slot machines. Failure to maintain appropriate control compromises the security, safety, and integrity of the casino floor. Following the conclusion of the event, the operator failed to promptly report these incidents to the AGCO as required.

Based on the findings of its review, the AGCO’s Registrar has issued an Order of Monetary Penalty (OMP) totaling $350,000 against Great Canadian Casino Resort Toronto. These penalties address critical failures in their operations, incident reporting, employee training, and the management of disturbances.

A gaming operator served with an OMP has 15 days to appeal the Registrar’s decision to the Licence Appeal Tribunal (LAT), an adjudicative tribunal that is part of Tribunals Ontario and independent of the AGCO.

“Casino operators have a fundamental duty to control their gaming environment. Great Canadian Casino Resort Toronto’s lapses in this incident compromised the safety of patrons and the security and integrity of the gaming floor,” Dr. Karin Schnarr, Chief Executive Officer and Registrar of AGCO, said.

The post AGCO Fines Great Canadian Casino Resort Toronto $350,000 for Serious Regulatory Violations Linked to Impromptu After-Party on Gaming Floor appeared first on Gaming and Gambling Industry in the Americas.

Canada

IGT and Atlantic Lottery Sign Eight-Year Video Lottery Central System Technology Agreement

International Game Technology PLC announced that its subsidiary, IGT Canada Solutions ULC (hereinafter “IGT”), signed an eight-year agreement with Atlantic Lottery to supply its IntelligenEVO video lottery central system technology across Atlantic Canada. The agreement includes the option for multiple extensions and positions the Atlantic Lottery to become the first World Lottery Association (WLA)-affiliated lottery operator to deploy IGT’s next-generation central management system in a game-to-system (G2S) distributed market.

“By leveraging IGT’s IntelligenEVO technology, Atlantic Lottery will power its video lottery network with the industry’s best-in-class central system and position itself to maximize future contributions to good causes. As an organization that prioritizes system security and exceptional player experiences, Atlantic Lottery believes that IGT’s IntelliegnEVO solution will help generate high player satisfaction and optimal network performance,” said Michael MacKinnon, Atlantic Lottery VP, Product.

“As a long-time supplier to Atlantic Lottery, IGT looks forward to helping the Lottery achieve its growth and player engagement goals with our leading-edge IntelligenEVO video lottery central system. IGT’s IntelligenEVO is a scalable technology for the WLA market that is backed by decades of experience and operator feedback, and maximizes the benefits of real-time data, cloud-based technologies and in-depth analytics,” said David Flinn, IGT SVP Canada, EMEA and LATAM, Gaming Sales.

With peak system security, network availability and responsible gaming functionalities, IntelligenEVO is a reliable, scalable solution that can meet the needs of today and in the future. The solution will accelerate time-to-market and enables the Atlantic Lottery to benefit from the system’s suite of player-focused functionality. The technology’s G2S and open API design optimizes data collection and delivery and will enable Atlantic Lottery to customize their program for evolving player needs.

The post IGT and Atlantic Lottery Sign Eight-Year Video Lottery Central System Technology Agreement appeared first on Gaming and Gambling Industry in the Americas.

BetRivers

NetGaming Goes Live in Ontario with Rush Street Interactive via BetRivers Platform

NetGaming, a fast-growing online casino content supplier, is proud to announce its launch in Ontario with Rush Street Interactive, Inc., a leading online casino and sports betting company in the United States, Canada and Latin America. This strategic collaboration marks a significant milestone for NetGaming as it continues to expand its footprint across regulated North American markets.

As part of the launch, Ontario players on BetRivers can now enjoy a diverse portfolio of NetGaming titles, known for their high-quality graphics, immersive gameplay, and unique themes. Standout games such as Zeus’s Thunderbolt, Bison Gold, and Fireball Inferno are among the first to go live, with additional titles set to follow soon.

This partnership is just the beginning. NetGaming plans to extend its collaboration with Rush Street Interactive into Michigan, New Jersey, Pennsylvania, Delaware, and Mexico over the coming months.

Pallavi Deshmukh, CEO of NetGaming, commented: “We are thrilled to go live with Rush Street Interactive, a powerhouse operator with a strong presence and loyal player base. This launch marks a significant milestone in our

North American expansion strategy and underscores our commitment to delivering exceptional gaming experiences tailored to local player preferences across the region.”

Richard Schwartz, CEO of Rush Street Interactive, commented: “We are pleased to partner with NetGaming to bring innovative, premium games to our players in Ontario. This collaboration aligns with our strategy to offer world-class

entertainment through engaging, action-packed online casino games. We look forward to expanding this partnership into additional regulated markets in the months ahead.”

This strategic partnership highlights both companies’ dedication to providing high- quality, innovative, and responsible entertainment to players in regulated markets.

The post NetGaming Goes Live in Ontario with Rush Street Interactive via BetRivers Platform appeared first on Gaming and Gambling Industry in the Americas.

-

AGCO7 days ago

AGCO7 days agoAGCO Fines Great Canadian Casino Resort Toronto $350,000 for Serious Regulatory Violations Linked to Impromptu After-Party on Gaming Floor

-

Africa7 days ago

Africa7 days agoALA Hosted Seminar on Artificial Intelligence and Cybersecurity

-

Canada7 days ago

Canada7 days agoIGT and Atlantic Lottery Sign Eight-Year Video Lottery Central System Technology Agreement

-

Africa6 days ago

Africa6 days agoDRC Signs MoU for Public-Private Partnership with Burundi’s East African General Trade Company

-

First7 days ago

First7 days agoFIRST and Genius Sports Extend Landmark Data Partnership, Powering Continued Growth

-

Latest News7 days ago

Latest News7 days agoUnlock Top-Tier Deals and Careers: Parimatch joins iGB L!VE 2025

-

Blokotech7 days ago

Blokotech7 days agoBlokotech unveils Cristian Tonanti as new Casino Partnership Manager

-

Brazil7 days ago

Brazil7 days agoEsportes da Sorte holds forum on “Integrity in Sports” with Ceará and Náutico