Gambling in the USA

Century Casinos, Inc. Announces Fourth Quarter and Full Year 2019 Results

Century Casinos, Inc. announced its financial results for the three months and year ended December 31, 2019.

Fourth Quarter 2019 Highlights*

- Net operating revenue was $67.2 million, an increase of 49% from the three months ended December 31, 2018.

- Loss from operations was ($14.7) million, a decrease of 846% from the three months ended December 31, 2018.

- Net loss attributable to Century Casinos, Inc. shareholders was ($20.1) million, a decrease of 4080% from the three months ended December 31, 2018.

- Adjusted EBITDA** was $9.8 million, an increase of 69% from the three months ended December 31, 2018.

- Loss per share was ($0.68).

2019 Highlights*

- Net operating revenue was $218.2 million, an increase of 29% from the year ended December 31, 2018.

- Loss from operations was ($5.2) million, a decrease of 155% from the year ended December 31, 2018.

- Net loss attributable to Century Casinos, Inc. shareholders was ($19.2) million, a decrease of 664% from the year ended December 31, 2018.

- Adjusted EBITDA** was $30.3 million, an increase of 30% from the year ended December 31, 2018.

- Basic loss per share was ($0.65), a decrease of 642% from the year ended December 31, 2018.

- Diluted loss per share was ($0.65), a decrease of 691% from the year ended December 31, 2018.

- Book value per share*** at December 31, 2019 was $5.54.

In December 2019, the Company determined that the intangible and tangible assets at Century Casino Bath were impaired. The impairment, which totaled $16.5 million, was determined after evaluating losses incurred by the casino since operations began and future forecasts of continued losses due to the current regulatory environment for casinos in England.

On December 6, 2019, the Company completed its acquisition (the “Acquisition”) of the operations of Isle Casino Cape Girardeau, located in Cape Girardeau, Missouri, Lady Luck Caruthersville, located in Caruthersville, Missouri, and Mountaineer Casino, Racetrack and Resort located in New Cumberland, West Virginia (collectively, the “Acquired Casinos”), from Eldorado Resorts, Inc. for an aggregate purchase price of approximately $110.6 million. Immediately prior to the Acquisition, the real estate assets underlying the Acquired Casinos were sold to an affiliate of VICI Properties Inc. (“VICI PropCo”). On the closing date, the Company and VICI PropCo entered into a triple net lease agreement (the “Master Lease”) for the three Acquired Casino properties. The Master Lease has an initial annual rent of approximately $25.0 million and an initial term of 15 years, with four five-year renewal options.

The consolidated results for the three months and year ended December 31, 2019 and 2018 are as follows:

|

For the three months |

For the year |

|||||||||||||||

|

Amounts in thousands, except per share data |

ended December 31, |

ended December 31, |

||||||||||||||

|

Consolidated Results: |

2019 |

2018 |

% Change |

2019 |

2018 |

% Change |

||||||||||

|

Net Operating Revenue |

$ |

67,236 |

$ |

45,106 |

49% |

$ |

218,227 |

$ |

168,938 |

29% |

||||||

|

(Loss) Earnings from Operations |

(14,745) |

1,976 |

(846%) |

(5,220) |

9,459 |

(155%) |

||||||||||

|

Net (Loss) Earnings Attributable to Century Casinos, Inc. Shareholders |

$ |

(20,140) |

$ |

506 |

(4080%) |

$ |

(19,155) |

$ |

3,394 |

(664%) |

||||||

|

Adjusted EBITDA** |

$ |

9,776 |

$ |

5,801 |

69% |

$ |

30,281 |

$ |

23,377 |

30% |

||||||

|

(Loss) Earnings Per Share Attributable to Century Casinos, Inc. Shareholders: |

||||||||||||||||

|

Basic |

$ |

(0.68) |

$ |

0.02 |

(3500%) |

$ |

(0.65) |

$ |

0.12 |

(642%) |

||||||

|

Diluted |

$ |

(0.68) |

$ |

0.02 |

(3500%) |

$ |

(0.65) |

$ |

0.11 |

(691%) |

||||||

“We are pleased with the fourth quarter results and the immediate impact the addition of the three casinos acquired from Eldorado Resorts had on our operating results,” Erwin Haitzmann and Peter Hoetzinger, Co-Chief Executive Officers of Century Casinos remarked. “The acquired casinos have had very encouraging initial results, and we are excited to continue integrating the operations into the Century brand and to see anticipated meaningful growth from this acquisition on Century Casinos in the future,” Messrs. Haitzmann and Hoetzinger concluded.

The Company is carefully monitoring the situation caused by the coronavirus (COVID-19) pandemic. Although the entire situation is unpredictable, our management teams are prepared to control what they can control. Our casinos are following and implementing the recommendations from the US Centers for Disease Control and Prevention, which include everyday preventative actions to help prevent the spread of respiratory viruses, such as washing your hands often with soap and water, avoiding touching your eyes, nose, and mouth with unwashed hands, covering your cough or sneeze with a tissue, cleaning and disinfecting frequently touched objects and surfaces and of course staying home when you are sick. We are also putting an extra effort into straight-forward and realistic guest messaging and have stepped-up employee trainings to ensure strict compliance with our policies and procedures. We are in constant communication with our employees to reinforce our sanitation safety procedures in both guest-facing and back-of-house areas. We are sanitizing high-traffic public areas at an increased frequency. Proper procedures are posted in all back-of-house work areas.

To date, COVID-19 has not had a significant impact on our US or Canadian markets, while the market in Poland has been weakening by approximately ten percent. Our customer base is very diversified within North America. Our casinos are ‘local’ casinos in urban and suburban locations, with the vast majority of our business from customers who live within an hour from our facilities. Our casinos have negligible meeting and convention business and few of our customers travel by air to visit us. This may temper the impact of COVID-19 on our business, but this situation continues to evolve and could adversely impact us until the virus runs its course.

Reportable Segment Results*

The table below shows the Company’s operating segments that are included in each of the Company’s reportable segments as of December 31, 2019:

|

Reportable Segment |

Operating Segment |

Reporting Unit |

|

United States |

Colorado |

Century Casino & Hotel – Central City |

|

Century Casino & Hotel – Cripple Creek |

||

|

West Virginia |

Mountaineer Casino, Racetrack & Resort |

|

|

Missouri |

Century Casino Cape Girardeau |

|

|

Century Casino Caruthersville |

||

|

Canada |

Edmonton |

Century Casino & Hotel – Edmonton |

|

Century Casino St. Albert |

||

|

Century Mile Racetrack and Casino |

||

|

Calgary |

Century Casino Calgary |

|

|

Century Downs Racetrack and Casino |

||

|

Century Bets! Inc. |

||

|

Poland |

Poland |

Casinos Poland |

|

Corporate and Other |

Corporate and Other |

Cruise Ships & Other |

|

Century Casino Bath |

||

|

Corporate Other |

The Company’s net operating revenue increased by $22.1 million, or 49%, and by $49.3 million, or 29%, for the three months and year ended December 31, 2019, compared to the three months and year ended December 31, 2018. Following is a summary of the changes in net operating revenue by reportable segment for the three months and year ended December 31, 2019, compared to the three months and year ended December 31, 2018:

|

Net Operating Revenue |

||||||||||||||||||||||

|

For the three months |

For the year |

|||||||||||||||||||||

|

ended December 31, |

ended December 31, |

|||||||||||||||||||||

|

Amounts in thousands |

2019 |

2018 |

$ Change |

% Change |

2019 |

2018 |

$ Change |

% Change |

||||||||||||||

|

United States |

$ |

23,926 |

$ |

7,938 |

$ |

15,988 |

201% |

$ |

49,998 |

$ |

33,483 |

$ |

16,515 |

49% |

||||||||

|

Canada |

20,291 |

15,678 |

4,613 |

29% |

80,650 |

61,361 |

19,289 |

31% |

||||||||||||||

|

Poland |

21,675 |

19,514 |

2,161 |

11% |

81,894 |

68,209 |

13,685 |

20% |

||||||||||||||

|

Corporate and Other |

1,344 |

1,976 |

(632) |

(32%) |

5,685 |

5,885 |

(200) |

(3%) |

||||||||||||||

|

Consolidated |

$ |

67,236 |

$ |

45,106 |

$ |

22,130 |

49% |

$ |

218,227 |

$ |

168,938 |

$ |

49,289 |

29% |

||||||||

The Company’s earnings from operations decreased by ($16.7) million, or (846%), and by ($14.7) million, or (155%), for the three months and year ended December 31, 2019, compared to the three months and year ended December 31, 2018. Following is a summary of the changes in earnings (loss) from operations by reportable segment for the three months and year ended December 31, 2019, compared to the three months and year ended December 31, 2018:

|

Earnings (Loss) from Operations |

||||||||||||||||||||||

|

For the three months |

For the year |

|||||||||||||||||||||

|

ended December 31, |

ended December 31, |

|||||||||||||||||||||

|

Amounts in thousands |

2019 |

2018 |

$ Change |

% Change |

2019 |

2018 |

$ Change |

% Change |

||||||||||||||

|

United States |

$ |

4,685 |

$ |

1,033 |

$ |

3,652 |

354% |

$ |

9,478 |

$ |

5,882 |

$ |

3,596 |

61% |

||||||||

|

Canada |

4,000 |

3,675 |

325 |

9% |

16,115 |

14,633 |

1,482 |

10% |

||||||||||||||

|

Poland |

1,627 |

460 |

1,167 |

254% |

5,915 |

145 |

5,770 |

3979% |

||||||||||||||

|

Corporate and Other |

(25,057) |

(3,192) |

(21,865) |

(685%) |

(36,728) |

(11,201) |

(25,527) |

(228%) |

||||||||||||||

|

Consolidated |

$ |

(14,745) |

$ |

1,976 |

$ |

(16,721) |

(846%) |

$ |

(5,220) |

$ |

9,459 |

$ |

(14,679) |

(155%) |

||||||||

Net earnings attributable to Century Casinos, Inc. shareholders decreased by ($20.6) million, or (4080%), and by ($22.5) million, or (664%), for the three months and year ended December 31, 2019, compared to the three months and year ended December 31, 2018. Following is a summary of the changes in net earnings (loss) attributable to Century Casinos, Inc. shareholders by reportable segment for the three months and year ended December 31, 2019, compared to the three months and year ended December 31, 2018:

|

Net Earnings (Loss) Attributable to Century Casinos, Inc. Shareholders |

||||||||||||||||||||||

|

For the three months |

For the year |

|||||||||||||||||||||

|

ended December 31, |

ended December 31, |

|||||||||||||||||||||

|

Amounts in thousands |

2019 |

2018 |

$ Change |

% Change |

2019 |

2018 |

$ Change |

% Change |

||||||||||||||

|

United States |

$ |

2,261 |

$ |

767 |

$ |

1,494 |

195% |

$ |

5,825 |

$ |

4,373 |

$ |

1,452 |

33% |

||||||||

|

Canada |

948 |

2,077 |

(1,129) |

(54%) |

6,669 |

7,715 |

(1,046) |

(14%) |

||||||||||||||

|

Poland |

1,352 |

179 |

1,173 |

655% |

3,466 |

(153) |

3,619 |

2365% |

||||||||||||||

|

Corporate and Other |

(24,701) |

(2,517) |

(22,184) |

(881%) |

(35,115) |

(8,541) |

(26,574) |

(311%) |

||||||||||||||

|

Consolidated |

$ |

(20,140) |

$ |

506 |

$ |

(20,646) |

(4080%) |

$ |

(19,155) |

$ |

3,394 |

$ |

(22,549) |

(664%) |

||||||||

Items deducted from or added to earnings from operations to arrive at net earnings (loss) attributable to Century Casinos, Inc. shareholders include interest income, interest expense, gains (losses) on foreign currency transactions and other, income tax expense and non-controlling interests.

The Company’s Adjusted EBITDA** increased by $4.0 million, or 69%, and by $6.9 million, or 30%, for the three months and year ended December 31, 2019 compared to the three months and year ended December 31, 2018. Following is a summary of the changes in Adjusted EBITDA** by reportable segment for the three months and year ended December 31, 2019 compared to the three months and year ended December 31, 2018:

|

Adjusted EBITDA** |

||||||||||||||||||||||

|

For the three months |

For the year |

|||||||||||||||||||||

|

ended December 31, |

ended December 31, |

|||||||||||||||||||||

|

Amounts in thousands |

2019 |

2018 |

$ Change |

% Change |

2019 |

2018 |

$ Change |

% Change |

||||||||||||||

|

United States |

$ |

5,441 |

$ |

1,582 |

$ |

3,859 |

244% |

$ |

11,825 |

$ |

8,061 |

$ |

3,764 |

47% |

||||||||

|

Canada |

5,378 |

4,991 |

387 |

8% |

21,212 |

19,522 |

1,690 |

9% |

||||||||||||||

|

Poland |

2,484 |

1,733 |

751 |

43% |

9,392 |

4,890 |

4,502 |

92% |

||||||||||||||

|

Corporate and Other |

(3,527) |

(2,505) |

(1,022) |

(41%) |

(12,148) |

(9,096) |

(3,052) |

(34%) |

||||||||||||||

|

Consolidated |

$ |

9,776 |

$ |

5,801 |

$ |

3,975 |

69% |

$ |

30,281 |

$ |

23,377 |

$ |

6,904 |

30% |

||||||||

Balance Sheet and Liquidity

As of December 31, 2019, the Company had $54.8 million in cash and cash equivalents and $179.0 million in outstanding debt on its balance sheet compared to $45.6 million in cash and cash equivalents and $59.5 million in outstanding debt at December 31, 2018. The outstanding debt as of December 31, 2019 included the following: $170.0 million related to the Company’s credit agreement with a group of lenders led by Macquarie Capital that the Company entered into in December 2019 in connection with the Acquisition, replacing the Company’s credit agreement with the Bank of Montreal; $2.0 million of bank debt related to Casinos Poland; $2.0 million of bank debt related to Century Casino Bath; and $15.0 million related to a long-term land lease for CDR, net of $10.0 million in deferred financing costs.

Conference Call Information

Today the Company will post a copy of its Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2019 on its website at www.cnty.com/investor/financials/sec-filings. The Company will also post a presentation on the year end results on its website at www.cnty.com/investor/presentations.

The Company will host its fourth quarter 2019 earnings conference call today, Friday, March 13th, at 8:00 am MDT. U.S. domestic participants should dial 1-844-244-9160. For all international participants, please use 330-931-4670 to dial-in. Participants may listen to the call live at www.centurycasinos.adobeconnect.com/earningsrelease or obtain a recording of the call on the Company’s website until March 31, 2020 at www.cnty.com/investor/financials/sec-filings.

|

CENTURY CASINOS, INC. AND SUBSIDIARIES |

||||||||||||

|

Condensed Consolidated Statements of (Loss) Earnings |

||||||||||||

|

For the three months |

For the year |

|||||||||||

|

ended December 31, |

ended December 31, |

|||||||||||

|

Amounts in thousands, except for per share information |

2019 |

2018 |

2019 |

2018 |

||||||||

|

Operating revenue: |

||||||||||||

|

Net operating revenue |

$ |

67,236 |

$ |

45,106 |

$ |

218,227 |

$ |

168,938 |

||||

|

Operating costs and expenses: |

||||||||||||

|

Total operating costs and expenses |

81,981 |

43,152 |

223,446 |

159,502 |

||||||||

|

Earnings (loss) from equity investment |

— |

22 |

(1) |

23 |

||||||||

|

(Loss) earnings from operations |

(14,745) |

1,976 |

(5,220) |

9,459 |

||||||||

|

Non-operating income (expense), net |

(3,569) |

(1,053) |

(6,747) |

(3,536) |

||||||||

|

(Loss) earnings before income taxes |

(18,314) |

923 |

(11,967) |

5,923 |

||||||||

|

Income tax provision |

(955) |

(133) |

(4,174) |

(1,917) |

||||||||

|

Net (loss) earnings |

(19,269) |

790 |

(16,141) |

4,006 |

||||||||

|

Net earnings attributable to non-controlling interests |

(871) |

(284) |

(3,014) |

(612) |

||||||||

|

Net (loss) earnings attributable to Century Casinos, Inc. shareholders |

$ |

(20,140) |

$ |

506 |

$ |

(19,155) |

$ |

3,394 |

||||

|

(Loss) earnings per share attributable to Century Casinos, Inc. shareholders: |

||||||||||||

|

Basic |

$ |

(0.68) |

$ |

0.02 |

$ |

(0.65) |

$ |

0.10 |

||||

|

Diluted |

$ |

(0.68) |

$ |

0.02 |

$ |

(0.65) |

$ |

0.10 |

||||

|

Weighted average common shares |

||||||||||||

|

Basic |

29,474 |

29,439 |

29,452 |

29,401 |

||||||||

|

Diluted |

29,474 |

29,861 |

29,452 |

29,962 |

||||||||

|

CENTURY CASINOS, INC. AND SUBSIDIARIES |

||||||

|

Condensed Consolidated Balance Sheets |

||||||

|

December 31, |

December 31, |

|||||

|

Amounts in thousands |

2019 |

2018 |

||||

|

Assets |

||||||

|

Current assets |

$ |

79,366 |

$ |

54,974 |

||

|

Property and equipment, net |

503,933 |

187,017 |

||||

|

Other assets |

143,601 |

36,834 |

||||

|

Total assets |

$ |

726,900 |

$ |

278,825 |

||

|

Liabilities and Equity |

||||||

|

Current liabilities |

$ |

56,570 |

$ |

50,020 |

||

|

Non-current liabilities |

498,255 |

45,422 |

||||

|

Century Casinos, Inc. shareholders’ equity |

163,306 |

176,321 |

||||

|

Non-controlling interests |

8,769 |

7,062 |

||||

|

Total liabilities and equity |

$ |

726,900 |

$ |

278,825 |

||

|

CENTURY CASINOS, INC. AND SUBSIDIARIES |

||||||||||||||||

|

Constant Currency* Results (unaudited) |

||||||||||||||||

|

For the three months |

For the year |

|||||||||||||||

|

ended December 31, |

ended December 31, |

|||||||||||||||

|

Amounts in thousands |

2019 |

2018 |

% Change |

2019 |

2018 |

% Change |

||||||||||

|

Net operating revenue as reported (GAAP) |

$ |

67,236 |

$ |

45,106 |

49% |

$ |

218,227 |

$ |

168,938 |

29% |

||||||

|

Foreign currency impact vs. 2018 |

559 |

7,207 |

||||||||||||||

|

Net operating revenue constant currency (non-GAAP)* |

$ |

67,795 |

$ |

45,106 |

50% |

$ |

225,434 |

$ |

168,938 |

33% |

||||||

|

(Loss) earnings from operations (GAAP) |

$ |

(14,745) |

$ |

1,976 |

(846%) |

$ |

(5,220) |

$ |

9,459 |

(155%) |

||||||

|

Foreign currency impact vs. 2018 |

934 |

955 |

||||||||||||||

|

(Loss) earnings from operations constant currency (non-GAAP)* |

$ |

(13,811) |

$ |

1,976 |

(799%) |

$ |

(4,265) |

$ |

9,459 |

(145%) |

||||||

|

Net (loss) earnings attributable to Century Casinos, Inc. shareholders as reported (GAAP) |

$ |

(20,140) |

$ |

506 |

(4080%) |

$ |

(19,155) |

$ |

3,394 |

(664%) |

||||||

|

Foreign currency impact vs. 2018 |

339 |

(40) |

||||||||||||||

|

Net (loss) earnings attributable to Century Casinos, Inc. shareholders constant currency (non-GAAP)* |

$ |

(19,801) |

$ |

506 |

(4013%) |

$ |

(19,195) |

$ |

3,394 |

(666%) |

||||||

Gains and losses on foreign currency transactions are added back to net (loss) earnings in the Company’s Adjusted EBITDA** calculations. As such, there is no foreign currency impact to Adjusted EBITDA** when calculating Constant Currency* results.

|

Adjusted EBITDA Margins *** (unaudited) |

||||

|

For the three months |

For the year |

|||

|

ended December 31, |

ended December 31, |

|||

|

2019 |

2018 |

2019 |

2018 |

|

|

United States |

23% |

20% |

24% |

24% |

|

Canada |

27% |

32% |

26% |

32% |

|

Poland |

11% |

9% |

11% |

7% |

|

Corporate and Other |

(262%) |

(127%) |

(214%) |

(155%) |

|

Consolidated Adjusted EBITDA Margin |

15% |

13% |

14% |

14% |

|

CENTURY CASINOS, INC. AND SUBSIDIARIES |

|||||||||||||||

|

Reconciliation of Adjusted EBITDA ** to Net Earnings (Loss) Attributable to Century Casinos, Inc. Shareholders by Reportable Segment. |

|||||||||||||||

|

For the three months ended December 31, 2019 |

|||||||||||||||

|

Amounts in thousands |

United |

Canada |

Poland |

Corporate |

Total |

||||||||||

|

Net earnings (loss) attributable to Century Casinos, Inc. shareholders |

$ |

2,261 |

$ |

948 |

$ |

1,352 |

$ |

(24,701) |

$ |

(20,140) |

|||||

|

Interest expense (income), net |

1,635 |

1,456 |

55 |

1,020 |

4,166 |

||||||||||

|

Income taxes (benefit) |

789 |

1,375 |

222 |

(1,431) |

955 |

||||||||||

|

Depreciation and amortization |

756 |

1,356 |

781 |

254 |

3,147 |

||||||||||

|

Net earnings attributable to non-controlling interests |

— |

195 |

676 |

— |

871 |

||||||||||

|

Non-cash stock-based compensation |

— |

— |

— |

324 |

324 |

||||||||||

|

Loss (gain) on foreign currency transactions, cost recovery income and other |

— |

26 |

(678) |

16,704 |

16,052 |

||||||||||

|

Loss on disposition of fixed assets |

— |

22 |

76 |

1 |

99 |

||||||||||

|

Acquisition costs |

— |

— |

— |

4,302 |

4,302 |

||||||||||

|

Adjusted EBITDA |

$ |

5,441 |

$ |

5,378 |

$ |

2,484 |

$ |

(3,527) |

$ |

9,776 |

|||||

|

For the three months ended December 31, 2018 |

|||||||||||||||

|

Amounts in thousands |

United |

Canada |

Poland |

Corporate |

Total |

||||||||||

|

Net earnings (loss) attributable to Century Casinos, Inc. shareholders |

$ |

767 |

$ |

2,077 |

$ |

179 |

$ |

(2,517) |

$ |

506 |

|||||

|

Interest expense (income), net |

— |

1,084 |

50 |

65 |

1,199 |

||||||||||

|

Income taxes (benefit) |

266 |

435 |

280 |

(848) |

133 |

||||||||||

|

Depreciation and amortization |

548 |

779 |

1,025 |

402 |

2,754 |

||||||||||

|

Net earnings attributable to non-controlling interests |

— |

174 |

89 |

21 |

284 |

||||||||||

|

Non-cash stock-based compensation |

— |

— |

— |

255 |

255 |

||||||||||

|

(Gain) loss on foreign currency transactions and cost recovery income |

— |

(95) |

(138) |

94 |

(139) |

||||||||||

|

Loss on disposition of fixed assets |

1 |

4 |

27 |

23 |

55 |

||||||||||

|

Pre-opening expenses |

— |

533 |

221 |

— |

754 |

||||||||||

|

Adjusted EBITDA |

$ |

1,582 |

$ |

4,991 |

$ |

1,733 |

$ |

(2,505) |

$ |

5,801 |

|||||

|

CENTURY CASINOS, INC. AND SUBSIDIARIES |

|||||||||||||||

|

Reconciliation of Adjusted EBITDA ** to Net Earnings (Loss) Attributable to Century Casinos, Inc. Shareholders by Reportable Segment. |

|||||||||||||||

|

For the Year ended December 31, 2019 |

|||||||||||||||

|

Amounts in thousands |

United |

Canada |

Poland |

Corporate |

Total |

||||||||||

|

Net earnings (loss) attributable to Century Casinos, Inc. shareholders |

$ |

5,825 |

$ |

6,669 |

$ |

3,466 |

$ |

(35,115) |

$ |

(19,155) |

|||||

|

Interest expense (income), net |

1,635 |

5,312 |

197 |

1,085 |

8,229 |

||||||||||

|

Income taxes (benefit) |

2,018 |

3,278 |

1,617 |

(2,739) |

4,174 |

||||||||||

|

Depreciation and amortization |

2,330 |

4,539 |

3,064 |

910 |

10,843 |

||||||||||

|

Net earnings (loss) attributable to non-controlling interests |

— |

1,295 |

1,731 |

(12) |

3,014 |

||||||||||

|

Non-cash stock-based compensation |

— |

— |

— |

1,303 |

1,303 |

||||||||||

|

(Gain) loss on foreign currency transactions, cost recovery income and other |

— |

(439) |

(1,096) |

16,709 |

15,174 |

||||||||||

|

Loss on disposition of fixed assets |

17 |

20 |

413 |

345 |

795 |

||||||||||

|

Acquisition costs |

— |

— |

— |

5,366 |

5,366 |

||||||||||

|

Pre-opening expenses |

— |

538 |

— |

— |

538 |

||||||||||

|

Adjusted EBITDA |

$ |

11,825 |

$ |

21,212 |

$ |

9,392 |

$ |

(12,148) |

$ |

30,281 |

|||||

|

For the Year ended December 31, 2018 |

|||||||||||||||

|

Amounts in thousands |

United |

Canada |

Poland |

Corporate |

Total |

||||||||||

|

Net earnings (loss) attributable to Century Casinos, Inc. shareholders |

$ |

4,373 |

$ |

7,715 |

$ |

(153) |

$ |

(8,541) |

$ |

3,394 |

|||||

|

Interest expense (income), net |

1 |

3,895 |

206 |

12 |

4,114 |

||||||||||

|

Income taxes (benefit) |

1,508 |

2,536 |

595 |

(2,722) |

1,917 |

||||||||||

|

Depreciation and amortization |

2,178 |

3,211 |

3,065 |

945 |

9,399 |

||||||||||

|

Net earnings (loss) attributable to non-controlling interests |

— |

722 |

(75) |

(35) |

612 |

||||||||||

|

Non-cash stock-based compensation |

— |

— |

— |

868 |

868 |

||||||||||

|

(Gain) loss on foreign currency transactions and cost recovery income |

— |

(235) |

(428) |

2 |

(661) |

||||||||||

|

Loss on disposition of fixed assets |

1 |

10 |

1,054 |

25 |

1,090 |

||||||||||

|

Pre-opening expenses |

— |

1,668 |

626 |

350 |

2,644 |

||||||||||

|

Adjusted EBITDA |

$ |

8,061 |

$ |

19,522 |

$ |

4,890 |

$ |

(9,096) |

$ |

23,377 |

|||||

CENTURY CASINOS, INC. AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION

* The impact of foreign exchange rates is highly variable and difficult to predict. The Company uses a Constant Currency basis to show the impact from foreign exchange rates on current period financial information compared to prior period financial information using the prior period’s foreign exchange rates. In order to properly understand the underlying business trends and performance of the Company’s ongoing operations, management believes that investors may find it useful to consider the impact of excluding changes in foreign exchange rates from the Company’s net operating revenue, (loss) earnings from operations and net earnings (loss) attributable to Century Casinos, Inc. shareholders. Constant currency results are calculated by dividing the current quarter or year to date local currency segment results, excluding the local currency impact of foreign currency gains and losses, by the prior year’s average exchange rate for the quarter or year to date and comparing them to actual U.S. dollar results for the prior quarter or year to date. The average exchange rates for the current and prior year are reported in Note 2 to the Consolidated Financial Statements included in Part II, Item 8, “Financial Statements and Supplementary Data” of the Company’s Annual Report on Form 10-K. The average exchange rates for the three months ended December 31, 2019 and 2018 are presented below.

|

For the three months |

||||||

|

ended December 31, |

||||||

|

Average Rates |

2019 |

2018 |

% Change |

|||

|

Canadian dollar (CAD) |

1.3199 |

1.3218 |

0.1% |

|||

|

Euros (EUR) |

0.9032 |

0.8763 |

(3.1%) |

|||

|

Polish zloty (PLN) |

3.8702 |

3.7668 |

(2.7%) |

|||

|

British pound (GBP) |

0.7766 |

0.7773 |

0.1% |

|||

|

Source: Pacific Exchange Rate Service |

||||||

Constant currency information is not a measure of financial performance under generally accepted accounting principles in the United States of America (GAAP) and should not be considered a substitute for net operating revenue, (loss) earnings from operations or net earnings (loss) attributable to Century Casinos, Inc. shareholders as determined in accordance with GAAP.

SOURCE Century Casinos, Inc.

Gambling in the USA

Gaming Americas Weekly Roundup – June 16-22

Welcome to our weekly roundup of American gambling news again! Here, we are going through the weekly highlights of the American gambling industry which include the latest news and new partnerships. Read on and get updated.

Latest News

PrizePicks announced it has been Certified by Great Place To Work for the first time — a prestigious recognition based on employee feedback about their experience working at the company. Great Place To Work is the global authority on workplace culture, employee experience and leadership behaviours proven to drive business performance. According to Great Place To Work research, job seekers are 4.5 times more likely to find a great boss at a Certified workplace. Team members at Certified companies are 93% more likely to look forward to coming to work and are twice as likely to feel they are paid fairly and have equal opportunities for advancement.

The Michigan Gaming Control Board has issued cease-and-desist orders to five illegal online gambling operators—BoVegas Casino, BUSR, Cherry Gold Casino, Lucky Legends and Wager Attack Casino—after discovering they were targeting Michigan residents without proper licenses. These operators are violating Michigan’s Lawful Internet Gaming Act, the Michigan Gaming Control and Revenue Act, and the Michigan Penal Code. The MGCB’s investigations found that these sites have been accepting wagers and deposits from Michigan residents on sports events, slots, blackjack and other casino games—all without the oversight and safeguards required by law. Players using these platforms face unreliable payouts, unfair gaming practices and have no legal recourse in case of disputes.

ZOOT, a sweepstakes gaming platform bringing video game sensibilities to iGaming entertainment, announced it has raised $6 million in seed funding led by CoinFund, one of the world’s first cryptonative investment firms, with participation from Griffin Gaming Partners to expand the current US-focused business to a global-facing, stablecoin-driven one. The investment further grows the opportunities for instant, borderless payments in digital entertainment as stablecoin adoption surges past $239 billion in circulation, with payment giants like Visa and PayPal racing to integrate crypto rails for faster, cheaper transactions. ZOOT is building an iGaming platform that pioneers a new approach to iGaming that combines the engagement of video games with the efficiency of blockchain-based payments.

Partnerships

Maverick Games has launched sports betting operations in Ontario, through a partnership with Delasport. Maverick Games will offer Ontarian players a premium sports betting experience, built on Delasport’s superior technology and known for its unique innovative features that players love including personalisation, recommendations, gamification, quick bets, player engagement features and more. Maverick Games is the second brand to launch on Delasport’s technology in Ontario, with another full turnkey brand set to go live soon. Delasport also recently unveiled its innovative sports betting jackpot network game, SuperPot.

International Game Technology PLC announced that it recently signed a new, three-year sports betting technology agreement with Boyd Gaming Corporation. Under the terms of the agreement, IGT’s award-winning PlaySports platform will continue powering Boyd Gaming’s retail and mobile sports betting offering in Nevada through August 2028. The new agreement builds on IGT and Boyd Gaming’s long-standing sports betting technology partnership that started in 2018. In addition to using the IGT PlaySports platform, Boyd Gaming will continue to offer IGT’s PlaySports Kiosks at its 10 retail betting locations across Nevada.

The post Gaming Americas Weekly Roundup – June 16-22 appeared first on European Gaming Industry News.

Catawba Nation Chief Brian Harris

Catawba Two Kings Casino Resort Rising in Kings Mountain as First Year of Construction is Completed

Significant construction has been completed during the first year of work on the $1 billion Catawba Two Kings Casino Resort in Kings Mountain, N.C., a site off Interstate-85 only 35 miles from Charlotte and close to the South Carolina border.

Construction on all aspects of the project is in full swing, with the foundations for the casino complex and hotel completed several months ago, the casino complex at its full height and expanding horizontally, and steel continuing to rise for the 24-story, 385-room hotel. The hotel tower framing is now 10 stories high, with an additional floor being added nearly every week. At completion, the hotel will be connected to the casino complex.

The casino complex includes the introductory casino on the first level, three levels of covered parking, a back-of-house level and top level with the main casino floor and restaurants. The introductory casino, set to open in spring 2026, will include 1350 slot machines, 20 table games, a 40-seat restaurant, a bar, sports betting kiosks, and Lucky North Rewards desk.

The introductory casino will replace the current temporary (prelaunch) casino, which continues to grow in popularity as it nears its fourth anniversary on July 1.

The main casino complex is targeted to open in 2027. It will be about 2 million square feet and feature:

• 4300 slot machines

• 100 table games

• 11 dining outlets, including a steakhouse, Italian restaurant, marketplace with six venues, café, and grab-and-go outlet

• A players lounge

• 11 bars, including a center bar and sports bar

• A 2700-space parking garage built under the casino complex and 800 surface parking spaces

The project has created hundreds of construction jobs. Upon completion, the casino resort will employ an estimated 2200 regional residents and citizens of the Catawba Nation.

“This casino resort will be an economic game changer for Catawba citizens and a force to drive the economy of Cleveland County and the City of Kings Mountain. This project is a testament to our resilience, our commitment to self-sufficiency, and our determination to build a better future for ourselves and our future generations,” Catawba Nation Chief Brian Harris said.

Harris noted the temporary casino is contributing to many community and charitable organizations in the region, and that will only increase as the full casino resort opens.

The project is being led by the Catawba Nation Gaming Authority under Vice President Trent Troxel, with Yates-Metcon as the construction general contractor; Delaware North as the gaming management, development and hospitality consultant; and SOSHNY Design architects.

“Once again, I want to thank the Cleveland County, City of Kings Mountain, federal and state leaders who have supported the Catawba Nation’s efforts develop the casino resort in its ancestral lands in North Carolina,” Harris said.

Work has also been completed on two key infrastructure projects for development of the permanent casino resort that were funded by the Catawba Nation: doubling the size of the Dixon School Road Bridge over I-85 near the casino entrance and installing new sewer lines near the casino.

The post Catawba Two Kings Casino Resort Rising in Kings Mountain as First Year of Construction is Completed appeared first on Gaming and Gambling Industry in the Americas.

Gambling in the USA

Xanada Investments Reveals Strategic Backing of Sweepium, Targeting the U.S. Sweepstakes Landscape

Xanada Investments, a leading ideological investment fund focused on the iGaming sector, has officially revealed its early-stage investment in Sweepium, a breakthrough B2B platform and game aggregator redefining how sweepstakes casino brands launch, operate, and scale in the U.S. market.

The decision to invest in Sweepium was driven by a clear alignment of vision: a bold team building real sweepstakes infrastructure for an underserved and fast-growing segment, while providing a serious competitive advantage to existing platforms.

Purpose-built for the complexities of the U.S. regulatory landscape, Sweepium delivers a fully integrated, turnkey platform that includes a bank-approved payment architecture, CRM, customer support, content management, game aggregation, and promotional tools. Its standout capability — its bank-approved payment system — the first of its kind in the U.S. sweepstakes sector — enabling operators to process transactions with institutional-grade compliance and reliability.

Over the past year, Xanada’s support extended far beyond capital. Acting as strategic advisors and active mentors, the fund worked closely with the Sweepium team to strengthen their operational and go-to-market strategy to accelerate brand onboarding and commercial traction.

Today, Sweepium is live with multiple operators, supports integrations with over 50 game providers, and enables new clients to launch in just 8–10 weeks from contract to first processed payment — a speed and standard unmatched in the space.

“From day one, Sweepium showed both clarity of vision and precision in execution,” said Vladimir Malakchi, CEO & Managing Partner at Xanada Investments. “Our decision to invest was driven not only by the unique positioning of the platform but by the team’s operational discipline and long-term thinking. Over the past year, we’ve worked closely with Sweepium to evolve their business infrastructure, guide strategic decisions, and help unlock market growth — and the results speak for themselves.”

Daniel Mitton, Founder & CEO of Sweepium, commented: “Partnering with Xanada Investments brought more than capital — it brought strategy, structure, and scale. Their team helped us align operations with long-term growth goals, navigate licensing, and open doors commercially. With Xanada’s support, we’ve accelerated our market readiness and laid the groundwork for sustainable expansion.”

As Sweepium enters its next phase of growth, the company is focused on expanding its partner base, deepening product capabilities, and continuing to lead in compliance-first innovation within the U.S. sweepstakes space.

About Xanada Investments

Xanada Investments is an ideological investment fund targeting PreSeed, Seed, and Series A funding rounds for innovative projects and leaders in the iGaming industry. With a focus on long-term success, Xanada is committed to providing not only capital but also strategic guidance and support to help businesses scale quickly and efficiently.

About Sweepium

Sweepium is a B2B platform and game aggregator enabling the launch of sweepstakes casino brands under a white-label model. The company supports over 80 game providers, offers full operational setup, and is the first provider of bank-approved white-label payments for sweepstakes in the U.S. market.

The post Xanada Investments Reveals Strategic Backing of Sweepium, Targeting the U.S. Sweepstakes Landscape appeared first on European Gaming Industry News.

-

Latest News7 days ago

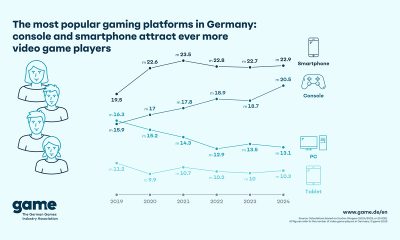

Latest News7 days agoThe Most Popular Gaming Platforms in Germany: Console and Smartphone Attract Ever More Video Game Players

-

Asia7 days ago

Asia7 days agoFIFA, NBA, UFC and More Sports Events Go Live – Crypto Sportsbook BETY Offers Global Sports Betting Coverage 2025

-

Balkans7 days ago

Balkans7 days agoSYNOT Partners with Efbet in Bulgaria

-

Australia6 days ago

Australia6 days agoVGCCC: Minors Exposed to Gambling at ALH Venues

-

EveryMatrix Press Releases7 days ago

EveryMatrix Press Releases7 days agoSlotMatrix unleashes divine riches in Fortuna Gold where gods rule the reels

-

Brazil7 days ago

Brazil7 days agoTG Lab unveils new Brazil office to further cement position as market’s most localised platform

-

Africa7 days ago

Africa7 days agopawaTech strengthens its integrity commitment with membership of the International Betting Integrity Association

-

Baltics7 days ago

Baltics7 days agoEstonian start-up vows to revolutionise iGaming customer support with AI