Latest News

9 Aspects to Look For in a Top iGaming Payment Provider

There are hundreds of iGaming payment providers out there. Which one will meet your demands? Many businesses ask this question. Not many get the right answer.

With the global online gaming market expected to reach $127 billion by 2027, getting the right iGaming payment services is paramount. Simply put, the better provider you have, the more customers you can serve, the faster payments will be, and the higher your income you will have.

Yet, choosing the right provider can be challenging, especially with the unique needs of high-risk industries like iGaming. In this piece, we will go through a nine-point checklist. These steps ensure you enter a pool of top iGaming payment providers.

So, buckle up.

1. Verify If an iGaming Software Provider is High-Risk Friendly

iGaming is a high-risk industry. That means higher fees and more scrutiny. Choose a provider specialising in high-risk sectors to avoid disruptions and reduce transaction rejections.

Keep note: Not all payment providers are willing to work with high-risk industries, leading to potential delays or increased fees.

The right iGaming payment provider must have these aspects to be truly high-risk friendly:

- Have no volume restrictions

- Understand the industry to the bone

- Provide a dedicated account manager with expert knowledge of the sector

- Support licenses in different jurisdictions

2. Check How Long It Takes for an iGaming Payment Provider to Open a Business Account

Now, you narrowed down the list of best payment providers for iGaming. The next important question to ask:

How long will it take to open a business account?

In most cases, when you need to open a business account, you can expect two challenges:

- Lengthy approval process.

- A lot of documents to provide.

Many banks does not understand industries like iGaming. That is why they ask tons of unrelated questions and require documents you don’t simply have. As a result, getting a business account can take weeks or months.

A good provider opens a business account for you in several weeks. A great iGaming software solutions provider opens a business account in about 48 hours.

https://account.paydo.com/en/auth/business/sign-up

3. Make Sure an iGaming Payment Provider Has SWIFT In Their Arsenal

For international transactions, SWIFT is a must. This scheme allows for faster, more secure iGaming transactions. It reduces delays and ensures smooth processing of player deposits and withdrawals.

Without SWIFT, iGaming operators risk slower processing times and dissatisfied players. Yet, the rule of thumb dictates that the more payment schemes you have access to the better.

4. Does iGaming Payment Provider Offer Multiple Currencies?

This should be your next question. Even if an iGaming payment provider is high-risk friendly, opens a business account fast, and is connected to SWIFT, this does not mean you get many currencies to work with. You still need to pay contractors in their local currency.

Also, setting up a multicurrency account can come at a significant cost. Banks and EMIs impose additional charges for each extra currency you might need.

5. Check If an iGaming Payment Provider Offers Merchant Services

If you have a website accepting payments, you need a good checkout.

What constitutes a “good” checkout?

In most cases, the number of chargebacks, holds, rolling reserves, as well as payment methods available. Besides, you want a checkout that can be easily integrated.

6. What About Mass Payouts?

Every iGaming operator knows how hard it can be to send multiple payments to several customers. When you don’t have mass payments with your iGaming provider, every payment must be made one by one. Without saying, it will take a lot of your time and nerve.

.

7. Confirm Whether an iGaming Payment Provider Have Virtual and Physical Cards

Virtual and physical cards allow flexibility for both business payments and player withdrawals. They can be used for payouts, ad spending, or corporate expenses. Besides, having a personalised plastic card speaks volumes about your brand.

8. Compliance With Global and Local Regulations

After going through the arsenal of services of a chosen best iGaming payment provider, the next logical step is to look at compliance. You must be sure a selected provider has the legal right to provide certain services and operate in partnership destinations.

To illustrate, as an iGaming payment provider, one should have at least these:

- The Financial Conduct Authority (FCA).

- Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

As an add-on, a good iGaming payment provider should have an Authorised Electronic Money Institution (UAB) license. This one allows the platform to issue electronic money and offer related financial services within the European Union (EU) and European Economic Area (EEA).

9. Double-Check the Security Measures an iGaming Payment Provider Implements

For top iGaming payment providers these security measures are non-negotiable:

- Built-in anti-fraud.

- PCI-DSS Level 1 compliance.

- 3D-Secure (3DS) technology.

- Anti-money laundering (AML) protocols.

- Automated KYC.

PayDo—All Payment Solutions in One Place

While all roads lead to Rome, all aforementioned aspects lead to platforms like PayDo.

PayDo is a payment ecosystem. It made sure all the aspects we talked about were covered. Namely, the platform is:

1. High-risk friendly:

-

- No volume restrictions.

- No hidden fees

- No minimal commitments

- No minimal balances

- No nonsense requirements

- All iGaming licenses (Curacao included).

- In-depth understanding of high-risk industries.

- Curacao and other licenses supported

- A dedicated account manager with extensive experience in iGaming

- Momentary payouts

- Scheduled payments

- 140+ destinations

2. Business account opening:

-

- Takes about 48 hours.

- Completely remote.

- Requires a standard package of documents.

- Onboarding is as quick as verification.

3. Nine payment schemes:

-

- SEPA

- SEPA instant

- Fedwire

- Target 2

- FasterPayments

- Chaps

- BACS

- Kronos2

4. Multicurrency:

-

- Dedicated IBAN with 35+ currencies and 150 countries.

- Personal account with 12+ currencies.

- No extra charges for currencies.

5. Checkout:

-

- Zero chargebacks

- No holds or rolling reserve

- Easy API integration

- 350+ payment methods

- Localization

- Instant settlements

- Conversion rate > 98%

- Unlimited websites

6. Mass Payouts:

-

- Automatic payouts without any manual inputs.

- Customers receive their funds without fees.

7. Virtual and Physical Cards:

-

- Offer employees personalized cards.

- Improve corporate expense management.

- No limit on issuance.

8. Compliance and Security:

1.Licensed by:

-

-

- FCA.

- FINTRAC

- UAB.

-

2.Security measures:

-

-

- Built-in anti-fraud.

- PCI-DSS Level 1 compliance.

- 3D-Secure (3DS) technology.

- Anti-money laundering (AML) protocols.

- Automated KYC.

- Encryption.

- Safeguarding.

-

Besides, recently PayDo was nominated for the Payment Innovation of the Year award at a

reputable iGaming-focused SBC 2024 convention.

Finally, PayDo have become a SWIFT Direct Participant. Now the platform can send and receive messages directly through the SWIFT network without intermediary banks.

For PayDo clients, it means faster transaction speed and fewer delays.

Conclusion

When choosing a payment provider for iGaming, check these aspects:

- High-risk friendly;

- Business account opening;

- SWIFT availability;

- Multiple currencies;

- Merchant services;

- Mass payouts;

- Virtual and physical cards;

- Compliance;

- Security measures.

The list is that long because top iGaming payment providers like PayDo work hard to develop a solution that will stand out in a competitive market. With PayDo, you get the services of 8-9 payment providers in one place and under one contract.

Don’t hesitate to open an account right now. We are ready when you are!

The post 9 Aspects to Look For in a Top iGaming Payment Provider appeared first on European Gaming Industry News.

Latest News

MGA Games Launches Poseidon’s Orb Slot Featuring Sticky Wilds and Free Spins

MGA Games, a prominent Spanish firm specializing in content creation for international casino operators, will debut Poseidon’s Orb on January 28, its latest video slot for the .com markets. This title encourages players to join an explorer on an epic quest to find the legendary city of Atlantis.

The game is a Video Slot with 5 reels and 3 rows, offering 10 paylines, and includes Wild and Scatter symbols that activate Free Spins. A remarkable aspect is the Sticky Wilds mechanic in the Free Spins round—an inventive element that boosts thrill and raises winning possibilities. It additionally includes an optional purchase of Free Spins, adjustable for each operator.

The theme of Poseidon’s Orb, drawn from global myths and legends, aims to attract a diverse audience of players. Its stunning visuals and film-inspired score further guarantee an engaging experience brimming with thrills and rewards.

Classified under popular themes like “Adventure,” “Mythology,” “Treasures,” and “Fantasy,” this latest MGA Games Video Slot serves as a valuable enhancement to any operator’s collection, improving player retention and profits, while the Free Spins purchase feature offers an extra revenue opportunity.

The post MGA Games Launches Poseidon’s Orb Slot Featuring Sticky Wilds and Free Spins appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Andrew Cochrane CCO at Soft2Bet

Soft2Bet Secures Two Top Honors at International Gaming and Global Gaming Events, ICE Barcelona 2026

Soft2Bet, a prominent provider of iGaming platforms and solutions, received two accolades at the International Gaming Awards and Global Gaming Awards, claiming Platform Provider of the Year 2026 at the Global Gaming Awards EMEA and Innovator of the Year at The International Gaming Awards 2026.

The acknowledgment stems from a solid track record of performance in both product and core platform functions, with Soft2Bet dedicated to creating innovative solutions that provide partners with wider options, increased scale, and enhanced operational control in casino and sportsbook, alongside significant localization possibilities and flexible gamification choices.

In the past year, Soft2Bet has bolstered its platform ecosystem by incorporating over 9,500 new casino titles and improving essential platform features to ensure consistent large-scale performance, maintaining over 1 million pre-match events and 800,000 live events each year.

Fueled by the acclaimed product MEGA (Motivational Engineering Gaming Application), Soft2Bet’s API-driven, independent offering provides a data-centric gamification layer that facilitates exceptionally tailored and localized player experiences. Through modular mechanics and instant optimization, MEGA aids partners in enhancing engagement, retention, and acquisition in both casino and sportsbook sectors.

Innovation also encompassed new brand experiences, such as the newly introduced in-platform MEGA 11 (football manager) gamification engine for Soft2Bet’s premier brands, Betinia and CampoBet, after the recent selection of Diego Simeone as the ambassador for both brands. Like iconic football managers in reality, players advance from Beginner to Legend by managing star teams and engaging in direct matchups in fantasy games, earning localized rewards and tailored experiences.

Andrew Cochrane, CCO at Soft2Bet, said: “These awards reflect the commitment and dedication of our entire team. This year, we will continue to focus on delivering high quality products. Because we know exactly how to establish high-performance brands from the start, this year is all about delivering the kind of cutting-edge solutions that keep our partners ahead of the curve in a crowded iGaming landscape”

These two awards mark a strong start to 2026 and reflect Soft2Bet’s progress over the past year, from platform expansion and product growth to a stronger gamification offering. As a market leader, Soft2Bet is committed to redefining the industry standard by delivering high-impact, player-centric innovations that drive engagement and set new benchmarks for the global gaming ecosystem.

The post Soft2Bet Secures Two Top Honors at International Gaming and Global Gaming Events, ICE Barcelona 2026 appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Latest News

QTech Games rolls out more fast-paced content from Yoriginal Games

QTech Games, the leading game aggregator for all emerging markets, has signed its latest supplier partnership with global B2B content developer and provider Yoriginal Games, enabling its platform customers to access the supplier’s expansive slots catalogue.

Yoriginal’s popular titles are crafted for the new wave in igaming: short-session players, mobile-first users, and operators who want real GGR performance. These eclectic games are also recognised for their player-retention features and sticky mechanics, and draw from Yoriginal Games’ deeper well of crash, scratch, slot and more traditional table-games content.

These games are light and lightning-fast to load, providing a ready solution to overcoming local obstacles to engagement in emerging markets, like Africa and LatAm, such as handset quality limitations, restricted access to fast networks, and high data costs.

This breakthrough announcement with QTech now affords the supplier unprecedented international reach across more emerging markets. In turn, incorporating this ever-evolving production line emphasizes QTech Games’ diverse range of gaming options, providing a definitive one-stop shop, which has fast become the “go-to” solution for worldwide operators across developing territories.

As the fastest-growing aggregator over the past few years, QTech’s platform offers the most expansive gaming portfolio around, localised for each region, with native mobile apps, powerful reporting and marketing tools, and 24/7 local-language support.

QTech Games CEO, Philip Doftvik, said: “We’re committed to rolling out more and more high-class content and product innovation that drives revenue for our partners. So, this deal with Yoriginal Games extends our impressive sequential pipeline for 2026 – and showcases our flexible array of content which solves for fine-grained, local requirements in countries where light, rapid-load games are a must. Their games are sleek and modern in design, backed by robust analytics to drive higher engagement and prolonged dwell-time.”

Kirill Bykov, CEO at Yoriginal Games, added: “At Yoriginal Games, we specialize in fast-paced, original casino games that bring instant excitement and big wins, crash, mines, dice, limbo, plinko, keno, blackjack, roulette and more. And while we’ve initially specialised in fast games, we also offer our premium aggregator partners, like QTech, access to our signature YOpen RGS program for developers, whereby QTech can benefit from even more of our partner slots content this year, above all in the domain of localised games.

“QTech’s platform is a gateway to global audiences, and we can’t wait to see how our highly engaging games perform across a largely greenfield landscape of emerging markets for Yoriginal.”

The post QTech Games rolls out more fast-paced content from Yoriginal Games appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Games Global5 days ago

Games Global5 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Latest News5 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Amusnet5 days ago

Amusnet5 days agoWeek 4/2026 slot games releases

-

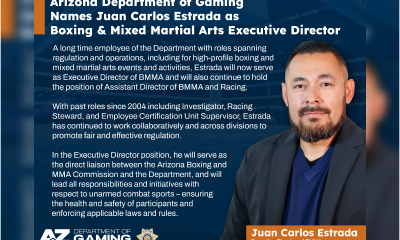

ADG6 days ago

ADG6 days agoArizona Department of Gaming Names Juan Carlos Estrada as Boxing and Mixed Martial Arts Executive Director

-

Anthony Dalla-Giacoma Chief Commercial Officer at Swintt6 days ago

Anthony Dalla-Giacoma Chief Commercial Officer at Swintt6 days agoSwintt Cruises the River of Fortune in Sun Wind Cash Boat

-

Anton Ivannikov CPO at Playson6 days ago

Anton Ivannikov CPO at Playson6 days agoPlayson’s Vegas Glitz Shines with Dual Bonus Features

-

Battle Royale6 days ago

Battle Royale6 days agoPrime Rush Goes Live in Early Access, Bringing a Brazil-First Mobile Battle Royale to Players

-

Attorney General Andrea Joy Campbell6 days ago

Attorney General Andrea Joy Campbell6 days agoAG Campbell Secures Court Order That Will Block Kalshi from Offering Unlawful Sports Wagers in Massachusetts