Latest News

GambleAware Publishes New Reports and Guide for Financial Services Industry to Help Prevent Gambling Harm

GambleAware has published a new report by the Behavioural Insights Team which analyses behavioural datasets to understand whether these could be used to build a clearer picture of the ways in which people gamble, identify possible harms, and eventually inform prevention, treatment, and support responses.

The commissioned research analysed bank transactional data from Monzo and HSBC, aiming to shed new light on what these datasets can, and cannot, tell us about gambling behaviour. The reports demonstrated that bank customer and transactional data can offer valuable insights into the success of gambling blocking tools and also provide unique profiles of gamblers. For example, of those using Monzo’s gambling blocker, it was found that the week before gamblers activated the block, their average daily gambling spend tripled. Specific profiles of gamblers were also revealed by the research, such as that gamblers had less money on average in their Monzo internal saving pots than non-gamblers, or that gamblers ranked “Very Concerning” by HSBC had on average 35.6 gambling transactions per month, compared to 15.6 in those ranked “Concerning”, and just 1.2 in the “Control” group.

Taken individually, however, these datasets are not enough to understand whether a customer is at risk of experiencing gambling harms. A dataset from a single bank is unlikely to offer a full picture of an individual’s spending, and so these exploratory research projects illustrated that further research is needed to create a fuller picture of an individual’s overall financial wellbeing.

“Our research with HSBC and Monzo has demonstrated that bank transactional data can be a useful tool in identifying gambling behaviours and the unique profiles of gamblers, but further work is needed to understand how such data can be used robustly. Different banks may use different factors, and different thresholds to identify gambling, and future work could look at developing a more standard operating model of how this kind of data should be used to identify those at risk of harm,” Dr Simon McNair, Advisor at BIT, said

“Our research with GambleAware helps us to understand gambling-related behaviours so that we can provide the best support to our customers. This includes opt-in solutions such as a gambling restriction feature to help people control their urge to gamble and automatic declines or referrals for lending to help prevent the customer getting into debt. Customers can also appoint third parties to help manage their finances either through a third-party mandate or our Independence Service. In addition, our specialist support team are on hand to aid customers at risk of financial harm and can refer to trusted external organisations where needed. We continue to work with charities such as Gamble Aware on other ways in which we can ensure these customers have access to the right support,” Maxine Pritchard, Head of Financial Inclusion and Vulnerability at HSBC, said.

“Our work with the Behavioural Insights Team has provided us with important insights into gambling behaviour and the impacts of gambling. At Monzo, this is an area we care deeply about and we’ve had amazing success so far with our gambling block, which has been used by more than 350,000 customers since its launch in 2017. We’re excited to use these insights to inform future work in this area, further reduce gambling harm and provide our customers with even more control over their financial lives,” Natalie Ledward, Head of Vulnerable Customers at Monzo, said.

GambleAware has commissioned the Personal Finance Research Centre at the University of Bristol to produce a practical guide for financial services seeking to protect customers from gambling-related financial harms. The guide offers real-life examples of what firms can do to identify and support customers who are at risk of gambling-related financial harm. It highlights the value of financial firms proactively analysing customer transaction data for spending patterns and behavioural signs that might indicate gambling-related vulnerability and enable firms to take action to prevent harm occurring.

“At a conservative estimate, at least five million people in Britain experience harmful gambling, either because of their own gambling or someone else’s. Regulated financial services firms are well-placed to address the financial harms linked to gambling-related vulnerability and our practical guide shows them how. Doing this may have knock-on benefits for other dimensions of gambling harm, such as people’s mental health,” Professor Sharon Collard, Research Director at the University of Bristol’s Personal Finance Research Centre, said.

“This research from the Behavioural Insights Team is a good first step to explore how bank transactional data may be able to identify behaviours indicative of gambling harm. Whilst more research is needed into this area, we encourage all financial institutions, including those from non-bank settings, to make the most of the new guide to see what they can do to protect their customers from gambling harm. By working with financial services and promoting the advice and support available, we can work collaboratively to respond to customer need to keep people safe from gambling harm,” Zoë Osmond, CEO at GambleAware, said.

Powered by WPeMatico

Clawbuster

REEVO Enters into Partnership with Clawbuster

REEVO has announced a new partnership with Clawbuster, a fast-rising iGaming studio known for blending nostalgic arcade mechanics with modern slot gameplay. This collaboration reinforces REEVO’s commitment to expanding its aggregation ecosystem with distinctive, high-engagement content designed to help operators stand out in competitive markets.

Through this partnership, Clawbuster’s growing portfolio of titles will be integrated into the REEVO aggregation platform, giving operators seamless access to content that combines creativity, strong mechanics and commercial performance.

Headquartered in Limassol, Cyprus and founded in 2022/2023, Clawbuster has quickly built momentum in multiple international markets by introducing a unique claw mechanic that transforms traditional slot gameplay into a suspense-driven hybrid experience.

The studio places strong emphasis on customization, VIP engagement and localised optimisation, aligning with REEVO’s focus on scalable and performance-oriented aggregation solutions.

For REEVO, this partnership represents another strategic step in expanding its global distribution network with studios that bring originality and measurable operator value.

Daniel Cuc, Head of Account Management at REEVO, said: “Partnering with Clawbuster is an exciting addition to REEVO’s aggregation platform. Their innovative approach to gameplay and strong focus on engagement align perfectly with our strategy to deliver differentiated, high-performing content to operators worldwide. At REEVO, we continue to expand our ecosystem with studios that bring fresh ideas and real commercial potential. Clawbuster’s creative direction and flexibility make them a strong fit for our growing global network.”

Evija Mole, Commercial Director at Clawbuster, said: “Bringing Clawbuster to REEVO marks a major milestone for our team. REEVO provides an ideal stage for the game, giving us the opportunity to showcase its energy, character, and rapid-fire excitement just the way we designed it.”

The post REEVO Enters into Partnership with Clawbuster appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

AdmiralBet

SYNOT Games Announces Strategic Partnership with Admiralbet

SYNOT Games has announced a strategic partnership with Admiralbet, Bulgaria’s foremost casino operator and market leader.

Under the new agreement, Admiralbet will showcase a selected portfolio of SYNOT Games-developed games. Players can enjoy a diverse selection that includes popular titles such as 40 Coins of Chance and 100 Stunning Fruits. The integration of these games into Admiralbet’s offerings promises to redefine gaming standards and deliver an enhanced entertainment experience.

This partnership is a key part of SYNOT Games’ strategic expansion into the Balkan region, a market known for its discerning players who demand cutting-edge iGaming solutions. This new venture with Admiralbet further emphasizes the company’s dedication to delivering unmatched gaming solutions and retention tools that address the evolving needs of today’s iGaming market.

Martina Krajčí, Chief Commercial Officer at SYNOT Games, said: “This collaboration with Admiralbet not only strengthens our market presence in Bulgaria but also opens the door to a new audience of sophisticated gamers seeking innovative, high-quality entertainment. We are committed to driving excellence in the region by providing state-of-the-art gaming experiences that set new benchmarks in the industry.”

Mr. Beleski, General Manager at Admiralbet, said: “Our collaboration with SYNOT Games represents a strategic enhancement of our casino offering. By integrating their high-quality and engaging titles, we continue our commitment to delivering a superior and diversified gaming experience that meets the expectations of Bulgarian players and reinforces our position as a trusted leader in the market.”

The post SYNOT Games Announces Strategic Partnership with Admiralbet appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Conferences

SYNOT Successfully Participated in the Irish Gaming Show

SYNOT has successfully participated in another edition of the Irish Gaming Show, which took place at the beginning of March at the Crowne Plaza Hotel in Dublin. This prestigious gaming exhibition represents a key meeting point for operators, manufacturers and distributors active in the Irish market.

In cooperation with the distributor John Lynch, SYNOT introduced the latest gaming systems Gamifire Prime and Firebird Platinum to visitors, presented in the modern UP2-32 cabinets. These brand-new game mixes offer players an attractive combination of fruit and themed games. The Gamifire Prime set features a total of 36 sophisticated titles, including popular Hold & Win concepts. Firebird Platinum also includes 36 games, featuring well-liked linked titles.

“The products attracted great interest among local operators and received very positive feedback. Our company representatives were ready to provide visitors with detailed information not only about the showcased products but also about other premium solutions from our portfolio. Our jackpot systems SUPER LINK and MAGIC BALL LINK also drew significant attention from visitors,” said Roland Andrýsek, Sales Director of SYNOT Group.

During the exhibition, the Company established a number of new business contacts and discussed opportunities for future cooperation. Expansion into key international markets remains an important part of SYNOT Group’s long-term strategy. The company aims to further strengthen its position not only in the Irish market but also in many other regions.

The post SYNOT Successfully Participated in the Irish Gaming Show appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Latest News7 days ago

Latest News7 days agoNFL LEGEND ROB GRONKOWSKI TAKES ON HIGH-STAKES POKER PROS ON POKERSTARS BIG GAME ON TOUR IN LAS VEGAS

-

Animal Wellness Action4 days ago

Animal Wellness Action4 days agoGREY2K USA Worldwide and Animal Wellness Action Celebrate House Agriculture Committee Passage of a Ban on Greyhound Racing in America

-

AI4 days ago

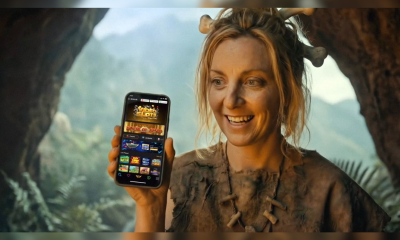

AI4 days agoNew Videoslots app stars in AI-assisted “Stone Age” ad

-

Inferno Mayhem4 days ago

Inferno Mayhem4 days agoPG Soft cranks up the volume with electrifying Inferno Mayhem slot

-

Caesars Entertainment Windsor Limited4 days ago

Caesars Entertainment Windsor Limited4 days agoOLG and Caesars Sign Long-term Operating Agreement for Windsor Casino

-

Agilysys Inc3 days ago

Agilysys Inc3 days agoWinford Resort & Casino Manila Philippines Deploys Agilysys Hospitality Technology to Elevate Operations and Service

-

Gambling in the USA7 days ago

Gambling in the USA7 days agoDigicode at NEXT.io Summit NYC 2026: Driving the Future of iGaming Technology

-

BHA4 days ago

BHA4 days agoBHA Appoints Brant Dunshea as its Chief Executive Officer