Compliance Updates

NY Court Rules Online Fantasy-sports Betting is Unconstitutional

A New York appellate court has ruled that online fantasy sports betting is unconstitutional in the state.

“We recognize that the legislature was sympathetic to and supportive of IFS (interactive fantasy services) participants. Nevertheless, we have rejected the legislature’s explicitly stated basis for the removal of IFS from the Penal Law definitions of gambling,” the appellate panel wrote in its decision.

The ruling by the New York State Appellate Division poses a new challenge for daily fantasy sports peddlers like FanDuel and DraftKings who seek to operate in the Empire State.

At issue is a 2016 amendment to Racing, Pari-Mutuel Wagering, and Breeding Law that declared that online fantasy sports did not constitute gambling and could thus be allowed.

A group of anti-gambling advocates sued over the law arguing that it violated the constitution. In October 2018, Albany Supreme Court Justice Gerald Connolly agreed with them and declared the 2016 amendment “null and void.”

Campaign for Fairer Gambling

$4.3 Billion Wagered Illegally During March Madness, Fueled by Social Media Influence

Latest analysis by online marketplace intelligence specialists, YieldSec, commissioned by the Campaign for Fairer Gambling (CFG), has revealed a stark contrast between legal and illegal online gambling activities during the 2024 NCAA Men’s & Women’s March Madness Basketball Tournaments in the US. YieldSec’s monitoring unveiled an overwhelming majority of betting-related social media posts and video content, reaching up to 73% and 78% respectively, directing audiences toward illegal betting and gambling operators.

YieldSec’s findings shed light on the strength of the illegal gambling grip on the American marketplace, with 378 illegal sports betting operators and 651 illicit affiliates aggressively targeting US March Madness audiences and claiming 64% of the total market share, generating $4.3 billion in illegal and untaxed wagering. The remaining $2.4 billion wagered legally amounts to just 36% of the total market share.

These statistics underscore the challenges in controlling the proliferation of unlicensed gambling operators that have historically capitalized on the fragmented legal landscape of online betting in the US.

Key findings for March Madness 2024:

- Illegal gambling on March Madness comprised 64% of US online marketplace wagering ($4.3 billion Handle).

- Total value of March Madness betting (legal and illegal) amounts to a handle of $6.7bn.

- 378 illegal sports betting operators actively targeted the US.

- 651 affiliates promoted illegal sports betting operators that actively targeted the US.

- Illegals dominated social media content with up to 73% of all social posts in favor of illegal operators.

- 78% of all video content that linked to March Madness betting was linked to illegal operators.

Derek Webb, Founder of CFG, said: “This Yield Sec special report illustrates the dire need for a comprehensive strategy to tackle illegal gambling in the US. The lack of a united government approach and lax oversight by states have only compounded the problem, enabling entities with dubious backgrounds to operate freely. It’s high time for U.S. leadership to spearhead a unified solution to this pervasive issue.”

Ismail Vali, Founder and CEO of YieldSec, said: “The overwhelming presence of illegal gambling during one of the biggest sports betting events of the year is a clear signal that enforcement and monitoring need to be prioritized. Our findings are a call to action for stakeholders across the board to intensify efforts in combating the spread of unlicensed gambling operations that exploit the online marketplace. With the dominance of illegals across our social media channels, it’s clear that the threats to American commerce, community and consumers are a lot closer to home than ever imagined.”

The Campaign for Fairer Gambling is now advocating for a cohesive governmental response to illegal gambling, urging the Department of Justice, Treasury, Federal Trade Commission, and the Trade Representative’s Office to consider the findings of the YieldSec report as a basis for developing effective countermeasures.

Compliance Updates

DGA: Three Orders and One Reprimand Issued to Mr. Green Limited for Breach of the Anti-Money Laundering Act

On April 10th, 2024, the Danish Gambling Authority has issued three orders to Mr. Green Limited for breaching the Anti-Money Laundering Act, on risk assessment, on procedures for internal controls and for failing to ensure that controls are carried out.

On April 10th, 2024, the Danish Gambling Authority has also given Mr. Green Limited a reprimand for breaching the rules on notification in the Anti-Money Laundering Act.

The reactions have been given in connection with the Danish Gambling Authority’s inspection of Mr. Green Limited’s materials that Mr. Green Limited has provided for compliance with the Anti-Money Laundering Act.

Order for insufficient risk assessment

Order (a) is issued because Mr. Green’s risk assessment is insufficient, as no separate risk assessment has been made of the individual identified risks associated with Mr. Green’s business model, including payment solutions, and the risk factors associated with it. It follows from section 7(1) of the Anti-Money Laundering Act that undertakings subject to the Act must identify and assess the risk that the undertaking may be misused for money laundering or terrorist financing. The Danish Gambling Authority’s assesses that the risk assessment must include a separate assessment of the risk of the individual payment solutions and delivery channels, as well as a separate risk assessment of the risk factors associated with these. Thus, Mr. Green did not comply with the risk assessment obligation.

Order for insufficient and lack of business procedures

Order (b) is issued because Mr. Green Limited does not have adequate procedures for internal controls, as these do not describe the interval at which controls should be performed. The order has also been given because Mr. Green Limited does not have written procedures on how to monitor that controls are carried out. It follows from section 8(1) of the Anti-Money Laundering Act that undertakings subject to the Act must have adequate written business procedures, which must include internal control. The business procedures should describe how the listed areas are handled in practice. The requirement for internal control also means that there must be controls of whether the controls are being carried out – in other words, that the controls are being checked. Mr. Green Limited has not sufficiently complied with the commitments on business procedures for controls.

Order for lack of documentation of controls

Order (c) is issued because Mr. Green Limited has not documented that controls have been carried out to verify that the internal controls have been performed. It follows from section 8(1) of the Anti-Money Laundering Act that undertakings subject to the Act must document the controls that have been carried out. Thus, Mr. Green Limited has not complied with the obligations to perform controls to ensure that the internal controls are performed.

Reprimand for not making an immediate notification

Reprimand (a) is given because Mr. Green Limited has in two cases not complied with the requirement for immediate notification to the Money Laundering Secretariat. According to section 26(1) of the Anti-Money Laundering Act, an undertaking must immediately notify the Money Laundering Secretariat if the undertaking knows, suspects or has reasonable grounds to suspect that a transaction, funds or activity is or has been related to money laundering or terrorist financing. Mr. Green has not complied with the notification obligations, as there has been no immediate notification.

Duty to act

The orders entail an obligation to act on the part of Mr. Green Limited. Mr. Green Limited must submit a revised risk assessment within June 10th, 2024.

Mr. Green must also within June 10th, 2024, submit a revised business procedure for internal controls and submit prepared business procedures for how the implementation of controls is monitored.

Mr. Green Limited must also submit documentation within October 10th, 2024, that it has been controlled that the controls have been carried out.

The reprimand does not entail any obligation to act on the part of Mr. Green Limited as the breach no longer exists.

The post DGA: Three Orders and One Reprimand Issued to Mr. Green Limited for Breach of the Anti-Money Laundering Act appeared first on European Gaming Industry News.

Compliance Updates

BetComply Appoints Martin Hodges as its New Chief Marketing Officer

BetComply has appointed Martin Hodges as its new chief marketing officer to spearhead its marketing strategies and growth initiatives.

Coming to BetComply with more than 15 years of experience in strategic marketing, Hodges has propelled brand development, strategic alliances and innovative campaigns while occupying senior marketing positions at several major companies in the sector.

Daniel Brookes, CEO of BetComply, said: “Martin’s appointment comes at a pivotal time for BetComply as we seek to enhance our market position and introduce innovative solutions that meet the evolving needs of our clients. His proven track record, dynamic leadership, and deep understanding of the iGaming industry will be instrumental in driving our marketing efforts and accelerating our growth. We are thrilled to have him on board.”

Hodges said: “I am excited to join BetComply and to be part of a company that is at the forefront of compliance services in the iGaming industry. The opportunity to contribute to BetComply’s mission and to work with a talented team to drive impactful marketing strategies is truly inspiring. I look forward to helping shape the future of this innovative company.”

The post BetComply Appoints Martin Hodges as its New Chief Marketing Officer appeared first on European Gaming Industry News.

-

Baltics6 days ago

Baltics6 days agoHacksaw Gaming and TOPsport are on TOP of their game with new partnership announcement in Lithuania

-

Compliance Updates6 days ago

Compliance Updates6 days agoDGA: Three orders and two reprimands to Skill on Net Ltd for breach of the Anti-Money Laundering Act

-

Central Europe6 days ago

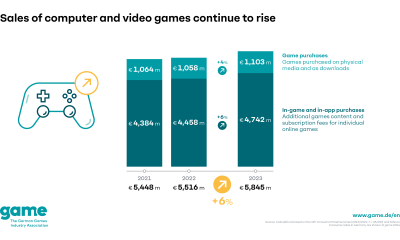

Central Europe6 days agoGerman games market in 2023: strong development in turbulent times

-

Baltics6 days ago

Baltics6 days agoHIPTHER Invites You to Recognize Gaming Excellence at the Baltic & Scandinavian Gaming Awards 2024 – Online Voting Session is Now Open!

-

Baltics6 days ago

Baltics6 days agoWazdan expands in Lithuania with Twinsbet deal

-

Latest News6 days ago

Latest News6 days agoSvenska Spel Appoints Gustav Georgson to Lead Public Affairs

-

Conferences in Europe6 days ago

Conferences in Europe6 days agoAltenar becomes General Sponsor of EEGS 2024

-

Balkans6 days ago

Balkans6 days agoESA Gaming unveils Balkan Bet collaboration