Central Europe

German games market in 2023: strong development in turbulent times

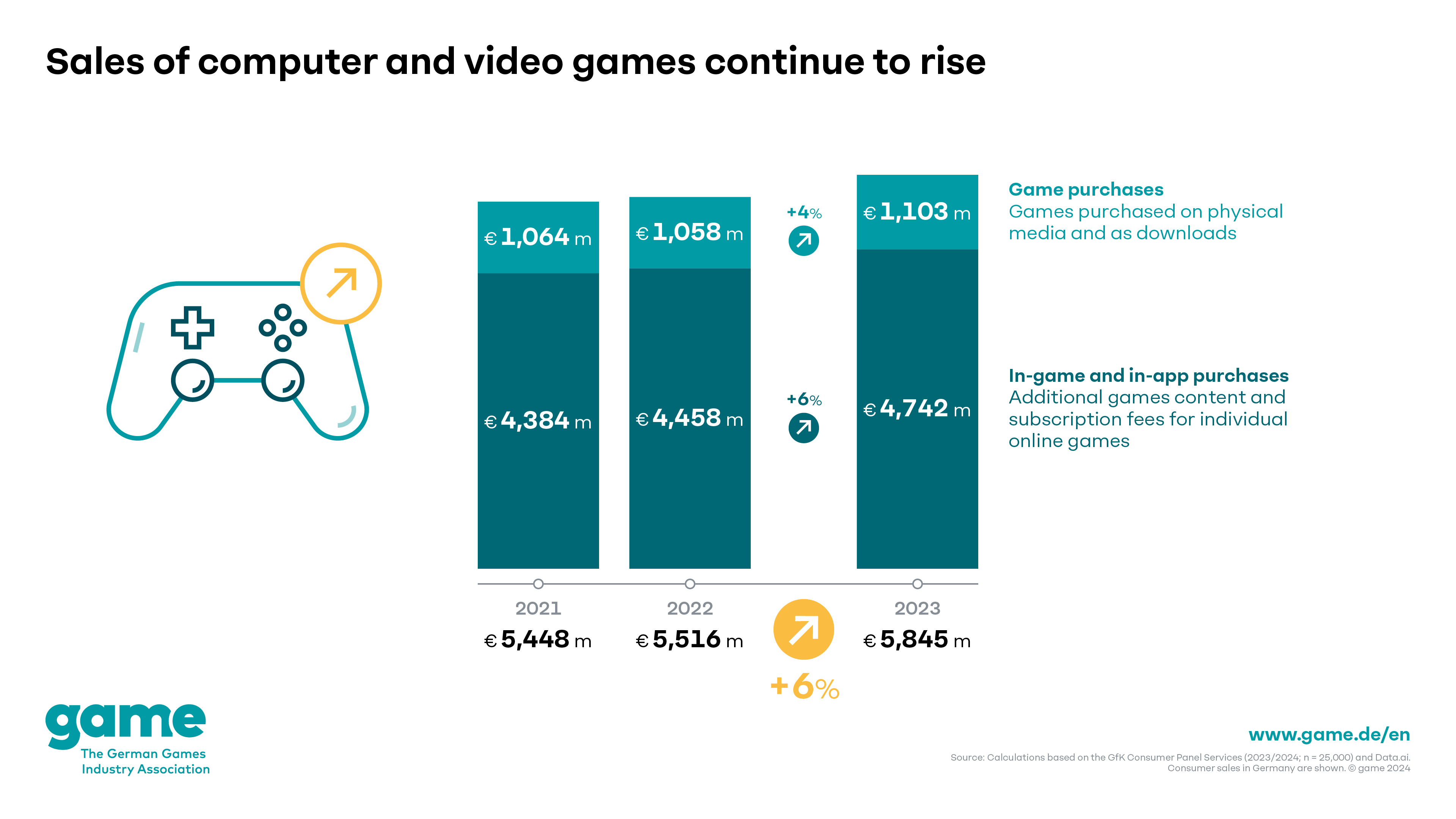

The German games market once again grew significantly overall in 2023: sales of games, games hardware and gaming online services rose by 6 per cent to around 9.97 billion euros. This is a significant increase after sales had only risen by 1 per cent in the previous year. The biggest growth drivers include games consoles and their accessories as well as in-game and in-app purchases. Despite the large number of top-class titles, which increased sales of games purchases by 4 per cent, the number of games sold fell by 8 per cent at the same time. There were also significant declines in some cases for gaming PCs and laptops. The data on the German games market is based on surveys conducted by the consumer panel services GfK and data.ai. The different developments in the individual market segments also show that 2023 was a year of contrasts for the games industry as a whole: on the one hand, more high-calibre titles were released within twelve months than ever before. On the other hand, some sales expectations were not met, particularly due to this abundance of outstanding games. Combined with generally high interest rates and a slowdown in the investment market, a wave of consolidation began worldwide, as a result of which developer studios are still being downsized or even closed and jobs are being cut.

‘The German games market continues to grow, but a close look at the data shows just how challenging these times are for game companies,’ says Felix Falk, Managing Director of game. ‘This is particularly true for small to medium-sized companies in Germany, most of which have only thin capital cover and therefore feel the impact of the tougher investment climate especially quickly. In such turbulent times reliable and internationally competitive political solutions are needed more than ever.’

Major differences between categories of games hardware

Sales revenues from various categories of games hardware developed very differently last year. Game consoles were among the most important growth drivers, posting a revenue increase of 44 per cent to break the billion-euro threshold, with total revenues of 1.1 billion euros. Demand for game console accessories was similarly robust, if at a slightly lower level. Sales revenues in this area jumped 32 per cent, to 374 million euros. In stark contrast, gaming PCs registered a clear decline as revenues from PCs and laptops marketed specially for games dropped by 17 per cent, to 547 million euros. Accessories for gaming PCs – including special input devices, graphic cards, etc. – fared only slightly better, with revenues falling by 7 per cent, to just under 1.3 billion euros.

‘Last year was the first year in a long time in which all current game consoles were easily available on the market,’ says Felix Falk. ‘The huge revenue gain in this category in 2023 shows how great the pent-up demand was among players. On the other hand, there was a clear drop in sales revenues from gaming PCs. After investing in PCs and laptops during the Covid-19 pandemic, a lot of video game players seem to be well-equipped for the moment.’

Sales revenue from games rises and gaming online services stabilise at a high level

Sales revenue from games developed positively overall in 2023. Across all platforms, purchases of PC and console games generated 4 per cent more revenue than in the year before. Total sales revenues in this area increased to around 1.1 billion euros. Considering the many high-quality game releases, however, this rise seems rather low. Indeed, the number of games sold actually dropped by 8 per cent. This reveals that the growth in revenue here is attributable exclusively to higher average prices. Last year, many video game players appear to have purchased high-quality titles shortly after their release and not waited for discounts. Also, because many of the top titles of 2023 are especially time-intensive, they didn’t leave room for players to acquire a larger number of games. In contrast, the market development for in-game and in-app purchases was significantly more positive, showing a revenue increase of about 6 per cent, to 4.7 billion euros. From an upgrade in a player character’s armour, to a season pass with a lot of additional content, to completely new campaigns, it has become ever more common for the playing time of a game to be extended or individualised through additional content. This trend continued in 2023. In-game sales revenues contribute significantly to covering continuously rising game development costs.

After a number of years of strong growth, sales revenues from online gaming services stabilised at a high level. Among the categories in this segment are fee-based subscription services that provide access to a large selection of games, cloud-based gaming, online multiplayer functions and the ability to save game progress in the cloud. Examples of these services include EA Play, Nintendo Switch Online, PlayStation Plus, Xbox Game Pass and Ubisoft+. Revenue from these services fell by 1 per cent in 2023, to 860 million euros.

The post German games market in 2023: strong development in turbulent times appeared first on European Gaming Industry News.

Austria

Blueprint Gaming Strengthens European Reach with Austria Debut on win2day

Collaboration allows the UK’s top slot provider to introduce a range of high-performing games to Austria’s sole licensed online gaming platform.

Blueprint Gaming has reinforced its presence in Europe by launching in the Austrian iGaming sector with win2day.

has reinforced its presence in Europe by launching in the Austrian iGaming sector with win2day.

The significant partnership with Austria’s sole regulated operator will allow win2day players to enjoy a selection of Blueprint Gaming’s renowned titles, with Eye of Horus and Cash Strike making up the initial set of available games.

Blueprint has established a solid reputation for providing feature-rich, localized content for various countries throughout the continent, and its newest market entry marks another phase in its ongoing European growth and greater global focus.

win2day is managed by Austrian Lotteries, established over 50 years ago and is the sole licensed online casino operator in Austria. The brand has developed a strong legacy as a reliable name in the market, taking pride in being one of the most accountable players in the industry.

The partnership is poised to enhance the entertainment experience for Austrian players by merging Blueprint’s esteemed status for creating immersive games with engaging mechanics and win2day’s strong market presence.

Samuel Haggblom, Director of Business Development at Blueprint Gaming , said: “Entering Austria with win2day represents a significant milestone in our European growth strategy. As the country’s only licensed online casino operator, it sets the standard for quality and responsibility, and we are proud to see our content launch on such a dynamic platform.

, said: “Entering Austria with win2day represents a significant milestone in our European growth strategy. As the country’s only licensed online casino operator, it sets the standard for quality and responsibility, and we are proud to see our content launch on such a dynamic platform.

“Our portfolio has consistently delivered strong performance across regulated markets, and we look forward to introducing Austrian players to iconic titles, with more high-performing releases set to follow.”

Georg Wawer, Managing Director of win2day, added: “As Austria’s only licensed online gaming operator, win2day is committed to delivering premium, secure and fully compliant entertainment to our players. With Blueprint Gaming, we are adding a well-established and internationally recognised studio to our portfolio, known for its strong brands and high production standards.

“In close cooperation, we ensure that every title is carefully aligned with Austria’s strict regulatory framework and our comprehensive player protection policies. This guarantees that innovation and entertainment always go hand in hand with responsibility and safety. Blueprint Gaming’s portfolio will be a strong and exciting enhancement to the win2day offering.”

The post Blueprint Gaming Strengthens European Reach with Austria Debut on win2day appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Alex Green Vice President Games at ZEAL

Wunderino Adds ZEAL’s Premium Slots as Partnership Kicks Off

ZEAL Instant Games, part of the ZEAL Group and an online gaming provider, has initiated a new partnership with Wunderino, a prominent online slot brand in Germany. As a part of the collaboration, Wunderino is enhancing its entertainment portfolio with a forthcoming increasing range of ZEAL slots. The initial titles are now active and accessible to players on Wunderino.de.

Increased diversity for gamers – enhanced exposure for premium titles.

The new collaboration brings evident benefits for both firms: Wunderino is boosting its online gaming selection with ZEAL content, further solidifying its status as an innovation-focused provider in the German iGaming sector. Simultaneously, ZEAL Instant Games leverages Wunderino’s robust brand visibility and influence, reaching new audiences.

At launch, well-known titles like “The Bookmaker,” “Treasure Volcano,” and “Vegas Blaze” are included in the first batch of games already offered. The objective is to enhance the portfolio by adding more new games in the upcoming months.

Comments regarding the partnership

“With Wunderino, we are gaining a partner that has stood for entertainment, dynamism, and a strong brand identity for many years,” says Alex Green, Vice President Games at ZEAL. “Integrating our titles into one of the most popular platforms in Germany is another important step in making our portfolio accessible to even more players and driving our strategic expansion.”

Wunderino adds: “ZEAL Instant Games stands for creative content, high quality, and reliable performance – all values that perfectly match our brand,” says Susanne Forsman, Group Chief Gaming Officer at Wunderino. “The new ZEAL slots will help enrich our offerings and provide our users with additional exciting experiences. We are very excited about the joint launch and what lies ahead.”

The post Wunderino Adds ZEAL’s Premium Slots as Partnership Kicks Off appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Central Europe

Powering the Next Generation of Online Casinos: Inside DSTGAMING’s Scalable iGaming Ecosystem

Interview with John Tan, Digital Marketing Analyst at DSTGAMING

Ahead of HIPTHER Prague Summit 2026, we speak with John Tan, Digital Marketing Analyst at DSTGAMING, to explore how their white label, turnkey, crypto-ready platforms, and powerful game aggregation solutions empower operators – from rapid launch and unified game integration to risk management, payments, and next-generation crypto deployment.

From your perspective, what are the biggest operational barriers new casino operators face today – and how does DSTGAMING address them through technology and infrastructure?

New casino operators often underestimate the complexity of launching and sustaining an iGaming operation. Beyond platform development, they face challenges related to licensing alignment, payment integrations, risk management, game provider negotiations, fraud prevention, and ongoing technical maintenance. Each of these components requires expertise, time, and significant capital investment.

DSTGAMING addresses these barriers by delivering a structured, technology-driven ecosystem that consolidates critical operational components into a single, unified infrastructure. Instead of managing multiple vendors and fragmented systems, operators gain access to a centralized platform that integrates game aggregation, payment gateways, compliance-ready frameworks, and backend management tools. This significantly reduces operational friction and allows operators to focus on market growth, branding, and player acquisition rather than technical troubleshooting.

DSTGAMING provides White Label solutions enabling casinos to go live in as little as a few weeks. What operational processes and technical frameworks make such rapid deployment possible?

Rapid deployment is made possible through a pre-configured yet flexible platform architecture. DSTGAMING’s White Label solution is built on a modular infrastructure where essential systems — player management, payment integrations, risk control, reporting dashboards, and game aggregation — are already technically optimized and tested.

Instead of building from scratch, operators plug into an established framework that supports domain setup, branding customization, provider configuration, and payment integration within a structured onboarding workflow. Automated compliance tools, ready-made back-office dashboards, and scalable cloud infrastructure further streamline the process. This approach minimizes development cycles while maintaining operational stability and performance.

The Turnkey solution focuses on full branding flexibility, user-friendly management, and extensive game libraries. How does this differ strategically from White Label in terms of operator control and long-term scalability?

Strategically, the White Label model is ideal for operators seeking speed-to-market with lower upfront investment and reduced technical responsibility. It provides a comprehensive operational framework where much of the infrastructure and maintenance is centrally managed.

The Turnkey solution, however, is designed for operators who require greater autonomy and long-term strategic control. It offers full branding flexibility, deeper system customization, independent licensing alignment, and enhanced scalability options. From a business standpoint, Turnkey allows operators to build their own technology identity while retaining access to DSTGAMING’s infrastructure backbone. This structure supports expansion into multiple jurisdictions, diversified payment ecosystems, and tailored player engagement strategies over time.

DSTGAMING’s Casino Game Aggregator provides access to more than 10,000 games from 100+ providers – how do you approach game content management, performance consistency, and provider diversity to ensure long-term player engagement?

Managing a large-scale aggregation portfolio requires structured curation rather than simple volume expansion. DSTGAMING focuses on performance analytics, regional player preferences, and technical optimization when onboarding providers.

Game content is continuously monitored for performance indicators such as session duration, retention rates, and conversion metrics. Low-performing titles can be rotated, while trending categories — whether slots, live casino, or crash games — are strategically highlighted. Provider diversity is carefully balanced to include established industry brands alongside emerging studios offering innovative mechanics.

From a technical standpoint, standardized API integration protocols and server optimization ensure latency consistency and stable gameplay across regions. This combination of analytics-driven curation and infrastructure reliability supports sustained player engagement rather than short-term spikes.

DSTGAMING also offers crypto-focused casino deployment. How is cryptocurrency reshaping payment flows, compliance considerations, and global player acquisition strategies?

Cryptocurrency is fundamentally reshaping cross-border transaction efficiency and player accessibility. Traditional payment systems often involve processing delays, regional banking restrictions, and high transaction fees. Crypto payments reduce these friction points by enabling faster settlement, lower costs, and broader global reach.

However, crypto integration also requires structured compliance frameworks. Responsible implementation includes wallet verification systems, AML alignment, transaction monitoring, and jurisdictional risk assessment. DSTGAMING integrates crypto-ready infrastructure within a controlled environment to balance operational efficiency with regulatory awareness.

From a growth perspective, crypto expands access to digitally native audiences and markets where conventional banking infrastructure may limit participation. Operators can position themselves competitively by offering both fiat and digital asset payment options within a secure and scalable ecosystem.

What key iGaming technology or business trends should operators watch most closely heading into 2026?

Heading into 2026, operators should closely monitor three primary areas: infrastructure scalability, payment diversification, and data-driven personalization.

First, scalable cloud-based architectures will become increasingly important as competition intensifies and multi-market expansion accelerates. Second, payment ecosystems will continue diversifying, including alternative payment methods, regional wallets, and cryptocurrency adoption. Third, advanced data analytics and AI-driven personalization will play a central role in player retention, segmentation, and responsible gaming monitoring.

Additionally, regulatory adaptability will remain critical. Operators must design systems that allow compliance updates without disrupting operational continuity.

DSTGAMING is joining the HIPTHER Prague Summit 2026 as the Lanyard Sponsor. What would you like operators and partners to take away from engaging with your team there?

DSTGAMING’s participation at the HIPTHER Prague Summit 2026 as Lanyard Sponsor reflects its long-term commitment to industry collaboration and technological advancement.

At the summit, the objective is not simply to present solutions, but to engage in strategic discussions with operators and partners about sustainable growth models, market expansion strategies, and infrastructure optimization. Visitors should walk away with a clear understanding that DSTGAMING provides more than a platform — it delivers a structured ecosystem designed to support rapid launch, scalable expansion, diversified payments, and long-term operational stability.

The focus remains on building partnerships grounded in technology reliability, strategic flexibility, and measurable business outcomes as the industry moves into its next phase of evolution.

The post Powering the Next Generation of Online Casinos: Inside DSTGAMING’s Scalable iGaming Ecosystem appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Canada6 days ago

Canada6 days agoPointsBet Canada to Contest Proposed 5-Day Suspension by AGCO

-

Africa6 days ago

Africa6 days agoEGT showcases African growth strategy at SiGMA Africa 2026

-

Ben Bradtke Co-Founder of ThrillTech6 days ago

Ben Bradtke Co-Founder of ThrillTech6 days agoThrillTech enters Brazilian market with EstrelaBet

-

Denmark6 days ago

Denmark6 days agoELA Games Strengthens Danish Market Presence via Stake.dk Tie-Up

-

BIG Cyber5 days ago

BIG Cyber5 days agoBMM INNOVATION GROUP TO SPONSOR AND EXHIBIT AT SBC RIO 2026 MARCH 3–5 AT RIOCENTRO, RIO DE JANEIRO

-

bets6 days ago

bets6 days agoRegulatory crossroads: Anti-match-fixing bill and betting tax rejection

-

Brasil6 days ago

Brasil6 days agoBrasil ante una encrucijada: match-fixing e impuesto rechazado

-

AdmiralBet Serbia5 days ago

AdmiralBet Serbia5 days agoDigitain Enters into Multi-Vector Collaboration with AdmiralBet Serbia