Gaming

How game studios can avoid common network and infrastructure issues

Mathieu Duperré, CEO and Founder of Edgegap

It’s common for video game developers to launch a day-one patch for new releases after their games have gone gold. The growing size of video games means it’s inevitable that some bugs will be missed during the QA period and go unnoticed until the game is in players’ hands.

Some of the most common issues experienced by game developers at launch are related to network and infrastructure, such as the connection issues causing chaos in Overwatch 2 and Call of Duty: Modern Warfare 2, as some players experience issues connecting to matches. And while there’s no way of eliminating lag, latency and disconnects from multiplayer games, developers can minimize the chances of them occurring and the disruption they cause by following a few simple steps.

Plan for the worst, expect the best

For many video game developers, the best-case scenario for the launch of their game – that it’s a huge hit and far more people end up playing it than they expected – can also be the worst-case scenario for infrastructure-related issues. An influx of too many players can lead to severe bottlenecking, resulting in lag and connectivity issues. In a worst-case scenario, servers become overloaded and stop responding to requests, usually leaving players unable to connect to online matchmaking.

Another worst-case scenario is planning for big numbers at launch and building the necessary infrastructure to support this, only for your game to launch and have nowhere near the traffic you were expecting. Not only is this a big problem for your bottom line, but things can get worse if you rush your search for an infrastructure provider and forget to read through the T&Cs properly.

Some infrastructure suppliers will onboard new studios on a fixed contract, not letting them scale back if they’ve overprovisioned their servers. Some infrastructure providers offer a lot of free credits, to begin with, only for those credits to expire after the first few months. Game studios then discover they’re responsible for fronting the cost of network traffic, load balancers, clusters, API calls, and many more products they had yet to consider.

With that in mind, try not to sign up for long-term agreements that don’t offer flexibility for scaling up or down. Your server setup has a lot to gain by being flexible, and your server requirements will likely change in the weeks following launch as you get a better idea of your player base; under-utilized servers are a waste of money and resources.

Test, test, and test again

You haven’t tested your online matchmaking properly if you’ve tested your servers under the strain of 1000 players, but you’re expecting 10,000 or 100,000 at launch. Your load tests are an essential part of planning for the worst-case scenario, and you should test your network under the same strain as if you suddenly experienced a burst in players.

Load testing is important because you’ll inevitably encounter infrastructure issues as your network comes under strain. Still, it’s only by facing those issues that you can identify them and plan for them accordingly once your game launches.

Similarly, you want to test your game in as many different locations as possible because there’s no way of telling where your traffic will be coming from. We’ve had cases where studios released a very popular game overnight in Chile but needed data centers. Thankfully, you can mitigate issues such as these by leveraging edge computing providers to reduce the distance between your players and the point of connection.

Consider the specific infrastructure needs of your game’s genre

Casual games with an optional multiplayer component will have a completely different network requirement to MMORPGs, with thousands of players connected to a centralized world. Similarly, a first-person-shooter with 64-player matchmaking will have a different network requirement than a side-scrolling beat ’em up or fighting game, which often requires custom netcodes due to the fast-paced nature of the combat.

People outside the video game industry assume all video games have similar payloads, but different game genres are as technically different in terms of infrastructure requirements as specific applications.

With that in mind, it’s essential for game studios, especially smaller ones, to regularly communicate with infrastructure partners and ensure they’ve got a thorough understanding of how the multiplayer components of your game will work. A decent infrastructure provider will be able to work with you to not only ensure load testing is carried out correctly but also help diagnose any broader issues.

Too many tools and not enough resources to use them

One thing that large network providers are very good at providing is tools, but these are often complex and require specific knowledge and understanding. It’s worth noting that large game studios have dedicated teams of engineers to manage these tools for AAA games with millions of players.

Smaller studios need to be realistic about the number of players they expect for new game releases and their internal resources to manage network and infrastructure-related issues and queries. You should partner with a provider that can handle all of this, so your studio can focus on making the best game possible. The more automation you can plan into your DevOps methodology, the better!

Takeaways for small game studios

While game studios likely encounter many issues as part of their game development journey, working these three pieces of advice into your DevOps pipeline is a sure way of minimizing infrastructure-related headaches.

Don’t reinvent the wheel – We’ve seen many studios trying to build bespoke systems rather than automate and use what’s already out there. If you can develop your netcode, engine and manage your Kubernetes, that’s great! But is it necessary, or is building these things from scratch just going to create trouble further down the line?

Understand your workflows – Plan for everything, use tech-agnostic vendors to remain flexible, get real-time visibility and logs for your matchmaking traffic, and have a 24/7 support plan for when your game is live. The more potential problems you’re aware of, the better.

Load testing your game – Build tiny tools and scripts to generate as much traffic as you can, breaking your system as often as possible.

Powered by WPeMatico

Gaming

Soft2Bet Introduces MEGA11, a Football Manager Experience Designed to Elevate Sportsbook Activity

Soft2Bet has revealed the debut of MEGA11, a football management game aimed at enhancing sportsbook interaction and improving player loyalty. Acknowledging that football manager and fantasy games rank among the most favored genres with the longest typical gameplay durations, MEGA11 provides a progression-oriented and captivating football manager experience focusing on fantasy league team construction, allowing players to tactically oversee their own teams and make important choices while competing in leagues and matches.

Users of sportsbooks are inherently used to waiting before making their next wager. That inactivity naturally leads to a decrease in daily engagement, even among bettors who are very focused on football. MEGA11 addresses this issue by providing users with a football management game seamlessly connected to the sportsbook experience. Rather than waiting for the upcoming kickoff, players can remain engaged by forming their team, modifying lineups, and battling in their personal matchups or leagues. This establishes a distinctive two-way interaction cycle, effortlessly integrating real-money wagering with social, engaging gameplay, transforming these calmer times into organized activity with defined objectives, advancement, and a motivation to come back.

MEGA11 is developed as an independent game featuring its own soft-currency system, without any direct links to sportsbook deposits or casino operations. The main experience is free-to-play, enabling players to advance at their own speed. For players seeking to advance quickly or enhance their team, MEGA11 provides optional purchases, such as more powerful player cards and boosters that speed up progress and offer a strategic advantage.

The engagement of the sportsbook is fueled by a straightforward, quantifiable mechanism. Each wager allows players to accumulate points that enhance their advancement in the football manager game. This advancement, consequently, activates sportsbook bonuses, actively encouraging ongoing involvement and strengthening consistent engagement. Advancement is organized via a five-level loyalty and gamification framework that reflects a football career trajectory: Beginner, Amateur, Professional, World Class, and Legend. The tiering aims to maintain motivation over time, providing a consistent feeling of progress that fosters longer-term retention instead of brief spurts of engagement.

The new engine enhances Soft2Bet’s larger MEGA portfolio, which currently features mechanics like MEGA Chance, MEGA Round, and MEGA Clawee. It further enhances Soft2Bet’s sportsbook offering with instant payouts, 24/7 support, and over 200 pre-match football markets, by introducing a perpetual football format designed to maintain fan engagement beyond the live match calendar.

The design of the product continues to prioritize player protection and compliance. MEGA11’s soft-currency, non-deposit model promotes secure and compliant interactions, emphasizing entertainment and advancement while adhering to responsible gaming standards in regulated regions.

Yoel Zuckerberg, CPO at Soft2Bet, stated: “MEGA11 is built to keep football fans engaged between matchdays, pairing a manager-style progression loop with a soft-currency model that supports compliant, long-term sportsbook loyalty. Football manager games are renowned for having the highest player immersion and longest session times in the industry. By bringing this experience to our partners, we are combining real betting with social gameplay to deliver authentic player experiences that resonate with fans and drive sustainable engagement.”

The introduction of MEGA11 enhances Soft2Bet’s emphasis on product-driven engagement, merging game design, loyalty strategies, and a robust regulatory framework to assist operators in achieving more reliable retention during the football season. The technology has received significant industry awards and is eliciting a strong positive reaction from players, confirming its influence on engagement and long-term value generation.

The post Soft2Bet Introduces MEGA11, a Football Manager Experience Designed to Elevate Sportsbook Activity appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Gaming

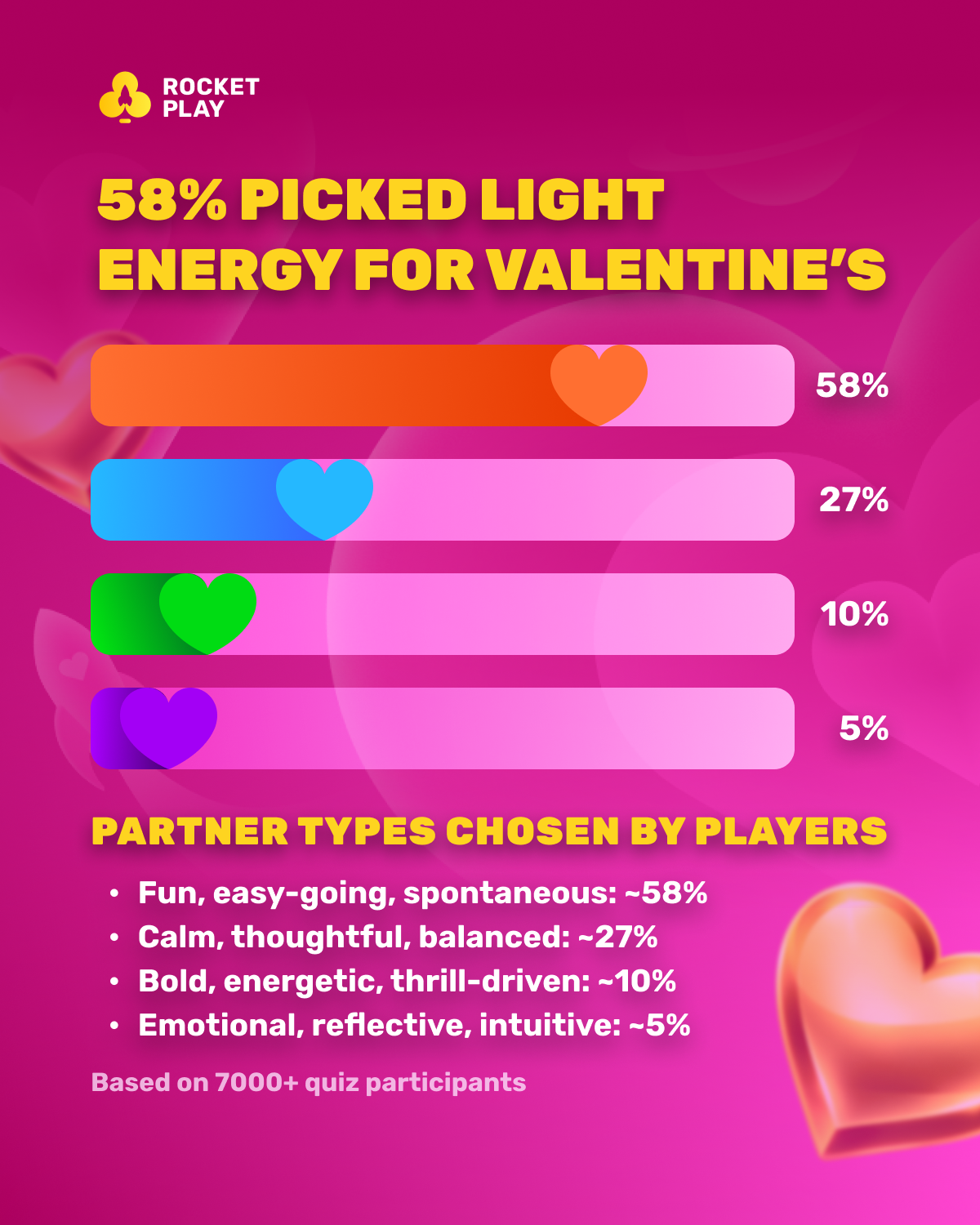

58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”.

This Valentine’s, RocketPlay tested a playful idea: players who seek thrills in gaming don’t necessarily want intensity in everything — including relationships. Instead of asking users to pick a “perfect partner,” RocketPlay launched Rocket Match, a fast, flirty quiz that matches players with a vibe: Bold, Sunny, Dreamy, or Adventurous.

Early Results Flip the Stereotype

Around 58% of participants matched with the Sunny archetype — defined by warmth, charm, and easy-going fun. The experiment suggests that when it comes to Valentine’s, RocketPlay’s community prefers light-hearted connection over drama or high stakes.

What Rocket Match Is

Rocket Match is a Valentine’s matchmaking quiz built inside the RocketPlay Universe. Players answer five simple, no-wrong-answer questions and instantly discover their match vibe.

The goal: move away from typical Valentine’s content that swings between overly serious romance or clichéd tropes. Rocket Match keeps it flirty, playful, and moment-focused, letting players discover a vibe rather than a label.

The four vibes include:

-

Bold – confident, high-energy, loves bigger sparks

-

Sunny – easy-going, playful, social, effortlessly charming

-

Dreamy – soft, romantic, focused on atmosphere and emotion

-

Adventurous – playful risk-taker, spontaneous, curious

Community Insights from Rocket Match

The quiz quickly gained traction, with 7,000+ completions, revealing a strong preference: Sunny, the archetype defined by warmth, lightness, and charm.

Alex Martin, PR Lead at RocketPlay, said:

“What we liked most about Rocket Match is how clearly it captured the mood people actually want on Valentine’s. It wasn’t about labels or big statements — it was about light energy, easy chemistry, and a feel-good kind of connection. That’s the vibe we try to build across the brand: simple to join, fun in the moment, and positive without the drama.”

Why It Matters

Rocket Match was more than a Valentine’s gimmick. It offered a snapshot of what RocketPlay’s community enjoys most: light energy, playful interaction, and feel-good connections. By turning a pop-culture moment into a small experiment, RocketPlay gained insight into player preferences, informing how the brand continues to design engaging, fun, and positive experiences.

The post 58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”. appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Gaming

58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”.

This Valentine’s, RocketPlay tested a simple idea: people who come to iGaming for thrill don’t necessarily want the same intensity in everything — including relationships. Instead of asking players to choose a “perfect partner,” we launched Rocket Match, a fast, playful quiz that matches players with a vibe — bold, sweet, dreamy, or adventurous.

Early results flipped the stereotype. Around 58% of participants matched with the same vibe — built around warmth, charm, and easy fun — suggesting that when it comes to Valentine’s, our community prefers light-hearted connection over drama or risk.

What Rocket Match is

Rocket Match is a Valentine’s matchmaking quiz built as a small cosmic adventure inside the gaming RocketPlay Universe. Players answer 5 light questions — no right or wrong answers — and instantly unlock a Rocket Match that compliments themself. The idea was simple: Valentine’s content online often swings between two extremes — overly serious romance or pure cliché. Rocket Match was created to do something different: keep it flirty, keep it playful, and let players discover a vibe that feels like a moment, not a label.

There were 4 vibes to match with:

Bold — confident, high-energy, loves a bigger spark and bolder choices.

Sunny — easy-going, lighthearted, funny, good communicator

Dreamy — softer, romantic, drawn to atmosphere and emotion.

Adventurous — playful risk-taker energy; spontaneous, curious, and always up for something new.

The lightweight Valentine’s experiment quickly gained traction, with 7,000+ players completing the quiz. The unexpected value came after: the answers revealed a clear preference in what players wanted Valentine’s to feel like — and that insight became the story.

Across responses, around 58% of participants landed on the same Rocket Match vibe — the “sunny” archetype. It’s defined by warmth, lightness, and easy charm: playful, social, and effortless to be around.

What it says about RocketPlay’s community

Rocket Match offered a clear read on the kind of Valentine’s energy players gravitate toward — and it’s lighter than the usual “high-stakes romance” stereotype. As Alex Martin, PR Lead, puts it: “What we liked most about Rocket Match is how clearly it captured the mood people actually want on Valentine’s. It wasn’t about labels or big statements — it was about light energy, easy chemistry, and a feel-good kind of connection. That’s the vibe we try to build across the brand: simple to join, fun in the moment, and positive without the drama.”

What started as a fun Valentine’s experiment quickly became a snapshot of what the community enjoys most: light energy, easy chemistry, and feel-good connection. Valentine’s was simply the right moment to test a playful, pop-culture format — and see what kind of “match” people gravitate toward.

The post 58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”. appeared first on Americas iGaming & Sports Betting News.

-

Blueprint Gaming6 days ago

Blueprint Gaming6 days agoBlueprint Gaming unleashes Frankenstein’s Fortune blending dynamic modifiers with multi-path bonus offering

-

Compliance Updates7 days ago

Compliance Updates7 days agoHow to Apply for a Finnish iGaming License: Gaming in Finland Webinar on Application Steps and Technical Standards

-

Big Daddy Gaming7 days ago

Big Daddy Gaming7 days agoBig Daddy Gaming® Expands European Footprint After MGA Licence Approval

-

Latest News4 days ago

Latest News4 days agoGGBET UA hosts Media Game – an open FC Dynamo Kyiv training session with journalists from sports publications

-

Compliance Updates6 days ago

Compliance Updates6 days agoMGA Publishes Results of Thematic Review on Self-exclusion Practices in Online Gaming Sector

-

Amusnet6 days ago

Amusnet6 days agoAmusnet Unveils Casino Engineering and Technology Milestones Achieved in 2025

-

Dan Brown6 days ago

Dan Brown6 days agoGames Global and Foxium return to the Colosseum in Rome Fight for Gold the Tiger’s Rage™

-

Brais Pena Chief Strategy Officer at Easygo7 days ago

Brais Pena Chief Strategy Officer at Easygo7 days agoStake Goes Live in Denmark Following Five-Year Licence Approval