Gaming

APPOCALYPSE NOW: MOBILE ADVERTISERS HAVE THEIR SAY ON PRIVACY-FIRST MARKETING

– Industry defining report from Tenjin and Growth FullStack sheds a light on mobile marketing one year on from Apple’s privacy changes –

Tenjin, a leading mobile measurement platform for indie and mid-sized mobile game publishers, together with Growth FullStack, a platform powering custom business intelligence for mobile advertisers, today release the full report of their revelatory research findings about the state of mobile marketing.

With billions of people shopping, socializing, scrolling and, of course, gaming on mobile for up to a third of their waking moments, it’s hardly surprising that mobile ad spend reached a spectacular $300 billion in 2021. This amount could hit as much as $350 billion in 2022, reflecting the strength of an industry boosted by permanent changes to user behavior brought about by the global COVID-19 pandemic.

Yet, for an industry that is so accustomed to knowing whom its dollars target and the return on investment they deliver with pinpoint granularity, the last year has been a rude awakening. Privacy-first changes have forever altered familiar ways of targeting and measuring ad performance, particularly on what is often seen as the most lucrative ecosystem of them all – Apple’s iOS.

Between the doomsaying predictions and a picture of booming ad spend, the reality mobile advertisers are operating in is much more nuanced. Tenjin and Growth FullStack wanted to drill deeper, and commissioned market research agency Atomik Research to conduct an online survey of more than 302 mobile advertisers in the UK and US.

Christopher Farm, CEO and Co-Founder of Tenjin, said:

“While the appocalypse may not have materialized as first predicted, our research shows that there are indeed some tectonic shifts underway. The reality is that the full ramifications of privacy-first marketing aren’t yet understood, even by people like us who spend their days entirely focused on deciphering them and coming up with solutions.”

Key findings:

-

Expectations vs reality – Despite feeling reasonably well prepared for Apple’s privacy changes (53% fairly, 15% very), the majority (55%) of mobile advertisers say that mobile advertising became more difficult in 2021. This had a considerable negative impact on advertisers’ revenues – The median estimated revenue loss due to Apple’s privacy changes was 39%.

-

Patchwork strategies – Mobile advertisers are using a patchwork of strategies to achieve success. 85% used probabilistic attribution or fingerprinting in 2022, despite more than three-quarters (77%) expecting Apple to clamp down on fingerprinting.

-

Teething problems with SKAN – Making the most of Apple’s anonymized SKAdNetwork data is a challenge for mobile advertisers. Few (32%) of companies have access to in-house data science talent, but three-quarters (75%) have implemented some form of marketing automation to gain insight from large, disparate datasets.

-

Gaming – Mobile games advertisers felt the impact of Apple’s privacy-first changes most keenly of all. They were more convinced that mobile marketing became more difficult in 2021 (gaming 68% vs 43% non-gaming), more likely to shift budget to Android (63% vs 48%), and use attribution methods such as probabilistic attribution or fingerprinting (91% vs 70%).

-

Optimism for 2022 – Despite a tough 2021, mobile advertisers are largely positive and bullish. 85% were optimistic that marketing would be less challenging in 2022, while almost two-thirds (65%) planned to increase rather than decrease their ad spend.

Christopher Farm commented on the findings:

“Mobile marketing can be best characterized as in a zombified state that’s somewhere between the familiar era of unrestricted targeting and the new, privacy-first one. The sustainability of the current patchwork model remains to be seen. It’s likely that, in the not too distant future, committing to understanding SKAN will become imperative rather than optional. And yet, despite a rough 2021 for mobile advertisers’ bottom lines, and with more change ahead, our research shows that advertisers’ optimism remains strong. After all, one thing is unchanged: the best mobile content and services are in high demand from billions of people the world over, on both iOS and Android.”

The research fieldwork took place with 302 companies with no known affiliation to Tenjin or Growth FullStack, and was conducted by Atomik Research, an independent creative market research agency that employs MRS-certified researchers and abides to MRS code.

Powered by WPeMatico

Gaming

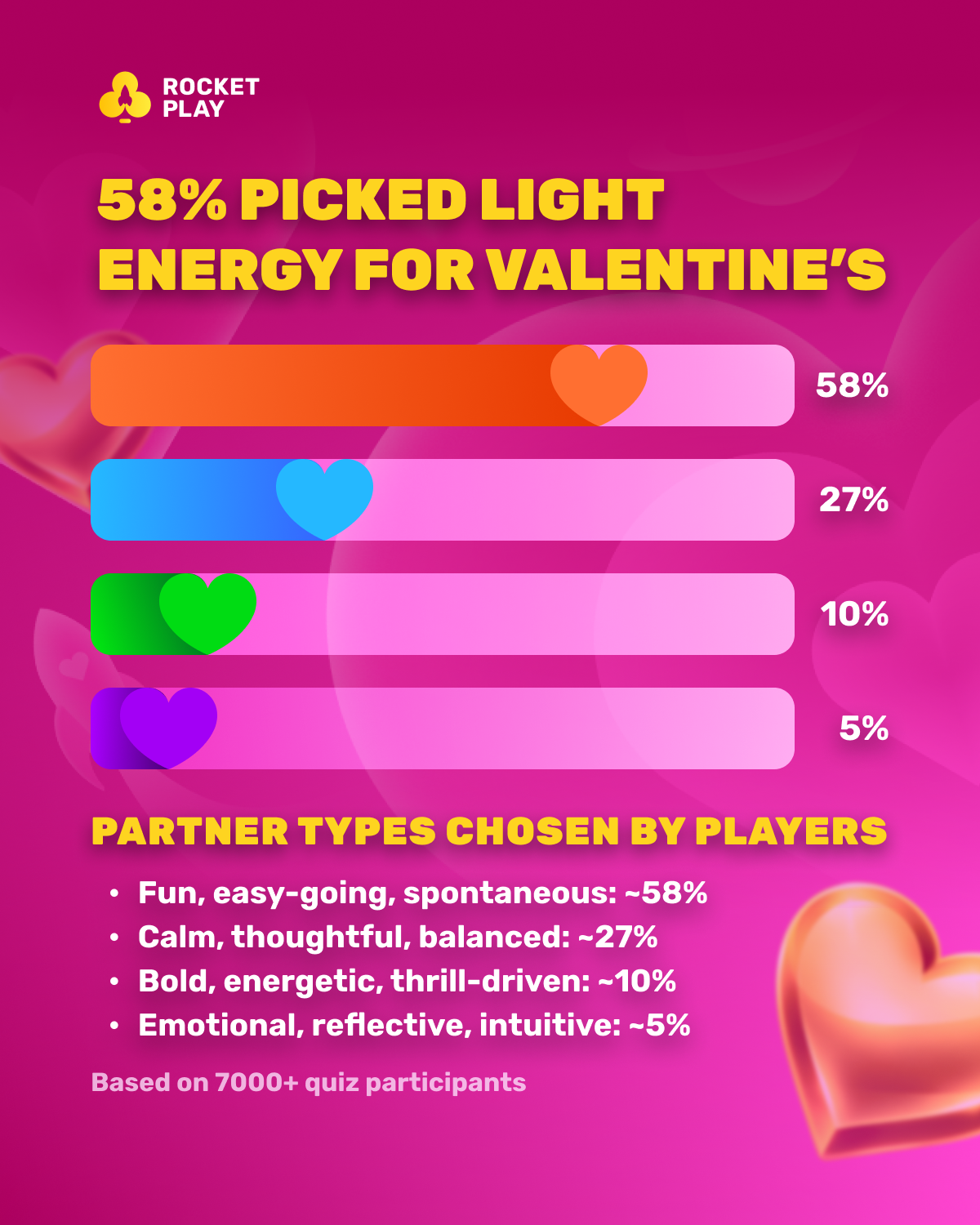

58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”.

This Valentine’s, RocketPlay tested a playful idea: players who seek thrills in gaming don’t necessarily want intensity in everything — including relationships. Instead of asking users to pick a “perfect partner,” RocketPlay launched Rocket Match, a fast, flirty quiz that matches players with a vibe: Bold, Sunny, Dreamy, or Adventurous.

Early Results Flip the Stereotype

Around 58% of participants matched with the Sunny archetype — defined by warmth, charm, and easy-going fun. The experiment suggests that when it comes to Valentine’s, RocketPlay’s community prefers light-hearted connection over drama or high stakes.

What Rocket Match Is

Rocket Match is a Valentine’s matchmaking quiz built inside the RocketPlay Universe. Players answer five simple, no-wrong-answer questions and instantly discover their match vibe.

The goal: move away from typical Valentine’s content that swings between overly serious romance or clichéd tropes. Rocket Match keeps it flirty, playful, and moment-focused, letting players discover a vibe rather than a label.

The four vibes include:

-

Bold – confident, high-energy, loves bigger sparks

-

Sunny – easy-going, playful, social, effortlessly charming

-

Dreamy – soft, romantic, focused on atmosphere and emotion

-

Adventurous – playful risk-taker, spontaneous, curious

Community Insights from Rocket Match

The quiz quickly gained traction, with 7,000+ completions, revealing a strong preference: Sunny, the archetype defined by warmth, lightness, and charm.

Alex Martin, PR Lead at RocketPlay, said:

“What we liked most about Rocket Match is how clearly it captured the mood people actually want on Valentine’s. It wasn’t about labels or big statements — it was about light energy, easy chemistry, and a feel-good kind of connection. That’s the vibe we try to build across the brand: simple to join, fun in the moment, and positive without the drama.”

Why It Matters

Rocket Match was more than a Valentine’s gimmick. It offered a snapshot of what RocketPlay’s community enjoys most: light energy, playful interaction, and feel-good connections. By turning a pop-culture moment into a small experiment, RocketPlay gained insight into player preferences, informing how the brand continues to design engaging, fun, and positive experiences.

The post 58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”. appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Gaming

58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”.

This Valentine’s, RocketPlay tested a simple idea: people who come to iGaming for thrill don’t necessarily want the same intensity in everything — including relationships. Instead of asking players to choose a “perfect partner,” we launched Rocket Match, a fast, playful quiz that matches players with a vibe — bold, sweet, dreamy, or adventurous.

Early results flipped the stereotype. Around 58% of participants matched with the same vibe — built around warmth, charm, and easy fun — suggesting that when it comes to Valentine’s, our community prefers light-hearted connection over drama or risk.

What Rocket Match is

Rocket Match is a Valentine’s matchmaking quiz built as a small cosmic adventure inside the gaming RocketPlay Universe. Players answer 5 light questions — no right or wrong answers — and instantly unlock a Rocket Match that compliments themself. The idea was simple: Valentine’s content online often swings between two extremes — overly serious romance or pure cliché. Rocket Match was created to do something different: keep it flirty, keep it playful, and let players discover a vibe that feels like a moment, not a label.

There were 4 vibes to match with:

Bold — confident, high-energy, loves a bigger spark and bolder choices.

Sunny — easy-going, lighthearted, funny, good communicator

Dreamy — softer, romantic, drawn to atmosphere and emotion.

Adventurous — playful risk-taker energy; spontaneous, curious, and always up for something new.

The lightweight Valentine’s experiment quickly gained traction, with 7,000+ players completing the quiz. The unexpected value came after: the answers revealed a clear preference in what players wanted Valentine’s to feel like — and that insight became the story.

Across responses, around 58% of participants landed on the same Rocket Match vibe — the “sunny” archetype. It’s defined by warmth, lightness, and easy charm: playful, social, and effortless to be around.

What it says about RocketPlay’s community

Rocket Match offered a clear read on the kind of Valentine’s energy players gravitate toward — and it’s lighter than the usual “high-stakes romance” stereotype. As Alex Martin, PR Lead, puts it: “What we liked most about Rocket Match is how clearly it captured the mood people actually want on Valentine’s. It wasn’t about labels or big statements — it was about light energy, easy chemistry, and a feel-good kind of connection. That’s the vibe we try to build across the brand: simple to join, fun in the moment, and positive without the drama.”

What started as a fun Valentine’s experiment quickly became a snapshot of what the community enjoys most: light energy, easy chemistry, and feel-good connection. Valentine’s was simply the right moment to test a playful, pop-culture format — and see what kind of “match” people gravitate toward.

The post 58% of respondents like the“warmy” archetype. Rocket Match by RocketPlay became “ Valentine’s Tinder in Gaming”. appeared first on Americas iGaming & Sports Betting News.

CEO of GGBET UA Serhii Mishchenko

GGBET UA kicks off the “Keep it GG” promotional campaign

A leading gaming brand in Ukraine has launched a collection of ads featuring the tagline “Keep it GG” as part of an extensive communications initiative. The videos are currently being broadcast on Ukrainian TV, online platforms, and the brand’s social media accounts.

“GG” (Good Game) started in video game culture, yet its significance has far surpassed the literal meaning of “well played.” Currently, it symbolizes a worldwide sign of honor and gratitude for the feelings exchanged following a match, no matter the outcome. This concept served as the basis for GGBET UA’s latest marketing campaign. The video series embodies a unique GG atmosphere: rather than using a conventional voiceover, it incorporates complete audio tracks; the narrative features both literal and metaphorical allusions to sports and esports terms, alongside in-game and casino aspects; and prominent Ukrainian footballers are among the main characters.

“Every game, every match, every tournament is a moment that brings people together. For us, it’s important that every interaction with GGBET gives users that good game feeling — an experience that outlives the result and leaves vivid emotions behind, just like after watching a match,” comments CEO of GGBET UA, Serhii Mishchenko.

Going beyond the traditional view of GG also signifies a more profound implication — the brand’s strategic focus. The international brand, which has concentrated on esports for several years and attained significant success in esports betting and collaborations, is now adopting best practices to enhance traditional sports in regional markets. GGBET UA showcases a wider strategy for Good Game via collaborations (FC Dynamo Kyiv, FC Polissya, and the Ukrainian Basketball Federation), by organizing its own events and special projects, including initiatives that blend sports with esports, like the Match of LeGGends: Derby showmatch on the server featuring esports athletes and football players.

The brand’s creative team collaborated with a Ukrainian advertising agency and a Ukrainian production company to develop the commercials. GGBET UA made this choice to assist the local creative sector amid the war.

The post GGBET UA kicks off the “Keep it GG” promotional campaign appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Amusnet6 days ago

Amusnet6 days agoWeek 7/2026 slot games releases

-

Aphrodite’s Kiss6 days ago

Aphrodite’s Kiss6 days agoLove on the Reels: Slotland Introduces “Aphrodite’s Kiss”

-

Brino Games6 days ago

Brino Games6 days agoQTech Games integrates more creative content from Brino Games

-

Baltics7 days ago

Baltics7 days agoEstonia to Reinstate 5.5% Online Gambling Tax From March 1

-

Denmark7 days ago

Denmark7 days agoRoyalCasino Partners with ScatterKings for Company’s Danish Launch

-

Booming Games7 days ago

Booming Games7 days agoTreasure Hunt Revival — Booming Games Launches Gold Gold Gold Hold and Win

-

Bet Rite7 days ago

Bet Rite7 days agoSpintec Expands into Canada with Bet Rite

-

ELA Games7 days ago

ELA Games7 days agoELA Games Unveils Tea Party of Fortune — A Magical Multiplier Experience