Blask Index

Saudi Arabia, Greece, and the Philippines Lead iGaming’s Rising Markets in 2025

Saudi Arabia, Greece, and the Philippines have emerged as the most significant rising markets of 2025, according to a comprehensive year-end analysis from the market intelligence ecosystem Blask.

The findings are based on the proprietary Blask Index, a real-time tracking tool that monitors player attention and search volumes across 107 countries. While established markets like the United Kingdom maintained the top spots, these three jurisdictions saw the most aggressive climbs in global rankings.

2025 Market Movers: The Biggest Climbers

The global iGaming landscape experienced a shift in 2025 as emerging interest in the Middle East and regulatory overhauls in Asia-Pacific redirected player attention.

| Market | Index Rank Change | 2025 Position | Key Growth Driver |

| Saudi Arabia | +9 Places | 20th | High youth demographics & digital adoption |

| Philippines | +4 Places | 12th | New PAGCOR B2B licensing framework |

| Greece | +4 Places | 17th | Robust online growth from operators like OPAP |

Saudi Arabia: The Surprise Performer

Saudi Arabia was the year’s most improved market, breaking into the Global Top 20 for the first time. Despite strict local prohibitions, the market saw a sharp uptick in interest driven by a young, mobile-first population (over 70% under age 35) and a massive shift toward digital entertainment under the Vision 2030 initiative. The growth reflects an “underground” surge in demand typically seen in restricted but hyper-connected markets.

Philippines: Regulatory Modernization

The Philippines climbed to 12th place, fueled by the PAGCOR (Philippine Amusement and Gaming Corporation) decision to formalize the iGaming supply chain. The introduction of the B2B Accreditation Framework in October 2025 forced game developers, aggregators, and payment providers to undergo formal probity checks, bringing the region in line with mature jurisdictions like the UK and Ontario.

Greece: Digital Transition

Greece’s ascent to 17th place was largely attributed to the performance of its largest operator, OPAP. The company reported double-digit growth in its iGaming and sports betting divisions throughout 2025, with online GGR surging nearly 20% in the first half of the year. This success underscores the Greek market’s successful transition from a retail-heavy model to a digital-first ecosystem.

“The global iGaming landscape is shifting faster than ever,” said Max Tesla, CEO and co-founder of Blask. “Operators that can spot emerging trends early, and understand what is actually driving interest on the ground, are far better positioned to capture new growth opportunities as they appear.”

The post Saudi Arabia, Greece, and the Philippines Lead iGaming’s Rising Markets in 2025 appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

AFCON 2025

AFCON’s month of football did not lift iGaming demand — Blask data analysis

AFCON 2025 ran from 21 December to 18 January, packing 52 matches across 19 matchdays. Given that schedule and the heavy interest in favourites such as Senegal, Morocco, Nigeria and Egypt, many expected a measurable boost in online gambling activity. However, Blask data shows the tournament produced only occasional deviations from normal patterns — even in the nations with teams that reached the final stages.

Key findings from Blask data

- No broad uplift: Overall iGaming demand did not climb consistently across markets during AFCON.

- Weekly rhythm dominated: The Blask Index largely followed pre-existing weekly patterns; matchday timings rarely overrode those cycles.

- Host-country anomaly: Morocco — with more viewer-friendly kick-offs (five of seven on Sundays or Friday evenings) — recorded the largest single day-to-day Blask Index move (26 December, Morocco vs Mali at 21:00 local).

- Vertical competition mattered: Live-match excitement often drew attention away from casino play rather than increasing it. Hourly Blask Index figures frequently fell or stayed flat during national-team matches.

- Market-share stability: Dominant brands (usually 1–4 operators) retained their daily shares; AFCON did not reshuffle leaders in most markets.

Why AFCON didn’t create a sustained iGaming spike

- Calendar beats event noise. Daily and weekly user habits — workweek rhythms, prime-time viewing slots and local schedules — remained the strongest determinants of iGaming demand.

- Attention is finite. While live betting benefits from matchday attention, casino verticals compete for the same user time. In practice, watching matches often reduced casino activity.

- Operator strategy limits volatility. In markets controlled by a few large operators, firms manage audience attention by shifting promotions across verticals rather than expanding overall demand. That keeps market shares relatively steady.

Notable exception: Nigeria’s operator flip-flop

Nigeria bucked the broader trend: two brands controlling 70%+ of audience attention exchanged top positions frequently. Bet9ja was the 2025 leader overall, but SportyBet overtook it on most AFCON days, including all Nigeria team matchdays — showing how high-profile tournaments can temporarily reorder leaderboards where competition is extremely concentrated.

What this means for operators and marketers

- Promotions should be tactical, not assuming scale. Expect matchday windows to deliver spikes in live-bet engagement but not necessarily a net rise across iGaming.

- Vertical-specific offers perform better. Tailor live-betting promos during matches and protect casino revenues with off-peak incentives.

- Local kick-off times matter. Host nations or markets with viewer-friendly schedules can see stronger short-term lifts — use that to time campaigns.

Conclusion

AFCON 2025 drew continent-wide interest, but Blask’s daily and hourly data indicate no broad, sustained iGaming uplift. Instead, the tournament rearranged attention — boosting live-bet engagement at times while leaving overall demand on its usual calendar-driven trajectory. For operators, the insight is clear: the calendar is king, and major sporting events tend to redistribute, not expand, iGaming activity.

The post AFCON’s month of football did not lift iGaming demand — Blask data analysis appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Blask Index

How Venezuela’s iGaming market is reacting to US pressure

Blask data indicates Venezuela’s iGaming demand remained stable in the initial days following the US operation in Caracas.

On 3 January, US forces detained Venezuelan president Nicolás Maduro, transporting him from Caracas to face prosecution in New York. The raid came after months of intensifying American pressure throughout 2025 — naval presence, targeted strikes, and a fresh sanctions package.

For Venezuela’s iGaming sector, the disruption poses a critical question: will demand collapse, or adapt?

First results

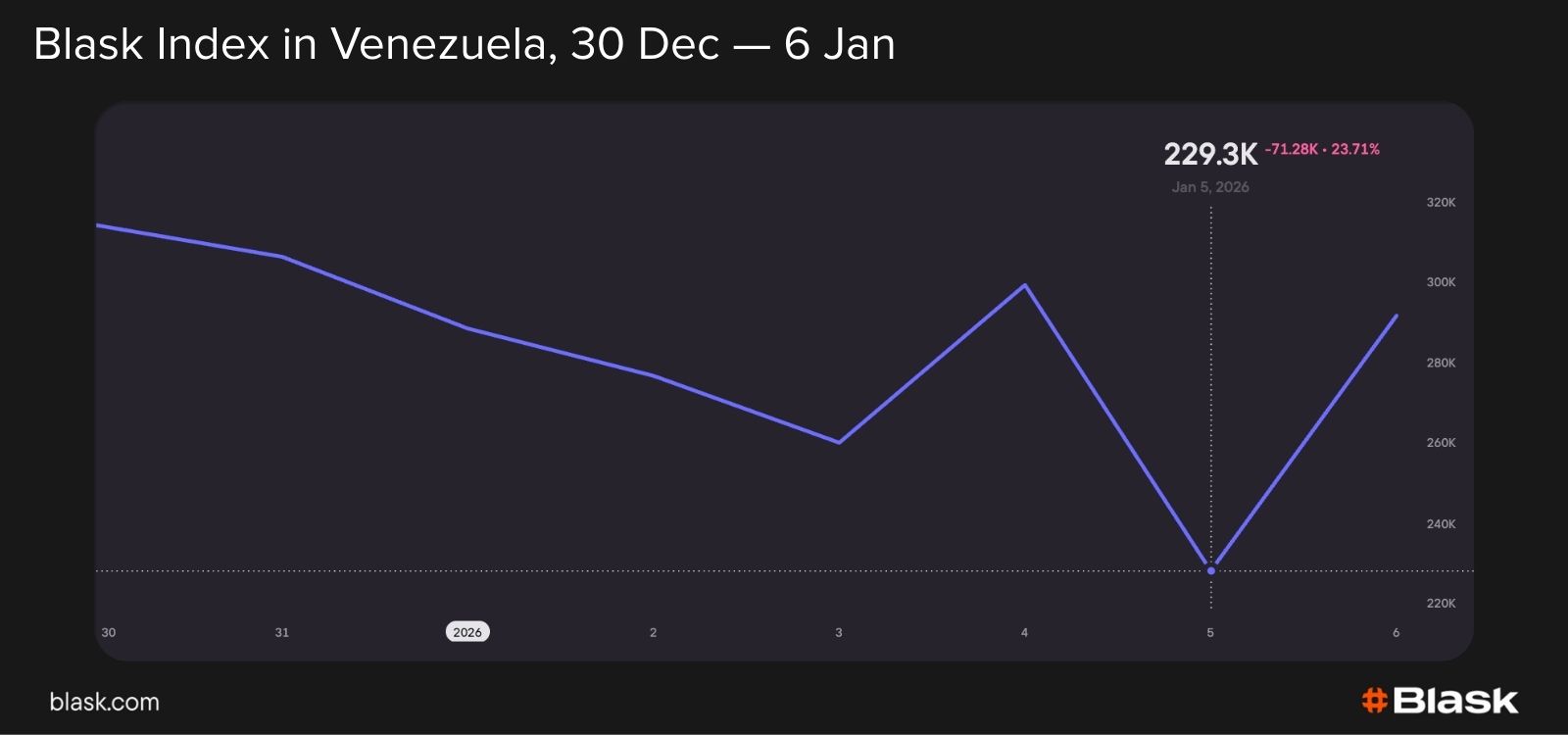

Blask’s daily Index remained within a tight corridor from 1–4 January, hovering in the high-200K zone. It dropped 5% to 257.4K on the day of the operation, before recovering the next day.

The data reveals no abrupt demand shift during this period. A slight decline sits within Venezuela’s normal daily fluctuations and does not point to a fundamental market change.

Rapid expansion, growing dominance

Venezuela stood out as one of iGaming’s strongest demand gainers in 2025. Blask Index surged 134.9% year-on-year — the second-highest growth worldwide.

This expansion came alongside increasing market dominance. By December, Triunfo Bet commanded 59% of Blask’s BAP (Brand Accumulated Power, measuring a brand’s portion of total user interest nationally), gaining 15 percentage points since January. The top three brands collectively reached over 85%, up 11 points.

The post How Venezuela’s iGaming market is reacting to US pressure appeared first on Americas iGaming & Sports Betting News.

-

BIG Cyber7 days ago

BIG Cyber7 days agoBMM INNOVATION GROUP TO SPONSOR AND EXHIBIT AT SBC RIO 2026 MARCH 3–5 AT RIOCENTRO, RIO DE JANEIRO

-

Latest News7 days ago

Latest News7 days agoCeuta refuerza su apuesta por el Juego en Interazar, la gran Feria española del Sector

-

AdmiralBet Serbia6 days ago

AdmiralBet Serbia6 days agoDigitain Enters into Multi-Vector Collaboration with AdmiralBet Serbia

-

Compliance Updates6 days ago

Compliance Updates6 days agoCrypto.com Receives Limited Financial Institutions Licence in Europe

-

Carlos Freitas6 days ago

Carlos Freitas6 days agoHölle Games Announces Strategic Partnership with Novibet

-

ELA Games4 days ago

ELA Games4 days ago“Patrick’s Treasure Pots”: Hunt for the Pot of Gold in ELA Games’ Celtic Adventure

-

Africa5 days ago

Africa5 days agoVeliGames Secures SiGMA Africa’s Industry Rising Star Award

-

Anders Svensson5 days ago

Anders Svensson5 days agoDBET Recruits Jonas Dahlquist, Kicks Off Fresh Football Podcast