Detroit casinos

Detroit Casinos Report $94.4M in January Revenue

The three Detroit casinos reported $94.4 million in monthly aggregate revenue (AGR) for the month of January 2024, of which $93.9 million was generated from table games and slots, and $500,221 from retail sports betting.

The January market shares were:

- MGM, 48%

- MotorCity, 30%

- Hollywood Casino at Greektown, 22%

Monthly Table Games, Slot Revenue, and Taxes

January 2024 table games and slot revenue decreased 9.1% when compared to January 2023 revenue. January’s monthly revenue was also 15.7% lower than December 2023. From Jan. 1 through Jan. 31, the Detroit casinos’ table games and slots revenue decreased by 9.1% compared to the same period last year.

The casinos’ monthly gaming revenue results were all lower compared to January 2023:

- MGM, down 11.3% to $44.6 million

- MotorCity, down by 10.4% to $27.1 million

- Hollywood Casino at Greektown, down by 2.9% to $22.2 million

In January 2024, the three Detroit casinos paid $7.6 million in gaming taxes to the State of Michigan. They paid $8.4 million for the same month last year. The casinos also reported submitting $11.2 million in wagering taxes and development agreement payments to the City of Detroit in January.

Monthly Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported $24.2 million in total retail sports betting handle, and total gross receipts were $520,988 for the month of January. Retail sports betting qualified adjusted gross receipts (QAGR) in January were up by $389,197 when compared to the same month last year. Compared to December 2023, January QAGR was down by $4.3 million.

January QAGR by casino was:

- MGM: $403,926

- MotorCity: $1.1 million

- Hollywood Casino at Greektown: negative ($1.0 million)

During January, the casinos paid $58,073 in gaming taxes to the state, compared to $4197 for the same period last year, and reported submitting $70,978 in wagering taxes to the City of Detroit based on their retail sports betting revenue.

Fantasy Contests

For December 2023, fantasy contest operators reported total adjusted revenues of $484,140 and paid taxes of $40,668.

From Jan. 1 through Dec. 31, 2023, fantasy contest operators reported $21.8 million in aggregate fantasy contest adjusted revenues and paid $1.8 million in taxes.

Detroit casinos

Michigan iGaming, Sports Betting Operators Report $399.8M in December Revenue, $3.8B Total for 2025

Michigan commercial and tribal operators reported a combined $399.8 million total internet gaming (iGaming) gross receipts and gross sports betting receipts in December. Gross receipts increased 19.1% compared to November.

Monthly Gross Receipts

December iGaming gross receipts totaled $315.8 million, the highest to date. The previous high was $278.5 million recorded in October 2025. December gross sports betting receipts totaled $84.0 million, which is a decrease from the $87.3 million recorded in November.

Monthly Adjusted Gross Receipts

Combined total iGaming and internet sports betting adjusted gross receipts (AGR) for December were $357.87 million, including $296.74 million from iGaming and $61.13 million from internet sports betting — representing an iGaming increase of 27.2% and a sports betting decrease of 5.6% when compared to November 2025. Compared to December 2024 reported revenues, iGaming AGR was up by 35.1% and sports betting was up by $60.9 million.

Monthly Handle

Total internet sports betting handle at $512.9 million was down by 18.7% from the $631.1 million handle recorded in November 2025.

Monthly State Taxes/Payments

The operators reported submitting $66.3 million in taxes and payments to the State of Michigan during December, of which:

• iGaming taxes and fees = $62.1 million

• Internet sports betting taxes and fees = $4.2 million

Monthly City of Detroit Taxes/Payments

The three Detroit casinos reported paying the City of Detroit $15.2 million in wagering taxes and municipal services fees during December, of which:

• iGaming taxes and fees = $13.8 million

• Internet sports betting taxes and fees = $1.4 million

Monthly Tribal Operators’ Payments

Tribal operators reported making $8.5 million in payments to governing bodies in December.

Annual Gross Receipts

In 2025, Michigan commercial and tribal operators reported a combined $3.8 billion total iGaming gross receipts and gross sports betting receipts — $3.1 billion from iGaming and $671.3 million from internet sports betting — a 29.5% increase over 2024.

Annual Adjusted Gross Receipts

In 2025, Michigan commercial and tribal operators reported a combined $3.3 billion total iGaming adjusted gross receipts and adjusted gross sports betting receipts — $2.9 billion from iGaming and $435.9 million from internet sports betting — a 39.5% increase over 2024.

Annual Handle

Total handle for 2025 was $5.4 billion.

Annual State Taxes/Payments

The operators paid $624.6 million in taxes and payments to the State of Michigan in 2025, of which:

• iGaming taxes and fees = $597.5 million

• Internet sports betting taxes and fees = $27.1 million

Annual City of Detroit Taxes/Payments

The three Detroit casinos reported paying the City of Detroit $161.4 million in wagering taxes and municipal services fees in 2025, of which:

• iGaming taxes and fees = $152.6 million

• Internet sports betting taxes and fees = $8.8 million

Annual Tribal Operators’ Payments

Tribal operators reported making $71.9 million in payments to governing bodies in 2025.

The post Michigan iGaming, Sports Betting Operators Report $399.8M in December Revenue, $3.8B Total for 2025 appeared first on Americas iGaming & Sports Betting News.

Detroit casinos

Detroit Casinos Report $105.1M in December Revenue, $1.2B for Year

The three Detroit casinos reported $105.1 million in monthly aggregate revenue (AGR) for the month of December 2025. Table games and slots generated $103.4 million and retail sports betting generated $1.7 million.

The December market shares were:

• MGM, 49%

• MotorCity, 29%

• Hollywood Casino at Greektown, 22%

Monthly Table Games, Slot Revenue, and Taxes

The casinos’ revenue for table games and slots for the month of December 2025 decreased 5.4% when compared to the same month last year. December’s monthly revenue was 2.9% lower when compared to the previous month, November 2025. From Jan. 1 through Dec. 31, the Detroit casinos’ table games and slots revenue decreased by 1.3% compared to the same period last year.

The casinos’ monthly gaming revenue results decreased compared to December 2024:

• MGM, down 1.0% to $50.7 million

• MotorCity, down 9.2% to $30.0 million

• Hollywood Casino at Greektown, down 9.5% to $22.7 million

In December 2025, the three Detroit casinos paid $8.4 million in gaming taxes to the State of Michigan. They paid $8.9 million for the same month last year. The casinos also reported submitting $12.8 million in wagering taxes and development agreement payments to the City of Detroit in December.

Quarterly Table Games, Slot Revenue, and Taxes

For the fourth quarter of 2025 that ended Dec. 31, aggregate revenue was down for all three Detroit casinos by 1.1% compared to the same period last year. Quarterly gaming revenue numbers for the casinos were:

• MGM: $154.1 million

• MotorCity: $91.9 million

• Hollywood Casino at Greektown: $69.8 million

Compared to the fourth quarter of 2024, MGM was up by 2.8%, and MotorCity and Hollywood Casino were down by 6.0% and 2.7%, respectively. The three casinos paid $25.6 million in gaming taxes to the state in the fourth quarter of 2025, compared to $25.9 million in the same quarter last year.

Monthly Retail Sports Betting Revenue and Taxes

The three Detroit casinos reported $12.23 million in total retail sports betting handle, and total gross receipts of $1.8 million for the month of December. Retail sports betting qualified adjusted gross receipts (QAGR) were up by $1.4 million in December when compared to December 2024, and up by 0.7% when compared to November 2025.

December QAGR by casino was:

MGM: $372,771

MotorCity: $747,568

Hollywood Casino at Greektown: $599,224

During December, the casinos paid $64,999 in gaming taxes to the state and reported submitting $79,444 in wagering taxes to the City of Detroit based on their retail sports betting revenue.

Annual Revenue for Table Games, Slots, and Retail Sports Betting

The total yearly aggregate revenue of $1.28 billion by the three Detroit casinos for slots, table games, and retail sports betting was generated by:

• Slots: $1.02 billion (79.5%)

• Table games: $247.8 million (19.4%)

• Retail sports betting: $14.2 million (1.1%)

The casinos’ market shares for the year were:

• MGM, 48%

• MotorCity, 30%

• Hollywood Casino at Greektown, 22%

Compared to 2024, slots and table games yearly gaming revenue for the three casinos were as follows:

• MGM, up by 0.3% to $605.3 million

• MotorCity, down by 2.5% to $376.1 million

• Hollywood Casino at Greektown, down by 3.1% to $283.9 million

Aggregate retail sports betting qualified adjusted gross receipts (QAGR) for 2025 was up by 45.9% to $14.2 million compared to last year, with MGM totaling $3.0 million, MotorCity totaling $6.8 million, and Hollywood Casino at Greektown totaling $4.4 million.

In 2025, the three Detroit casinos paid the state $102.5 million in wagering taxes for slots and table games, and $535,323 in wagering taxes for retail sports betting. In 2024, they had paid $103.9 million and $372,729 for each, respectively.

Fantasy Contests

For November, fantasy contest operators reported total adjusted revenues of $1.16 million and paid taxes of $97,032.

From Jan. 1 through Nov. 30, fantasy contest operators reported $8.9 million in aggregate fantasy contest adjusted revenues and paid $744,022 in taxes.

The post Detroit Casinos Report $105.1M in December Revenue, $1.2B for Year appeared first on Americas iGaming & Sports Betting News.

Detroit casinos

Detroit Casinos Report $101M in June Revenue

The three Detroit casinos—MGM Grand Detroit, MotorCity Casino, and Hollywood Casino at Greektown—collectively generated $101.04 million in revenue for June 2025.

Table games and slot machines accounted for $100.38 million of the monthly total, while retail sports betting contributed $665,435.

June 2025 Market Share:

• MGM Grand Detroit: 48%

• MotorCity Casino: 31%

• Hollywood Casino at Greektown: 21%

Table Games and Slot Machine Revenue

Revenue from table games and slots decreased by 4.0% compared with June 2024 and dropped 11% from May 2025. For the first half of 2025 (January 1 – June 30), combined table games and slots revenue was down 0.8% year-over-year.

Casino-specific revenues compared to June 2024 were:

• MGM Grand Detroit: $48.43 million, down 0.6%

• MotorCity Casino: $30.63 million, down 2.7%

• Hollywood Casino at Greektown: $21.32 million, down 12.5%

The three casinos paid $8.1 million in state gaming taxes in June 2025, down from $8.5 million in June 2024. They also submitted $11.9 million in wagering taxes and development agreement payments to the City of Detroit.

Retail Sports Betting Revenue

In June 2025, the casinos reported a combined retail sports betting handle of $7.2 million, generating $666,374 in gross receipts. Qualified adjusted gross receipts (QAGR) from retail sports betting fell 25.1% from June 2024 and 48.1% from May 2025.

QAGR by casino:

• MGM Grand Detroit: $275,397

• MotorCity Casino: $242,069

• Hollywood Casino at Greektown: $147,969

The casinos paid $25,153 in state taxes from retail sports betting revenue and submitted $30,743 in wagering taxes to the City of Detroit.

Fantasy Contests

Fantasy contest operators reported $716,927 in adjusted revenues for May 2025 and paid $60,222 in taxes.

The post Detroit Casinos Report $101M in June Revenue appeared first on Gaming and Gambling Industry in the Americas.

-

Latest News6 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Games Global6 days ago

Games Global6 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Amusnet6 days ago

Amusnet6 days agoWeek 4/2026 slot games releases

-

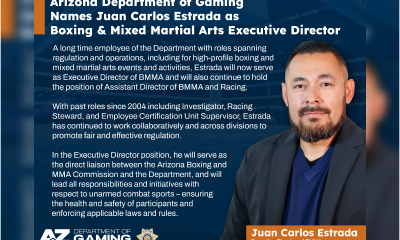

ADG7 days ago

ADG7 days agoArizona Department of Gaming Names Juan Carlos Estrada as Boxing and Mixed Martial Arts Executive Director

-

Battle Royale7 days ago

Battle Royale7 days agoPrime Rush Goes Live in Early Access, Bringing a Brazil-First Mobile Battle Royale to Players

-

AFCON 20257 days ago

AFCON 20257 days agoAFCON’s month of football did not lift iGaming demand — Blask data analysis

-

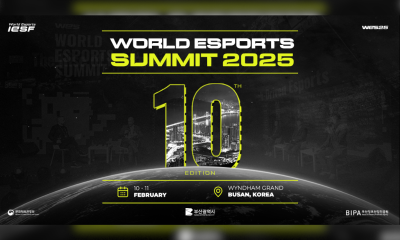

Asia6 days ago

Asia6 days agoWorld Esports Summit Celebrates Its 10th Edition in Busan

-

affiliate marketing6 days ago

affiliate marketing6 days agoN1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona