Latest News

Sportradar Reports Strong Growth and Increased Profitability and Cash Flow

Sportradar Group AG, the leading global technology company enabling next generation engagement in sports and provider of business-to-business solutions to the global sports betting industry, today announced financial results for its third quarter ended September 30, 2022.

Third Quarter 2022 Highlights

- Revenue in the third quarter of 2022 increased 31% to €178.8 million ($175.2 million)1 compared with the third quarter of 2021. 2022 year-to-date revenue grew 28% compared to the same nine months in 2021.

- The RoW Betting segment, accounting for 56% of total revenue, grew 28% to €100.9 million ($98.9 million)1, driven by strong performance from our Managed Betting Services (MBS).

- U.S. segment revenue grew 61% to €31.6 million ($31.0 million)1 compared to the third quarter of 2021, driven by strong market growth and positive adoption of in-play betting. The U.S. segment turned profitable for the first time since the Company’s initial public offering and generated a positive Adjusted EBITDA margin of 11%.

- The Company’s Adjusted EBITDA2 in the third quarter of 2022 increased 75% to €36.5 million ($35.8 million)1 compared with the third quarter of 2021 as a result of strong revenue growth even with continuous investments in the Company’s growing business.

- Adjusted EBITDA margin2 was 20% in the third quarter of 2022, an increase of 500 bps compared to the quarter for the prior year period and 400 bps higher compared to the second quarter of 2022.

- Adjusted Free Cash Flow2 in the third quarter of 2022 increased to €33.9 million, compared to €32.9 million for the prior year period. The resulting Cash Flow Conversion2 was 93% in the quarter.

- During the quarter, the Company prepaid €200.0 million of its outstanding debt. As of September 30, 2022, total debt was €236.9 million, and cash and cash equivalents totaled €512.5 million.

- The Company has raised its guidance for revenue and the lower end of its Adjusted EBITDA2 range for the full year 2022.

| Key Financial Measures | Q3 | Q3 | Change | |

| In millions, in Euros | 2022 | 2021 | % | |

| Revenue | 178.8 | 136.8 | 31% | |

| Adjusted EBITDA2 | 36.5 | 20.9 | 75% | |

| Adjusted EBITDA margin2 | 20% | 15% | – | |

| Adjusted Free Cash Flow2 | 33.9 | 32.9 | 3% | |

| Cash Flow Conversion2 | 93% | 158% | – |

1 For the convenience of the reader, we have translated Euros amounts at the noon buying rate of the Federal Reserve Bank on September 30, 2022, which was €1.00 to $0.98.

2 Non-IFRS financial measure; see “Non-IFRS Financial Measures and Operating Metrics” and accompanying tables for further explanations and reconciliations of non-IFRS measures to IFRS measures.

Carsten Koerl, Chief Executive Officer of Sportradar said: “Our strong performance in the third quarter exceeded our expectations across all key financial metrics. We consistently managed to grow revenue, profitability and cash flows despite adverse market conditions during the first three quarters of 2022. The Company exceeds expectations quarter-in and quarter-out, and as a result of our operational performance – in particular the U.S. and the betting rest-of-world business – as well as our organizational streamlining, we are able to raise our full year guidance for revenue and increase the lower end of our Adjusted EBITDA range.”

“We are proud of the continuous success of our U.S. operations. We managed to generate a U.S. profit for the first time in the third quarter, displaying solid operational leverage in the business model. Underpinning this success is the extension of our long-term partnership with FanDuel. This partnership is a testimony for our strategy, to expand our relationships and become an embedded technology provider for our customers, based on strategic long-term deals with our league partners.”

Ulrich Harmuth, Interim Chief Financial Officer added: “The financial results in the third quarter demonstrated that Sportradar consistently has managed to grow almost three times faster than the underlying betting market and our growing scale has led to margin expansion – as indicated by the U.S. segment turning profitable in the third quarter. As a result of this strong momentum and based on what we can see today, our 2023 preliminary expectations are for revenue to grow in the mid-20’s percent while expanding Adjusted EBITDA margin above 2022 levels.

Segment Information

RoW Betting

- Segment revenue in the third quarter of 2022 increased by 28% to €100.9 million compared with the third quarter of 2021. This growth was driven primarily by increased sales of our higher value-add offerings including Managed Betting Services (MBS), which increased 84% to €38.2 million, and Live Odds Services, which increased 12% to €27.1 million. MBS growth was attributable to a record annualized turnover3 of €19.0 billion and the success of our strategy to move existing customers to higher value add products.

- Segment Adjusted EBITDA2 in the third quarter of 2022 increased 8% to €48.2 million compared with the third quarter of 2021. Segment Adjusted EBITDA margin2 decreased to 48% from 57% in the third quarter of 2021 driven by inorganic investments into AI capabilities for our MBS business, expanding our sport rights portfolio, as well as temporary cost savings in sport rights and scouting from the prior year due to the COVID-19 pandemic.

RoW Audiovisual (AV)

- Segment revenue in the third quarter of 2022 increased by 14% to €33.1 million compared with the third quarter of 2021. Growth was driven by cross-selling audiovisual content to existing data customers and expanding AV portfolio sales with existing AV customers.

- Segment Adjusted EBITDA2 in the third quarter of 2022 increased 32% to €12.6 million compared with the third quarter of 2021. Segment Adjusted EBITDA margin2 increased to 38% from 33% compared with the third quarter of 2021 as a result of AV revenue growth.

United States

- Segment revenue in the third quarter of 2022 increased by 61% to €31.6 million compared with the third quarter of 2021. This growth was driven by a strong increase of U.S. betting services, driven by cross-selling non-data products to betting operators as well as benefiting from our customers’ growth as a result of a development in the underlying market and new states legalizing betting.

- Segment Adjusted EBITDA2 in the third quarter of 2022 was €3.4 million compared with a loss of (€6.6) million in the third quarter of 2021, primarily driven by enhanced operating leverage as a result of the growing scale of our business despite continuous investments in the U.S. segment’s products and content portfolio. Segment Adjusted EBITDA margin2 improved to 11% from (34%) compared with the third quarter of 2021.

2 Non-IFRS financial measure; see “Non-IFRS Financial Measures and Operating Metrics” and accompanying tables for further explanations and reconciliations of non-IFRS measures to IFRS measures.

3 Turnover is the total amount of stakes placed and accepted in betting.

Costs and Expenses

- Purchased services and licenses in the third quarter of 2022 increased by €18.1 million to €47.5 million compared with the third quarter of 2021, reflecting continuous investments in content creation and processing, higher event coverage and higher scouting costs. Of the total, approximately €13.7 million was expensed sports rights.

- Personnel expenses in the third quarter of 2022 increased by €16.9 million to €68.3 million, an increase of 33% compared with the third quarter of 2021. Adjusted for inorganic hires, personnel cost grew 27% compared to the third quarter in 2021.

- Other Operating expenses in the third quarter of 2022 decreased by €4.9 million to €20.3 million, as a result of our efforts to increase the effectiveness of our central services and due to one-time costs resulting from our initial public offering in September 2021.

- Total sport rights costs in the third quarter of 2022 increased by €5.9 million to €34.6 million compared with the third quarter of 2021, primarily a result of costs associated with new acquired rights in 2022 for the ITF, UEFA and ATP.

Recent Business/Company Highlights

- Sportradar and FanDuel sign long-term agreement for Official NBA data through the 2030-31 season. Providing FanDuel with a comprehensive portfolio of betting products and entertainment tools, Sportradar remains the preferred data and odds supplier to FanDuel through 2031. Using official NBA data, Sportradar and FanDuel will collaborate to enhance the sports betting experience with new offerings such as certain player tracking data to create props and same game parlays. Additionally, FanDuel will use Sportradar’s proprietary Live Channel Trading (LCT) product.

- Sportradar reaffirms leadership position in cricket market with partnerships with Australian Premier Cricket competitions. Sportradar announced the renewal of partnership agreements with the top tier club cricket competitions in Tasmania, Queensland, and Western Australia. Currently, Sportradar is partners with every single state and territory cricket governing body in Australia. Extensions with these clubs enable Sportradar to remain the official streaming partner until mid-2025

- Sportradar and International Golf Federation enter integrity partnership. Sportradar’s Integrity Services (SIS) unit signed a multi-year integrity partnership with the International Golf Federation (IGF). Under the terms of the initial two-year agreement, SIS will provide bet monitoring through its Universal Fraud Detection System (UFDS) for several IGF competitions. Sportradar Integrity Services have detected more than 7,300 suspicious matches during the past 17 years, with over 600 taking place in 2022 alone.

- Tennis Data Innovations and Sportradar team up to expand official tennis data distribution. The partnership sees the launch of a “new secondary feed,” to enable the provision of betting-related services based on official ATP Tour and ATP Challenger Tour scores to a suite of global bookmakers. Of significance, the partnership sees the ATP change its data framework, allowing bookmakers to have uninterrupted access to official data, as scores to date have been delivered directly from the umpire’s chair.

- Sportradar continues to evolve its organizational structure to set it up for continued success in achieving its strategic goals around growth, organizational effectiveness and efficiency. The Company is optimizing its organization by appointing global leaders for content creation, product development and commercial excellence – with the U.S. retaining a dedicated go-to-market approach. With this new structure, the Company will become faster in decision-making and execution, and will be more effective and efficient in serving global customers with a growing global product portfolio. The net effect will also be to significantly reduce the number of direct reports to the CEO.

Annual Financial Outlook

Sportradar has updated its outlook for revenue and Adjusted EBITDA for fiscal 2022 as follows:

- Sportradar has raised its revenue outlook for fiscal 2022 to a range of €718.0 million to €723.0 million ($703.6 million to $708.5 million)1, from its previous range of €695.0 million to €715.0 million representing prospective growth of 28% to 29% over fiscal 2021.

- Outlook for Adjusted EBITDA2 is narrowed to a range of €124.0 million to €127.0 million ($121.5 million to $124.5 million)1 from the previous range of €123.0 million to €133.0 million, representing 22% to 24% growth versus last year.

- Adjusted EBITDA margin2 is expected to be in the range of 17% to 18%.4

Powered by WPeMatico

casino operator growth

Groove Shines at ICE Barcelona 2026 as the Go-To Growth Partner for iGaming Operators

Groove, the award-winning iGaming platform and aggregator, has emerged from ICE Barcelona 2026 as the definitive growth partner for ambitious operators in 2026.

The event marked a milestone for the brand, generating high-value partnerships and demonstrating strong market demand for an integrated, scalable, and commercially strategic platform.

Over the three-day summit, Groove positioned itself at the heart of strategic conversations with operators and providers seeking solutions for sustainable growth, market diversification, and deeper player engagement. With an unprecedented volume of meetings, a clear trend emerged: operators are moving beyond basic content access, seeking a collaborative, technology-driven partner to navigate global expansion.

“The energy and focus at ICE 2026 validated our core why: aggregation has evolved into a strategic growth discipline,” said Yahale Meltzer, Co-Founder and COO of Groove.

“Operators aren’t coming to us just for games—they are looking for a roadmap. They want a partner who can provide content, technology frameworks, and commercial tools, like Instant Tournaments, as a seamless growth engine. In a fragmented market, Groove’s integrated approach is not just an advantage—it’s a necessity for serious operators in 2026.”

Groove’s Strategic Edge: Global Content and Localized Growth

Groove’s unique ability to act as a single conduit for global content and localized strategy was a central theme at ICE. The platform’s agility enables operators to thrive in established regulated markets while tapping into high-potential verticals such as Sweepstakes and Crypto gaming. This differentiation empowers operators to diversify portfolios, increase revenue, and streamline operational efficiency.

“We engaged with operators who have concrete 2026 plans, from new entries in Latin America to strategic European expansions,” explained Giusy Campo, Business Development Director at Groove.

“My role is to translate platform capabilities into commercial velocity. At ICE, we moved decisively from concept to pipeline execution. The market recognizes Groove as a partner that delivers with precision.”

Partnerships and Collaboration: Driving Innovation

Groove strengthened its global network by connecting with game studios and exploring exclusive content and technical collaborations designed to deliver innovative gaming experiences faster.

“ICE is ultimately about partnership in its truest sense,” said Rachel Tourgeman, Head of Partnerships at Groove.

“The quality of dialogue with existing and potential partners was exceptional, covering hyper-localized game curation, tournament tools, and strategies for player retention. Groove’s model of acting as an extension of our partners’ teams—providing tools and strategic insight—is exactly what the market needs now.”

Looking Ahead: Defining Growth for 2026

Groove exits ICE Barcelona 2026 not merely as a platform provider, but as the go-to growth partner for the iGaming industry. With a fortified pipeline, strategic market mandate, and a focus on turning aggregation into accelerated growth, Groove is set to define the iGaming landscape in 2026, helping operators expand globally and engage players meaningfully.

For more information, visit groovetech.com.

The post Groove Shines at ICE Barcelona 2026 as the Go-To Growth Partner for iGaming Operators appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

betting app engagement

Inside NFL Stadiums: How Fans Are Driving Record Sports Betting Engagement During Live Games

During the latest NFL season, one of the most valuable arenas for sports betting engagement wasn’t online or at home—it was inside the stadium itself. Using insights from GeoComply Edge Stadium Data, analysts examined how fans interacted with betting apps while attending live NFL games, revealing a powerful convergence of fandom, technology, and real-time wagering.

Stadium Data, analysts examined how fans interacted with betting apps while attending live NFL games, revealing a powerful convergence of fandom, technology, and real-time wagering.

From the season opener at Lincoln Financial Field in Philadelphia to the final Wildcard Weekend matchup at Acrisure Stadium in Pittsburgh on January 12, GeoComply analyzed in-stadium activity across every NFL venue located in US states with legal sports betting. The findings provide a clear, data-driven picture of how live attendance influences digital betting behavior.

The result is a uniquely detailed view into in-stadium engagement, customer acquisition, and long-term bettor value, offering operators critical insight into where and when fans are most likely to engage.

GeoComply Edge Stadium Data: Visibility Others Don’t Have

GeoComply Edge is purpose-built to measure fan acquisition and betting engagement within precise stadium-level geofences. This advanced location intelligence allows sportsbooks and operators to identify which teams, games, and venues generate the strongest engagement, turning live events into actionable growth opportunities.

Rather than tracking generic app usage, GeoComply Edge delivers insights into:

- Which NFL games drive the highest in-stadium betting activity

- How frequently fans check betting apps during live action

- Where new sportsbook accounts are created inside stadiums

- How engagement varies by venue, team performance, and market maturity

This season-long data view highlights how in-person fandom directly translates into digital wagering behavior, offering a deeper understanding of the customer journey.

Growth Leaders: Stadiums Where Betting Engagement Is Accelerating

Five NFL stadiums stood out for year-over-year growth in geolocation checks and active betting accounts—two strong indicators of in-stadium betting engagement.

In many cases, increased engagement closely followed on-field success. Teams such as the Denver Broncos, Pittsburgh Steelers, New England Patriots, and Carolina Panthers returned to playoff contention after turnaround seasons, reigniting fan excitement and digital interaction.

The Las Vegas Raiders emerged as a notable outlier. Allegiant Stadium continues to function as a destination venue, attracting traveling fans from across the country and creating a uniquely strong in-stadium betting environment, independent of team performance.

Engagement Rate Leaders: Quality Over Volume

While total geolocation volume remains important, the most telling metric this season was engagement rate—the percentage of fans inside the stadium actively using betting apps during games.

Top-performing venues recorded 10% to 13% engagement, meaning nearly one in every eight fans accessed a sports betting app at least once while attending a live NFL game. This highlights the growing normalization of in-game wagering as part of the live sports experience.

New User Acquisition: Stadiums as Sportsbook Growth Engines

One of the most compelling insights from GeoComply Edge data is the consistent creation of brand-new betting customers inside NFL stadiums.

Leading venues generated new sportsbook sign-ups at rates between 0.2% and 0.7% of total attendance per game. For a typical 65,000-seat stadium, that translates to 130 to 450 new accounts per game.

GEHA Field, home of the Kansas City Chiefs, led all venues in new customer creation, benefiting from Missouri’s launch of mobile sports betting on December 1, 2025, during the Chiefs’ final three home games.

Reducing Friction with Compliant Onboarding

GeoComply supports operators at every stage of the customer journey. Through IDComply®, the company enables a fully compliant KYC process that delivers 95%+ onboarding success rates, while GeoComply Edge pinpoints where and when these high-value acquisition moments occur.

This dual approach allows sportsbooks to engage fans in a way that is timely, targeted, and non-intrusive, enhancing both compliance and customer experience.

Doing More With “Where” at Live Sporting Events

NFL stadiums have evolved into digital engagement hubs, where live entertainment, mobile technology, and sports betting intersect in real time.

GeoComply Edge Stadium Data brings clarity to this intersection by providing:

- Actionable insights into in-stadium betting behavior

- Clear visibility into acquisition and engagement trends

- A season-long perspective beyond single-game analysis

As the NFL continues to grow and fan experiences become increasingly digital, one conclusion is unmistakable: the future of sports betting is already unfolding inside the stadium.

The post Inside NFL Stadiums: How Fans Are Driving Record Sports Betting Engagement During Live Games appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

betting brand marketing

Esportes da Sorte Secures Major Sponsorship for FIFA World Cup 2026 Broadcasts on SBT and N Sports

Leading Brazilian iGaming brand Esportes da Sorte has announced a high-profile sponsorship agreement for the FIFA World Cup 2026 broadcasts on SBT and N Sports, reinforcing its presence during one of the most influential sporting events in the world.

The partnership includes extensive brand activations throughout the entire tournament, spanning television, streaming, and digital media.

The sponsorship package delivers wide national exposure through SBT’s free-to-air broadcasts, simulcast coverage, the +SBT streaming platform, and the N Sports pay-TV channel. In addition to traditional broadcast placements, Esportes da Sorte will activate across the broadcasters’ digital ecosystems, including official websites, YouTube channels, and other owned digital platforms.

According to Marcela Campos, Vice President of the Esportes Gaming Brasil Group, which owns the Esportes da Sorte brand, the initiative strategically aligns the company with one of the largest moments of audience engagement in global sport. The FIFA World Cup represents a unique opportunity to amplify brand recall, increase engagement frequency, and strengthen emotional connections with football fans.

“The World Cup is a global event that concentrates attention, conversation, and excitement on an unparalleled scale. In Brazil, it represents one of the most powerful moments of sports audience mobilisation. Maintaining a consistent and high-frequency presence on SBT’s broadcasts allows us to expand our brand positioning and deepen Esportes da Sorte’s connection with the football fan experience,” Campos explained.

On television, Esportes da Sorte will feature prominently through promotional spots, opening and closing idents, commercial break placements, and video inserts. The agreement also includes sponsorship of a dedicated FIFA World Cup 2026 programme, airing throughout the competition, alongside integrated editorial content within the broadcasters’ schedules.

Digitally, the brand will be embedded within the official World Cup broadcasts on SBT and N Sports, while also appearing in additional content initiatives produced by both channels. This multi-platform strategy ensures comprehensive coverage of the tournament, maximising visibility and engagement across broadcast and online audiences.

With this partnership, Esportes da Sorte further cements its position as a major player in Brazil’s regulated iGaming market, leveraging the cultural power of football and the global reach of the FIFA World Cup to strengthen brand equity and long-term consumer affinity.

The post Esportes da Sorte Secures Major Sponsorship for FIFA World Cup 2026 Broadcasts on SBT and N Sports appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Games Global7 days ago

Games Global7 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Latest News6 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Amusnet6 days ago

Amusnet6 days agoWeek 4/2026 slot games releases

-

Asia7 days ago

Asia7 days agoWorld Esports Summit Celebrates Its 10th Edition in Busan

-

affiliate marketing6 days ago

affiliate marketing6 days agoN1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

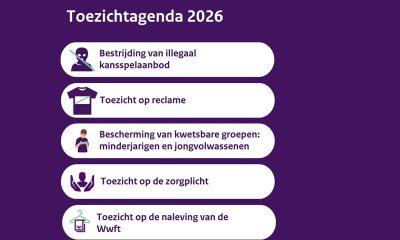

Compliance Updates7 days ago

Compliance Updates7 days agoDutch Regulator Outlines 5 Key Supervisory Priorities for 2026 Agenda

-

BetPlay3 days ago

BetPlay3 days agoBlask Awards 2025: Betano, Caliente, BetPlay, Betsson and others define Latin America’s iGaming landscape

-

AI gaming platforms6 days ago

AI gaming platforms6 days agoBetConstruct AI Sets the Tone for 2026 iGaming with Harmony Choice Event in Barcelona