Central Europe

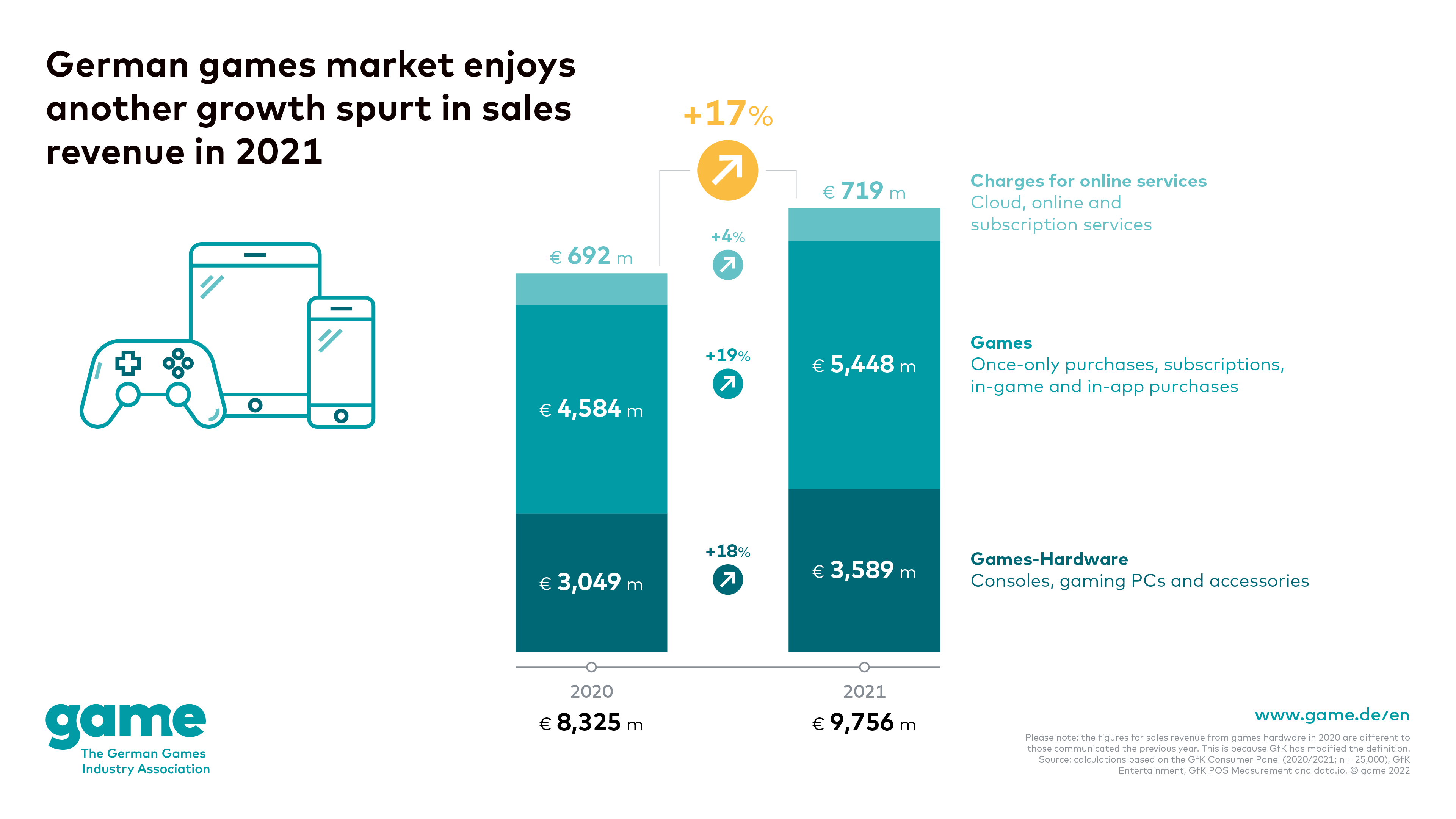

German games market grows by 17 per cent in 2021

The German games market has followed up its historic growth spurt in 2020 with yet another year of significant growth: in 2021, approx-imately 9.8 billion euros in revenues were generated from games, charges for online services and games hardware. This is an increase of 17 per cent com-pared to the previous year. Already in 2020, the German games market was able to grow by 32 per cent, which was due in part to the growth in new video game players that resulted from the Covid-19 pandemic. These are the numbers released today by game – the German Games Industry Association, based on data collected by the market research companies GfK and data.ai. The demand for games hardware, particularly for games consoles (+23 per cent) and acces-sories for gaming PCs (+22 per cent), as well as in-game and in-app purchases (+30 per cent), was the biggest driver of growth.

According to Felix Falk, Managing Director of game: ‘Following the historic growth spurt in 2020, the German games market continued its strong perfor-mance with significant growth in 2021. This also demonstrates that the people who first took up playing during the lockdowns are still enjoying it. We are partic-ularly delighted by the strong growth in games hardware. No matter whether they are using games consoles or gaming PCs, Germany’s video game players once again invested considerable sums in their equipment to ensure that they would be able to continue enjoying their games in the best possible quality in future. In fact, demand in some cases exceeded supply, meaning that it would have been possible to increase sales revenue by even more.’

Games, games hardware and charges for online services: all three market segments posted growth once again

Sales revenue from purchases of computer and video games grew by 19 per cent to about 5.4 billion euros. So-called in-game and in-app purchases were once again the biggest driver of growth here, with sales revenue increasing by 30 per cent overall to about 4.2 billion euros. This is happening in response to a sustained trend towards free-to-play games, as well as a general increase in the length of time that individual titles are being supported with the frequent addition of new free and charged content. Sales revenue from the once-only purchase of games, on the other hand, fell significantly, by 9 per cent to about 1.1 billion eu-ros. Sales revenue through monthly subscription charges for individual games – a model that is common among online role-playing games – also fell, by 11 per cent to 145 million euros.

Sales revenue from games hardware grew by 18 per cent overall to about 3.6 billion euros. Games consoles are in particular demand: although retailers were often sold out of some models, sales revenue still managed to increase by 23 per cent to 808 million euros. Approximately 1 billion euros were generated from sales of gaming PCs – both desktops and laptops. This is an increase of 10 per cent compared to the previous year. More and more video game players are also investing in accessories to make their experience even better. Demand for graphic cards, keyboards, mice, monitors and VR headsets for gaming is espe-cially strong. Sales revenue from purchases of gaming PC accessories grew by 22 per cent to about 1.5 billion euros. Sales revenue from games console ac-cessories increased by 11 per cent to 306 million euros.

Following a huge 50 per cent leap in growth in 2020, sales revenue generated by online gaming services rose by an additional 4 per cent to 720 million euros in 2021. Gaming subscription services such as the Xbox Game Pass, EA Play and Ubisoft+ made a key contribution to this growth, with their sales revenue increas-ing by 22 per cent to 220 million euros. Cloud gaming services, on the other hand, experienced a decline of 13 per cent to 63 million euros. One of the rea-sons for this is the fact that some cloud gaming functions have been integrated into other services free of charge, meaning that no independent sales revenues are generated for these functions. Sales revenue from online gaming services also fell, by 2 million euros to 437 million euros. These are frequently offered for various games consoles and include – depending on the specific offer – free monthly games, games discounts, the ability to play online, or even cloud stor-age for saved games.

Powered by WPeMatico

Central Europe

Poland to Classify Gambling Streaming as Serious Crime

The Polish Parliament is considering a landmark draft law to curb harmful digital content, specifically targeting the phenomenon known as “patostreaming.”

Patostreaming is recognised as a new term to categorise criminal offences related to the broadcasting of online violence, abuse and sexually degrading content.

The proposed legislation would criminalize the broadcasting of violence, abuse, and sexually degrading material. Additionally, the bill seeks to outlaw the promotion of online gambling by social media influencers. By amending the Penal Code, supporters aim to bridge the legal gap between digital behaviour and offline criminal acts, ensuring online offenders face the same accountability as those in the physical world.

The bill carries the backing of ministers of Poland’s new Civic Coalition (KO) government, formed in late 2025 by the union of the Citizens Platform (PO), Modern (Nowoczesna) and the Polish Initiative (iPL).

Supporters call for clearer enforcement powers to treat the online broadcasting of serious criminal acts as a punishable offence, aligning digital conduct with crimes already sanctioned offline.

If adopted, the legislation would introduce prison sentences ranging from three months to five years for individuals who publicly share real or staged content depicting serious criminal acts via online platforms.

The same penalty range would also apply to influencers found to be illegally promoting online gambling activity that remains heavily restricted under Poland’s state-controlled gambling regime.

KO ministers have framed the initiative as part of a broader effort to strengthen online protections for Polish youth, citing rising exposure to violent digital content and illegal gambling promotions across social media platforms.

The post Poland to Classify Gambling Streaming as Serious Crime appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Casino-Groups

Sebastian Jarosch Becomes Head of AI at Casinos Groups

Sebastian Jarosch is no longer solely the founder and managing director of Casino Groups as he is also taking on the role of Head of AI, at least on an interim basis. This personnel decision marks a conscious step towards closer integration of corporate management and technological responsibility.

In future, Jarosch will not only be responsible for the strategic direction of the company, but also for the further development of the AI systems that already form a central part of the product landscape. Casino Groups is one of the best-known platforms, which has been using and continuously developing an AI-supported rating system for online casinos for some time.

The decision to anchor the role of Head of AI directly at management level was a conscious one. Artificial intelligence now influences almost all areas of the affiliate business, from content structures and data analysis to regulatory documentation and product logic. Such a development requires decisions that bring together economic objectives, technological possibilities and legal frameworks.

Sebastian Jarosch brings this perspective from years of experience in the iGaming sector. As an entrepreneur, he is familiar with economic dependencies as well as the challenges of increasing regulation. The additional responsibility in the AI area makes it possible to set technological courses more quickly, define priorities more clearly and establish innovation as an integral part of corporate management.

The new role of Head of AI fits in perfectly with current developments in the iGaming market. Increasing regulatory requirements, rising acquisition and content costs, and the growing influence of AI-powered search systems are changing the economic fundamentals of the affiliate business. Visibility is no longer achieved solely through reach, but through authority, consistency and verifiable quality.

With this appointment, Casino Groups is sending a clear signal to the outside world. Affiliate companies are increasingly being valued like media or technology companies. Partners and investors are placing greater emphasis on compliance, data competence and sustainable product development. The bundling of management and AI responsibility strengthens the company’s credibility in these areas.

At the same time, Casinos Groups is positioning itself as a player that does not delegate innovation, but actively drives it forward. The interim nature of the role creates space for further development and adaptation without diluting the strategic ambition. For the industry as a whole, this step underlines that AI expertise has arrived at the management level.

The role of Head of AI forms the organisational foundation for this development. It ensures that technological innovation, editorial standards and economic objectives are interlinked. Casino Groups is thus pursuing a clear line: technology as a tool, people as an authority and quality as a connecting element.

The post Sebastian Jarosch Becomes Head of AI at Casinos Groups appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Birgit Wimmer

Birgit Wimmer Named Chairwoman as NOVOMATIC AG Reshapes Supervisory Board

“As Chairwoman of the Supervisory Board, I look forward to working together with my colleagues on both the Supervisory Board and the Executive Board as we help to successfully shape the Group’s strategic and sustainable development,” says Birgit Wimmer.

Dr. Haig Asenbauer, an internationally experienced lawyer with particular expertise in cross-border M&A transactions, company reorganization, and complex investment structures, was elected to serve as Deputy Chairman. Martina Flitsch retains her position as a Member of the Supervisory Board. She has many years of experience in international group structures and in providing strategic and legal support for corporate investments. Dr. Robert Hofians, a recognized finance and capital markets expert who also has extensive experience in the fields of governance and regulation in his roles as a professor and public accountant, also remains a Member of the Supervisory Board.

As of January 1, 2026, the Supervisory Board of NOVOMATIC AG is now composed as follows:

- Birgit Wimmer, MSc., MBA (Chairwoman)

- Dr. Haig Asenbauer (Deputy Chairman)

- Martina Flitsch (Member)

- Dr. Robert Hofians (Member)

The post Birgit Wimmer Named Chairwoman as NOVOMATIC AG Reshapes Supervisory Board appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Compliance Updates7 days ago

Compliance Updates7 days agoFinland Govt Looks at Whether Scratchcards can be Gifted Again

-

Claire Osborne Managing Director of Interactive at Inspired Entertainment5 days ago

Claire Osborne Managing Director of Interactive at Inspired Entertainment5 days agoTwo new slots from Inspired — Coin Inferno Step ‘N’ Stack™ and Mummy It Up™

-

Latest News5 days ago

Latest News5 days agoACR POKER GIVES PLAYERS A SHOT TO QUALIFY ONLINE FOR $700,000 GTD ENJOY POKER SERIES MAIN EVENT THIS FEBRUARY IN URUGUAY

-

Canada6 days ago

Canada6 days agoHigh Roller Technologies Signs Letter of Intent with Kindbridge Behavioral Health to Support Responsible Gambling in Ontario

-

Amusnet4 days ago

Amusnet4 days agoWeek 5/2026 slot games releases

-

Compliance Updates7 days ago

Compliance Updates7 days agoVNLOK Report: Over 95% of Gambling Ads on Meta Platforms are from Illegal Providers

-

David Nilsen Editor-in-Chief at Kongebonus7 days ago

David Nilsen Editor-in-Chief at Kongebonus7 days agoKongebonus Awards 2025 Winners Announced

-

Compliance Updates4 days ago

Compliance Updates4 days agoNational Council on Problem Gambling Adopts 1-800-MY-RESET as New National Problem Gambling Helpline Number