Latest News

How to Choose an iGaming Offer: N1 Partners x RichAds Share Their Expertise

What does it really take to pick the right iGaming offer for promotion? With so many variables to consider, it’s easy to make mistakes, especially for affiliates just starting out.

To help clarify things, N1 Partners and the RichAds ad network joined forces to share practical advice on choosing profitable offers and avoiding common pitfalls.

The conversation took place during the N1 Puzzle Promo — a competition where affiliates, both seasoned and new, experiment with different traffic sources, tools, brands, and GEOs to achieve one main goal: maximize profits from their traffic. And selecting the right offer is the first step toward success.

Meet the Experts

Before diving into the tips, here are the people sharing their insights:

Daria Maichuk Affiliate Manager at N1 Partners |

Veronika Ponomareva Head of Customer Service at RichAds |

What is RichAds?

RichAds is an ad network offering a wide range of traffic sources, including:

- Telegram ads

- Push notifications

- Popunders

- Domain redirects

- Native ads

- Display traffic

Prices start at just $0.005 CPC for push ads and $0.5 CPM for popunders, with access to traffic across 200+ GEOs from Tier 3 to Tier 1.

How to Choose an iGaming Offer: Expert Advice

We asked Daria and Veronika the most important questions affiliates have when evaluating iGaming offers.

1. What parameters of an iGaming offer should be analyzed first before launching?

Daria Maichuk

“Start with the GEO: is gambling legal, how competitive is the market, and how solvent is the audience? Then check the payment model (CPA, RevShare, Hybrid) and the funnel: registration flow, minimum deposit, and site usability. The product matters too — top providers, live casino, sports, esports, localization, and bonuses. Finally, look at retention: how long players stay active and what campaigns keep them engaged.”

Veronika Ponomareva

“First of all, it’s the payout conditions, brand and its reputation on the market, as well as the funnel flow and the content of pre-landing/landing pages to pay attention to. Many things can affect a campaign’s result such as verification before the first deposit, the lack of locally popular payment methods support and the first deposit amount.”

2. How can a beginner determine the potential of an offer? Which metrics should they focus on to avoid wasting budget?

Daria Maichuk

“Key metrics are Conversion Rate (CR), Earnings Per Click (EPC), and Click-Through Rate (CTR). A low CTR usually means the offer doesn’t match the audience or creatives. Test multiple landers — welcome pages and reg forms typically perform best. Also consider First Time Deposits (FTD) and retention, as they reflect the long-term potential of an offer.”

Veronika Ponomareva

“Cost per registration, cost per conversion and ROI — are basic yet the most crucial things to look at. Potential means the long-lasting profit, so pay attention to the LTV (Lifetime Value). An offer could have a moderate EPC, but if the player retention is high and brings many secondary deposits, then the LTV would be extremely high accordingly. Ask your manager about the LTV of the offer in the required geo.”

3. How does a brand’s license affect the choice of GEO and traffic?

Daria Maichuk

“White licenses allow affiliates to work in regulated markets and run campaigns on official ad channels like Google Ads, FB, and TikTok. Grey licenses are also usable, but platforms often restrict or ban them, so affiliates need strong moderation skills.”

Veronika Ponomareva

“The licensing topic is highly important due to the fact that it determines the legality of traffic and what sources are acessible. Strict licenses (MGA, UKGC) approve only the cleanest traffic (mostly PPC and SEO). The traffic is very expensive, but provides quality leads. Curacao license gives more freedom as you can work with push-traffic, teasers and popunders. High risks come with no license at all as well as the accessible traffic sources are very limited.”

4. Which three GEOs currently deliver the highest ROI in iGaming, and why?

Daria Maichuk

“Germany: high purchasing power, stable LTV and retention, large deposits, strong conversion.

Canada: fast-growing, high trust in licensed brands, boosting CR and retention.

Australia: players spend more, stay active longer, and convert well into deposits.”

Veronika Ponomareva

“Depends on the traffic source we’re looking at, for example, if it’s either push or pop, then Bangladesh, Brazil and South Africa are currently on top.”

5. How can you understand whether an offer fits your main traffic source (FB, PPC, push, etc.) before testing?

Daria Maichuk

“Beginners often test blindly, but it’s possible to know in advance. FB and Google are the most widespread sources. Google traffic is highly engaged because players search for the product themselves. Facebook is harder for retention, but we work actively to improve it, especially for this audience, where push campaigns are essential. Push/Pop works for most offers, though CR is lower. If an offer has working apps (ASO), it can also be promoted through stores.”

Veronika Ponomareva

“Facebook and Google Ads are following strict guidelines on accessible content regarding iGaming offers, so it’s a common headache for marketers to test offers there and co-exist with moderation rules. Push and pop traffic doesn’t apply so many demands to the advertising content, so they’re way more preferrable for promotion means. So are Telegram Mini Apps, by the way, since they feature more tolerant moderation by advertising networks and fresh relevant audience.”

6. Top 3 traffic sources for iGaming in 2025?

Daria Maichuk

“Google: high-intent users, precise targeting.

Facebook: huge reach, flexible creative testing.

SEO: long-term stability, independent of traffic costs, especially effective for RevShare.”

Veronika Ponomareva

“Telegram Mini Apps: fresh audience, broad opportunities for advertising formats and extremely relevant users who come from casual games and tap-to-earn clickers.

Push-notifications: proven traffic source with high CTR and pre-made user bases that provide easier outreach to converting players.

Popunders: high CR and cost-effective means for promotion, since quality landing pages are usually enough to convert impulsive gamblers.”

7. Do your affiliates drive traffic through Telegram and what are the specifics? What do you think about mini-app traffic?

Daria Maichuk

“Yes, we’ve seen such cases, but most affiliates still prefer other sources. Data is still limited, but we’re closely monitoring Telegram and mini-app traffic and see strong potential here.”

Veronika Ponomareva

“For us it’s a channel that we actively explore, since introducing Telegram Mini App ads showed us how much of a potential they hold straight away. First of all, TMAs themselves offer a global coverage and outreach to a variety of potential leads for the iGaming products, coming from all over games and applications. In fact, since the moderation policies there are independent from the official Telegram Ads platform, that gives additional interest to this traffic.”

8. How many FTDs are needed to objectively evaluate an iGaming offer?

Daria Maichuk

“PPC: 20–30 FTD.

Facebook (slots): 20–30 FTD.

Facebook (crash games): at least 100 FTD.

In-app: around 100 FTD.”

Veronika Ponomareva

“At least 30 FtD, but to evaluate the offer properly it’s best to look into the player activity in the long run, the average amount of the deposits and other in-depth metrics.”

9. Which KPIs do you recommend for testing: ROI, FTD, deposit, or retention?

Daria Maichuk

“We often use soft KPIs. On average, we expect the avg dep count to be >=2. Sometimes we also track the ratio of total deposits to partner payout.”

Veronika Ponomareva

“It’s a complex matter as hitting the KPIs is usually the result of a combination of factors getting along.”

10. What should affiliates do if an offer “drops” after two weeks — switch or optimize?

Daria Maichuk

“If results were good initially, optimize creatives and targeting. If not, check whether the creatives included slots actually available in the product. Our managers always provide updated slot and targeting recommendations.”

Veronika Ponomareva

“Optimize the campaign, examine the metrics, check the creatives, change landing pages – try to find the correlation to this in the traffic performance.”

11. Which statistical indicators show that an offer can be scaled?

Daria Maichuk

“The main sign is stable positive ROI over several days or weeks. Also look at the funnel (click → registration → deposit) and player retention.”

Veronika Ponomareva

“Simply, a more or less stable ROI is the main indicator here.”

12. How to scale an offer within one source without lowering CR?

Daria Maichuk

“Increase budgets gradually — 10–20% every 1–2 days. Scale your best-performing bundles first. Always refresh creatives: without new content, audiences burn out and CR declines.”

Veronika Ponomareva

“The same level scaling is the key. If by creatives, then create new combinations of creatives and landing pages. If by the audience — gradually add more newcomer oriented targetings, instead of increasing the bids on the current ones. Just test everything by degrees.”

Conclusion

The N1 Puzzle Promo highlighted not only the competitive spirit among affiliates but also the importance of knowing how to pick the right iGaming offers. From choosing GEOs and traffic sources to tracking KPIs and scaling campaigns, the advice from N1 Partners and RichAds gives affiliates a clear roadmap to better results.

RichAds continues to support the iGaming community with its self-serve platform, offering access to 220+ GEOs and multiple traffic types from push and popunders to Telegram Mini Apps and native ads.

Launch smarter campaigns, work with the right offers, and grow your iGaming profits!

The post How to Choose an iGaming Offer: N1 Partners x RichAds Share Their Expertise appeared first on European Gaming Industry News.

BetConstruct AI

BetConstruct AI Set to Transform the African iGaming Frontier at SiGMA Africa 2026

BetConstruct AI is proud to announce its participation in SiGMA Africa 2026, demonstrating its commitment to technological innovation and operator empowerment across the rapidly growing African iGaming market.

Visitors to Stand N 062 will experience BetConstruct AI’s full suite of AI-driven solutions, designed to optimize player engagement, automate operations, and deliver high-performance platforms tailored to Africa’s diverse regulatory and market requirements.

AI-Powered Platform Solutions

The showcase features BetConstruct AI’s industry-leading Sportsbook and Casino Platforms, engineered to handle high-volume traffic while maintaining stability and scalability for the continent’s expanding player base.

In addition to core betting infrastructure, BetConstruct AI provides tools for operator autonomy and efficiency:

-

CMS Pro – A centralized content management hub streamlining business operations.

-

SpringBuilder X – A mobile-first, SEO-driven drag-and-drop website builder with AI-assisted optimization for speed and simplicity.

-

BetChain AI – Revolutionary AI-assisted design for iGaming websites, enabling partners to build and manage digital identities quickly and efficiently.

BetConstruct AI Suite: Enhancing Operator Performance

-

CRM AI – Advanced behavioral analytics to boost player retention and loyalty.

-

Umbrella AI – Real-time risk management and automated player protection.

-

AI Game Recommendation System – Personalized content delivery to increase engagement across demographics.

-

Betting Mate – AI companion providing real-time stats and insights to enhance the player experience.

The Choice to Grow Program

Operators can participate in “The Choice to Grow”, a performance-based initiative offering a 51% invoice discount every third month for achieving a 16.67% GGR increase per quarter across products including Sportsbook, Virtual Sports, and partner brands such as PopOK Gaming and CreedRoomz. Premium service benefits are included.

Harmony Dinner: Networking & Collaboration

On March 4, BetConstruct AI will host the Harmony Dinner at Cabo Beach, Cape Town, an exclusive event fostering collaboration among industry leaders, operators, and visionaries to discuss the future of gaming and shared growth opportunities.

Visit Stand N 062

BetConstruct AI invites industry stakeholders, operators, and media to explore its AI-driven ecosystem, demonstrating how connected technology enables operational efficiency, innovation, and market leadership in Africa.

The post BetConstruct AI Set to Transform the African iGaming Frontier at SiGMA Africa 2026 appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

B2Tech

B2Tech to Present at SiGMA Africa 2026 in Cape Town, Showcasing Its Integrated Betting Ecosystem

B2Tech will present at SiGMA Africa 2026, highlighting its omni-channel platform technology and continued growth across regulated African jurisdictions. The company’s participation underscores its focus on delivering a unified framework connecting core platform infrastructure, operator brands, marketing services, and embedded payments.

SiGMA Africa brings together iGaming and digital entertainment stakeholders, including licensed operators, affiliates, regulators, investors, and suppliers. With African regulation evolving rapidly, the summit will explore compliance, licensing, market entry strategies, and financial solutions.

Integrated Platform Solutions

B2Tech designs best-in-class sportsbook and casino platform technology, optimized for mobile-first deployment and regulated markets. The platform includes:

-

Localization features: multi-currency support and compliance aligned with market-by-market obligations

-

Operational tools: risk management, performance analytics, and regulatory adherence

-

Scalable infrastructure: supporting efficient and consistent operations across multiple jurisdictions

B2Tech powers numerous licensed sportsbook and iGaming operations across Africa, combining global technology standards with local operational expertise. The company enables operators to adapt to evolving regulations while maintaining scalable, high-performance systems.

YellowBet: Pan-African Sportsbook & iGaming Brand

Within the B2Tech ecosystem, YellowBet operates as a pan-African sportsbook and iGaming brand powered by B2Tech’s proprietary platform. Centralized control ensures performance, reporting, and regulatory compliance at a group level, while maintaining market-specific flexibility to provide tailored betting experiences. Learn more: yellowbet.com

Africa Bet Partners: Structured Affiliate Program

The Africa Bet Partners program supports affiliate acquisition across regulated African markets with defined commission models, reporting transparency, and localized promotional alignment. This enables affiliates to access regulated markets in a controlled and compliant manner. More info: africabetpartners.com

PayAlo: Embedded Payments Infrastructure

Integrated payments are delivered via PayAlo, embedded in B2Tech’s platform and compatible with API integrations for third-party platforms. PayAlo supports deposits and withdrawals across jurisdictions while ensuring compliance, synchronized reporting, and unified transaction monitoring.

SiGMA Africa 2026 Presence

At Booth 73, attendees can meet B2Tech’s leadership team to discuss platform architecture, market expansion, and ecosystem development, and learn how a centralized, integrated platform model supports regulatory compliance and sustainable operations.

About B2Tech

B2Tech is a technology provider specializing in sportsbook and casino platform solutions for regulated African markets. B2Tech empowers licensed operators with scalable, compliant technology, enabling growth across multiple markets under a single unified management system.

Contact

Norman Itumo Nthiwa

B2Tech Communications

[email protected]

The post B2Tech to Present at SiGMA Africa 2026 in Cape Town, Showcasing Its Integrated Betting Ecosystem appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Atlaslive

Atlaslive Shortlisted in Five Categories at GamingTECH CEE Awards 2026

Atlaslive, a leading B2B iGaming platform provider, has been shortlisted in five categories at the GamingTECH CEE Awards 2026. The awards are part of the HIPTHER Prague Summit, scheduled for March 24–25, 2026, in Prague, Czech Republic.

The company has been nominated in the following categories:

-

Best Online Casino Provider in CEE

-

Online Casino Innovator of the Year (CEE)

-

Best iGaming Platform Provider (PAM) in CEE

-

Best Live Casino Provider in CEE

-

Best Sports Betting Provider in CEE

These nominations highlight Atlaslive’s presence across platform infrastructure, live casino solutions, sportsbook operations, and product development.

Anastasiia Poltavets, CMO at Atlaslive, said:

“This recognition across five categories reflects the breadth of our platform. We focus on building infrastructure that performs under scale, supports multi-vertical growth, and adapts to evolving regulatory standards. Being shortlisted in both casino and sportsbook categories confirms that our approach delivers measurable impact across the full iGaming ecosystem.”

The GamingTECH CEE Awards spotlight innovation, operational performance, and leadership within the Central and Eastern European gaming and technology sector, recognizing companies contributing to platform development and service quality across regulated markets. Online voting is now open, and industry peers can cast their vote via the official GamingTECH CEE Awards page. Winners will be revealed during the awards ceremony at the HIPTHER Prague Summit in March.

Atlaslive continues to develop scalable, performance-focused iGaming infrastructure for operators across regulated markets.

About Atlaslive

Atlaslive is an iGaming platform provider delivering a dynamic platform for live operations and regulated growth. Casino, Sportsbook, and unified All-in-One solutions are available via White Label, Turnkey, and API integration models, enabling operators to launch faster, scale confidently, and retain full control over their business and growth strategy.

The post Atlaslive Shortlisted in Five Categories at GamingTECH CEE Awards 2026 appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Latest News7 days ago

Latest News7 days agoGGBET UA hosts Media Game – an open FC Dynamo Kyiv training session with journalists from sports publications

-

Latest News7 days ago

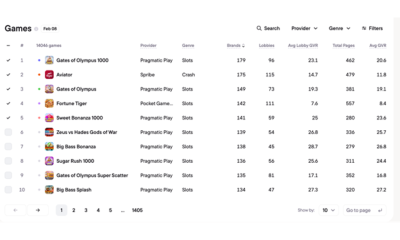

Latest News7 days agoSlots dominate Brazil’s casino catalog, but crash games capture outsized player demand,Blask data reveals

-

Latest News7 days ago

Latest News7 days agoBagelmania Backroom Comedy night lineup announced for Thursday, Feb. 26

-

Baltics4 days ago

Baltics4 days agoHIPTHER Baltics Launches in Vilnius with Agenda Revealing Lithuania’s 2026 Regulatory Reset

-

Amusnet4 days ago

Amusnet4 days agoAmusnet Enters into Strategic Partnership with Twinsbet Arena in Vilnius, Lithuania

-

AI-Powered Compliance and Player Support4 days ago

AI-Powered Compliance and Player Support4 days agoDigerCompanion — Digicode’s AI Solution for Compliance and Player Support in Regulated iGaming

-

Brazil4 days ago

Brazil4 days agoOctoplay Enters Brazilian Market Through a Strategic Partnership with Superbet

-

iGaming7 days ago

iGaming7 days agoN1 Insights: The iGaming Trends Everyone Will Be Talking About This March