Industry News

Games Global Announces Launch of IPO

Games Global Limited (“Games Global”), a leading developer, distributor and marketer of innovative online, casino-style gaming (“iGaming”) content and integrated business-to-business solutions to iGaming operators, announced today that it has launched the roadshow for its initial public offering (“IPO”) of 14,500,000 ordinary shares. The offering consists of 6,000,000 ordinary shares offered by Games Global and 8,500,000 ordinary shares to be sold by Games Global’s existing shareholder (the “Selling Shareholder”). Games Global will not receive any proceeds from the sale of the shares by the Selling Shareholder. The underwriters will have a 30-day option to purchase up to an additional 2,175,000 ordinary shares from the Selling Shareholder at the IPO price, less underwriting discounts and commissions. The IPO price is currently expected to be between $16.00 and $19.00 per share. Games Global has applied to list its ordinary shares on the New York Stock Exchange under the symbol “GGL”.

J.P. Morgan, Jefferies and Macquarie Capital are acting as joint lead book-running managers for the proposed offering. Barclays and BTIG are acting as book-running managers for the proposed offering.

The proposed offering will be made only by means of a prospectus. Copies of the preliminary prospectus relating to the proposed offering, when available, may be obtained from:

- J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, or by email at [email protected] or [email protected];

- Jefferies LLC, Attention: Equity Syndicate Prospectus Department, 520 Madison Avenue, New York, NY 10022, by phone at (877) 821-7388, or by email at [email protected]; or

- Macquarie Capital (USA) Inc., Attention: Equity Syndicate Department, 125 West 55th Street, New York, NY 10019, or by email at [email protected]

A registration statement relating to these securities has been filed with the U.S. Securities and Exchange Commission but has not yet become effective. These securities may not be sold, nor may offers to buy be accepted, prior to the time the registration statement becomes effective. This press release does not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

In any member state of the European Economic Area (the “EEA”) this announcement, and the offering, are only addressed to and directed at persons who are “qualified investors” (“Qualified Investors”) within the meaning of Regulation (EU) 2017/1129 (the “Prospectus Regulation”). In the United Kingdom, this announcement, and the offering, are only addressed to and directed at persons who are “qualified investors” within the meaning of the Prospectus Regulation as it forms part of domestic law in the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 who (i) have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”), (ii) are high net worth entities who fall within Article 49(2)(a) to (d) of the Order, or (iii) are persons to whom it may otherwise lawfully be communicated (all such persons being referred to as “relevant persons”).

This announcement must not be acted on or relied on (i) in the United Kingdom, by persons who are not relevant persons, and (ii) in any member state of the EEA, by persons who are not Qualified Investors. Any investment or investment activity to which this announcement relates is available only to and will only be engaged with (i) in the United Kingdom, relevant persons, and (ii) in any member state of the EEA, Qualified Investors.

The post Games Global Announces Launch of IPO appeared first on European Gaming Industry News.

BetBlocker

New Turkish-language tool from BetBlocker extends service to 90 million additional people

Gambling harm prevention charity BetBlocker today reveals the extension of their award-winning assistance into Turkish.

In 2025, BetBlocker saw a tremendous increase in support, with more than three hundred thousand individual users initiating a block throughout the year. This significant level of engagement has been made possible by the diverse array of languages into which the charity has translated its assistance.

Yesilay, the main Turkish support service, reports that requests for help with gambling are now surpassing those for alcohol, drugs, or tobacco, alongside significant uptake and harm among youth, making the launch of Turkish language support timely and relevant.

Founder and Trustee for BetBlocker, Duncan Garvie, offered these comments: “BetBlocker is genuinely excited to roll out our second language expansion of 2026.

We’ve experienced phenomenal uptake of the service over the last 12 months and figures hare steadily rising. One of the biggest drivers of that growth has been improving the accessibility of our support by meeting users where they are and offering support in the language that they’re most comfortable accessing in.

Alongside Turkey itself, there are substantial Turkish speaking communities across Europe, the Middle East and North America. It is our hope that this evolution of BetBlocker will ensure that a deeper level of support is available more widely across the Turkish diaspora.

BetBlocker would like to offer our deepest thanks to Fatmatuz Zehra Pehlivan, a Clinical Psychologist and researcher, who volunteers Green Cresent in the field of addiction treatment. Fatmatuz volunteered her time to help translate our app, and every Turkish language user we support owe her their thanks for the donation of her time and expertise.

As with many of the communities BetBlocker now supports, we would not be able to reach so many people without the kindness and generosity of field experts like Fatmatuz.”

The post New Turkish-language tool from BetBlocker extends service to 90 million additional people appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Anastasia Rimskaya Chief Account Officer at Aviatrix

Aviatrix Launches New Loot Boxes to Deepen Progression and Reward Paths

Aviatrix has launched a new Loot Box feature for its premier crash game, presenting collectible rewards, free bets, and progression bonuses aimed at boosting long-term player engagement.

Loot Boxes are granted through a daily rewards mechanism, with players obtaining them according to their in-game actions and advancement. Every box holds a variety of rewards, such as aircraft skins, complimentary bets, and aviation experience points.

The feature enhances Aviatrix’s developing loyalty system, providing players with fresh options to personalize their aircraft and earn rewards through continuous engagement.

Anastasia Rimskaya, Chief Account Officer at Aviatrix, said: “Loot Boxes are part of our wider vision for Aviatrix as a connected multi-game universe. As we expand our iGaming Metaverse, features like Loot Boxes add another meaningful layer to how players build their profile, customise their aircraft and earn rewards across the ecosystem.”

Unveiled in February, the Aviatrix iGaming Metaverse signifies the supplier’s shift from a standalone crash game to an integrated multi-title ecosystem.

Starting with the imminent debut of Aviatrix Second Chance and continuing with upcoming titles like Aviatrix Fruits and Aviatrix Mines, every game will utilize a single integrated player profile, progression system, and rewards and achievements framework.

The post Aviatrix Launches New Loot Boxes to Deepen Progression and Reward Paths appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Alec Gehlot Chief Executive Officer at PlaySignal

PlaySignal Debuts: Alec Gehlot’s New Sophisticated Responsible Gaming Platform

Alec Gehlot, previous senior executive at Optimove, has introduced PlaySignal, a responsible gaming platform aimed at assisting operators in identifying and addressing player risk promptly.

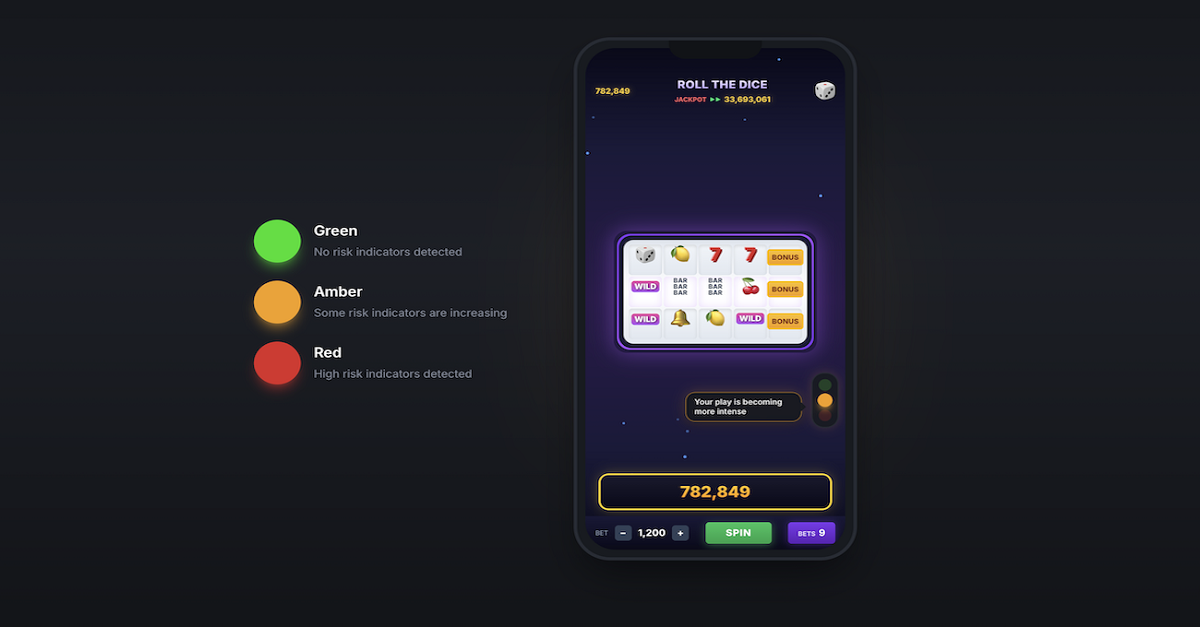

PlaySignal employs a traffic-light system featuring green, amber, and red signals to steer player conduct and indicate when behaviors start to enter higher-risk areas. The platform seeks to minimize avoidable exclusions by offering operators enhanced visibility of rising risks, while simultaneously giving players more understanding of how their actions are evaluated.

Leveraging behavioural analytics, PlaySignal tracks player actions during gameplay and displays information as distinct signals. This allows teams to act earlier and react more appropriately as risk evolves.

The product connects with current operator systems to assist responsible gaming, CRM, and compliance teams by providing a unified view of activities, encouraging a more uniform strategy among teams as regulatory demands grow in important markets.

Building on his time at Optimove, where he collaborated with operators on segmentation, retention, and user engagement, Gehlot recognized a demand for innovative tools to enhance player protection as regulatory and tax pressures mount in regulated markets.

The company launched PlaySignal at ICE earlier this year, where it was a contender in the Innovators Challenge, and initiated talks with operators in various markets. The initial launch will concentrate on the UK prior to global expansion.

Alec Gehlot, Chief Executive Officer at PlaySignal, said: “Regulation and taxation are only moving in one direction, and operators need new tools to adapt. Player protection can no longer be treated as a compliance obligation; it has to become a competitive differentiator.

“Regulated operators are under real pressure, particularly in the UK, and we believe giving them earlier visibility of risk is essential not just for protection, but for long-term sustainability.”

The post PlaySignal Debuts: Alec Gehlot’s New Sophisticated Responsible Gaming Platform appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Baltics5 days ago

Baltics5 days agoHIPTHER Baltics Launches in Vilnius with Agenda Revealing Lithuania’s 2026 Regulatory Reset

-

AI-Powered Compliance and Player Support5 days ago

AI-Powered Compliance and Player Support5 days agoDigerCompanion — Digicode’s AI Solution for Compliance and Player Support in Regulated iGaming

-

Amusnet5 days ago

Amusnet5 days agoAmusnet Enters into Strategic Partnership with Twinsbet Arena in Vilnius, Lithuania

-

Andrew Cardno5 days ago

Andrew Cardno5 days agoQCI Launches its Data Community Platform in Australia

-

Brazil5 days ago

Brazil5 days agoOctoplay Enters Brazilian Market Through a Strategic Partnership with Superbet

-

Free spins5 days ago

Free spins5 days agoOnlyPlay Releases Pub Fruits

-

Latest News5 days ago

Latest News5 days agoSpinomenal Debuts Magical Genie — 3×3 Hold & Hit Adventure

-

Latest News5 days ago

Latest News5 days agoWhen Everyone Sends Hearts, WinSpirit Asked a Different Question