Latest News

The MGA publishes its 2022 Annual Report and Financial Statements

The Malta Gaming Authority (MGA/Authority) is publishing its Annual Report and audited Financial Statements for the financial year ending 31 December 2022. In addition to outlining the performance of the Maltese gaming business in 2022, the report gives a broad summary of the Authority’s accomplishments during the year under review and offers a medium-term outlook for the future. A thorough report outlining key statistics for the land-based and online gaming industries is then presented.

Supervisory Activities

- 28 compliance audits were conducted and 228 desktop reviews were carried out during 2022, accompanied by additional AML/CFT compliance examinations that are carried out by the FIAU, or by the MGA on its behalf. Following information which emerged from compliance audits, compliance reviews and formal investigations, the Authority issued 10 warnings and cancelled six (6) licences. In addition, the MGA issued a total of 16 administrative penalties as well as three (3) regulatory settlements, with a collective total financial penalty of €179,150.

- A total of 25 licensees were subject to remediation and/or administrative measures by the FIAU, ranging from written reprimands to administrative penalties, based on the breaches identified during examinations carried out in previous years, including by the MGA. In total, these amounted to just over €738,000.

- Six (6) individuals and companies were deemed by the Fit & Proper Committee to not be up to the Authority’s probity standards due to various factors, including due to the risks of money laundering or funding of terrorism.

- Forty-one (41) gaming licence applications were received during 2022. Thirty-one (31) licences were issued, while twenty-one (21) were unsuccessful.

- Over 1,500 criminal probity screening checks were undertaken on individuals, shareholders and ultimate beneficial owners, key persons and other employees, and companies from both the land-based and online gaming sectors.

- The Authority conducted 48 interviews with prospective MLROs and key persons carrying out the AML/CFT function to determine the knowledge and suitability of each candidate.

- The Commercial Communication Committee of the MGA issued a total of nine (9) Letters of Breach following breaches of the Commercial Communications Regulations (S.L. 583.09).

- In its efforts to protect players and encourage responsible gambling, the Authority supported a total of 5,280 players who requested assistance, covering most of the cases received during 2022 and the spill-over from 2021.

- The MGA conducted 85 responsible gaming-themed website checks, through which 38 URLs were found to have misleading information. This led to 17 notices being published on the MGA website, and 30 observation letters that were sent out reflecting responsible gaming issues.

Improvements in Efficiency and Effectiveness

- The Authority commissioned a sectorial skills strategy to address the gaming industry’s challenges with respect to the ongoing demand for qualified and skilled human capital, which increased significantly as the economy grew and diversified into numerous sectors.

- Consultation exercises were conducted with industry stakeholders regarding the bets offered by licensees – with a focus on sports integrity and player protection considerations – on the proposed amendments to the Player Protection Directive (Directive 2 of 2018), and on the proposed policy on the use of Innovative Technology Arrangements (ITAs) and the acceptance of Virtual Financial Assets (VFAs) and Virtual Tokens, which led to amendments and a finalised Policy, respectively.

- The Authority streamlined the approval process of appointing an MLRO in collaboration with the FIAU while, at the same time, ensuring that the industry is kept updated on any changes affecting this process and on any best practices that are intrinsic to the role of the MLRO.

- The concept of Agreed-Upon Procedures (AUPs) Reports was introduced, covering player funds and Gaming Revenue. Audit firms are drawing up these reports in compliance with the ‘International Standard on Related Services (ISRS) 4400 (Revised) Agreed-Upon Procedures Engagements’.

- The MGA kickstarted a process for possibly implementing a voluntary Environmental, Social and Governance (ESG) Code of Good Practice for the industry to showcase and increase the positive social and environmental impacts of the gambling sector.

National and International Cooperation

- Throughout 2022, the Authority issued 43 news items on its website and 26 external communications, providing a synopsis of various updates and developments at the Authority and across the industry.

- A total of 224 alerts were sent to the industry, 167 of which were also sent to the appropriate Sports Governing Bodies.

- A total of 44 requests for information specifically relating to the manipulation of sports competitions or breaches in sports rules were submitted by enforcement agencies, sport governing bodies, integrity units, and other regulatory bodies. As a result of such requests, data was exchanged in 25 instances. Additionally, a total of 475 suspicious betting reports from licensees and other concerned parties were received.

- During the period under review, the Authority was a direct participant in 15 different investigations across the globe relating to the manipulation of sports competitions or breaches in sports rules, as well as an indirect participant in 3 such investigations.

- The Authority received a total of 83 international cooperation requests from other regulators and sent 97 such requests, with the majority referring to requests for background checks as part of an authorisation process.

- A total of 177 official replies were issued providing feedback on the regulatory good standing of our licensed operators to the relevant authorities asking for this information.

- The MGA works together with other local regulating authorities and governing bodies. This is reflected through responses furnished by the MGA to requests for information made by the Asset Recovery Bureau (ARB), the FIAU, as well as the MPF on the gaming sector. Additionally, the relevant information is provided to the Sanctions Monitoring Board (SMB) to assist in issuing penalties in instances of non-compliance with sanctions screening obligations.

In publishing this report, the CEO, Dr Carl Brincat said: “This report is testament to our collective efforts in promoting a fair and sustainable gaming ecosystem. Through proactive measures and leaner regulation processes, we strive to ensure a level playing field that nurtures innovation while safeguarding against any potential risks.

“As the global gaming landscape evolves, our role becomes even more critical. We embrace this responsibility with utmost determination, working tirelessly to stay ahead of emerging trends, technologies, and challenges. We remain steadfast in our pursuit of robust frameworks that inspire confidence, protect vulnerable individuals and render Malta the home for gaming operators of good will.”

Powered by WPeMatico

Latest News

QTech Games add more content muscle with Reflex Gaming portfolio

QTech Games, the leading game aggregator for all emerging markets, has signed its latest supplier partnership with Reflex Gaming, the UK’s largest independently owned omnichannel game supplier, enabling its platform customers to access the studio’s expansive slots catalogue.

Established in 2004, Reflex Gaming’s prolific production line run of legendary games has catapulted the supplier to igaming prominence and recognition, offering a diverse array of gaming experiences across both digital and analogue markets, and driving through new innovations in gaming, including the creation of entirely new gaming categories.

Reflex Gaming creates the highest quality digital gaming content for license to many of the world’s leading casino operators, as evidenced by its steady stream of recent hit titles, including Candy Crazed Pandas DoubleMax, Big Game Fishing Christmas Catch, The Cursed Idol, and 8 Balls of Fire Blazing Bounty. All of these games and more are now available via QTech’s premier platform, which is taking the widest range of online games to international markets, with established names sitting alongside the industry’s most exciting up-and-coming providers.

This collaboration naturally broadens Reflex Gaming’s international scope, unlocking untapped regions for diversified growth, above all in Africa and Latin America.

QTech Games CEO, Philip Doftvik, said: “We’re dedicated to constantly launching more and more first-class content and product innovation that drives revenue for our partners. So, this deal with Reflex Gaming extends our impressive sequential pipeline into 2026 – and we’ve so much more to come this year! In today’s marketplace, only premium games of the highest standard separate you from the crowd. So, we look forward to sharing their wide spectrum of games with both leading and challenger operator brands in emerging markets worldwide.”

Mat Ingram, Chief Product Officer at Reflex Gaming, added: “At Reflex Gaming, we pride ourselves on working with the sector’s biggest and most commercially recognised partners, and QTech Games fits our growth plan perfectly, as we continue to expand our horizons into new territories, leveraging our brand’s values which . QTech’s platform is a gateway to global audiences, so we can’t wait to see how our highly engaging games perform across a greenfield landscape of emerging markets.”

The post QTech Games add more content muscle with Reflex Gaming portfolio appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Blokotech

Blokotech serves up Global Padel Tour in collaboration with SiGMA

- Buenos Aires – 16 March (12:00–19:00)

- Malta – 28 April (10:00–16:00)

- Miami – 9 June (time TBC)

- Rome – Grand Finale – 2 November (time TBC)

Additionally, SiGMA CMO Lauranne Urban added: “Blokotech’s Padel Tour is a wonderful idea that we’ve been honoured to help bring to life. It will provide the perfect platform for sporting action, networking and industry culture. This initiative aligns with our event philosophy to deliver engaging, community-driven experiences beyond the conference floor.”

The post Blokotech serves up Global Padel Tour in collaboration with SiGMA appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

155.io

Elantil integrates 155.io into online marketplace

Just when operators were starting to think the range of content offered by Elantil couldn’t possibly get any more diverse, the pioneering platform solutions provider has pulled off one of the great early rug pulls of 2026 by integrating 155.io into its online marketplace.

Proudly supplying “betting on chaos” since 2024, 155.io is a disruptive live game company that’s already made big waves in the industry due to its incredibly unique line-up. Designed to offer real-time madness for a mobile-first world, 155.io takes creative concepts and broadcasts them from its studio to operators around the world, creating an all-new kind of immersive betting experience.

Games offered by the supplier include Rush Hour, where players bet on how much traffic will cross a zone based on real CCTV footage, Duck Racing, where eight fearless rubber duckies race down a lazy river obstacle course with players betting on the winner, and Marble Plinko, which will definitely be a familiar concept to anyone who took part in Elantil’s Marble Races at ICE this year!

Now that 155.io’s full line-up of quirky live games has been added to Elantil’s Marketplace, operators will be able to reach out to the supplier’s business development and sales partner, RPM Gaming, directly to form their own custom agreements, with Elantil handling everything else.

By doing things this way, customers have full flexibility over the length and terms of their deal, enabling them to hand-pick the best games for their target audience while also cutting out the middleman and saving on costs – both of which are hallmarks of the Elantil approach to business.

John Debono, Chief Technical Officer at Elantil, said: “As something of a disruptive presence in the industry ourselves, it goes without saying that Elantil is naturally drawn to fellow innovators in the iGaming space. 155.io certainly fits that description, and by adding their distinctive range of live games to our online marketplace, we’ll be able to offer our partners a totally unique line-up of content that will help them create greater engagement and retention with mobile-first players.”

Sam Jones, Chief Executive Officer at 155.io, said: “155.io and Elantil are both companies that have made names for themselves by doing things differently, so we’re really happy to be sharing our chaotic brand of mobile-first content with a platform provider that genuinely appreciates the importance of going against the status quo. Now that our full line-up of games is integrated into their marketplace, I’m looking forward to seeing what our real-time madness can do for Elantil operators!”

The post Elantil integrates 155.io into online marketplace appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Latest News6 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Games Global6 days ago

Games Global6 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Amusnet6 days ago

Amusnet6 days agoWeek 4/2026 slot games releases

-

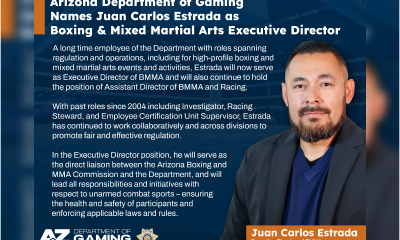

ADG7 days ago

ADG7 days agoArizona Department of Gaming Names Juan Carlos Estrada as Boxing and Mixed Martial Arts Executive Director

-

Battle Royale7 days ago

Battle Royale7 days agoPrime Rush Goes Live in Early Access, Bringing a Brazil-First Mobile Battle Royale to Players

-

AFCON 20257 days ago

AFCON 20257 days agoAFCON’s month of football did not lift iGaming demand — Blask data analysis

-

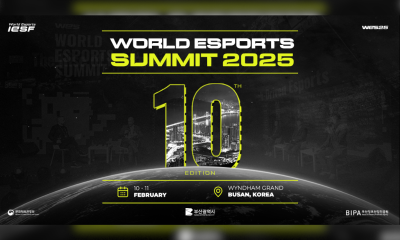

Asia6 days ago

Asia6 days agoWorld Esports Summit Celebrates Its 10th Edition in Busan

-

affiliate marketing6 days ago

affiliate marketing6 days agoN1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona