Industry News

Kambi Group plc Q2 Report 2022

Financial summary

- Revenue amounted to €34.7 (Q2 2021: 42.8) million for the second quarter of 2022 and €71.5 (H1 2021: 86.0) million for the first half of 2022

- Operating profit (EBIT) for the second quarter of 2022 was €4.9 (16.6) million, at a margin of 14.1% (38.8%), and €12.2 (35.3) million, at a margin of 17.1% (41.0%) for the first half of 2022

- Earnings per share for the second quarter of 2022 were €0.109 (0.432) and €0.286 (0.919) for the first half of 2022

- Cash flow amounted to €0.1 (11.4) million for the second quarter of 2022 and €5.6 (28.0) million for the first half of 2022

Key highlights

- Operator turnover increased by 16%, when adjusting for the migration of DraftKings, leading to revenue of €34.7 million

- Strong financial performance against demanding 2021 comparatives, with numerous headwinds including the Netherlands impact, the seasonality effect of the quiet sporting calendar and the DraftKings migration

- Expanded partner network following an online agreement with Mohegan Gaming & Entertainment and its Fallsview Casino brand in Ontario, Canada

- Signed an extended deal with Greenwood Gaming and Entertainment, which owns US multi-state operator betPARX

- Continued expansion across North America including going live on day one in Canada and launches in the United States and Mexico

- Completed phase one of pricing separation from platform, key to enabling the provision of modularised trading services while delivering greater differentiation capabilities

“In Q2, Kambi delivered another positive quarter with underlying growth remaining healthy and operator turnover up 16% when adjusting for the migration of DraftKings. This performance was achieved despite a quieter than usual sporting calendar, particularly with the soccer World Cup taking place later in the year, outside its usual Q2 starting slot. We also signed a partnership with Mohegan Gaming & Entertainment, launched in Canada and Mexico, and announced an extension to our contract with US multi-state operator betPARX, all while making significant strategic progress.

Behind the scenes we have been working tirelessly on executing on our product strategy. Kambi’s Bet Builder offering is a good example of what we can achieve in this regard having taken a leading position in bet combinability, now a must-have for any high-quality sportsbook. As such, I was delighted to see our Bet Builder product receive the recognition it deserves during Q2 when it won the Innovation in Sports Betting Software award at the EGR B2B Awards, along with Kambi being recognised as the best B2B sportsbook provider once more.

However, we have only scratched the surface of what is possible and our product roadmap looks exciting as we continue to raise the bar in sports technology provision. Integral to our product and wider company strategy is our commitment to opening up our platform and modularising our service, enabling Kambi to increase its total addressable market. Not only will this enable us to develop new and exciting products at greater speed, therefore ensuring Kambi’s turnkey offering remains at the cutting edge, but it will also create additional revenue streams as we make available market-leading modules as a standalone service to operators outside of the network.

In Q2, we hit an important milestone on this modularisation journey. As we communicated in the previous quarter, we have been focused on separating pricing functionality from our core platform and in recent weeks we were pleased to soft launch our first standalone pricing functionality for a limited number of low-tier soccer leagues. This functionality leverages Kambi’s recently developed Trading Gateway, serving the Kambi platform as well as potentially operators outside the Kambi network, and presents partners with an opportunity to take even more control of their offering should they wish.

This is an exciting time for Kambi. The product journey we are on today along with our healthy balance sheet and positive underlying financial performance means we are on a strong footing for the future. We were delighted to see Kindred relaunch in the Netherlands recently and with more product launches, partner signings and a World Cup to come, I look forward to an even greater second half of the year.”

Powered by WPeMatico

BetBlocker

New Turkish-language tool from BetBlocker extends service to 90 million additional people

Gambling harm prevention charity BetBlocker today reveals the extension of their award-winning assistance into Turkish.

In 2025, BetBlocker saw a tremendous increase in support, with more than three hundred thousand individual users initiating a block throughout the year. This significant level of engagement has been made possible by the diverse array of languages into which the charity has translated its assistance.

Yesilay, the main Turkish support service, reports that requests for help with gambling are now surpassing those for alcohol, drugs, or tobacco, alongside significant uptake and harm among youth, making the launch of Turkish language support timely and relevant.

Founder and Trustee for BetBlocker, Duncan Garvie, offered these comments: “BetBlocker is genuinely excited to roll out our second language expansion of 2026.

We’ve experienced phenomenal uptake of the service over the last 12 months and figures hare steadily rising. One of the biggest drivers of that growth has been improving the accessibility of our support by meeting users where they are and offering support in the language that they’re most comfortable accessing in.

Alongside Turkey itself, there are substantial Turkish speaking communities across Europe, the Middle East and North America. It is our hope that this evolution of BetBlocker will ensure that a deeper level of support is available more widely across the Turkish diaspora.

BetBlocker would like to offer our deepest thanks to Fatmatuz Zehra Pehlivan, a Clinical Psychologist and researcher, who volunteers Green Cresent in the field of addiction treatment. Fatmatuz volunteered her time to help translate our app, and every Turkish language user we support owe her their thanks for the donation of her time and expertise.

As with many of the communities BetBlocker now supports, we would not be able to reach so many people without the kindness and generosity of field experts like Fatmatuz.”

The post New Turkish-language tool from BetBlocker extends service to 90 million additional people appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Anastasia Rimskaya Chief Account Officer at Aviatrix

Aviatrix Launches New Loot Boxes to Deepen Progression and Reward Paths

Aviatrix has launched a new Loot Box feature for its premier crash game, presenting collectible rewards, free bets, and progression bonuses aimed at boosting long-term player engagement.

Loot Boxes are granted through a daily rewards mechanism, with players obtaining them according to their in-game actions and advancement. Every box holds a variety of rewards, such as aircraft skins, complimentary bets, and aviation experience points.

The feature enhances Aviatrix’s developing loyalty system, providing players with fresh options to personalize their aircraft and earn rewards through continuous engagement.

Anastasia Rimskaya, Chief Account Officer at Aviatrix, said: “Loot Boxes are part of our wider vision for Aviatrix as a connected multi-game universe. As we expand our iGaming Metaverse, features like Loot Boxes add another meaningful layer to how players build their profile, customise their aircraft and earn rewards across the ecosystem.”

Unveiled in February, the Aviatrix iGaming Metaverse signifies the supplier’s shift from a standalone crash game to an integrated multi-title ecosystem.

Starting with the imminent debut of Aviatrix Second Chance and continuing with upcoming titles like Aviatrix Fruits and Aviatrix Mines, every game will utilize a single integrated player profile, progression system, and rewards and achievements framework.

The post Aviatrix Launches New Loot Boxes to Deepen Progression and Reward Paths appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Alec Gehlot Chief Executive Officer at PlaySignal

PlaySignal Debuts: Alec Gehlot’s New Sophisticated Responsible Gaming Platform

Alec Gehlot, previous senior executive at Optimove, has introduced PlaySignal, a responsible gaming platform aimed at assisting operators in identifying and addressing player risk promptly.

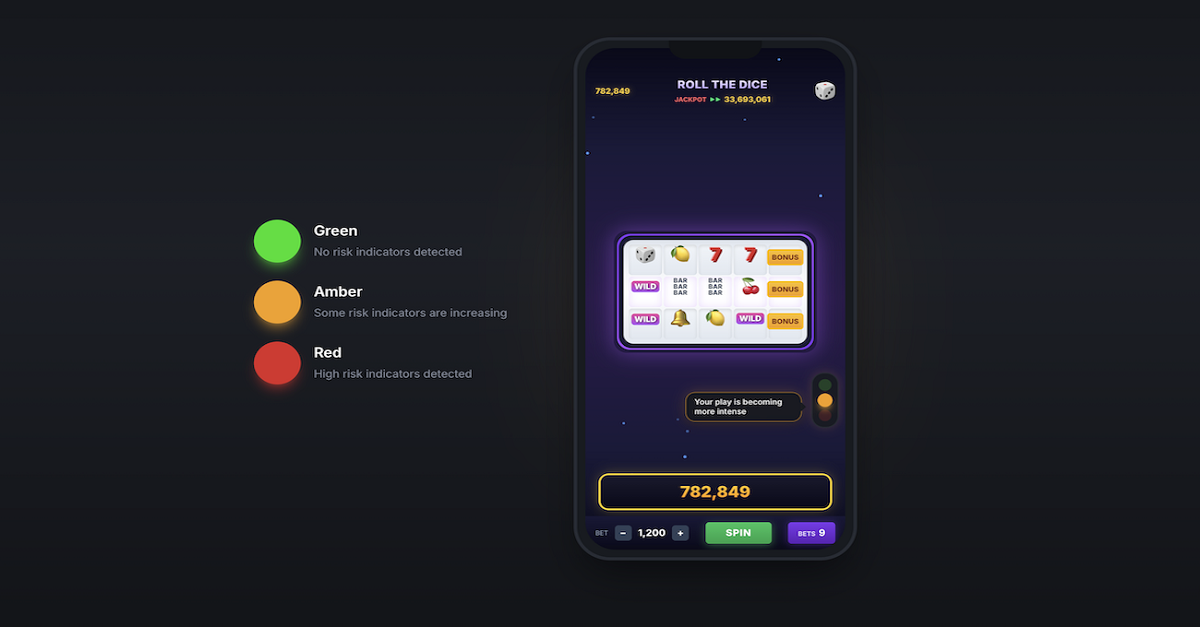

PlaySignal employs a traffic-light system featuring green, amber, and red signals to steer player conduct and indicate when behaviors start to enter higher-risk areas. The platform seeks to minimize avoidable exclusions by offering operators enhanced visibility of rising risks, while simultaneously giving players more understanding of how their actions are evaluated.

Leveraging behavioural analytics, PlaySignal tracks player actions during gameplay and displays information as distinct signals. This allows teams to act earlier and react more appropriately as risk evolves.

The product connects with current operator systems to assist responsible gaming, CRM, and compliance teams by providing a unified view of activities, encouraging a more uniform strategy among teams as regulatory demands grow in important markets.

Building on his time at Optimove, where he collaborated with operators on segmentation, retention, and user engagement, Gehlot recognized a demand for innovative tools to enhance player protection as regulatory and tax pressures mount in regulated markets.

The company launched PlaySignal at ICE earlier this year, where it was a contender in the Innovators Challenge, and initiated talks with operators in various markets. The initial launch will concentrate on the UK prior to global expansion.

Alec Gehlot, Chief Executive Officer at PlaySignal, said: “Regulation and taxation are only moving in one direction, and operators need new tools to adapt. Player protection can no longer be treated as a compliance obligation; it has to become a competitive differentiator.

“Regulated operators are under real pressure, particularly in the UK, and we believe giving them earlier visibility of risk is essential not just for protection, but for long-term sustainability.”

The post PlaySignal Debuts: Alec Gehlot’s New Sophisticated Responsible Gaming Platform appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Blueprint Gaming7 days ago

Blueprint Gaming7 days agoBlueprint Gaming unleashes Frankenstein’s Fortune blending dynamic modifiers with multi-path bonus offering

-

Compliance Updates7 days ago

Compliance Updates7 days agoMGA Publishes Results of Thematic Review on Self-exclusion Practices in Online Gaming Sector

-

Latest News5 days ago

Latest News5 days agoGGBET UA hosts Media Game – an open FC Dynamo Kyiv training session with journalists from sports publications

-

Amusnet7 days ago

Amusnet7 days agoAmusnet Unveils Casino Engineering and Technology Milestones Achieved in 2025

-

Dan Brown7 days ago

Dan Brown7 days agoGames Global and Foxium return to the Colosseum in Rome Fight for Gold the Tiger’s Rage™

-

Asia6 days ago

Asia6 days agoBooks on Wheels: DigiPlus Foundation Brings Mobile Library to Boost Literacy Among Aurora’s Young Learners

-

Bragg Gaming Group7 days ago

Bragg Gaming Group7 days agoBragg Gaming Group Partners with StarGames

-

3 Oaks Gaming7 days ago

3 Oaks Gaming7 days ago3 Oaks Gaming unleashes the power of the wild with 4 Wolf Drums: Hold and Win