Latest News

Global $12.754 Bn Casino Management Systems Markets, 2016-2021, 2021-2026F, 2031F

The “Casino Management Systems Global Market Report 2022, By Component, Application, End User” report has been added to ResearchAndMarkets’ offering.

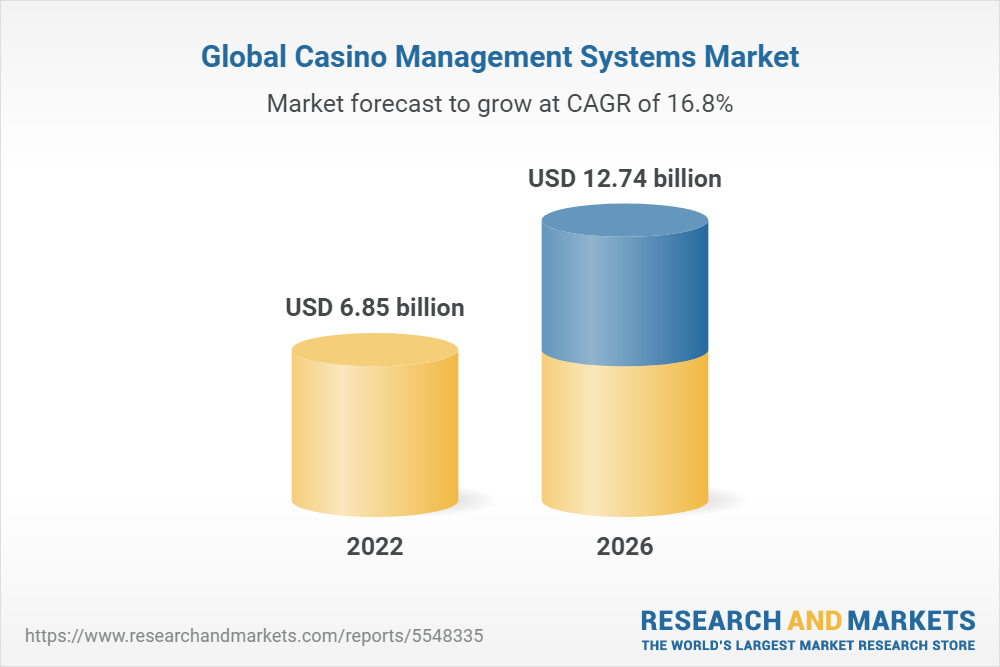

The global casino management systems market is expected to grow from $5.71 billion in 2021 to $6.85 billion in 2022 at a compound annual growth rate (CAGR) of 20.1%. The market is expected to reach $12.74 billion in 2026 at a CAGR of 16.8%.

The casino management systems market consists of sales of casino management systems by entities (organizations, sole traders, and partnerships) that are used to assist in the ongoing management, monitoring, and operations of casino or gaming organizations. Casino management systems provide various club operations such as management systems, accounting and analytics tools, and security and surveillance systems. These technologies assist in keeping track of client and personnel activities across the gaming club floor, as well as maintaining a database for future use.

The main types of components in casino management systems are hardware and software. The software involves CRM software, casino player tracking software, PMS, and inventory management systems that are being used in casino games. The different applications include security and surveillance, analytics, accounting, and cash management, player tracking, property management, marketing and promotions, others and are implemented in small and medium casinos, large casinos.

North America was the largest region in the casino management systems market in 2020. Asia Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in this report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Increasing legalization and rising number of gaming establishments are expected to propel the growth of the casino management systems market. A gaming establishment refers to any gaming property such as a casino, hotel, or resort that includes various games or betting that require a legal license.

For instance, in July 2021, in Germany, a new interstate Treaty on Gambling (“ISTG 2021”) has come into action, which includes new licensing possibilities for sports betting, virtual slot machines, and online poker for private operators. In the USA, as of 2019, land-based commercial casinos are permitted in 18 states and six states have permitted riverboat casinos. Therefore, the increasing legalization and rising number of gaming establishments are driving the growth of the casino management systems market.

Product innovations are shaping the casino management systems market. Major companies operating in the casino management systems sector are focused on new product innovations to meet the consumer demand and strengthen their position. For instance, in January 2021, Cher-Ae Heights Casino, a US-based gaming company and Konami Gaming Inc., a US based manufacturer of casino management systems launched SYNKROS Casino Management System in Trinidad, California.

Konami’s Synkros is best known for its reliability, marketing tools, analytics tools, and robust data. It captures and compiles the data through all connected areas of the casino property and generates a 360-degree patron view. The SYNKROS Casino management system provides a unique mix of marketing solutions to Cher-Ae Heights Casino’s customers, including floor-wide bonusing activities, random drawings, personalised incentives, offers, and more.

In August 2021, Grover Gaming, Inc., a US-based developer of software and gaming systems acquired Digital Dynamics Software, Inc. for an undisclosed amount. Through this acquisition Grover Gaming will be able to enhance its gaming performance by integrating SAS-based digital gaming equipment and casino communications into its own software. Digital Dynamics Software is a US-based developer of SAS Gateway, GAP gaming protocol, SAS Engine, and the casino management system software.

Key Topics Covered:

1. Executive Summary

2. Casino Management Systems Market Characteristics

3. Casino Management Systems Market Trends And Strategies

4. Impact Of COVID-19 On Casino Management Systems

5. Casino Management Systems Market Size And Growth

5.1. Global Casino Management Systems Historic Market, 2016-2021, $ Billion

5.1.1. Drivers Of The Market

5.1.2. Restraints On The Market

5.2. Global Casino Management Systems Forecast Market, 2021-2026F, 2031F, $ Billion

5.2.1. Drivers Of The Market

5.2.2. Restraints On the Market

6. Casino Management Systems Market Segmentation

6.1. Global Casino Management Systems Market, Segmentation By Component, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

- Hardware

- Software

6.2. Global Casino Management Systems Market, Segmentation By Application, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

- Security And Surveillance

- Analytics

- Accounting And Cash Management

- Player Tracking

- Property Management

- Marketing And Promotions

- Others

6.3. Global Casino Management Systems Market, Segmentation By End User, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

- Small And Medium Casinos

- Large Casinos

7. Casino Management Systems Market Regional And Country Analysis

7.1. Global Casino Management Systems Market, Split By Region, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

7.2. Global Casino Management Systems Market, Split By Country, Historic and Forecast, 2016-2021, 2021-2026F, 2031F, $ Billion

Companies Mentioned

- Advansys Limited

- Agilysys Inc.

- Aristocrat Technologies Australia Pty Ltd.

- Avigilon

- Bally Technologies Inc.

- Casinfo LLC

- Cyrun

- Dallmeier

- Honeywell International Inc.

- International Game Technology PLC.

- Konami Gaming Inc.

- Scientific Games Corporation

- Next Level Security Systems Inc.

- Novomatic

- NtechLab

- Amatic Industries GmbH

- Playtech

- CasinoFlex Systems

- RNGplay

- Delta Casino Systems

- Ensico

- TableTrac Inc.

- Winsystems

Powered by WPeMatico

Gems of Ra 3 Pots

Evoplay Opens the Portal to Wealth in Gems of Ra 3 Pots

Evoplay, the acclaimed game development studio, has unveiled a sunlit Egyptian tale with the launch of Gems of Ra 3 Pots, its newest slot game where holy riches and celestial enhancements influence every spin.

Nestled among majestic pyramids, Gems of Ra 3 Pots crafts a realm overseen by the deities Anubis, Horus, and Isis, each bestowing distinct abilities that alter the Bonus Game.

Wilds show up on reels two to five, replacing all standard symbols to form winning combinations. They can appear as individual icons or in complete stacks, boosting the likelihood of triggering payouts in the base game.

Central to the experience are four kinds of Bonus symbols: Blue, Red, Green, and Money, each with random values and the chance to activate Mini, Mega, and Super jackpots.

Activating the Bonus Game occurs when landing Blue, Red, or Green symbols with a matching booster. The Extra Wealth enhancer boosts the worth of as many as four Bonus symbols, while Extra Reels introduces a separate independent bonus area, with both grids merging their rewards at the conclusion of the round. The Extra Spins booster enhances the feature to four spins, prolonging the pursuit of treasure even more.

The Bonus Game can be activated with one, two, or all three boosters at the same time. In this feature, only Money Bonus symbols are present, and gathering all 15 spots grants access to the Grand Jackpot.

Featuring win potential exceeding 6,000x, the game combines a traditional Egyptian slot ambiance with a contemporary feature design centered on strategy-focused bonus upgrades.

Ivan Kravchuk, CEO at Evoplay, said: “Gems of Ra 3 Pots is all about discovery and escalation. We wanted to create a slot that captures the grandeur of Egyptian mythology while giving players meaningful ways to influence the Bonus Game through the different god-powered boosters.

“It’s a title that combines atmosphere, clarity, and strong win potential, offering a fresh take on a theme players continue to love.”

The post Evoplay Opens the Portal to Wealth in Gems of Ra 3 Pots appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

bet365

Peter & Sons Joins bet365 in Strategic Multi‑Market Collaboration

Maverick game studio Peter & Sons has revealed a significant new collaboration with bet365, a top online gambling operator globally, enhancing its foothold in essential regulated markets around the world.

Peter & Sons’ unique portfolio has now launched with bet365 in the Netherlands, Spain, the United Kingdom, and various other regulated markets, providing fully localized and compliant experiences customized for players in each region. The launch signifies an important achievement for the studio, emphasizing its dedication to controlled expansion and enduring strategic alliances.

Established in 2019 with a goal to represent the “anti-boring,” Peter & Sons has gained acclaim for striking art direction, engaging narratives, and creative mechanics. Through the integration of exceptional artistry, mathematics, and sound creation, the studio consistently produces top-performing games that shine in competitive markets.

bet365 is internationally acknowledged for its technology-focused platform, strict regulatory adherence, and exceptional player experience. Catering to millions of clients in regulated regions, the operator is recognized for collaborating with top suppliers to improve its varied gaming portfolio.

The partnership is expected to grow further in the upcoming months, with Italy, Brazil, Ontario, Greece, and Sweden already confirmed as new launch markets. This gradual implementation will greatly expand the worldwide availability of Peter & Sons’ content, presenting its distinctive collection to a wider global audience.

Yann Bautista, Commercial Director and Founder at Peter & Sons commented: “Partnering with bet365 represents an important step in our regulated market strategy. bet365’s reputation for technological excellence and compliance aligns perfectly with our long-term vision. We are proud to see our games live across several major jurisdictions and look forward to expanding this collaboration even further.”

Clement Le Scanff, bet365 Head of Gaming Commercial and Operations, said: “We’re delighted to announce our partnership with Peter & Sons. This collaboration is testament to our commitment to providing cutting-edge content that enhances the customer experience and delivers engaging, entertaining gameplay.”

The post Peter & Sons Joins bet365 in Strategic Multi‑Market Collaboration appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Alina Mihaela Popa Chief Commercial Officer at ICONIC21

ICONIC21 Boosts Romania Operations Through VivaBet Alliance

ICONIC21 advances its strategic growth in regulated markets through a new collaboration with VivaBet, a rapidly expanding online casino operator in Romania.

By means of this agreement, sought-after supplier ICONIC21 provides a collection of more than 15 live casino games, enhancing VivaBet’s selection with content focused on performance.

VivaBet established a solid presence in the Romanian market by emphasizing a varied casino selection and a user-friendly platform designed for local users. Functioning within Romanian regulations, the brand persists in investing to broaden its content library to stay pertinent in a fiercely competitive landscape.

The inclusion of ICONIC21’s live casino collection helps achieve this goal by presenting contemporary studios, rapid gameplay, and multiplier-driven features that enhance player involvement.

Among the games going live with VivaBet are some of ICONIC21’s strongest performers:

· Gravity Blackjack

· Gravity Roulette

· Multiple variations of Baccarat

The Gravity Series, recognized for its multiplier mechanics integrated into classic formats, introduces an additional dimension to conventional table games. This strategy has reliably produced high engagement metrics in various markets.

Merging traditional casino elements with improved payout opportunities and refined studio aesthetics, the collection meets the desires of Romanian players who are progressively pursuing both recognition and extra thrill.

Commenting on the partnership, Alina Mihaela Popa, Chief Commercial Officer at ICONIC21, said: “Romania is a key regulated market for us, and partnering with VivaBet marks another important step in strengthening our footprint locally. We see strong demand for live content that blends classic gameplay with modern mechanics, particularly within our Gravity Series. Collaborating with an operator that understands its audience and is focused on continuous growth allows us to deliver real value.”

From VivaBet’s side, Matei Secaci, Head of Casino, added: “We are pleased to integrate ICONIC21’s live portfolio into our platform. Expanding our array of games with a provider that is growing quickly and investing in high quality production enables us to further enhance the experience we offer our players. The addition of titles such as Gravity Blackjack and Gravity Roulette brings fresh energy to our live casino section.”

The partnership with VivaBet is a key element of ICONIC21’s wider growth plan in regulated European markets. Through providing adaptable integration, a varied live portfolio, and studio-led innovation, the company remains a dependable partner for operators in search of unique live casino content.

With the increasing demand for interactive, enhanced live games, collaborations like this one strengthen ICONIC21’s dedication to providing scalable, performance-oriented solutions customized to the requirements of each market.

The post ICONIC21 Boosts Romania Operations Through VivaBet Alliance appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Amusnet6 days ago

Amusnet6 days agoWeek 7/2026 slot games releases

-

Aphrodite’s Kiss6 days ago

Aphrodite’s Kiss6 days agoLove on the Reels: Slotland Introduces “Aphrodite’s Kiss”

-

Brino Games6 days ago

Brino Games6 days agoQTech Games integrates more creative content from Brino Games

-

Baltics7 days ago

Baltics7 days agoEstonia to Reinstate 5.5% Online Gambling Tax From March 1

-

Denmark7 days ago

Denmark7 days agoRoyalCasino Partners with ScatterKings for Company’s Danish Launch

-

Booming Games7 days ago

Booming Games7 days agoTreasure Hunt Revival — Booming Games Launches Gold Gold Gold Hold and Win

-

Bet Rite7 days ago

Bet Rite7 days agoSpintec Expands into Canada with Bet Rite

-

ELA Games7 days ago

ELA Games7 days agoELA Games Unveils Tea Party of Fortune — A Magical Multiplier Experience