Latest News

Notice of Kambi Group Plc Annual General Meeting 2022

In terms of Articles 41 and 42 of the Articles of Association of the Company

NOTICE IS HEREBY GIVEN that that THE ANNUAL GENERAL MEETING (the “Meeting”) of Kambi Group plc, company number C 49768 (the “Company”) will be held on Tuesday 17 May 2022 at 11.00 CEST at Kambi, Hälsingegatan 38, 113 43 Stockholm, to consider the following Agenda. The registration of shareholders starts at 10.30 CEST.

Right to attendance and voting

- To be entitled to attend and vote at the Meeting (and for the purpose of the determination by the Company of the number of votes they may cast), shareholders must be entered on the Company’s register of members maintained by Euroclear Sweden AB by Monday 25 April 2022.

- Shareholders whose shares are registered in the name of a nominee should note that they may be required by their respective nominee/s to temporarily re-register their shares in their own name in the register of members maintained by Euroclear Sweden AB in order to be entitled to attend and vote (in person or by proxy) at the Meeting. Any such re-registration would need to be effected by Monday 25 April 2022. Shareholders should therefore liaise with and instruct their nominees well in advance thereof.

- To be entitled to attend and vote in person at the Meeting, shareholders must notify Euroclear Sweden AB of their intention to attend the Meeting by Monday 25 April 2022 and can do so by (i) e-mail to [email protected] or (ii) mail to: Kambi Group plc, c/o Euroclear Sweden AB, Box 191, SE-101 23 Stockholm, Sweden or (iii) by phone on +46 8 402 9092 during the office hours of Euroclear Sweden AB. Notification should include the shareholder’s name, address, email address, daytime telephone number, personal or corporate identification number, number of shares held in the Company, as well as details of any proxies (if applicable, in the case that the shareholder has appointed a third party representative to attend the Meeting in their stead). Information submitted in connection with the notification will be computerised and used exclusively for the Meeting. See below for additional information on the processing of personal data.

Shareholders’ right to appoint a proxy

- A shareholder who is entitled to attend and vote at the Meeting, is entitled to appoint one or more proxies to attend and vote on his or her behalf. A proxy need not also be a shareholder. If the shareholder is an individual, the proxy form must be signed by the appointer (or his authorised attorney) or comply with Article 126 of the Articles. If the shareholder is a corporation, the proxy form must be signed on its behalf by an authorised attorney or a duly authorised officer of the corporation or comply with Article 126 of the Articles.

- Proxy forms must clearly indicate whether the proxy is to vote in their discretion or in accordance with the voting instructions sheet attached to the proxy form. Your proxy shall vote as you have directed in respect of the resolutions set out in this notice or on any other resolution that is properly put to the meeting. If the proxy form is returned to the Company without any indication as to how the proxy shall vote, generally or in respect of a particular resolution, the proxy shall exercise their discretion as to how to vote or whether to abstain from voting, generally or in respect of that particular resolution (as applicable).

- Where the shareholder is a corporation, a document evidencing the signatory right of the officer signing the proxy form, must be submitted with the proxy form. Where the proxy form is signed on behalf of the shareholder by an attorney (rather than by an authorised representative, in the case of a corporation), the original power of attorney or a copy thereof certified or notarised in a manner acceptable to the Board of Directors must be submitted to the Company, failing which the appointment of the proxy may be treated as invalid.

Agenda

1. Opening of the Meeting

2. Election of Chair of the Meeting

3. Drawing up and approval of the voting list

4. Approval of the Agenda

5. Determination that the Meeting has been duly convened

6. Election of two persons to approve the minutes

7. Presentation of the Consolidated Financial Statements (Annual Report), the Financial Statements of the Company for the year ended 31 December 2021 and the auditor’s reports.

8. The CEO’s presentation

Ordinary Business (Ordinary Resolutions)

9. To receive and approve the Consolidated Financial Statements (Annual Report) and the Financial Statements of the Company for the year ended 31 December 2021 and the Reports of the Directors and Reports of the Auditors thereon. (Resolution a)

10. To approve the remuneration report set out on page 55 of the Company’s Annual Report and Financial Statements for the year ended 31 December 2021. (Resolution b)

11. To determine the number of Board members. (Resolution c)

12. To determine the Board members’ fees. (Resolution d)

13. To re-elect Lars Stugemo as a Director of the Company. (Resolution e)

14. To re-elect Anders Ström as a Director of the Company. (Resolution f)

15. To re-elect Patrick Clase as a Director of the Company. (Resolution g)

16. To re-elect Marlene Forsell as a Director of the Company. (Resolution h)

17. To re-elect Cecilia de Leeuw as a Director of the Company. (Resolution i)

18. To appoint the Chair of the Board. (Resolution j)

19. Resolution on guidelines for how the Nomination Committee shall be appointed. (Resolution k)

20. To re-appoint Mazars as Auditors of the Company, represented by Paul Giglio, and to authorise the Directors to determine the Auditors’ remuneration. (Resolution l)

Special Business (Extraordinary Resolutions)

21. THAT the Directors be and are hereby duly authorised and empowered in accordance with Articles 85(1) and 88(7) of the Companies Act and Article 3 of the Articles, on one or several occasions prior to the date of the next Annual General Meeting of the Company, to issue and allot up to a maximum of 3,106,480 Ordinary ‘B’ shares in the Company of a nominal value of €0.003 each (corresponding to a dilution of 10% of total shares as at the date of the notice to the 2022 Annual General Meeting) for payment in kind or through a direct set-off in connection with an acquisition, and to authorise and empower the Directors to restrict or withdraw the right of pre-emption associated to the issue of the said shares. This resolution is being taken in terms and for the purposes of the approvals necessary in terms of the Companies Act and the Articles of Association of the Company. (Resolution m)

22. WHEREAS (i) at a meeting of the Board of Directors of the Company held on 30 March 2022, the Directors resolved to obtain authority to buy back Ordinary ‘B’ shares in the Company having a nominal value of €0.003 each; and

(ii) pursuant to Article 5 of the Articles and Article 106(1) (b) of the Companies Act a company may acquire any of its own shares otherwise than by subscription, provided inter alia authorisation is given by an extraordinary resolution, which resolution will need to determine the terms and conditions of such acquisitions and in particular the maximum number of shares to be acquired, the duration of the period for which the authorisation is given and the maximum and minimum consideration.

NOW THEREFORE the members of the Company resolve that the Company be generally authorised to make purchases of Ordinary ‘B’ shares in the Company of a nominal value of €0.003 each in its capital, subject to the following:

(a) the maximum number of shares that may be so acquired is 3,106,480 which is equivalent to 10% of total shares as at the date of the notice to the 2022 Annual General Meeting;

(b) the minimum price that may be paid for the shares is SEK1 per share;

(c) the maximum price that may be paid for the shares is SEK1,000 per share;

(d) the maximum aggregate number of shares that can either be i) issued and allotted under Resolution m and, ii) bought back under this Resolution n, shall not exceed 3,106,480; and

(e) the authority conferred by this resolution shall expire on the date of the 2023 Annual General Meeting, but in any case shall not exceed the period of 18 months, but not so as to prejudice the completion of a purchase contracted before that date. (Resolution n)

23. Closing of the Annual General Meeting

Information about proposals related to Agenda items

Agenda item 2

The Nomination Committee proposes that Lars Stugemo be elected Chair of the Meeting.

Agenda item 10

The Board of Directors proposes that the AGM approves the remuneration report on page 55 of the Company’s Annual Report and Financial Statements for the year ended 31 December 2021.

Agenda item 11

The Nomination Committee proposes that the Board of Directors should consist of five Directors.

Agenda item 12

The Nomination Committee appointed by the Directors of the Company pursuant to Article 90 of the Articles, proposes that the aggregate amount per annum of the ordinary remuneration of Directors shall not exceed €360,000 (previously €360,000).

The Directors have determined in terms of Articles 68 and 69 of the Articles that the annual amount of the ordinary remuneration of a Director shall be €52,500 (previously €52,500) and of the Chair of the Board shall be €105,000 (previously €105,000). The annual extra remuneration payable to each member of the Audit Committee and the Remuneration Committee shall be €7,000 (previously €7,000). Additionally, the directors have determined that an extra remuneration of €2,000 (previously €1,100) is payable to each director per licence application handled in the US, and a fee, at the rate of €2,100 (previously €2,100) per day spent in the US in conjunction with handling of the applications, is paid to any director as required.

Agenda item 18

The Nomination Committee proposes that Lars Stugemo is appointed as the Chair of the Board.

Agenda item 19

The Nomination Committee proposes that the Annual General Meeting resolves that, until the general meeting of the shareholders decides otherwise, the Nomination Committee shall consist of not less than four and not more than five members, of which one shall be the Chair of the Board of Directors. The members of the Nomination Committee shall represent all shareholders and be appointed by the three or four largest shareholders as at 30 September each year, having expressed their willingness to participate in the Nomination Committee.

Agenda item 20

Following a formal tender process and in accordance with the recommendation by the Audit Committee, the Nomination Committee proposes that Mazars Malta be re-appointed auditor for the period from the end of the Annual General Meeting 2022 until the end of the Annual General Meeting 2023. The Nomination Committee proposes that the auditor’s fees be paid based on approved invoices.

Agenda item 21

The objectives of the authorisation are to increase the financial flexibility of the Company and to enable the Company to use its own financial instruments for payment in kind or through a directed set-off to a selling partner in connection with any business acquisitions the Company may undertake or to settle any deferred payments in connection with business acquisitions. The market value of the shares on each issue date will be used in determining the price at which shares will be issued. For the purposes of Article 88(7) of the Companies Act, through this resolution the members of the Company are also authorising the Board of Directors to restrict or withdraw the members’ right of pre-emption that would normally entitle members to be offered the newly issued shares in the Company in proportion to their shareholding before such new shares are offered to third parties.

Agenda item 22

The Board of Directors proposes that the acquisition by the Company of its own shares shall take place on First North Growth Market at Nasdaq Stockholm or via an offer to acquire the shares to all members of the Company. Such acquisitions of own shares may take place on multiple occasions and will be based on market terms, prevailing regulations and the capital situation at any given time. Notification of any purchase will be made to First North Growth Market at Nasdaq Stockholm and details will appear in the Company’s annual report and accounts. Any resolution to repurchase own shares will be publicly disclosed. The objective of the buyback and transfer right is to ensure added value for the Company’s shareholders and to give the Board increased flexibility with the Company’s capital structure.

Following such buybacks, the intention of the Board would be to either cancel, use as consideration for an acquisition or transfer to employees under a company share incentive plan. Once repurchased, further shareholder and Bondholder approval would be required before those shares could be cancelled.

If used as consideration for an acquisition the intention would be that they would be issued as shares and not sold first.

Note

Holder of the Convertible Bond

This notice is also sent to Moneytainment Media Ltd, a limited liability company incorporated in Malta with Registration No. C 41331, and of Registered Office at Level 6, The Centre, Tigne Point, Sliema TPO 0001, Malta, as the holder of the Convertible Bond, having the right to attend the Annual General Meeting as an observer.

Other

The Company has 31,064,797 ordinary B shares outstanding as of the date of this notice (one vote per ordinary B share).

By order of the board,

Kambi Group plc

Malta, March 2022

Powered by WPeMatico

ELA Games

Following ICE 2026 Triumph, ELA Games Officially Releases “Wealth of the East”

ELA Games is excited to announce the official B2B launch of Wealth of the East. The game, now accessible to partners, was initially introduced to the industry as the studio’s highlight during the three-day event in Barcelona, where it attracted the attention of numerous operators and aggregators because of its unique combination of slot mechanics and tabletop gaming.

The unique unveiling at ICE turned out to be a significant triumph, paving the way for the complete rollout. The ELA Games exhibit gathered industry representatives to engage with the game’s distinctive selling proposition: a twenty-sided Dice (D20) element that adds a tactile, physical sensation to digital slot gaming.

A Festivity of Wealth

The reels of Wealth of the East sparkle with the vibrant essence of an Eastern celebration. The gameplay is centered around the charming figure God Fu, a god of wealth serving as the Wild symbol in the game. He may arrive at any moment, and when he shows up, all Dice on the display spring to life, uncovering multipliers that enhance every coin visible or activate instant Jackpots. These empowered coins provide instant payouts, rewarding players as soon as they appear.

Sparking the Hold & Win Safe

The game showcases a visually impressive progression system crafted to uphold the festive theme and decorated with vibrant reds and golds. Every gathered coin also flies upward into the Golden Pot located above the reels, gradually enriching it with festive treasure that players can see and experience.

As the pot overflows, the screen bursts into red and gold as the Hold & Win game starts. Players receive 3 respins and a setup prepared to collect gold. In this intense feature, the elusive Imperial Lotus can appear, boosting multiple rewards simultaneously and elevating the entire round to new levels.

Game Stats:

● Reels: 5×3

● Lines: 10

● Max Win: x5,000

● Max Exposure: €250,000

● Buy Bonus: Yes

● Volatility: Mid

● RTP: 93.97% / 96.06%

Marharyta Yerina, Managing Director of ELA Games, commented: “Wealth of the East was the perfect title for us to showcase at ICE 2026. We took the classic t’Eastern Celebration’ theme and gave it a distinct twist with the God Fu character and his twenty-sided dice. It adds an original, tactile layer of excitement that players really respond to. The ‘Rising Pot’ visualizes the journey toward the bonus, keeping the excitement building spin after spin. We can’t wait for the industry to see the celebration in action.”

The post Following ICE 2026 Triumph, ELA Games Officially Releases “Wealth of the East” appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Latest News

QTech Games add more content muscle with Reflex Gaming portfolio

QTech Games, the leading game aggregator for all emerging markets, has signed its latest supplier partnership with Reflex Gaming, the UK’s largest independently owned omnichannel game supplier, enabling its platform customers to access the studio’s expansive slots catalogue.

Established in 2004, Reflex Gaming’s prolific production line run of legendary games has catapulted the supplier to igaming prominence and recognition, offering a diverse array of gaming experiences across both digital and analogue markets, and driving through new innovations in gaming, including the creation of entirely new gaming categories.

Reflex Gaming creates the highest quality digital gaming content for license to many of the world’s leading casino operators, as evidenced by its steady stream of recent hit titles, including Candy Crazed Pandas DoubleMax, Big Game Fishing Christmas Catch, The Cursed Idol, and 8 Balls of Fire Blazing Bounty. All of these games and more are now available via QTech’s premier platform, which is taking the widest range of online games to international markets, with established names sitting alongside the industry’s most exciting up-and-coming providers.

This collaboration naturally broadens Reflex Gaming’s international scope, unlocking untapped regions for diversified growth, above all in Africa and Latin America.

QTech Games CEO, Philip Doftvik, said: “We’re dedicated to constantly launching more and more first-class content and product innovation that drives revenue for our partners. So, this deal with Reflex Gaming extends our impressive sequential pipeline into 2026 – and we’ve so much more to come this year! In today’s marketplace, only premium games of the highest standard separate you from the crowd. So, we look forward to sharing their wide spectrum of games with both leading and challenger operator brands in emerging markets worldwide.”

Mat Ingram, Chief Product Officer at Reflex Gaming, added: “At Reflex Gaming, we pride ourselves on working with the sector’s biggest and most commercially recognised partners, and QTech Games fits our growth plan perfectly, as we continue to expand our horizons into new territories, leveraging our brand’s values which . QTech’s platform is a gateway to global audiences, so we can’t wait to see how our highly engaging games perform across a greenfield landscape of emerging markets.”

The post QTech Games add more content muscle with Reflex Gaming portfolio appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Blokotech

Blokotech serves up Global Padel Tour in collaboration with SiGMA

- Buenos Aires – 16 March (12:00–19:00)

- Malta – 28 April (10:00–16:00)

- Miami – 9 June (time TBC)

- Rome – Grand Finale – 2 November (time TBC)

Additionally, SiGMA CMO Lauranne Urban added: “Blokotech’s Padel Tour is a wonderful idea that we’ve been honoured to help bring to life. It will provide the perfect platform for sporting action, networking and industry culture. This initiative aligns with our event philosophy to deliver engaging, community-driven experiences beyond the conference floor.”

The post Blokotech serves up Global Padel Tour in collaboration with SiGMA appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Latest News6 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Games Global6 days ago

Games Global6 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Amusnet6 days ago

Amusnet6 days agoWeek 4/2026 slot games releases

-

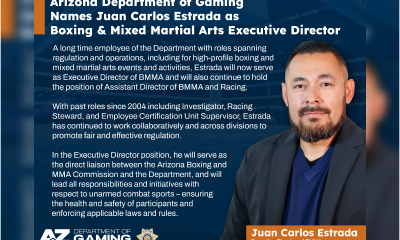

ADG7 days ago

ADG7 days agoArizona Department of Gaming Names Juan Carlos Estrada as Boxing and Mixed Martial Arts Executive Director

-

AFCON 20257 days ago

AFCON 20257 days agoAFCON’s month of football did not lift iGaming demand — Blask data analysis

-

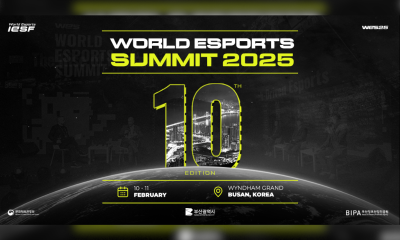

Asia6 days ago

Asia6 days agoWorld Esports Summit Celebrates Its 10th Edition in Busan

-

affiliate marketing6 days ago

affiliate marketing6 days agoN1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Compliance Updates6 days ago

Compliance Updates6 days agoDutch Regulator Outlines 5 Key Supervisory Priorities for 2026 Agenda