Canada

Compliable Secures $3.6m New Capital to Further Enhance Compliance Tech Platform Focused on Real-Money Gaming

Bettor Capital Leads Financing and Industry Leader, Carl Sottosanti, Joins the Board of Directors

Leading compliance software provider Compliable has completed a $3.6m seed extension round led by Bettor Capital, an investment that will enable the supplier to further strengthen its ground-breaking platform and expand the scope of products and services that it provides to real-money gaming operators.

The investment from Bettor Capital marks the second funding round for Compliable in the past year, with the company previously securing $1.7m seed funding in a round led by Chicago-based KB Partners.

Additionally, Carl Sottosanti, a fund advisor to Bettor Capital and former General Counsel of Penn National Gaming, has joined Compliable’s board of directors.

For real-money sports betting and iGaming companies in North America, the Compliable platform offers a solution that makes it far easier to complete, manage and maintain gaming licenses across multiple states and jurisdictions. Compliable’s software platform and tools provide customers both significant time and cost savings, enabling operators to enter new markets more quickly and to meaningfully reduce the ongoing burden of regulatory requirements.

Launched in 2020, Compliable has signed several new customers, ranging from market leaders to start-ups, and with online gaming legislation continuing to gain momentum across numerous US states, the demand for the platform has intensified. Compliable will use the new capital to accelerate the delivery of key functionality and features to facilitate and speed up launches as sports betting and iGaming continue their rapid expansion across the US. It also allows Compliable to expand its executive team with Justin Stempeck, former Director of Licensing at DraftKings, who joined Compliable as Chief Strategy Officer.

Chris Oltyan, CEO of Compliable, said: “Following discussions with our customers, prospects, regulators and industry contacts it became clear that our solution is timely and necessary, and we realized that expanding our engineering team was essential to keep up with the many feature requests. Additionally, with Justin to help navigate the compliance landscape, we’re positioned to grow exponentially in the coming year. We are also excited to partner with Bettor Capital who brings significant real-money gaming experience and has a deep focus on the software supply chain within the industry.”

David VanEgmond, founder and CEO of Bettor Capital, said: “With the ever growing complexity of licensing in the real-money gaming market, Compliable has quickly become an integral part of how companies process and maintain their regulatory compliance as they enter new markets. I know first-hand from my time as an executive at FanDuel how critical and resource-intensive it can be to comply with diverse gaming regulations on a state-by-state basis. Compliable’s technology makes this process easier and saves companies money, which we believe represents a great long-term value proposition for a software vendor to an exciting growth industry.”

Carl Sottosanti, Member of Compliable’s Board of Directors, said: “Compliance must be top-of-mind for all companies entering the complex US online market and with Compliable’s platform, the employee gaming licensing process is significantly simplified and expedited. I look forward to being part of the company’s journey in what is a very exciting time for the industry.”

Powered by WPeMatico

Canada

High Roller Technologies Signs Letter of Intent with Kindbridge Behavioral Health to Support Responsible Gambling in Ontario

High Roller Technologies Inc., operator of the award-winning, premium online casino brands High Roller and Fruta, announced it has entered into a non-binding Letter of Intent (LOI) with Kindbridge Behavioral Health (Kindbridge) to support its commitment to responsible gambling in Ontario, subject to licensing and regulatory approval.

Through the planned partnership with Kindbridge, High Roller intends to offer eligible Ontario players who choose to self-exclude a confidential pathway to support that helps individuals understand their options and take next steps at their own pace. The experience begins with education and a guided triage process, followed by the option to connect with no-cost peer support and, when appropriate, licensed Canadian clinicians. Using a stepped-care approach, individuals can start where they feel ready and access additional support over time, based on their needs and goals.

“We believe entertainment should always be enjoyed responsibly. Partnering with Kindbridge reinforces our commitment to player wellbeing by ensuring that anyone who may be experiencing challenges with their gambling activity has access to meaningful, professional support. This collaboration reflects our responsibility not only as an operator, but as a trusted brand that puts people first,” said Seth Young, Chief Executive Officer at High Roller.

Kindbridge works with gaming operators across North America to deliver early-intervention programs designed to identify, assess, and support at-risk individuals, including integration with self-exclusion and responsible gaming workflows.

“Building strong, accessible pathways to support is an essential part of effective responsible gambling programs.nOperators are uniquely positioned to assist individuals who may be experiencing distress by helping connect them to appropriate care. We’re proud to work with High Roller to expand access to specialized clinicians and evidence-based resources, supporting healthier outcomes for players and more effective responsible gambling frameworks,” said Daniel Umfleet, Founder & CEO of Kindbridge Behavioral Health.

Seth Young, who currently serves as Chief Executive Officer of High Roller, is a current shareholder, member of the Board of Advisors, and former member of the Board of Directors at Kindbridge.

The post High Roller Technologies Signs Letter of Intent with Kindbridge Behavioral Health to Support Responsible Gambling in Ontario appeared first on Americas iGaming & Sports Betting News.

Brightstar Lottery PLC

Brightstar Lottery Delivers Industry-Leading Sales Force Automation Solution to Ontario Lottery and Gaming Corporation

Brightstar Lottery PLC announced that it has deployed its Sales Wizard salesforce automation tool to the Ontario Lottery and Gaming Corporation (OLG). Brightstar’s powerful, cloud-based Sales Wizard easily integrates with OLG’s central system and equips sales representatives with actionable insights and compelling data to identify lottery retail opportunities and make every retail visit more effective.

“Brightstar’s Sales Wizard is enabling OLG’s sales force with digital access to actionable data while unlocking operational efficiencies so that our sales representatives can make the best use of every retail visit. Sales Wizard is highly configurable so OLG can leverage this product in a variety of ways to meet our evolving business needs,” said Vanessa Theoret, OLG Sr. Director Retail Sales & Account Management.

“OLG joins 24 other lotteries in using Brightstar’s Sales Wizard to help responsibly grow sales. Sales Wizard was designed to be a flexible, convenient tool for lottery sales representatives to work strategically with retailers, providing data, reports, and insights to understand sales trends and optimize as needed,” said Scott Gunn, Brightstar Chief Operating Officer North America Lottery.

Sales Wizard is the industry-leading sales force automation tool that provides sales teams with timely, relevant information and is available in user-friendly mobile apps for greater efficiency in the field. Currently supporting more than 148,000 retailers globally, Sales Wizard provides data and insights on sales, instant ticket inventory, instant ticket facings, point-of-sale equipment and signage, and much more.

Brightstar serves nearly 90 lottery customers and their players on six continents.

The post Brightstar Lottery Delivers Industry-Leading Sales Force Automation Solution to Ontario Lottery and Gaming Corporation appeared first on Americas iGaming & Sports Betting News.

Canada

ComeOn Launches New Marketing Campaign in Ontario

ComeOn Group has launched its new marketing campaign in Ontario. The campaign underscores ComeOn Group’s long-term commitment to sustainable expansion – powered by ComeOn’s proprietary technology and a clear focus on delivering standout, personalized entertainment experiences at scale.

Since entering Ontario in 2022 with its licensed online casino offering, ComeOn Group has steadily built its presence in one of North America’s most competitive regulated markets. In late 2024, the Group reached a major strategic milestone with the launch of its full proprietary sportsbook in the province, expanding its product portfolio and strengthening its position as a full-suite iGaming operator.

The addition of sportsbook enables ComeOn to offer both casino and sports betting within a unified entertainment ecosystem. This expansion aligns with the Group’s broader global strategy to accelerate sportsbook growth, leveraging its in-house platform, trading capabilities, and risk management expertise to scale efficiently across regulated jurisdictions.

To support this next phase of growth in Ontario, ComeOn Group has shifted to an independent media planning model, activating a bold, high-frequency presence across Linear TV, Connected TV (CTV), and Digital channels. This approach reflects the Group’s product-led philosophy- pairing increased brand visibility with a seamless, personalized player journey powered by a robust, in-house technology stack built for performance and scale.

At the centre of the campaign is a series of premium television commercials starring Jeremy Piven, a long-standing ComeOn brand ambassador. Piven’s high-energy presence and authentic connection to sports reinforce the brand’s entertainment-first positioning, bringing ComeOn’s sportsbook experience to life across TV and digital. Produced by ComeOn Group’s internal creative hub, the campaign provides a cohesive creative platform that clearly differentiates the brand in a crowded market.

Efi Peleg, Chief Commercial Officer at ComeOn Group, said: “Ontario is a critical and highly competitive market for us. By shifting to independent media planning and activating a true 360-degree marketing mix, we’re not just increasing awareness – we’re demonstrating the strength of our proprietary platform and our ability to deliver a superior, personalised player experience. Our headline campaign, led by Jeremy Piven, brings our entertainment-first proposition to life and reflects our broader strategy of driving sustainable growth in key regulated markets through differentiated products and data-driven execution.”

The post ComeOn Launches New Marketing Campaign in Ontario appeared first on Americas iGaming & Sports Betting News.

-

Latest News6 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Games Global6 days ago

Games Global6 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Amusnet6 days ago

Amusnet6 days agoWeek 4/2026 slot games releases

-

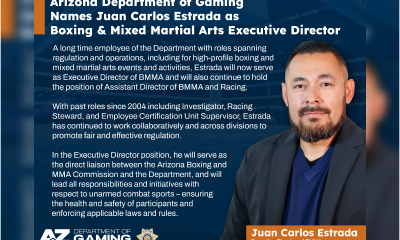

ADG7 days ago

ADG7 days agoArizona Department of Gaming Names Juan Carlos Estrada as Boxing and Mixed Martial Arts Executive Director

-

Anton Ivannikov CPO at Playson7 days ago

Anton Ivannikov CPO at Playson7 days agoPlayson’s Vegas Glitz Shines with Dual Bonus Features

-

Battle Royale7 days ago

Battle Royale7 days agoPrime Rush Goes Live in Early Access, Bringing a Brazil-First Mobile Battle Royale to Players

-

Blueprint Gaming7 days ago

Blueprint Gaming7 days agoUnlock Features and Riches with Blueprint Gaming’s Gold Strike Express™

-

AFCON 20257 days ago

AFCON 20257 days agoAFCON’s month of football did not lift iGaming demand — Blask data analysis