Greece

BetGames readies Greece rollout with major Kaizen Gaming deal

BetGames, the leading live dealer and betting games supplier, has taken the next step in its enviable recent expansion by bringing its award-winning products and services into Greece with Kaizen Gaming.

Following a record-breaking 18 months, the latest tier-one move highlights the evolution of BetGames’ commercial growth as the industry’s unique live dealer and betting games supplier.

Kaizen Gaming is one of the fastest- growing gaming tech companies in Europe, currently operating in six countries, under the Stoiximan brand in Greece and Cyprus and as the Betano brand in Germany, Portugal and Romania.

The development comes after the studio’s recent major relaunch of its Lotto products and bolsters the success it has already seen with its market-leading popular content across Europe.

Thanks to the deal, Kaizen players are now able to enjoy an array of hit BetGames titles such as its revolutionised Lotto games, as well as the equally refreshed next-generation Wheel of Fortune.

Perennial BetGames chart-toppers such as Bet on Poker, War of Bets, and its innovative twist on Texas hold’em poker, 6+ Poker, will also be available to players. Each has proven to be industry-leading revenue drivers, and hugely popular with global audiences.

Reflecting on the studio’s latest milestone, BetGames’ COO Aiste Garneviciene said: “Maintaining our recent growth momentum is vital for us and our move into Greece is helping us capitalise on that.

“It’s been a long time coming and we couldn’t be happier that Greek players will be able to start enjoying our wonderful products! With a whole host of re-vamped games, we’re ready to take the country by storm with some of the best live dealer and betting games available globally.

“It’s been a big year of us so far, and after all the hard work and investment we’ve put into our company, we’re now in the ideal position to make the absolute the most of our latest expansion. Our partnership with Kaizen Gaming will no doubt prove to be the first of many big-name announcements in the region.”

Christos Mavridis, Live Casino Manager at Kaizen Gaming, added: “We have a thriving domestic market in Greece and as one of its leading operators, we need to have the best products on our platforms.

“We, at Kaizen Gaming, continually improve our products and services to offer the best experience to those who trust us for their entertainment and BetGames’ range of hugely popular titles will suit the Greek market perfectly. We’re delighted to have them on board.”

The latest in a key series of deals signed in recent months, BetGames is expected to go live shortly with a further number of major tier-one operators, with more news expected over the coming weeks.

The move follows BetGames launch of its first Malta-based Hub, opened earlier this year – with a business development focus on LatAm, African and European markets.

Established as the industry’s ‘go-to’ regulated live dealer supplier, BetGames holds licences issued by multiple jurisdictions including the UK, as well as being compliant with the local regulatory requirements of Malta, Italy, Lithuania, Estonia, Bulgaria and various relevant South African gambling authorities.

Powered by WPeMatico

Greece

Monobala Renews its Partnership with STATSCORE

Monobala, a premier Greek sports medium, has officially renewed its partnership with STATSCORE, a leading sports data provider and technology partner for the media industry worldwide. Strategic reunion signals STATSCORE’s competitive edge in Greek football data coverage, as a top media outlet chooses depth and service quality.

The collaboration marks a significant homecoming for Monobala, which is re-integrating STATSCORE’s solutions to boost its football reporting. Under this new agreement, the Greek company will deploy LivematchPro and ScoutsFeed to deliver real-time insights, deep statistics and immersive visualisations to its audience.

The decision to return to STATSCORE was driven by the provider’s unmatched coverage of the Greek football pyramid.

“Returning to STATSCORE wasn’t just about data quality – it was about coverage depth. No other provider offers the granularity we need for top tiers of Greek football and the National Team. Our readers expect front-row access to the analytical side of football, and STATSCORE’s verified data allows our journalists to focus on storytelling while the insights drive engagement. It’s the combination of comprehensive local coverage and service quality that brought us back,” said Panos Voglis, Director of Monobala.gr.

STATSCORE provides the infrastructure necessary for Monobala to offer detailed data for all the key competitions, including:

• The three top tiers of Greek football and the Greek Football Cup: ensuring local fans never miss a beat of domestic action.

• The Greek national team: providing verified data for all international fixtures.

• European competitions: delivering top-tier data and insights for elite continental tournaments.

For Monobala, the move represents a commitment to high-journalistic standards with the top-quality data that is both Verified by STATSCORE and delivered at a competitive price point.

This partnership serves as a testament to STATSCORE’s growing global influence, as its cutting-edge data solutions and sports technology continue to gain widespread recognition among elite media organizations worldwide.

“When a premium media outlet evaluates the entire market and chooses to come back, it sends a clear signal about data quality, coverage depth, and partnership value that STATSCORE provides. As a dedicated technology partner for the media industry, we are proud to witness how our data empowers journalists and editors, providing them with the verified insights they need to stay ahead in a competitive market,” said George Fotev, CRO at STATSCORE.

The post Monobala Renews its Partnership with STATSCORE appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

blask

Greece Led Europe’s iGaming Growth in 2025 — Now the Drivers Are Fully Explained

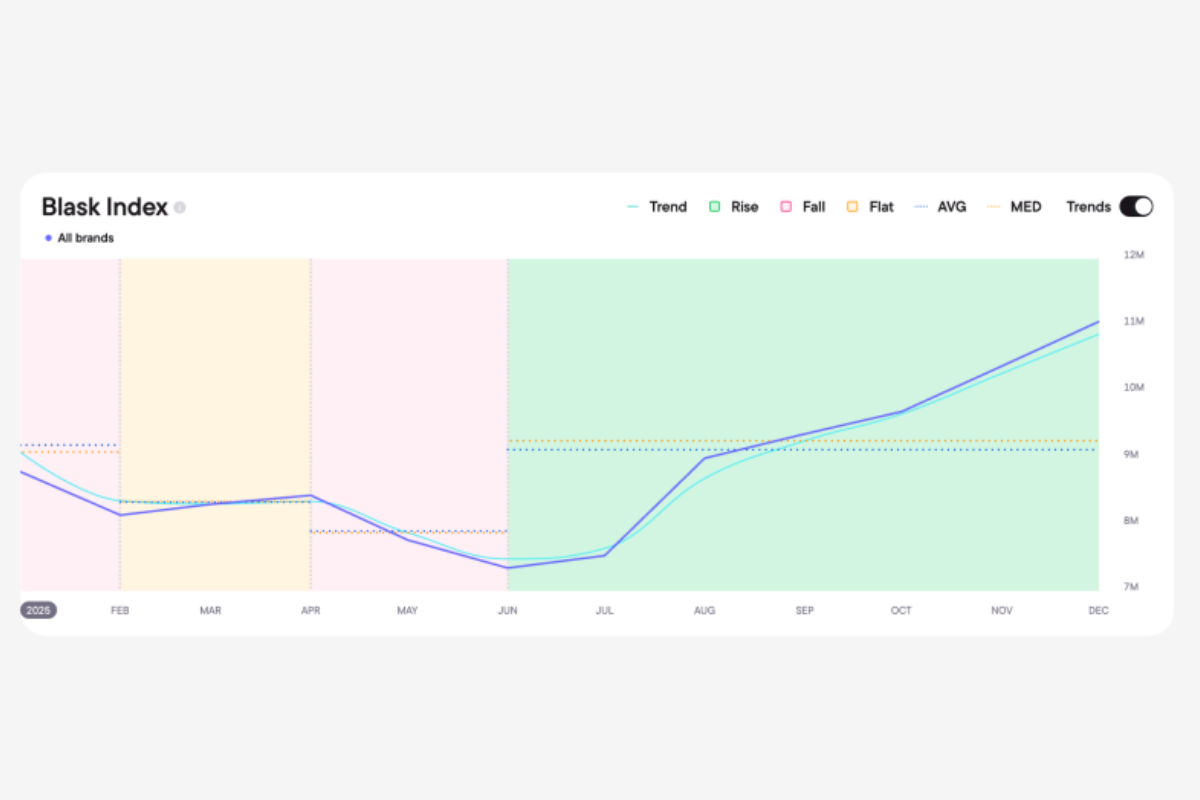

In the second half of 2025, Greece emerged as Europe’s fastest-growing iGaming market. While several major jurisdictions slowed or declined, Greek market demand rose by more than 50% between June and December, standing out as one of the year’s clearest growth stories.

According to data from Blask, the surge was not the result of a single tournament or seasonal spike. Instead, it reflected a structural shift driven by a combination of sports momentum, regulatory reform and casino market dynamics — factors that can now be traced in detail through Blask’s newly released Market Explanation feature.

Continuous sports momentum without demand gaps

Greece’s growth was underpinned by a tightly stacked sports calendar that sustained engagement across multiple months. EuroBasket 2025 in late August, the kickoff of the Stoiximan Super League, UEFA Champions League matchdays under the new league-phase format, and the EuroLeague season featuring Greek clubs created a continuous rhythm of high-interest betting cycles throughout autumn.

Rather than short-lived peaks followed by sharp declines, demand remained elevated well beyond individual events. This is a pattern clearly visible on the Blask Index trend line.

Casino reform reshaped demand behavior

One of the most significant contributors came from the casino segment. Greece’s decision to raise RNG stake limits from €2 to €20 altered the mechanics of the market, allowing online casinos to absorb demand during sports off-peak periods.

As sports-led acquisition increasingly converted into casino play, operators reported double-digit iGaming growth. Market Explanation analysis shows that this effect persisted over time, confirming the shift as structural rather than seasonal.

Enforcement redirected demand to licensed operators

Regulatory action further reinforced the upward trend. In December, Greek authorities blocked approximately 11,000 illegal gambling domains. Instead of suppressing demand, the move redirected player interest toward licensed platforms, strengthening regulated market performance.

The impact was amplified by the adoption of IRIS instant payments, which reduced deposit friction and improved conversion from interest to activity.

From tracking trends to understanding causes

To surface these drivers, Blask has introduced Market Explanation — an AI-powered layer within the Blask Index that allows users to click on any country’s trend line and instantly see a sourced breakdown of the forces behind the movement. Sports calendars, regulatory changes, casino dynamics and macro factors are analyzed together, turning raw demand signals into actionable market context.

Greece’s 2025 performance illustrates how this approach changes market analysis. Rather than simply observing that demand is rising, operators, suppliers and investors can now see why it is happening — and which levers are shaping the trajectory of a market in real time.

The post Greece Led Europe’s iGaming Growth in 2025 — Now the Drivers Are Fully Explained appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Fotini Matthaiou Executive Director of Casino at Novibet

Novibet Expands Greek Casino Offering with Octoplay Live

“The current Greek launch with Novibet demonstrates the momentum of our European expansion,” says Ralitsa Georgieva, Director of Business Development at Octoplay. “Adding Greece to our portfolio of regulated markets reinforces our strategy of rapid growth across Europe, bringing our premium content to new player audiences throughout the continent.”

Fotini Matthaiou, Executive Director of Casino at Novibet, comments:“Our partnership with Octoplay marks another important step in Novibet’s ongoing commitment to delivering next-generation gaming experiences. By integrating Octoplay’s innovative portfolio into our platform, we continue to expand the range of premium content available to our players, combining cutting-edge technology with entertainment value. At Novibet, we constantly seek strategic collaborations that enhance the quality and diversity of our offering, ensuring that every player enjoys a personalized, world-class gaming experience.”

The post Novibet Expands Greek Casino Offering with Octoplay Live appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Latest News7 days ago

Latest News7 days agoTRUEiGTECH Unveils Enterprise-Grade Prediction Market Platform for Operators

-

Blueprint Gaming5 days ago

Blueprint Gaming5 days agoBlueprint Gaming unleashes Frankenstein’s Fortune blending dynamic modifiers with multi-path bonus offering

-

Compliance Updates6 days ago

Compliance Updates6 days agoHow to Apply for a Finnish iGaming License: Gaming in Finland Webinar on Application Steps and Technical Standards

-

Africa7 days ago

Africa7 days agoEveryMatrix gains South Africa licence with customer launch pipeline on the rise

-

Big Daddy Gaming6 days ago

Big Daddy Gaming6 days agoBig Daddy Gaming® Expands European Footprint After MGA Licence Approval

-

Andréia Oliveira Betsul’s Operations Director7 days ago

Andréia Oliveira Betsul’s Operations Director7 days agoBetsul launches Brazil’s first native betting app in partnerships with Vibra Solutions

-

Latest News4 days ago

Latest News4 days agoGGBET UA hosts Media Game – an open FC Dynamo Kyiv training session with journalists from sports publications

-

Compliance Updates5 days ago

Compliance Updates5 days agoMGA Publishes Results of Thematic Review on Self-exclusion Practices in Online Gaming Sector