Compliance Updates

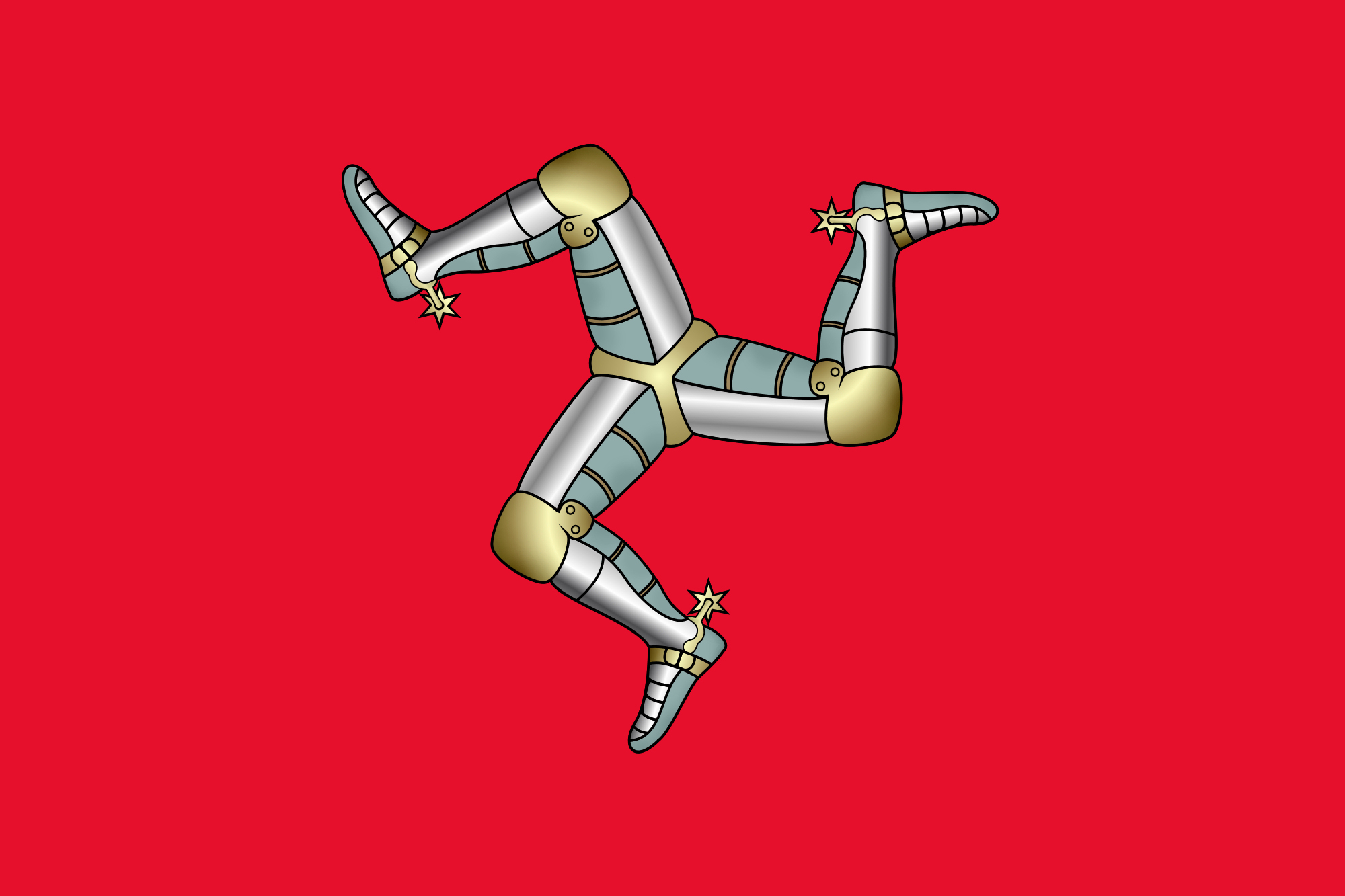

Isle of Man Sees Unprecedented Demand in Licence Applications From Global Online Gambling Businesses

The Isle of Man has seen a huge increase in demand from global gaming operators amid proposed changes to regulation and structure in some jurisdictions.

Initial enquiries, sparked by uncertainty about the impact and scope of jurisdictional and political changes, and positive follow-up discussions have seen service providers on the Isle of Man report an uptick in enquiries from businesses wanting to relocate to the Island over the last 12 months.

There has been a thirty per cent increase in demand this year with the number of licensees to be supervised by the Gambling Supervision Commission now at 55 with several more in the pipeline, an increase of 21 in last 12 months, in comparison to 8 licence approvals in 2019.

The recent regulatory changes in alternate jurisdictions, combined with the Island’s handling of Covid-19 and the introduction of a new software supplier licence has contributed to a significant surge in the number of applications as businesses seek strong regulation around player protection providing comfort to banks, PSP’s and investors.

Steve Brennan, Chief Executive of The Isle of Man Gambling Supervision Commission, comments:

“We are exceptionally busy at the minute processing a significant rise in the number of applications for online gambling operators.

We continued to work throughout lockdown, and over the last 10 months, we have received or completed a considerable number of applications. By the time we have closed those out and added recent applications, we will have 60 licences to supervise.”

Speaking on why operators are choosing the Isle of Man, Jade Zorab, Director of Amber Gaming, responded:

“The Isle of Man has proven to be at the forefront of the more notable eGaming jurisdictions over the years. It has a combination of a stable political and economic environment, low tax and advanced IT infrastructure in addition to a cluster of experienced and reliable professional organisations – all of which has created a compelling proposition for eGaming companies both locally and further afield.

“The Island also offers a flexible licensing regime with a pragmatic and efficient regulator, which is especially valuable during a time where there is so much global uncertainty and regulatory changes in several other jurisdictions which brings the prospect of significant operational challenges. Given the Island’s strong reputation and open and innovative approach in the evolving gaming landscape, the future outlook is positive and it is no surprise that the Isle of Man is experiencing an influx of eGaming ventures, which we are proud to support.”

Lyle Wraxall, Chief Executive at Digital Isle of Man, adds:

“A key strength of the Isle of Man is its commitment to the development and continued success of the eGaming companies domiciled here. Digital Isle of Man supports this by striving to build and maintain solid foundations for our Island businesses to flourish, offering quick fire advice and tackling obstacles to ease business decisions and burdens along the way.

We have strong heritage and credentials in the eGaming sector and are renowned for our premium regulation which is becoming more and more important to businesses. As businesses licensed elsewhere seek security and continued business growth, the experience and expertise based in the Isle of Man is the logical next step for businesses to mature and grow.

The Isle of Man has a track record of being a safe and secure place for businesses to grow, and boasts a confident, stable economy, with no market restrictions, ensuring minimal disruption to business progress and opportunities.”

Powered by WPeMatico

Compliance Updates

Dutch Regulator Publishes Match-fixing Trend Analysis 2025

The Dutch gambling regulator, Kansspelautoriteit (KSA), has published its Match-fixing Trend Analysis for 2025.

The number of reports of possible match-fixing in 2025 remained roughly the same as in 2024. However, there was a change within the reports: gambling providers reported more athletes betting on their own competition, which wasn’t the case in 2024.

Gambling providers are obligated to prevent match-fixing as much as possible. They can do this, for example, by not offering bets on high-risk matches. If a provider suspects match-fixing, it can report it to the Sports Betting Intelligence Unit (SBIU) of the Royal Netherlands Gambling Authority (KSA). In recent years, the KSA has actively worked to raise awareness about filing these reports.

In 2025, the KSA received 12 reports of match-fixing from 9 different license holders, compared to 13 reports the previous year. It is striking that 4 of these reports concerned betting on the club’s own competition, while this category did not occur in 2024. In this context, the KSA increased its focus on preventative education for athletes in 2025, informing them about what is and is not permitted and the associated risks.

Last year, the KSA published a guideline, “Commitment to Integrity,” to provide providers with additional tools to combat match-fixing. Furthermore, an ongoing investigation into the sports betting offerings of various providers was conducted throughout 2025. This investigation resulted in several warnings and a penalty for prohibited offerings.

The post Dutch Regulator Publishes Match-fixing Trend Analysis 2025 appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Australia

Liquor & Gaming NSW Targets Social Media Influencers Promoting Gambling Products

Liquor & Gaming NSW (L&GNSW) is putting gambling operators on notice that social media influencers are a key focus of its regulatory priorities for 2026.

L&GNSW is responsible for monitoring online wagering and gaming machine advertising visible to the NSW community, including posts on social media, to ensure they comply with NSW laws.

Hospitality and Racing Deputy Secretary Tarek Barakat said with the rise of social media influencers promoting gambling, it was important businesses including online bookmakers and gaming machine operators understood the law and their responsibilities.

“We are putting gambling operators on notice that a key priority for us this year is examining their marketing and customer retention practices, including the use of social media personalities,” Mr Barakat said.

“Gambling operators should be careful about any affiliate or partnership arrangements as we are holding them responsible for the advertising of their products.

“The things we are targeting include paid and unpaid promotional partnerships with wagering operators and gaming machine operators, influencer content that normalises betting behaviour or glamorises gaming products, and in particular, the use of platforms, including podcasts, with large youth or vulnerable audiences.

“These practices may increase the risk of gambling harm by blurring the line between entertainment and marketing, and by exposing at‑risk groups to persuasive promotional content.

“L&GNSW will require social media content creators to demonstrate that their social media and website content complies with legal requirements.

“We also work with other responsible agencies as required to ensure people abide by the law and gambling harm is minimised.”

Mr Barakat said other 2026 regulatory priorities are targeting:

• barriers to closing gambling accounts, VIP or loyalty programmes and other marketing practices, including direct advertising used by casino and gaming venue operators

• casino governance and integrity

• alcohol-related harm hotspots, including areas experiencing increasing rates of alcohol-related crime and high-risk events.

By publishing its annual regulatory priorities, L&GNSW aims to communicate the key regulatory issues that it is addressing and provide industry with an opportunity to proactively modify or cease behaviour that may raise concerns.

The post Liquor & Gaming NSW Targets Social Media Influencers Promoting Gambling Products appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Compliance Updates

REEVO’s Aggregation Platform Secures Official Certification in Peru

REEVO, the iGaming aggregation powerhouse, has announced that its aggregation platform has received official certification in Peru, enabling operators in the region to seamlessly integrate a wide range of premium third-party content through a single, high-performance API connection.

With this certification in place, Peruvian operators can now:

• Launch faster with a single API, robust orchestration, and a proven back-office system.

• Optimize performance through real-time insights, flexible promotional tools, and streamlined content management.

• Localize efficiently with market-ready technology built for compliance, reliability, and growth.

“Peru is a rapidly developing iGaming market in Latin America, and this certification marks another milestone in our mission to deliver seamless, compliant aggregation solutions across the region. Our focus remains on speed, scalability, and content excellence, helping operators bring quality entertainment to players faster and smarter,” said Karl Grech, Head of Business Development at REEVO.

The post REEVO’s Aggregation Platform Secures Official Certification in Peru appeared first on Americas iGaming & Sports Betting News.

-

Canada5 days ago

Canada5 days agoPointsBet Canada to Contest Proposed 5-Day Suspension by AGCO

-

Africa5 days ago

Africa5 days agoEGT showcases African growth strategy at SiGMA Africa 2026

-

Ben Bradtke Co-Founder of ThrillTech5 days ago

Ben Bradtke Co-Founder of ThrillTech5 days agoThrillTech enters Brazilian market with EstrelaBet

-

Denmark5 days ago

Denmark5 days agoELA Games Strengthens Danish Market Presence via Stake.dk Tie-Up

-

BIG Cyber5 days ago

BIG Cyber5 days agoBMM INNOVATION GROUP TO SPONSOR AND EXHIBIT AT SBC RIO 2026 MARCH 3–5 AT RIOCENTRO, RIO DE JANEIRO

-

Brasil5 days ago

Brasil5 days agoBrasil ante una encrucijada: match-fixing e impuesto rechazado

-

ANJ5 days ago

ANJ5 days agoWhat’s up and what’s next on the French gambling market ?

-

bets5 days ago

bets5 days agoRegulatory crossroads: Anti-match-fixing bill and betting tax rejection