Canada

United States Addiction Rehab Industry Report 2020

The “The U.S. Addiction Rehab Industry – 5th Edition” report has been added to ResearchAndMarkets.com’s offering.

Drug, alcohol and other addiction rehab in the United States is big business – $42 billion this year.

There are now 14,000+ treatment facilities and growing. A total of 3.7 million persons received treatment, but many more need it and facilities are filled to capacity. Insurance coverage for rehab has increased, but scandals abound as shoddy facilities opened and patient brokering, overbilling and deceptive marketing became common. Reforms are pending. Private equity firms are investing.

This new study examines the nature of the business, types of rehab, reasons for the renewed growth of addiction rehab services since the Great Recession and the opioid crisis, national receipts/growth from 1983-2018, 2020 and 2025 forecasts, average facility revenues and operating ratios, industry structure and participation by non-profit, for-profit, inpatient and outpatient programs, extensive drug/alcohol abuser demographics. Discussion of the Florida Model, destination markets in FL and CA, effects of increased volume due to the Affordable Care Act, industry history and evolution, and discussion of all major industry trends.

Includes all the pertinent data compiled by SAMHSA’s latest government survey, data from the NIDA, NAATP, state agencies, and more.

9 in-depth company profiles are provided for: Hazelden Betty Ford Foundation, CRC Health Group, Promises Behavioral Health, Passage Malibu, American Addiction Centers, The Caron Foundation, Comprehensive Care Corp., Malibu Horizon Rehab Center, and Behavioral Health of The Palm Beaches.

COVID-19 Update July 2020:

The publisher has issued a free July 2020 update for this report, analyzing the probable impacts of the Covid-19 pandemic on drug & alcohol addiction treatment centers.

It discusses: operational changes, the shift to virtual visits, a shift to more outpatient care, impact on federal state and local program funding, findings of recent industry surveys, examples of reduced caseloads and state actions, potential facility closures, how the industry may actually benefit from the pandemic, and revised 2020 and 2025 market growth forecasts.

Key Topics Covered:

Introduction, Sources & Methodology Used

Executive Overview of Major Findings

Discussion of scope of U.S. alcohol and drug addiction problem, cost to society, impact of treatment, structure of treatment providers industry (no. of facilities by type), major industry trends and issue, industry size, growth and forecasts (1983-2025 F), effects of recessions and Affordable Care Act, outlook for 2020, list of leading treatment organizations/companies, user demographic highlights of 2019 SAMSHA government survey regarding scope of drug & alcohol abuse/usage/persons in treatment, client & facility characteristics – highlights of all report chapters.

Nature and Structure of the Industry

- Discussion of different types of centers (% for-profit, non-profit, private/government, by primary focus), typical programs offered, treatment programs by type site

- Discussion of indicators of program quality

- Inpatient vs. outpatient care, etc. (no. of facilities, patients served, occupancy rate, industry revenues, average revenues per facility, mean no. of clients per facility,

- Typical cost of rehab

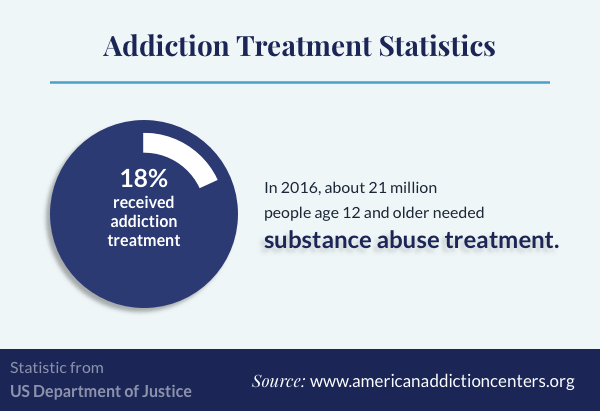

- Demand for care: no. of persons that need treatment

- Discussion of the industry’s major problems and scandals (deceptive marketing, overbilling, patient brokering, fraud, etc.)

- Various types of rehab (drug, alcohol, sex addiction, gambling, Internet, post-traumatic stress),

- The 6 major types of rehab (philosophies – faith-based, evidence-based, 12-step, etc.)

Demographics -SAMHSA Survey Findings – Data on Substance Abusers

- Key statistics about national costs of drug & alcohol abuse, hospitalizations, opioid use

- Discussion of trends in illicit drug use, persons age 12 or older: (usage of marijuana, cocaine, heroin, hallucinogens, methamphetamine, nonmedical use of prescription drugs – number and percent of persons)

- Discuss trends in alcohol use, persons age 12 or older: (heavy drinking, binge drinking, current use – number and % of persons)

- Marijuana use – discussion, number and % of persons

- Cocaine use – discussion, number and % of persons

- Heroin use – discussion, number and % of persons

- Methamphetamine use – discussion, number and % of persons

- Inhalants use – discussion, number and % of persons:

- Hallucinogens use – discussion, number and % of persons:

- Psychotherapeutics use – discussion, number and % of persons:

- The Opioid epidemic: discussion, number and % of persons

Major Industry Trends & Issues

- Discussion of insurance fraud and overbilling, patient brokering, deceptive marketing

- Discussion of The Affordable Care Act and the Mental Health Parity and Addiction Equity

- Act and how it has upended the industry’s business model

- Compliance with evidence-based practices is spotty

- Private equity investors pour money into addiction treatment

- Attempts at reform: actions by Google, The Federal Support Act

- Discussion of The Opioid Crisis & Treatment, medically assisted treatment.

Industry Size, Growth, Segments, Forecasts

- Summary: Total industry size, estimates by government vs. other mkt. research firms, public vs. private spending/funding

- The treatment population: no. and % of people actually receiving treatment: 2018, payment by source of funds

- Number of treatment facilities in U.S., % treated by type facility, median no. of clients (total and by outpatient, residential, hospital, detox)

- Estimates of industry size ($ revenues): 2019 SAMHSA report, growth of private, public, out-of-pocket spending 2020 outlook and effect of Affordable Care Act, projected increase of persons in treatment, effects of recessions

- 2025 Forecast: major trends discussion: reliance on public financing, Medicaid, increased private insurance coverage, E-health, effect of recessions

- Discussion of Medicaid and Other State and Local Financing.

- The high-end market segment: discussion of the private pay marketplace, $ value

- Destination markets: discussion of the South Florida market, the “Florida Model”, history

- Discussion of the gambling addiction market: no. of problem gamblers, amount spent per year

- Sex addiction: discussion of why it has come into the mainstream, Tiger Woods and other celebrity publicity, types of treatment programs, list of top treatment centers.

Treatment Facility Operating Ratios

- U.S. Census Bureau ratios for mental health & substance abuse facilities (2017, 2012, 2007) – no. of facilities, revenues, avg. revenues per center, payroll costs, no. of employees (outpatient vs. inpatient centers) – summary

- Discussion of no. of clients per facility, mean cost of care, cost to treat per person, outpatient care

Competitor Profiles of the Leading Treatment Organizations and Multi-Center Chains

(For each organization, a discussion of: history/founding, description of major programs, services, estimated/actual revenues, no. of centers, fees, facilities operated, mergers, sold facilities, recent developments.)

- Hazelden Betty Ford Foundation

- CRC Health Group

- American Addiction Centers

- Promises Behavioral Health

- Passage Malibu

- The Caron Foundation

- Comprehensive Care Corp.

- Malibu Horizon Rehab Center

- Behavioral Health of The Palm Beaches

Directory of Industry Reference Sources

- Name/address/phone of drug & alcohol abuse-related industry trade associations, government reports, major EAP industry trade journals, hotline phone numbers, etc.

- List of state substance abuse agencies

For more information about this report visit https://www.researchandmarkets.com/r/lnnm5i

Powered by WPeMatico

Alberta iGaming Corporation

Alberta iGaming Corporation Partners with Responsible Gambling Council

The Alberta iGaming Corporation (AiGC) has announced a partnership with the Responsible Gambling Council (RGC) that will make RG Check accreditation a mandatory requirement for all internet gaming (iGaming) sites entering Alberta’s regulated market.

This collaboration demonstrates Alberta’s commitment to player protection by ensuring every regulated operator meets the highest evidence-based standards for responsible gambling.

“Alberta is committed to building a safer, regulated iGaming environment where player protection comes first. By requiring RG Check accreditation, we’re ensuring that every iGaming operator in our market has demonstrated their commitment to player safety through independent verification of their responsible gambling programs,” said Dan Keene, Interim AiGC CEO.

RG Check is a Canadian-made, globally trusted, independent responsible gambling accreditation program. Developed by RGC more than a decade ago, RG Check evaluates sites against rigorous, evidence-based standards, covering governance, player safeguards, staff training, and marketing practices. The accreditation provides clear, measurable accountability and has become the gold standard for responsible gambling across multiple jurisdictions.

“This partnership with AiGC demonstrates the power of regulators and responsible gambling experts working together to protect players from day one. Alberta is building on a strong foundation established in Ontario, where RG Check has proven its value in creating safer gambling environments. This proactive approach ensures that player protection isn’t an afterthought; it’s built into the market from the ground up,” said Sarah McCarthy, CEO of RGC.

Alberta’s requirement will ensure that:

• All iGaming sites must achieve RG Check accreditation

• Operators must maintain their accreditation in good standing while operating in Alberta

• RGC will conduct assessments based on internationally recognized responsible gambling standards

• AiGC will work closely with RGC to ensure ongoing compliance and continuous improvement.

Requiring accreditation in Alberta’s market reflects AiGC’s commitment to promoting responsible gambling, and will create a level playing field where protecting players is a competitive advantage, not just a compliance checkbox.

For operators who currently hold RG Check accreditation in another jurisdiction, the transition to Alberta will be streamlined. While a distinct Alberta accreditation is still required, existing accreditations will be recognized to simplify the process and reduce costs. Operators will benefit from an efficient onboarding process that reduces administrative burden while maintaining the same rigorous standards for player protection.

The post Alberta iGaming Corporation Partners with Responsible Gambling Council appeared first on Americas iGaming & Sports Betting News.

Canada

St8 launches in Ontario through partnership with Tonybet

Casino games aggregator and full-service technology provider, St8 has officially gone live in Ontario’s regulated market through a new partnership with international brand Tonybet.

Through the partnership, Tonybet gains access to St8’s casino games aggregation platform, offering a wide range of premium titles from leading providers through a single API, alongside bonusing and promotional tools, compliance and licensing solutions, advanced reporting and data capabilities.

Built as a single scalable platform, St8’s products are designed to help operators launch and grow across regulated markets with fast, flexible technology solutions while maintaining full compliance.

The agreement marks a further step in St8’s global growth strategy as the company continues to expand its presence across regulated jurisdictions.

Vladimir Negine, CEO at St8, said: “Going live in Ontario is an important milestone for St8 and reflects our continued commitment to growth in regulated markets. Since receiving our Ontario licence, we have focused on building strong local partnerships and delivering a platform that combines scalability, speed and compliance.

“As a respected international brand, Tonybet shares our commitment to building reliable solutions for regulated markets, and we look forward to working closely together as we continue to expand our presence in regulated jurisdictions worldwide.”

Kiryl Liudvikevich, Head of Product at Tonybet, added: “As we expand our presence in Ontario, it is important for us to work with technology partners that support continued growth while meeting the highest regulatory standards.

“St8’s platform gives us the flexibility to integrate a wide range of content and tools through a single connection, helping us scale smoothly while maintaining a strong focus on player experience.”

St8 continues to lead the way as a partner of choice for regulated markets. In addition to its Ontario licence, the company holds licences in key regulated jurisdictions like the United Kingdom, Sweden and Romania, among others.

The post St8 launches in Ontario through partnership with Tonybet appeared first on Americas iGaming & Sports Betting News.

Canada

Rivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives

Rivalry Corp. announced that its Board of Directors has approved a significant reduction in operating activity as the Company evaluates strategic alternatives in respect of its assets and operations.

The Company is engaged in discussions with third parties regarding potential transactions. However, in light of recent performance volatility, the Board has determined to materially reduce the scale of operations while assessing whether a strategic transaction or other alternative can be advanced.

Effective immediately, the Company is implementing substantial cost reductions, including a significant workforce reduction and reduced operating expenditures. The Company has paused player activity on its platform and is facilitating player withdrawals in the ordinary course.

The Company is assessing a range of potential alternatives, which may include asset-level transactions, corporate transactions, restructuring initiatives or other strategic outcomes.

Given the Company’s reduced operating scale and the ongoing evaluation process, there can be no assurance that any strategic alternative will be completed or that operations will continue in their current form.

The post Rivalry Corp. Announces Significant Reduction in Operations and Evaluation of Strategic Alternatives appeared first on Americas iGaming & Sports Betting News.

-

Blueprint Gaming6 days ago

Blueprint Gaming6 days agoBlueprint Gaming unleashes Frankenstein’s Fortune blending dynamic modifiers with multi-path bonus offering

-

Compliance Updates7 days ago

Compliance Updates7 days agoHow to Apply for a Finnish iGaming License: Gaming in Finland Webinar on Application Steps and Technical Standards

-

Big Daddy Gaming7 days ago

Big Daddy Gaming7 days agoBig Daddy Gaming® Expands European Footprint After MGA Licence Approval

-

Latest News4 days ago

Latest News4 days agoGGBET UA hosts Media Game – an open FC Dynamo Kyiv training session with journalists from sports publications

-

Compliance Updates6 days ago

Compliance Updates6 days agoMGA Publishes Results of Thematic Review on Self-exclusion Practices in Online Gaming Sector

-

Amusnet6 days ago

Amusnet6 days agoAmusnet Unveils Casino Engineering and Technology Milestones Achieved in 2025

-

Brais Pena Chief Strategy Officer at Easygo7 days ago

Brais Pena Chief Strategy Officer at Easygo7 days agoStake Goes Live in Denmark Following Five-Year Licence Approval

-

Dan Brown6 days ago

Dan Brown6 days agoGames Global and Foxium return to the Colosseum in Rome Fight for Gold the Tiger’s Rage™