Latest News

The ANJ publishes the results of the online gambling market for the 2nd quarter of 2020: the sectors are very differently impacted by the COVID crisis

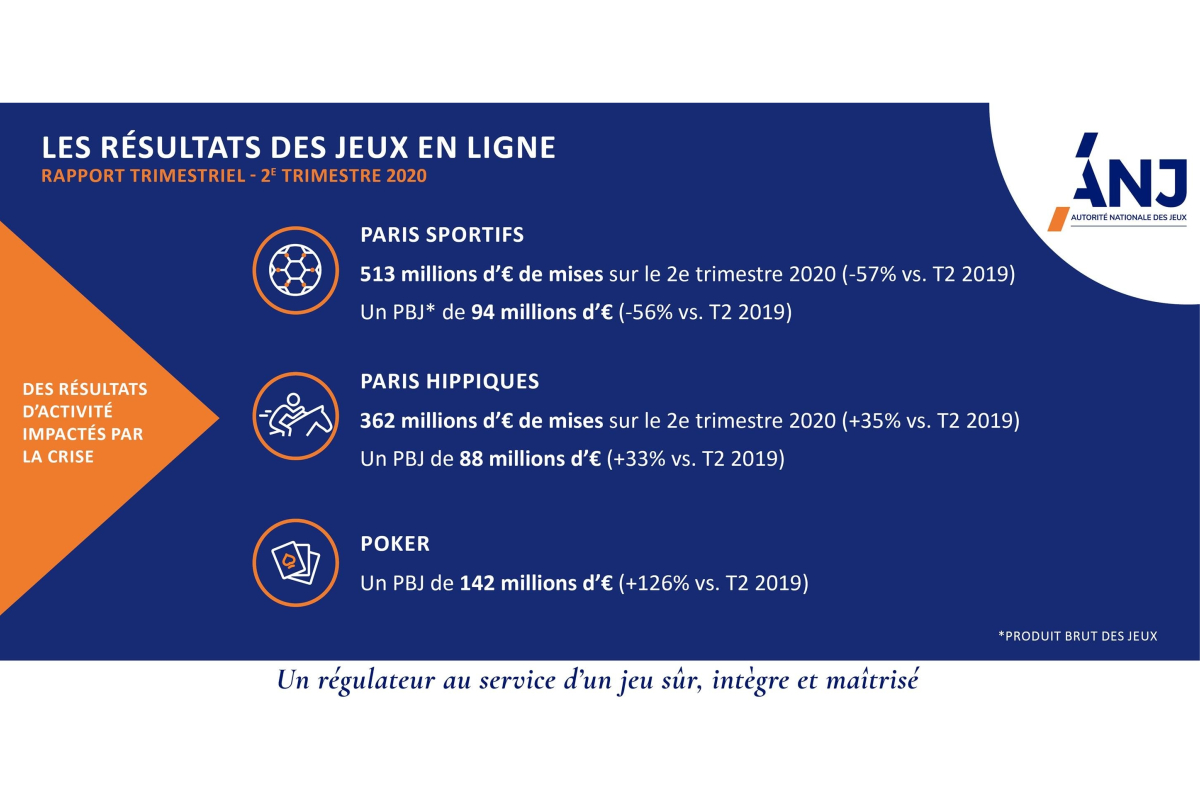

In the 2nd quarter of 2020, the online gambling market recorded a decrease of 6% of its GGR[1] and a decrease in active player accounts of 9%. It is the sports betting sector that has been the most affected by the effects of the health crisis with a decrease of 56% of its GGR. Conversely, the poker and, to a lesser extent, horseracing betting segments recorded a sharp increase of their GGR.

The lockdown (from 16 March to 10 May) was particularly handicapping for operators, who recorded a decrease of 24% over the period compared to 2019.

However, despite this health crisis, the GGR of the legal online market reached 758 million euros over the first 6 months of the year, an increase of 8% compared to the first half of 2019.

The collapse of online sports betting : -56% of the GGR

The online sports betting segment is generally the most dynamic part of the online gambling market. On the flip side of this trend, the sports betting offer for the quarter was profoundly altered by the massive cancellations or the delayed recovery of sporting events. With this reduction of the supply, and in order to support the market, the ARJEL Board authorized the add of 7 competitions to the list of sporting events, allowing them for sports betting in France (Australian football, 1st Australian soccer league, Hungarian football cup, 1st South Korea and China football leagues, baseball in Korea and hockey in Belarus).

These new competitions, while meeting ARJEL’s requirements regarding the fight against sports manipulation, have made it possible for operators to maintain a sports betting offer throughout the period of suspension of major competitions. All in all, operators’ GGR in the sports betting market amounted to 94 million euros in the second quarter, a decrease of 56% compared to 2019. The decline in operators’ turnover fell to 87% over the lockdown period.

As a result of this unprecedented situation, the number of active player accounts fell by 36%, albeit at a slower pace than the decrease of the GGR. The average spending per active player account over the quarter[2] amounted to 86€ compared to 126 € in Q2 2019 (-32%).

While operators had planned to make a significant marketing effort for EURO 2020, they sharply reduced their sports betting advertising spending during the 2nd quarter of 2020[3] in response to the decline in their activity.

The results provided by the FDJ demonstrate similar difficulties in the sports betting segment. The monopoly recorded indeed a decrease of 39% in sports betting stakes, all channels combined, in the first semester and up to around 61% in the second quarter alone.

An increase of online horseracing betting: +33% of the GGR

The horseracing betting offer was significantly affected this quarter following the interruption of French horseraces until 11 May 2020. However, the bets recorded during this period increased by 16%, in particular thanks to the maintenance and additions of foreign horseraces to the French horseraces betting calendar, approved by the Ministry of Agriculture and Food after an informal advice from ARJEL[4]. The increase of horseracing stakes is also due to the shift of some sports bettors to horseracing betting during the period. As soon as French races resumed, the market recorded an increase of the number of players, that accelerated the growth of the stakes over the quarter.

The online horseracing betting market activity is once again growing at a rate not observed since the market opened in 2010. The players’ stakes reached 362 million euros this quarter, up 35% compared to the second quarter of 2019. This volume of stakes also corresponds to the highest level generated over a quarter. At the same time, the GGR of the quarter increased by 88 million euros in proportions almost similar to stakes (+ 33%), its highest level since the opening of the market.

The PMU, operator under exclusive rights regarding offline horseracing betting, reported a decrease of 31% of the stakes in the 1st half of the year, all channels combined. However, business results improved at the end of the semester, thanks to the gradual reopening of points of sale and racecourses.

The booming of online poker: +126% of the GGR

The lockdown period has been very advantageous to the online poker segment. The popularity for this activity has led to the recruitment of many new players. As a result, nearly 1.100.000 active player accounts (APAs) participated in online poker games during the quarter, an increase of 68% relative to last year.

As a result, the poker GGR reached 142 million euros in the second quarter, its biggest result for a quarter and 44 million higher than the GGR of the first quarter of 2020. The growth of the poker GGR is of 126% compared to Q2 2020, which corresponds to the most significant increase recorded over a quarter.

This growth is due both to an increase in the number of active players (+ 68% compared to Q2 2019) and to the intensification of gambling. The average spending per active player account thus increased sharply in Q2 2020 (+ 34%), reaching € 134 compared to € 99 in Q2 2019.

The ANJ in brief

The “Pacte” Act and the ordinance of October 2, 2019 reforming the regulation of gambling have set up a new gambling regulatory authority (ANJ). It follows ARJEL with a significantly extended regulatory scope and enhanced powers.

The ANJ is now responsible for all components of the legal gambling market, both online andoffline:

- online games that ARJEL regulated, such as sports betting and horse racing betting and poker offered by the 14 licensed operators ;

- all the games of La Française des Jeux or the PMU sold in physical points of sale or online;

- 237 racecourses;

- 202 casinos, with the exception of anti-money laundering issues and the integrity of the games offered, which remain under the responsibility of the Ministry of Home Affairs.

Methodology

The following elements have been compiled using data provided by licensed online gambling and betting operators on a weekly and quarterly basis. The ANJ communications take account of statistical confidentiality. It cannot publish information relating to the activity of monopoly markets (FDJ and PMU) other than that already disclosed by operators under exclusive rights.

Powered by WPeMatico

Latest News

RESORTS WORLD LAS VEGAS NAMES TOM MCMAHON SENIOR VICE PRESIDENT OF SLOT OPERATIONS AND MARKETING

Resorts World Las Vegas is continuing the expansion of its executive leadership team with the appointment of Tom McMahon as Senior Vice President of Slot Operations and Marketing.

A respected leader with more than two decades of experience in gaming and hospitality, McMahon steps into his role effective immediately.

“Tom’s deep expertise in luxury casino operations and marketing makes him a powerful addition to our team,” said Carlos Castro, President and Chief Financial Officer of Resorts World Las Vegas. “We look forward to the leadership he will provide in this essential function at Resorts World Las Vegas.”

McMahon has held senior roles at some of the most recognized names in the industry, including Wynn Resorts, Bellagio Resort & Casino, Las Vegas Sands, Venetian | Palazzo and most recently Sycuan Casino Resort. At Resorts World Las Vegas, he will lead initiatives across slot operations, marketing and the Genting Rewards Loyalty Program, with a focus on innovation, guest engagement and operational excellence.

Said McMahon, “Returning to Las Vegas to join a forward-thinking property like Resorts World is an incredible opportunity. I am eager to help shape the next chapter of growth by enhancing the guest experience and building on the strong foundation already in place.”

For more information about Resorts World Las Vegas, please visit rwlasvegas.com.

The post RESORTS WORLD LAS VEGAS NAMES TOM MCMAHON SENIOR VICE PRESIDENT OF SLOT OPERATIONS AND MARKETING appeared first on Gaming and Gambling Industry in the Americas.

Compliance Updates

Expanse Studios (GMGI) Obtains Croatian iGaming Certification

Expanse Studios, the B2B game development division of Golden Matrix Group Inc. (NASDAQ: GMGI), has received official certification from Croatia’s Ministry of Finance for its flagship game Super Heli, with additional titles in the company’s 56-game portfolio expected to receive approval in the coming weeks for the EU member state.

The certification marks a strategic entry into a market that generated US$484.70m in 2024, with projected growth at a CAGR of 8.4% during 2024-2030. Super Heli, Expanse’s most popular crash-style game, becomes the first of the studio’s titles approved for the Croatian market, paving the way for broader portfolio distribution.

Tapping Into High-Growth European Market

Croatia represents a compelling opportunity for B2B gaming suppliers, with the Online Casinos segment alone projected at US$218.10m in 2024. According to iGamingToday’s latest market research, Croatia’s gambling market will reach €720.42 million by 2025, making it one of Europe’s fastest-growing regulated markets.

Among the key market benefits are:

- Accelerating digital adoption – Internet penetration jumped from 76% in 2020 to 83% in 2023

- Over 20.6 million tourist arrivals in 2023 following Schengen Zone entry

- Over 500,000 Croatians expected to engage in regular online gambling by 2027

Strategic Value for the Company

The certification strengthens Expanse Studios’ European footprint at a critical juncture. With 56 proprietary titles and 500+ B2B partners globally, Expanse is expected to capture a meaningful share in the growing EU market.

“Croatia certification is more than market access—it’s validation of our content quality and compliance capabilities in demanding EU jurisdictions,” said Damjan Stamenkovic, CEO of Expanse Studios. “With our flagship title Super Heli already approved and more games in the pipeline, we’re very excited for the opportunities this markets brings us”

Competitive Advantage in Regulated Markets

Croatia’s regulatory framework favors established, compliant B2B providers. Operators must obtain licenses requiring significant capital investment, and only licensed casino games operators who have at least one brick-and-mortar casino can offer online gambling. This creates high barriers to entry and positions certified B2B suppliers like Expanse as essential partners for operators.

The post Expanse Studios (GMGI) Obtains Croatian iGaming Certification appeared first on European Gaming Industry News.

Latest News

Kristina Jakovleva Represents Slotsjudge at iGB London 2025

The iGB London 2025 event is set to push the boundaries of the online gambling market, and Kristina Jakovleva, Business Development Manager at SEOBROTHERS, will represent Slotsjudge. The event is expected to gather over 15,000 attendees and more than 300 sponsors, and Kristina plans to cover technological trends, discuss affiliate marketing strategies, and foster industry-specific networking.

Event Overview: About iGB London 2025

As one of the iGaming industry’s key global events, iGB London brings together thousands of professionals to drive innovation and growth. Following the success of previous editions, with over 6,500+ affiliates and 150+ programs on offer, the upcoming event promises even greater opportunities for business and collaboration.

Over 15,000+ industry specialists are to join the event this time. This year, participants will discuss technological trends, regulatory updates, affiliate marketing, and branding strategies. Participants can gain actionable insights and learn from successful case studies, making the event both exciting and informative.

About Kristina Jakovleva: Expertise & Plans

Starting her career in education at Liverpool John Moores University, Kristina has been in the iGaming market for years, working as a customer support specialist, affiliate manager, and ultimately as a Business Development Manager at SEOBROTHERS.

Years of experience and a focus on growth enabled Kristina to understand which approach best suited the company quickly, and she successfully implemented strategic partnerships and business growth initiatives to benefit from industry-specific networking.

Expectations & Final Thoughts

Attendees can enjoy iGB London 2025 on 2–3 July 2025 at ExCeL London, and an exclusive AI Concierge service will be available to cover basic questions about the event. Nick Hill, Executive Director at Premier Hill, says that ‘it represents the entire industry, and it is a must-attend show.’

It’s an excellent opportunity for the Slotsjudge team to gain performance-driven insights and plan future growth over the next 12 to 24 months, while other participants can learn from Kristina Jakovleva’s work, reinforcing Slotsjudge’s ongoing commitment to innovation and the overall growth of the iGaming industry.

The post Kristina Jakovleva Represents Slotsjudge at iGB London 2025 appeared first on European Gaming Industry News.

-

Australia7 days ago

Australia7 days agoVGCCC: Minors Exposed to Gambling at ALH Venues

-

Central Europe5 days ago

Central Europe5 days agoGerman Federal Government Significantly Increases the Budget for Games Funding

-

Croc’s Lock7 days ago

Croc’s Lock7 days agoFBM® unveils golden treasures in Mexico with Croc’s Lock™ bites

-

Africa7 days ago

Africa7 days agoSA Rugby Renews its Partnership with Betway

-

Eastern Europe6 days ago

Eastern Europe6 days agoThunderkick enhances presence in Romania through MaxBet partnership

-

BETBY6 days ago

BETBY6 days agoBETBY EXPANDS LATAM FOOTPRINT WITH MOBADOO ESPORTS PARTNERSHIP

-

California State Assemblymember Avelino Valencia5 days ago

California State Assemblymember Avelino Valencia5 days agoNew Bill in California Could End Online Sweepstakes Gaming

-

Compliance Updates7 days ago

Compliance Updates7 days agoHonolulu Mayor Signs New Laws Targeting Illegal Game Rooms