Gambling in the USA

Century Casinos, Inc. Announces Fourth Quarter and Full Year 2019 Results

Century Casinos, Inc. announced its financial results for the three months and year ended December 31, 2019.

Fourth Quarter 2019 Highlights*

- Net operating revenue was $67.2 million, an increase of 49% from the three months ended December 31, 2018.

- Loss from operations was ($14.7) million, a decrease of 846% from the three months ended December 31, 2018.

- Net loss attributable to Century Casinos, Inc. shareholders was ($20.1) million, a decrease of 4080% from the three months ended December 31, 2018.

- Adjusted EBITDA** was $9.8 million, an increase of 69% from the three months ended December 31, 2018.

- Loss per share was ($0.68).

2019 Highlights*

- Net operating revenue was $218.2 million, an increase of 29% from the year ended December 31, 2018.

- Loss from operations was ($5.2) million, a decrease of 155% from the year ended December 31, 2018.

- Net loss attributable to Century Casinos, Inc. shareholders was ($19.2) million, a decrease of 664% from the year ended December 31, 2018.

- Adjusted EBITDA** was $30.3 million, an increase of 30% from the year ended December 31, 2018.

- Basic loss per share was ($0.65), a decrease of 642% from the year ended December 31, 2018.

- Diluted loss per share was ($0.65), a decrease of 691% from the year ended December 31, 2018.

- Book value per share*** at December 31, 2019 was $5.54.

In December 2019, the Company determined that the intangible and tangible assets at Century Casino Bath were impaired. The impairment, which totaled $16.5 million, was determined after evaluating losses incurred by the casino since operations began and future forecasts of continued losses due to the current regulatory environment for casinos in England.

On December 6, 2019, the Company completed its acquisition (the “Acquisition”) of the operations of Isle Casino Cape Girardeau, located in Cape Girardeau, Missouri, Lady Luck Caruthersville, located in Caruthersville, Missouri, and Mountaineer Casino, Racetrack and Resort located in New Cumberland, West Virginia (collectively, the “Acquired Casinos”), from Eldorado Resorts, Inc. for an aggregate purchase price of approximately $110.6 million. Immediately prior to the Acquisition, the real estate assets underlying the Acquired Casinos were sold to an affiliate of VICI Properties Inc. (“VICI PropCo”). On the closing date, the Company and VICI PropCo entered into a triple net lease agreement (the “Master Lease”) for the three Acquired Casino properties. The Master Lease has an initial annual rent of approximately $25.0 million and an initial term of 15 years, with four five-year renewal options.

The consolidated results for the three months and year ended December 31, 2019 and 2018 are as follows:

|

For the three months |

For the year |

|||||||||||||||

|

Amounts in thousands, except per share data |

ended December 31, |

ended December 31, |

||||||||||||||

|

Consolidated Results: |

2019 |

2018 |

% Change |

2019 |

2018 |

% Change |

||||||||||

|

Net Operating Revenue |

$ |

67,236 |

$ |

45,106 |

49% |

$ |

218,227 |

$ |

168,938 |

29% |

||||||

|

(Loss) Earnings from Operations |

(14,745) |

1,976 |

(846%) |

(5,220) |

9,459 |

(155%) |

||||||||||

|

Net (Loss) Earnings Attributable to Century Casinos, Inc. Shareholders |

$ |

(20,140) |

$ |

506 |

(4080%) |

$ |

(19,155) |

$ |

3,394 |

(664%) |

||||||

|

Adjusted EBITDA** |

$ |

9,776 |

$ |

5,801 |

69% |

$ |

30,281 |

$ |

23,377 |

30% |

||||||

|

(Loss) Earnings Per Share Attributable to Century Casinos, Inc. Shareholders: |

||||||||||||||||

|

Basic |

$ |

(0.68) |

$ |

0.02 |

(3500%) |

$ |

(0.65) |

$ |

0.12 |

(642%) |

||||||

|

Diluted |

$ |

(0.68) |

$ |

0.02 |

(3500%) |

$ |

(0.65) |

$ |

0.11 |

(691%) |

||||||

“We are pleased with the fourth quarter results and the immediate impact the addition of the three casinos acquired from Eldorado Resorts had on our operating results,” Erwin Haitzmann and Peter Hoetzinger, Co-Chief Executive Officers of Century Casinos remarked. “The acquired casinos have had very encouraging initial results, and we are excited to continue integrating the operations into the Century brand and to see anticipated meaningful growth from this acquisition on Century Casinos in the future,” Messrs. Haitzmann and Hoetzinger concluded.

The Company is carefully monitoring the situation caused by the coronavirus (COVID-19) pandemic. Although the entire situation is unpredictable, our management teams are prepared to control what they can control. Our casinos are following and implementing the recommendations from the US Centers for Disease Control and Prevention, which include everyday preventative actions to help prevent the spread of respiratory viruses, such as washing your hands often with soap and water, avoiding touching your eyes, nose, and mouth with unwashed hands, covering your cough or sneeze with a tissue, cleaning and disinfecting frequently touched objects and surfaces and of course staying home when you are sick. We are also putting an extra effort into straight-forward and realistic guest messaging and have stepped-up employee trainings to ensure strict compliance with our policies and procedures. We are in constant communication with our employees to reinforce our sanitation safety procedures in both guest-facing and back-of-house areas. We are sanitizing high-traffic public areas at an increased frequency. Proper procedures are posted in all back-of-house work areas.

To date, COVID-19 has not had a significant impact on our US or Canadian markets, while the market in Poland has been weakening by approximately ten percent. Our customer base is very diversified within North America. Our casinos are ‘local’ casinos in urban and suburban locations, with the vast majority of our business from customers who live within an hour from our facilities. Our casinos have negligible meeting and convention business and few of our customers travel by air to visit us. This may temper the impact of COVID-19 on our business, but this situation continues to evolve and could adversely impact us until the virus runs its course.

Reportable Segment Results*

The table below shows the Company’s operating segments that are included in each of the Company’s reportable segments as of December 31, 2019:

|

Reportable Segment |

Operating Segment |

Reporting Unit |

|

United States |

Colorado |

Century Casino & Hotel – Central City |

|

Century Casino & Hotel – Cripple Creek |

||

|

West Virginia |

Mountaineer Casino, Racetrack & Resort |

|

|

Missouri |

Century Casino Cape Girardeau |

|

|

Century Casino Caruthersville |

||

|

Canada |

Edmonton |

Century Casino & Hotel – Edmonton |

|

Century Casino St. Albert |

||

|

Century Mile Racetrack and Casino |

||

|

Calgary |

Century Casino Calgary |

|

|

Century Downs Racetrack and Casino |

||

|

Century Bets! Inc. |

||

|

Poland |

Poland |

Casinos Poland |

|

Corporate and Other |

Corporate and Other |

Cruise Ships & Other |

|

Century Casino Bath |

||

|

Corporate Other |

The Company’s net operating revenue increased by $22.1 million, or 49%, and by $49.3 million, or 29%, for the three months and year ended December 31, 2019, compared to the three months and year ended December 31, 2018. Following is a summary of the changes in net operating revenue by reportable segment for the three months and year ended December 31, 2019, compared to the three months and year ended December 31, 2018:

|

Net Operating Revenue |

||||||||||||||||||||||

|

For the three months |

For the year |

|||||||||||||||||||||

|

ended December 31, |

ended December 31, |

|||||||||||||||||||||

|

Amounts in thousands |

2019 |

2018 |

$ Change |

% Change |

2019 |

2018 |

$ Change |

% Change |

||||||||||||||

|

United States |

$ |

23,926 |

$ |

7,938 |

$ |

15,988 |

201% |

$ |

49,998 |

$ |

33,483 |

$ |

16,515 |

49% |

||||||||

|

Canada |

20,291 |

15,678 |

4,613 |

29% |

80,650 |

61,361 |

19,289 |

31% |

||||||||||||||

|

Poland |

21,675 |

19,514 |

2,161 |

11% |

81,894 |

68,209 |

13,685 |

20% |

||||||||||||||

|

Corporate and Other |

1,344 |

1,976 |

(632) |

(32%) |

5,685 |

5,885 |

(200) |

(3%) |

||||||||||||||

|

Consolidated |

$ |

67,236 |

$ |

45,106 |

$ |

22,130 |

49% |

$ |

218,227 |

$ |

168,938 |

$ |

49,289 |

29% |

||||||||

The Company’s earnings from operations decreased by ($16.7) million, or (846%), and by ($14.7) million, or (155%), for the three months and year ended December 31, 2019, compared to the three months and year ended December 31, 2018. Following is a summary of the changes in earnings (loss) from operations by reportable segment for the three months and year ended December 31, 2019, compared to the three months and year ended December 31, 2018:

|

Earnings (Loss) from Operations |

||||||||||||||||||||||

|

For the three months |

For the year |

|||||||||||||||||||||

|

ended December 31, |

ended December 31, |

|||||||||||||||||||||

|

Amounts in thousands |

2019 |

2018 |

$ Change |

% Change |

2019 |

2018 |

$ Change |

% Change |

||||||||||||||

|

United States |

$ |

4,685 |

$ |

1,033 |

$ |

3,652 |

354% |

$ |

9,478 |

$ |

5,882 |

$ |

3,596 |

61% |

||||||||

|

Canada |

4,000 |

3,675 |

325 |

9% |

16,115 |

14,633 |

1,482 |

10% |

||||||||||||||

|

Poland |

1,627 |

460 |

1,167 |

254% |

5,915 |

145 |

5,770 |

3979% |

||||||||||||||

|

Corporate and Other |

(25,057) |

(3,192) |

(21,865) |

(685%) |

(36,728) |

(11,201) |

(25,527) |

(228%) |

||||||||||||||

|

Consolidated |

$ |

(14,745) |

$ |

1,976 |

$ |

(16,721) |

(846%) |

$ |

(5,220) |

$ |

9,459 |

$ |

(14,679) |

(155%) |

||||||||

Net earnings attributable to Century Casinos, Inc. shareholders decreased by ($20.6) million, or (4080%), and by ($22.5) million, or (664%), for the three months and year ended December 31, 2019, compared to the three months and year ended December 31, 2018. Following is a summary of the changes in net earnings (loss) attributable to Century Casinos, Inc. shareholders by reportable segment for the three months and year ended December 31, 2019, compared to the three months and year ended December 31, 2018:

|

Net Earnings (Loss) Attributable to Century Casinos, Inc. Shareholders |

||||||||||||||||||||||

|

For the three months |

For the year |

|||||||||||||||||||||

|

ended December 31, |

ended December 31, |

|||||||||||||||||||||

|

Amounts in thousands |

2019 |

2018 |

$ Change |

% Change |

2019 |

2018 |

$ Change |

% Change |

||||||||||||||

|

United States |

$ |

2,261 |

$ |

767 |

$ |

1,494 |

195% |

$ |

5,825 |

$ |

4,373 |

$ |

1,452 |

33% |

||||||||

|

Canada |

948 |

2,077 |

(1,129) |

(54%) |

6,669 |

7,715 |

(1,046) |

(14%) |

||||||||||||||

|

Poland |

1,352 |

179 |

1,173 |

655% |

3,466 |

(153) |

3,619 |

2365% |

||||||||||||||

|

Corporate and Other |

(24,701) |

(2,517) |

(22,184) |

(881%) |

(35,115) |

(8,541) |

(26,574) |

(311%) |

||||||||||||||

|

Consolidated |

$ |

(20,140) |

$ |

506 |

$ |

(20,646) |

(4080%) |

$ |

(19,155) |

$ |

3,394 |

$ |

(22,549) |

(664%) |

||||||||

Items deducted from or added to earnings from operations to arrive at net earnings (loss) attributable to Century Casinos, Inc. shareholders include interest income, interest expense, gains (losses) on foreign currency transactions and other, income tax expense and non-controlling interests.

The Company’s Adjusted EBITDA** increased by $4.0 million, or 69%, and by $6.9 million, or 30%, for the three months and year ended December 31, 2019 compared to the three months and year ended December 31, 2018. Following is a summary of the changes in Adjusted EBITDA** by reportable segment for the three months and year ended December 31, 2019 compared to the three months and year ended December 31, 2018:

|

Adjusted EBITDA** |

||||||||||||||||||||||

|

For the three months |

For the year |

|||||||||||||||||||||

|

ended December 31, |

ended December 31, |

|||||||||||||||||||||

|

Amounts in thousands |

2019 |

2018 |

$ Change |

% Change |

2019 |

2018 |

$ Change |

% Change |

||||||||||||||

|

United States |

$ |

5,441 |

$ |

1,582 |

$ |

3,859 |

244% |

$ |

11,825 |

$ |

8,061 |

$ |

3,764 |

47% |

||||||||

|

Canada |

5,378 |

4,991 |

387 |

8% |

21,212 |

19,522 |

1,690 |

9% |

||||||||||||||

|

Poland |

2,484 |

1,733 |

751 |

43% |

9,392 |

4,890 |

4,502 |

92% |

||||||||||||||

|

Corporate and Other |

(3,527) |

(2,505) |

(1,022) |

(41%) |

(12,148) |

(9,096) |

(3,052) |

(34%) |

||||||||||||||

|

Consolidated |

$ |

9,776 |

$ |

5,801 |

$ |

3,975 |

69% |

$ |

30,281 |

$ |

23,377 |

$ |

6,904 |

30% |

||||||||

Balance Sheet and Liquidity

As of December 31, 2019, the Company had $54.8 million in cash and cash equivalents and $179.0 million in outstanding debt on its balance sheet compared to $45.6 million in cash and cash equivalents and $59.5 million in outstanding debt at December 31, 2018. The outstanding debt as of December 31, 2019 included the following: $170.0 million related to the Company’s credit agreement with a group of lenders led by Macquarie Capital that the Company entered into in December 2019 in connection with the Acquisition, replacing the Company’s credit agreement with the Bank of Montreal; $2.0 million of bank debt related to Casinos Poland; $2.0 million of bank debt related to Century Casino Bath; and $15.0 million related to a long-term land lease for CDR, net of $10.0 million in deferred financing costs.

Conference Call Information

Today the Company will post a copy of its Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2019 on its website at www.cnty.com/investor/financials/sec-filings. The Company will also post a presentation on the year end results on its website at www.cnty.com/investor/presentations.

The Company will host its fourth quarter 2019 earnings conference call today, Friday, March 13th, at 8:00 am MDT. U.S. domestic participants should dial 1-844-244-9160. For all international participants, please use 330-931-4670 to dial-in. Participants may listen to the call live at www.centurycasinos.adobeconnect.com/earningsrelease or obtain a recording of the call on the Company’s website until March 31, 2020 at www.cnty.com/investor/financials/sec-filings.

|

CENTURY CASINOS, INC. AND SUBSIDIARIES |

||||||||||||

|

Condensed Consolidated Statements of (Loss) Earnings |

||||||||||||

|

For the three months |

For the year |

|||||||||||

|

ended December 31, |

ended December 31, |

|||||||||||

|

Amounts in thousands, except for per share information |

2019 |

2018 |

2019 |

2018 |

||||||||

|

Operating revenue: |

||||||||||||

|

Net operating revenue |

$ |

67,236 |

$ |

45,106 |

$ |

218,227 |

$ |

168,938 |

||||

|

Operating costs and expenses: |

||||||||||||

|

Total operating costs and expenses |

81,981 |

43,152 |

223,446 |

159,502 |

||||||||

|

Earnings (loss) from equity investment |

— |

22 |

(1) |

23 |

||||||||

|

(Loss) earnings from operations |

(14,745) |

1,976 |

(5,220) |

9,459 |

||||||||

|

Non-operating income (expense), net |

(3,569) |

(1,053) |

(6,747) |

(3,536) |

||||||||

|

(Loss) earnings before income taxes |

(18,314) |

923 |

(11,967) |

5,923 |

||||||||

|

Income tax provision |

(955) |

(133) |

(4,174) |

(1,917) |

||||||||

|

Net (loss) earnings |

(19,269) |

790 |

(16,141) |

4,006 |

||||||||

|

Net earnings attributable to non-controlling interests |

(871) |

(284) |

(3,014) |

(612) |

||||||||

|

Net (loss) earnings attributable to Century Casinos, Inc. shareholders |

$ |

(20,140) |

$ |

506 |

$ |

(19,155) |

$ |

3,394 |

||||

|

(Loss) earnings per share attributable to Century Casinos, Inc. shareholders: |

||||||||||||

|

Basic |

$ |

(0.68) |

$ |

0.02 |

$ |

(0.65) |

$ |

0.10 |

||||

|

Diluted |

$ |

(0.68) |

$ |

0.02 |

$ |

(0.65) |

$ |

0.10 |

||||

|

Weighted average common shares |

||||||||||||

|

Basic |

29,474 |

29,439 |

29,452 |

29,401 |

||||||||

|

Diluted |

29,474 |

29,861 |

29,452 |

29,962 |

||||||||

|

CENTURY CASINOS, INC. AND SUBSIDIARIES |

||||||

|

Condensed Consolidated Balance Sheets |

||||||

|

December 31, |

December 31, |

|||||

|

Amounts in thousands |

2019 |

2018 |

||||

|

Assets |

||||||

|

Current assets |

$ |

79,366 |

$ |

54,974 |

||

|

Property and equipment, net |

503,933 |

187,017 |

||||

|

Other assets |

143,601 |

36,834 |

||||

|

Total assets |

$ |

726,900 |

$ |

278,825 |

||

|

Liabilities and Equity |

||||||

|

Current liabilities |

$ |

56,570 |

$ |

50,020 |

||

|

Non-current liabilities |

498,255 |

45,422 |

||||

|

Century Casinos, Inc. shareholders’ equity |

163,306 |

176,321 |

||||

|

Non-controlling interests |

8,769 |

7,062 |

||||

|

Total liabilities and equity |

$ |

726,900 |

$ |

278,825 |

||

|

CENTURY CASINOS, INC. AND SUBSIDIARIES |

||||||||||||||||

|

Constant Currency* Results (unaudited) |

||||||||||||||||

|

For the three months |

For the year |

|||||||||||||||

|

ended December 31, |

ended December 31, |

|||||||||||||||

|

Amounts in thousands |

2019 |

2018 |

% Change |

2019 |

2018 |

% Change |

||||||||||

|

Net operating revenue as reported (GAAP) |

$ |

67,236 |

$ |

45,106 |

49% |

$ |

218,227 |

$ |

168,938 |

29% |

||||||

|

Foreign currency impact vs. 2018 |

559 |

7,207 |

||||||||||||||

|

Net operating revenue constant currency (non-GAAP)* |

$ |

67,795 |

$ |

45,106 |

50% |

$ |

225,434 |

$ |

168,938 |

33% |

||||||

|

(Loss) earnings from operations (GAAP) |

$ |

(14,745) |

$ |

1,976 |

(846%) |

$ |

(5,220) |

$ |

9,459 |

(155%) |

||||||

|

Foreign currency impact vs. 2018 |

934 |

955 |

||||||||||||||

|

(Loss) earnings from operations constant currency (non-GAAP)* |

$ |

(13,811) |

$ |

1,976 |

(799%) |

$ |

(4,265) |

$ |

9,459 |

(145%) |

||||||

|

Net (loss) earnings attributable to Century Casinos, Inc. shareholders as reported (GAAP) |

$ |

(20,140) |

$ |

506 |

(4080%) |

$ |

(19,155) |

$ |

3,394 |

(664%) |

||||||

|

Foreign currency impact vs. 2018 |

339 |

(40) |

||||||||||||||

|

Net (loss) earnings attributable to Century Casinos, Inc. shareholders constant currency (non-GAAP)* |

$ |

(19,801) |

$ |

506 |

(4013%) |

$ |

(19,195) |

$ |

3,394 |

(666%) |

||||||

Gains and losses on foreign currency transactions are added back to net (loss) earnings in the Company’s Adjusted EBITDA** calculations. As such, there is no foreign currency impact to Adjusted EBITDA** when calculating Constant Currency* results.

|

Adjusted EBITDA Margins *** (unaudited) |

||||

|

For the three months |

For the year |

|||

|

ended December 31, |

ended December 31, |

|||

|

2019 |

2018 |

2019 |

2018 |

|

|

United States |

23% |

20% |

24% |

24% |

|

Canada |

27% |

32% |

26% |

32% |

|

Poland |

11% |

9% |

11% |

7% |

|

Corporate and Other |

(262%) |

(127%) |

(214%) |

(155%) |

|

Consolidated Adjusted EBITDA Margin |

15% |

13% |

14% |

14% |

|

CENTURY CASINOS, INC. AND SUBSIDIARIES |

|||||||||||||||

|

Reconciliation of Adjusted EBITDA ** to Net Earnings (Loss) Attributable to Century Casinos, Inc. Shareholders by Reportable Segment. |

|||||||||||||||

|

For the three months ended December 31, 2019 |

|||||||||||||||

|

Amounts in thousands |

United |

Canada |

Poland |

Corporate |

Total |

||||||||||

|

Net earnings (loss) attributable to Century Casinos, Inc. shareholders |

$ |

2,261 |

$ |

948 |

$ |

1,352 |

$ |

(24,701) |

$ |

(20,140) |

|||||

|

Interest expense (income), net |

1,635 |

1,456 |

55 |

1,020 |

4,166 |

||||||||||

|

Income taxes (benefit) |

789 |

1,375 |

222 |

(1,431) |

955 |

||||||||||

|

Depreciation and amortization |

756 |

1,356 |

781 |

254 |

3,147 |

||||||||||

|

Net earnings attributable to non-controlling interests |

— |

195 |

676 |

— |

871 |

||||||||||

|

Non-cash stock-based compensation |

— |

— |

— |

324 |

324 |

||||||||||

|

Loss (gain) on foreign currency transactions, cost recovery income and other |

— |

26 |

(678) |

16,704 |

16,052 |

||||||||||

|

Loss on disposition of fixed assets |

— |

22 |

76 |

1 |

99 |

||||||||||

|

Acquisition costs |

— |

— |

— |

4,302 |

4,302 |

||||||||||

|

Adjusted EBITDA |

$ |

5,441 |

$ |

5,378 |

$ |

2,484 |

$ |

(3,527) |

$ |

9,776 |

|||||

|

For the three months ended December 31, 2018 |

|||||||||||||||

|

Amounts in thousands |

United |

Canada |

Poland |

Corporate |

Total |

||||||||||

|

Net earnings (loss) attributable to Century Casinos, Inc. shareholders |

$ |

767 |

$ |

2,077 |

$ |

179 |

$ |

(2,517) |

$ |

506 |

|||||

|

Interest expense (income), net |

— |

1,084 |

50 |

65 |

1,199 |

||||||||||

|

Income taxes (benefit) |

266 |

435 |

280 |

(848) |

133 |

||||||||||

|

Depreciation and amortization |

548 |

779 |

1,025 |

402 |

2,754 |

||||||||||

|

Net earnings attributable to non-controlling interests |

— |

174 |

89 |

21 |

284 |

||||||||||

|

Non-cash stock-based compensation |

— |

— |

— |

255 |

255 |

||||||||||

|

(Gain) loss on foreign currency transactions and cost recovery income |

— |

(95) |

(138) |

94 |

(139) |

||||||||||

|

Loss on disposition of fixed assets |

1 |

4 |

27 |

23 |

55 |

||||||||||

|

Pre-opening expenses |

— |

533 |

221 |

— |

754 |

||||||||||

|

Adjusted EBITDA |

$ |

1,582 |

$ |

4,991 |

$ |

1,733 |

$ |

(2,505) |

$ |

5,801 |

|||||

|

CENTURY CASINOS, INC. AND SUBSIDIARIES |

|||||||||||||||

|

Reconciliation of Adjusted EBITDA ** to Net Earnings (Loss) Attributable to Century Casinos, Inc. Shareholders by Reportable Segment. |

|||||||||||||||

|

For the Year ended December 31, 2019 |

|||||||||||||||

|

Amounts in thousands |

United |

Canada |

Poland |

Corporate |

Total |

||||||||||

|

Net earnings (loss) attributable to Century Casinos, Inc. shareholders |

$ |

5,825 |

$ |

6,669 |

$ |

3,466 |

$ |

(35,115) |

$ |

(19,155) |

|||||

|

Interest expense (income), net |

1,635 |

5,312 |

197 |

1,085 |

8,229 |

||||||||||

|

Income taxes (benefit) |

2,018 |

3,278 |

1,617 |

(2,739) |

4,174 |

||||||||||

|

Depreciation and amortization |

2,330 |

4,539 |

3,064 |

910 |

10,843 |

||||||||||

|

Net earnings (loss) attributable to non-controlling interests |

— |

1,295 |

1,731 |

(12) |

3,014 |

||||||||||

|

Non-cash stock-based compensation |

— |

— |

— |

1,303 |

1,303 |

||||||||||

|

(Gain) loss on foreign currency transactions, cost recovery income and other |

— |

(439) |

(1,096) |

16,709 |

15,174 |

||||||||||

|

Loss on disposition of fixed assets |

17 |

20 |

413 |

345 |

795 |

||||||||||

|

Acquisition costs |

— |

— |

— |

5,366 |

5,366 |

||||||||||

|

Pre-opening expenses |

— |

538 |

— |

— |

538 |

||||||||||

|

Adjusted EBITDA |

$ |

11,825 |

$ |

21,212 |

$ |

9,392 |

$ |

(12,148) |

$ |

30,281 |

|||||

|

For the Year ended December 31, 2018 |

|||||||||||||||

|

Amounts in thousands |

United |

Canada |

Poland |

Corporate |

Total |

||||||||||

|

Net earnings (loss) attributable to Century Casinos, Inc. shareholders |

$ |

4,373 |

$ |

7,715 |

$ |

(153) |

$ |

(8,541) |

$ |

3,394 |

|||||

|

Interest expense (income), net |

1 |

3,895 |

206 |

12 |

4,114 |

||||||||||

|

Income taxes (benefit) |

1,508 |

2,536 |

595 |

(2,722) |

1,917 |

||||||||||

|

Depreciation and amortization |

2,178 |

3,211 |

3,065 |

945 |

9,399 |

||||||||||

|

Net earnings (loss) attributable to non-controlling interests |

— |

722 |

(75) |

(35) |

612 |

||||||||||

|

Non-cash stock-based compensation |

— |

— |

— |

868 |

868 |

||||||||||

|

(Gain) loss on foreign currency transactions and cost recovery income |

— |

(235) |

(428) |

2 |

(661) |

||||||||||

|

Loss on disposition of fixed assets |

1 |

10 |

1,054 |

25 |

1,090 |

||||||||||

|

Pre-opening expenses |

— |

1,668 |

626 |

350 |

2,644 |

||||||||||

|

Adjusted EBITDA |

$ |

8,061 |

$ |

19,522 |

$ |

4,890 |

$ |

(9,096) |

$ |

23,377 |

|||||

CENTURY CASINOS, INC. AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION

* The impact of foreign exchange rates is highly variable and difficult to predict. The Company uses a Constant Currency basis to show the impact from foreign exchange rates on current period financial information compared to prior period financial information using the prior period’s foreign exchange rates. In order to properly understand the underlying business trends and performance of the Company’s ongoing operations, management believes that investors may find it useful to consider the impact of excluding changes in foreign exchange rates from the Company’s net operating revenue, (loss) earnings from operations and net earnings (loss) attributable to Century Casinos, Inc. shareholders. Constant currency results are calculated by dividing the current quarter or year to date local currency segment results, excluding the local currency impact of foreign currency gains and losses, by the prior year’s average exchange rate for the quarter or year to date and comparing them to actual U.S. dollar results for the prior quarter or year to date. The average exchange rates for the current and prior year are reported in Note 2 to the Consolidated Financial Statements included in Part II, Item 8, “Financial Statements and Supplementary Data” of the Company’s Annual Report on Form 10-K. The average exchange rates for the three months ended December 31, 2019 and 2018 are presented below.

|

For the three months |

||||||

|

ended December 31, |

||||||

|

Average Rates |

2019 |

2018 |

% Change |

|||

|

Canadian dollar (CAD) |

1.3199 |

1.3218 |

0.1% |

|||

|

Euros (EUR) |

0.9032 |

0.8763 |

(3.1%) |

|||

|

Polish zloty (PLN) |

3.8702 |

3.7668 |

(2.7%) |

|||

|

British pound (GBP) |

0.7766 |

0.7773 |

0.1% |

|||

|

Source: Pacific Exchange Rate Service |

||||||

Constant currency information is not a measure of financial performance under generally accepted accounting principles in the United States of America (GAAP) and should not be considered a substitute for net operating revenue, (loss) earnings from operations or net earnings (loss) attributable to Century Casinos, Inc. shareholders as determined in accordance with GAAP.

SOURCE Century Casinos, Inc.

Gambling in the USA

The Plaza Hotel & Casino brings back the only All-Inclusive Hotel Room Package in Las Vegas this summer

Given its popularity for the past two summers, the Plaza Hotel & Casino is again offering Las Vegas’ only all-inclusive hotel room package starting at $104 per person per night for stays this summer.

The Plaza was the first Las Vegas property to introduce an all-inclusive hotel room package in the summer of 2024. It was so well received by guests that the iconic downtown Las Vegas property has offered it every summer since.

“We always want our guests to have a great time and feel that they are getting the best value for their vacation dollars,” said Jonathan Jossel, CEO of the Plaza Hotel & Casino. “Our all-inclusive hotel package has been created based on our guests’ feedback and offers waived resort fees, meals, bottomless drinks, and other perks to ensure they have a memorable experience.”

The Plaza’ all-inclusive hotel room package waives all resort fees, but guests still can enjoy free access to the fitness center, self-parking, and rooftop pool. The package also includes free early check-in, free bottled water, bottomless drinks from the Omaha Bar and Sports Book Bar on the casino floor, and breakfast and dinner from various dining outlets. Guests also receive a 25% discount on cocktails at the rooftop pool, because there is no better way to enjoy a summer vacation than sipping a chilled beverage poolside.

The Plaza’s all-inclusive hotel room package is available for booking online for stays June 1 through August 31 at plazahotelcasino.com/las-vegas-all-inclusive-room-package/.

The post The Plaza Hotel & Casino brings back the only All-Inclusive Hotel Room Package in Las Vegas this summer appeared first on Americas iGaming & Sports Betting News.

American gambling industry

Gaming Americas Weekly Roundup – January 19-25

Welcome to our weekly roundup of American gambling news again! Here, we are going through the weekly highlights of the American gambling industry which include the latest news and new partnerships. Read on and get updated.

Latest News

Lotto.com, the nation’s first online lottery platform to digitally deliver draw games and scratch tickets, has announced a major milestone – reaching 4 million customers, and counting, in less than five years since launching in Spring 2021. As the fastest-growing lottery courier platform, Lotto.com continues to redefine accessibility and convenience for players nationwide. Customers have collectively won over $150 million in prizes through Lotto.com, including $90 million in draw wins and $63 million in scratch wins, with more than 7 million winning tickets ordered on the platform. These results highlight the excitement, ease and trust players have in Lotto.com’s modern approach to lottery.

NCAA President Charlie Baker has requested the Commodity Futures Trading Commission to pause all college sport offerings in prediction markets until the agency implements appropriate regulations. The NCAA sent a letter to the CFTC calling for a robust system of safeguards and detailed its willingness to work with the regulatory body to assist with developing the necessary guardrails to protect student-athletes and college sports. The critical safeguards requested include age and advertising restrictions, enhanced integrity monitoring, prop market prevention, anti-harassment measures, and harm reduction resources.

The Nevada Gaming Control Board has filed a civil enforcement action in the District Court for Carson City against BLOCKRATIZE INC. d/b/a POLYMARKET; QCX LLC d/b/a POLYMARKET US; and ADVENTURE ONE QSS INC. d/b/a POLYMARKET. In its complaint, the Board asked the court for a declaration and injunction to stop Polymarket from offering unlicensed wagering in violation of Nevada law. Polymarket operates a derivatives exchange and prediction market where it offers event contracts for sale. These products are offered for sale on Polymarket’s mobile app and are made available to people in Nevada. The Board considers offering sports event contracts, or certain other events contracts, to constitute wagering activity under NRS 463.0193 and 463.01962 and, therefore, entities offering such event contracts must be licensed.

Partnerships

High Roller Technologies Inc. announced it has entered into a binding Letter of Intent (LOI) with Crypto.com | Derivatives North America (CDNA), for an exclusive partnership to launch an event-based prediction markets product in the US. The events contracts will be offered by CDNA, a CFTC-registered exchange and clearinghouse and affiliate of Crypto.com, to customers through HighRoller.com. The partnership will offer people the opportunity to trade event contracts across markets including finance, entertainment, and sports, through a legal, engaging, and user-friendly platform.

High Roller Technologies Inc. announced it has signed a non-binding Letter of Intent (LOI) with Lines.com, a premier sports media platform owned by Spike Up Media, to enter into and execute a strategic marketing partnership designed to accelerate customer acquisition and brand awareness for High Roller’s planned entry into U.S. prediction markets. This LOI follows High Roller’s announcement of its strategic partnership with Crypto.com | Derivatives North America to launch a regulated event-based prediction markets product in the US. Through the contemplated strategic marketing partnership, Lines.com will serve as a key distribution and media partner, leveraging its high-intent audience, advanced automation infrastructure, and market-leading conversion performance to support High Roller’s prediction markets rollout.

The post Gaming Americas Weekly Roundup – January 19-25 appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

BetMGM Casino

BetMGM Reveals 2025’s Most Searched Casino Games

Key Findings

- Nevada recorded the highest combined casino game search interest nationally, achieving a perfect 500/500 score in 2025, the only state to do so.

- Home to Las Vegas—the world-renowned center of casino gaming and entertainment—Nevada recorded casino game searches 181% above the national average last year, reinforcing the city’s dominance in gambling culture.

- Michigan led all legal online casino states for overall search interest across major casino game categories.

- The most-searched casino games nationwide were slots.

- Search interest across legal online casino states was closely matched last year, led by Michigan.

- The District of Columbia showed the lowest search interest, searching 38% below the national average.

Casino Game Online Search Results

| Game | Score

*Maximum 5,100 |

Search Interest |

| Slots | 2831 | 31.2% |

| Casino | 1717 | 18.9% |

| Roulette | 1607 | 17.7% |

| Poker | 1594 | 17.6% |

| Blackjack | 1329 | 14.6% |

Legal Online Casino States Where BetMGM Operates

| Legal Online Casino States | Casino Game Search Interest Score (Out of a total of 500) | National Ranking |

| Michigan | 172 | 20 |

| West Virginia | 171 | 21 |

| Pennsylvania & New Jersey | 169 | 22 |

Key Insights from Legal Online Casino States

Here are a few of the key findings from this research:

1. Slots Dominate Regulated Markets

Slots are the top-searched casino game in every legal online casino state except New Jersey, reinforcing slots as the primary driver of online casino interest in regulated U.S. markets.

2. New Jersey Stands Out with Roulette-Led Interest

New Jersey is the only legal online casino state where roulette outranked slots as the most searched game in 2025. This indicates a more diversified player base with a stronger interest in live dealer and table games.

3. Search Interest is Tightly Clustered Across Legal States

Michigan, West Virginia, Pennsylvania, and New Jersey all ranked closely together nationally (positions 20–22), with very similar search interest scores.

Methodology

BetMGM Casino analysed Google search trends to assess nationwide interest in casino games over a 12-month period, covering January 1 to December 31, 2025.

Search interest was measured across five core casino game categories:

- Casino

- Slots

- Poker

- Blackjack

- Roulette

Only the generic category terms (for example, “slots”, “poker”, and “casino”) were analyzed. No modifiers such as “online”, “real money”, or brand-specific keywords were included. This approach ensures the data reflects overall interest in casino games, rather than being influenced by regulatory differences, platform availability, or other variables in individual states. It is critical to note Google Trends is strongest when you compare high-volume, generic terms.

Google Trends scores were used to compare relative search interest by state, with values scaled from 0 to 100 per category, where 100 represents the highest level of search interest observed during the period analysed.

This methodology allows for a consistent, like-for-like comparison of casino game popularity across the United States, highlighting regional interest patterns and broader gambling trends rather than online-only behavior.

Play Your Favorite Online Casino Games at BetMGM

Whether you search for online slots, casino table games, or live dealer casino game experiences, you can find your favorite online casino games at BetMGM Casino.

When you sign up to enjoy any of these great games, you’ll also get access to great ongoing and limited-time promotions, as well as the BetMGM Rewards loyalty program that offers both online and in person benefits for BetMGM players.

The post BetMGM Reveals 2025’s Most Searched Casino Games appeared first on Americas iGaming & Sports Betting News.

-

Games Global5 days ago

Games Global5 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Latest News5 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Amusnet5 days ago

Amusnet5 days agoWeek 4/2026 slot games releases

-

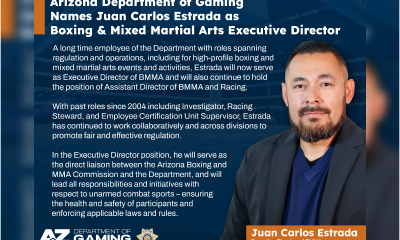

ADG6 days ago

ADG6 days agoArizona Department of Gaming Names Juan Carlos Estrada as Boxing and Mixed Martial Arts Executive Director

-

Anthony Dalla-Giacoma Chief Commercial Officer at Swintt6 days ago

Anthony Dalla-Giacoma Chief Commercial Officer at Swintt6 days agoSwintt Cruises the River of Fortune in Sun Wind Cash Boat

-

Anton Ivannikov CPO at Playson6 days ago

Anton Ivannikov CPO at Playson6 days agoPlayson’s Vegas Glitz Shines with Dual Bonus Features

-

Battle Royale6 days ago

Battle Royale6 days agoPrime Rush Goes Live in Early Access, Bringing a Brazil-First Mobile Battle Royale to Players

-

Attorney General Andrea Joy Campbell6 days ago

Attorney General Andrea Joy Campbell6 days agoAG Campbell Secures Court Order That Will Block Kalshi from Offering Unlawful Sports Wagers in Massachusetts