Industry News

Gaming Innovation Group divesting its B2C vertical to Betsson Group

Gaming Innovation Group Inc. (GiG) signs a Share Purchase Agreement (SPA) with Betsson Group (Betsson) for the divestment of GiG’s B2C assets which include the operator brands Rizk, Guts, Kaboo and Thrills. Betsson will, through this agreement, become a long term partner of GiG, generating revenues to GiG’s Platform Services. On the day of closing, Betsson will pay €31 million, consisting of a €22.3 million cash payment for the acquisition, plus a prepaid platform fee of €8.7 million. GiG will use the proceeds to repay the Company’s SEK300 million 2017 – 2020 bond.

Betsson commits to keep the brands operational on GiG’s platform for a minimum of 30 months. For the first 24 months, Betsson will pay a premium platform fee based on NGR generated. Based on the expected platform fees, the total value of the transaction is estimated at approximately €50 million.

Betsson, listed at Nasdaq Stockholm, is one of the most dominant European companies in online gambling with a long and strong track record of brand building, both organically and via acquisitions. It offers online casino, proprietary sportsbook and other online games in a multi-brand strategy via gaming licences in twelve countries in Europe and Central Asia.

The sale of the B2C vertical is a result of GiG’s strategic review, initiated in November 2019, leading to an evolved strategic direction to reduce complexity and improve efficiency. By divesting the B2C vertical, GiG will free up resources, enabling full dedication on driving and growing its B2B business, securing stable and sustainable earnings and profit margins. GiG sees a large and sustainable addressable market for its platform business as the regulation of the iGaming industry continues and is well positioned with the omni-channel platform offering to capitalise on the continued digital transformation of the worldwide gambling market.

GiG has, as part of the strategic review, taken a decision to make its technical platform sportsbook agnostic, and partner with other sport book providers to offer the best solutions to its customers. Betsson’s sportsbook solution is intended to be integrated on GiG’s platform-offering. Both GiG and Betsson will gain strategic advantage in having the possibility to sell their respective B2B solutions in an environment without conflict of their own B2C brands.

In order to keep the strategic position for its own proprietary sportsbook, GiG will seek joint ventures or other constellations with partners to release the true asset value of the sportsbook and to secure external long term funding. The ambition is to gradually grow with existing and new long term partners, including the fast growing US market. GiG is one of the few B2B providers present with omni-channel online gambling services in multi-state jurisdictions in the US.

Pontus Lindwall, Chief Executive Officer of Betsson AB comments: “We believe this deal offers a good opportunity for Betsson to consolidate, create synergies and apply our core B2C skills and marketing insights to scale these assets to their true potential. The agreement with GiG further strengthens and expands Betsson’s outreach and growth potential for its proprietary sportsbook and payments platforms in the B2B market.

Betsson has significantly invested in the development of its sportsbook and now delivers a powerful offering. A key strategy is to grow our sportsbook with B2B customers and I am excited to collaborate with GiG as a distribution channel. We share the same passion for sports betting and providing a player environment which is unique, entertaining and safe.”

Richard Brown, Chief Executive Officer of GiG says: “I am very excited about this transaction as it provides multiple upsides to GiG. While putting the Company in a financially sustainable position, it gives us the ability to focus on where we see real long term shareholder value. This transaction serves as a strategic focusing of the Company’s efforts towards the B2B segment. Offering both B2C and B2B services had synergies in the past, however, the current conflicting priorities of the two business areas, and increased complexity in the market, have lessened the potential offering on both fronts and our ability to sign new customers.

I am delighted to retain our brands on the platform and in the process, adding Betsson as a partner as we share the same ambition of responsibility for all stakeholders, safe play for the end user, and an entertaining user experience. I am certain that together with their speciality, focus and strong track record on driving B2C growth, it will be a fruitful partnership. Additionally, the planned integration of Betsson’s sportsbook into our platform offering, not only provides cost saving synergies, it also allows us to offer one of the most well-renowned European sportsbooks to our current and future B2B partners. We are excited to support Betsson’s growth of the brands we have built and now look forward to GiG next chapter as a specialist iGaming B2B provider“.

GiG’s full year 2019 revenues were €123.0 million (€29.4m in Q4 2019) with an EBITDA of €14.1 million (€4.8m Q4 2019), assuming B2C as continued operations. The isolated B2C full year 2019 revenues were €79.0 million (€19.0m in Q4 2019) with a full year 2019 EBITDA of €8.1 million (€4.1m in Q4 2019). The divestment of the B2C vertical will lead to a write-down of the remaining book value of the B2C assets and related goodwill, an impairment will be recognised in the fourth quarter 2019.

With the divestment of the B2C vertical, full year 2020 revenues are expected in the range of €70 – 75 million, with an EBITDA expected in the range of €14 – 17 million, including, for comparison, B2C as continued operations until completion of the transaction.

Expected completion of the transaction is mid April 2020, giving time for the compulsory regulatory approvals from merger control and gaming authorities. GiG is in dialogue with its largest bondholders and will seek consent from its bondholders to extend the repayment of the 2017 – 2020 bond from the maturity date in March 2020 until 22 April 2020. Written resolutions for the two bonds will commence shortly, and GiG has received voting undertakings from investors representing around 53% of the outstanding volume in the 2017 – 2020 bond, and around 46% of the outstanding volume in the 2019 – 2022 bond. As compensation for the extension of repayment date in the 2017- 2020 bond, bondholders in said bond will receive a consent fee of 0.35% of the nominal amount.

GiG invites all interested parties to a press conference with Q&A today, 14 February, at 08:30 CET. Questions can be addressed both in the call and via the web. Please find dial-in details and weblink below.

Weblink (an on-demand version will be available approx. 30 minutes after the call using the same link):

https://tv.streamfabriken.com/gig-press-conference

Participants dial in numbers:

SE: +46 856642651

NO: +47 23500243

UK: +44 3333000804

US: +18558570686

DK: +45 35445577

IT: +39 0236013821

Participants Pin code: 84408716#

Stella EOC acts as financial adviser to GiG in connection with the transaction.

BetBlocker

New Turkish-language tool from BetBlocker extends service to 90 million additional people

Gambling harm prevention charity BetBlocker today reveals the extension of their award-winning assistance into Turkish.

In 2025, BetBlocker saw a tremendous increase in support, with more than three hundred thousand individual users initiating a block throughout the year. This significant level of engagement has been made possible by the diverse array of languages into which the charity has translated its assistance.

Yesilay, the main Turkish support service, reports that requests for help with gambling are now surpassing those for alcohol, drugs, or tobacco, alongside significant uptake and harm among youth, making the launch of Turkish language support timely and relevant.

Founder and Trustee for BetBlocker, Duncan Garvie, offered these comments: “BetBlocker is genuinely excited to roll out our second language expansion of 2026.

We’ve experienced phenomenal uptake of the service over the last 12 months and figures hare steadily rising. One of the biggest drivers of that growth has been improving the accessibility of our support by meeting users where they are and offering support in the language that they’re most comfortable accessing in.

Alongside Turkey itself, there are substantial Turkish speaking communities across Europe, the Middle East and North America. It is our hope that this evolution of BetBlocker will ensure that a deeper level of support is available more widely across the Turkish diaspora.

BetBlocker would like to offer our deepest thanks to Fatmatuz Zehra Pehlivan, a Clinical Psychologist and researcher, who volunteers Green Cresent in the field of addiction treatment. Fatmatuz volunteered her time to help translate our app, and every Turkish language user we support owe her their thanks for the donation of her time and expertise.

As with many of the communities BetBlocker now supports, we would not be able to reach so many people without the kindness and generosity of field experts like Fatmatuz.”

The post New Turkish-language tool from BetBlocker extends service to 90 million additional people appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Anastasia Rimskaya Chief Account Officer at Aviatrix

Aviatrix Launches New Loot Boxes to Deepen Progression and Reward Paths

Aviatrix has launched a new Loot Box feature for its premier crash game, presenting collectible rewards, free bets, and progression bonuses aimed at boosting long-term player engagement.

Loot Boxes are granted through a daily rewards mechanism, with players obtaining them according to their in-game actions and advancement. Every box holds a variety of rewards, such as aircraft skins, complimentary bets, and aviation experience points.

The feature enhances Aviatrix’s developing loyalty system, providing players with fresh options to personalize their aircraft and earn rewards through continuous engagement.

Anastasia Rimskaya, Chief Account Officer at Aviatrix, said: “Loot Boxes are part of our wider vision for Aviatrix as a connected multi-game universe. As we expand our iGaming Metaverse, features like Loot Boxes add another meaningful layer to how players build their profile, customise their aircraft and earn rewards across the ecosystem.”

Unveiled in February, the Aviatrix iGaming Metaverse signifies the supplier’s shift from a standalone crash game to an integrated multi-title ecosystem.

Starting with the imminent debut of Aviatrix Second Chance and continuing with upcoming titles like Aviatrix Fruits and Aviatrix Mines, every game will utilize a single integrated player profile, progression system, and rewards and achievements framework.

The post Aviatrix Launches New Loot Boxes to Deepen Progression and Reward Paths appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Alec Gehlot Chief Executive Officer at PlaySignal

PlaySignal Debuts: Alec Gehlot’s New Sophisticated Responsible Gaming Platform

Alec Gehlot, previous senior executive at Optimove, has introduced PlaySignal, a responsible gaming platform aimed at assisting operators in identifying and addressing player risk promptly.

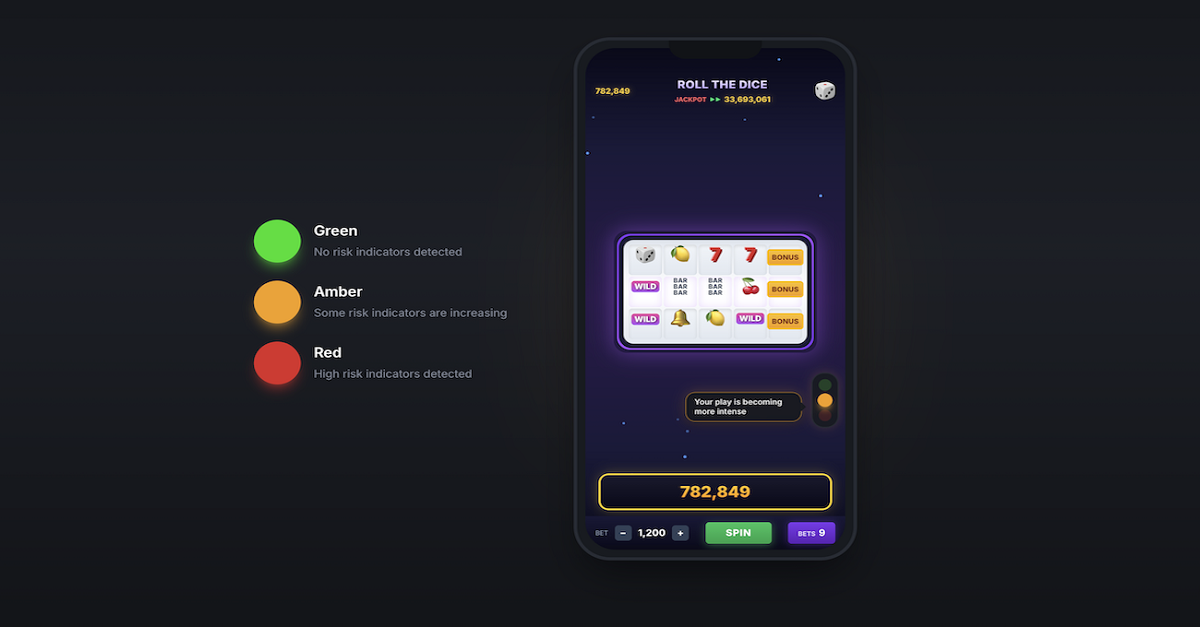

PlaySignal employs a traffic-light system featuring green, amber, and red signals to steer player conduct and indicate when behaviors start to enter higher-risk areas. The platform seeks to minimize avoidable exclusions by offering operators enhanced visibility of rising risks, while simultaneously giving players more understanding of how their actions are evaluated.

Leveraging behavioural analytics, PlaySignal tracks player actions during gameplay and displays information as distinct signals. This allows teams to act earlier and react more appropriately as risk evolves.

The product connects with current operator systems to assist responsible gaming, CRM, and compliance teams by providing a unified view of activities, encouraging a more uniform strategy among teams as regulatory demands grow in important markets.

Building on his time at Optimove, where he collaborated with operators on segmentation, retention, and user engagement, Gehlot recognized a demand for innovative tools to enhance player protection as regulatory and tax pressures mount in regulated markets.

The company launched PlaySignal at ICE earlier this year, where it was a contender in the Innovators Challenge, and initiated talks with operators in various markets. The initial launch will concentrate on the UK prior to global expansion.

Alec Gehlot, Chief Executive Officer at PlaySignal, said: “Regulation and taxation are only moving in one direction, and operators need new tools to adapt. Player protection can no longer be treated as a compliance obligation; it has to become a competitive differentiator.

“Regulated operators are under real pressure, particularly in the UK, and we believe giving them earlier visibility of risk is essential not just for protection, but for long-term sustainability.”

The post PlaySignal Debuts: Alec Gehlot’s New Sophisticated Responsible Gaming Platform appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Blueprint Gaming7 days ago

Blueprint Gaming7 days agoBlueprint Gaming unleashes Frankenstein’s Fortune blending dynamic modifiers with multi-path bonus offering

-

Compliance Updates7 days ago

Compliance Updates7 days agoMGA Publishes Results of Thematic Review on Self-exclusion Practices in Online Gaming Sector

-

Latest News5 days ago

Latest News5 days agoGGBET UA hosts Media Game – an open FC Dynamo Kyiv training session with journalists from sports publications

-

Amusnet7 days ago

Amusnet7 days agoAmusnet Unveils Casino Engineering and Technology Milestones Achieved in 2025

-

Asia6 days ago

Asia6 days agoBooks on Wheels: DigiPlus Foundation Brings Mobile Library to Boost Literacy Among Aurora’s Young Learners

-

Dan Brown7 days ago

Dan Brown7 days agoGames Global and Foxium return to the Colosseum in Rome Fight for Gold the Tiger’s Rage™

-

Bragg Gaming Group7 days ago

Bragg Gaming Group7 days agoBragg Gaming Group Partners with StarGames

-

3 Oaks Gaming7 days ago

3 Oaks Gaming7 days ago3 Oaks Gaming unleashes the power of the wild with 4 Wolf Drums: Hold and Win