FR0012612646

Groupe Partouche and Betsson AB announce partnership to launch online casino services in Belgium

Groupe Partouche and Betsson AB announce

partnership to launch online casino services in Belgium

Paris, June 15th 2023, 7:30am CEST

Groupe Partouche, French casino operator leader listed on Euronext (PARP), and Betsson AB, online gaming leader listed on Nasdaq Stockholm Mid Cap (BETS), are pleased to announce a new strategic partnership in order to offer online casino services in the Belgian regulated market through the Middelkerke casino, owned by Partouche.

The partnership will leverage Betsson’s expertise in the online gaming sector and Groupe Partouche’s market leadership in land-based casinos to deliver attractive online casino offering tailored to the Belgian market. This offering should be launched in 2023 subject to the official obtention of the license needed.

Groupe Partouche operates land-based casinos in France and Switzerland and also holds an offline casino license in Belgium, which can be extended to an online casino license. With this license, a full range of online casino products can be offered to the Belgian market.

Both Betsson and Groupe Partouche are committed to developing their new collaboration and exploring additional ways to expand the partnership.

About Betsson AB

Betsson AB is a holding company that invests in and manages fast-growing companies within online gaming. The company is one of the largest in online gaming in Europe and has the ambition to outgrow the market, organically and through acquisitions. This should be done in a profitable and sustainable manner, and with local adaptations. Betsson AB is listed on Nasdaq Stockholm (BETS B).

About Groupe Partouche

Groupe Partouche was established in 1973 and has grown to become one of the market leaders in Europe in its business sector. Listed on the stock exchange, it operates casinos, a gaming club, hotels, restaurants, spas and golf courses. The Group operates 41 casinos and employs nearly 3,900 people. It is well known for innovating and testing the games of tomorrow, which allows it to be confident about its future, while aiming to strengthen its leading position and continue to enhance its profitability. Groupe Partouche was floated on the stock exchange in 1995, and is listed on Euronext Paris, Compartment B (Mid Cap). ISIN: FR0012612646 – Bloomberg: PARP:FP – Reuters: PARP.PA – Bloomberg: PARP:FP

Attachment

FR0012612646

GROUPE PARTOUCHE: Sustained performance over 2025 – Turnover of € 460.2 M, up by +6.0 %

Sustained performance over 2025

Turnover of € 460.2 M, up by +6.0 %

Paris, 9th December 2025, 06:00 p.m. Groupe Partouche European leader in gaming, published this day its consolidated turnover for the 4th quarter of fiscal year 2025 (August to October 2025) et for the whole fiscal year (November 2024 to October 2025).

Annual turnover generated by all activities

Gross Gaming Revenue (GGR) reached € 748.3 M for fiscal year 2025, an increase of +5.1 %, compared to € 712.3 M a year earlier. The renovation in 2024 of three of the largest casinos in Annemasse, Divonne, and La Tour-de-Salvagny paid off, as their GGR recorded strong growth of +20.9 %, +17.7 %, and +15.0 %, respectively. In the 4th quarter of 2025, GGR increased by 6.4 % to € 197.8 M (compared to € 186.0 M in Q4 2024).

In France, annual GGR benefited from a 4.9 % increase in attendance and grew by 5.2 % to € 669.4 M (compared to € 636.1 M in 2024). GGR of all gaming categories improved: slot machines saw a 3.7% increase to € 522.6 M (vs. € 504.0 M in 2024), electronic table games a 10.6 % increase to € 86.9 M (vs. € 78.6 M in 2024), and non-electronic table games a 12.0 % increase to € 59.9 M (vs. € 53.5 M in 2024). In Q4 2025, GGR increased by + 6.1 % to € 177.0 M, compared to € 166.9 M a year earlier.

Internationally, annual GGR increased by +3.5 % year-on-year to € 78.9 M, compared to € 76.3 M a year earlier, including a favourable exchange rate effect of € 1.4 M related to the Meyrin casino in Switzerland. Slot machines GGR rose by +3.1 % to € 40.7 M (vs. € 39.5 M in 2024), as for traditional games GGR (up 3.8% to € 38.2 M vs. € 36.8 M in 2024), driven by Swiss online games (up 7.9% to € 25.4 M). In Q4 2025, GGR reached € 20.8 M, representing a +9.0 % increase compared to Q4 2024 (€ 19.1 M).

At a constant scope of consolidation, excluding the acquisition of Casino Partouche Cannes 50 Croisette on 28th February 2025 and the opening on 28th January 2025 of Cotonou casino in the Republic of Benin, GGR increased to € 734.1 M up 3.0% (vs € 712.3 M in 2024).

In total, after levies, Net Gaming turnover amounted to € 352.4 M over 12 months, representing a +4.0 % increase (compared to € 338.7 M in 2024). It reached € 83.3 M in the 4th quarter 2025 (+4.6 % vs. Q4 2024: € 79.7 M).

Turnover excluding NGR increased by 12.4 % to € 110.7 M (€ 98.5 M in 2024), driven by casinos non-gaming turnover (€ 65.5 M, +17.5%), including online gaming turnover from the Belgian subsidiary Casino de Middelkerke (€ 2.8 M, up +88.0%). The division Other grew (+18.6 %) to € 13.8 M, primarily due to the strong performance of Copal Beach in Cannes (+75.9%).

Globally, 2025 annual turnover amounts to € 460.2 M, up +6.0 % compared to 2024, with a growth remaining solid in Q4 2025.

Refinancing – New syndicated loan

Groupe Partouche arranged a refinancing syndicated loan with a six-year amortizing term, as well as a revolving credit facility with the same maturity, for a total amount of € 80 M. The Group is thus refinancing itself with a banking pool comprised of six all-times partners, joined by two new banks.

The income of said transaction is used to refinance the existing syndicated loan (€ 23.5 M, with maturity dates at 18th October 2025 for the revolving portion and 18th July 2026 for the main loan) and the Government-guaranteed loan (€ 3.8 M), thereby extending the average maturity of its debt.

Must Group Partnership

Founded in 2024, Must Group (40% owned by Groupe Partouche) has had a very successful year.

Its flagship location, the Copal Beach in Cannes, achieved a turnover of € 5.4 M in its first full year of operation, confirming the success of its concept.

Driven by three Parisian projects, 2026 will mark a new stage in its development plan with the reopening of the Doobie’s restaurant, the modernization of the Medellín club, and the creation of a new lifestyle destination on Place des Victoires (Paris):

- Doobie’s will reopen in early 2026 as a 400 m² restaurant-collector’s home, offering an immersive experience in the heart of Paris 8th district. The venue will plunge its visitors into a world inspired by the New-York great fashion houses and private clubs;

- Acquired in 2025, the Medellín club is experiencing 3% revenue growth and is entering a new phase of restructuring. Renovations are planned for summer of 2026 to strengthen its identity and enhance the customer experience;

- A café-restaurant, designed in collaboration with designer Ora Ito, will open in Q2 2026, becoming the first establishment of its kind on a prime location in Paris.

Upcoming events: Income fiscal year at 31st October 2025 – Tuesday 27th January 2026, after stock market closure

Groupe Partouche was established in 1973 and has grown to become one of the market leaders in Europe in its business sector. Listed on the stock exchange, it operates casinos, a gaming club, hotels, restaurants, spas and golf courses. The Group operates 43 casinos and employs nearly 3,900 people. It is well known for innovating and testing the games of tomorrow, which allows it to be confident about its future, while aiming to strengthen its leading position and continue to enhance its profitability. Groupe Partouche was floated on the stock exchange in 1995, and is listed on Euronext Paris, Compartment. ISIN: FR0012612646 – Reuters PARP.PA – Bloomberg: PARP:FP

ANNEX

1- Consolidated turnover

| In €M | 2025 | 2024 | Variation |

| 1st quarter (November N-1 to January N) | 126.4 | 118.7 | +6.5% |

| 2nd quarter (February to April) | 106.9 | 101.9 | +4.9% |

| 3rd quarter (May to July) | 114.5 | 106.7 | +7.3% |

| 4th quarter (August to October) | 112.4 | 107.0 | +5.1% |

| Total consolidated turnover | 460.2 | 434.3 | +6.0% |

2- Construction of consolidated turnover

2.1 – 4th quarter

| In €M | 2025 | 2024 | Variation |

| Gross Gaming Revenue (GGR) | 197.8 | 186.0 | +6.4% |

| Levies | -114.5 | -106.3 | +7.7% |

| Net Gaming Revenue (NGR) | 83.3 | 79.7 | +4.6% |

| Turnover excluding NGR | 29.7 | 27.9 | +6.3% |

| Fidelity programme | -0.6 | -0.6 | -3.3% |

| Total consolidated turnover | 112.4 | 107.0 | +5.1% |

2.2 – Aggregate 12 months

| In €M | 2025 | 2024 | Variation |

| Gross Gaming Revenue (GGR) | 748.3 | 712.3 | +5.1% |

| Levies | -395.9 | -373.7 | +6.0% |

| Net Gaming Revenue (NGR) | 352.4 | 338.7 | +4.0% |

| Turnover excluding NGR | 110.7 | 98.5 | +12.4% |

| Fidelity programme | -2.9 | -2.9 | +1.4% |

| Total consolidated turnover | 460.2 | 434.3 | +6.0% |

3- Breakdown of turnover by activity

3.1 – 4th quarter

| In €M | 2025 | 2024 | Variation |

| Casinos | 100.0 | 94.4 | +5.9% |

| Hotels | 8.7 | 9.0 | -3.6% |

| Other | 3.8 | 3.5 | +6.2% |

| Total consolidated turnover | 112.4 | 107.0 | +5.1% |

3.2 – Aggregate 12 months

| En M€ | 2025 | 2024 | Variation |

| Casinos | 415.0 | 391.5 | +6.0% |

| Hotels | 31.4 | 31.2 | +0.8% |

| Other | 13.8 | 11.6 | +18.7% |

| Total consolidated turnover | 460.2 | 434.3 | +6.0% |

4- Glossary

The “Gross Gaming Revenue” corresponds to the sum of the various operated games, after deduction of the payment of the winnings to the players. This amount is debited of the “levies” (i.e. tax to the State, the city halls, CSG, CRDS).

The «Gross Gaming Revenue» after deduction of the levies, becomes the “Net Gaming Revenue “, a component of the turnover.

Attachment

FR0012612646

GROUPE PARTOUCHE: Turnover first 9 months – € 347.8 M up +6.2% – Solid momentum confirmed in all activities – Closure of the Financière Partouche safeguard plan

Turnover first 9 months

€ 347.8 M up +6.2%

Solid momentum confirmed in all activities

Closure of the Financière Partouche safeguard plan

Paris, 9th September 2025, 06:00 p.m. Groupe Partouche European leader in gaming, published this day its consolidated turnover for the 3rd quarter of fiscal year 2025 (May- July 2025)

Sustained activity in the 3rd quarter with turnover up by +7.3% to € 114.5 M

The Gross Gaming Revenue (GGR) reached during the 3rd quarter 2025, € 189.0 M, up by + 5.3% compared to 3rd quarter 2024 (€ 179.5 M). The dynamic is evident across all geographic areas and gaming forms:

- In France, the Gross Gaming Revenue increased by +5.3% reaching € 169.1 M (vs. € 160.7 M in Q3 2024), supported by a +5.8% increase in attendance. In detail, the slots’ Gross Gaming Revenue increased by +2.6% to € 130.4 M (vs. € 127.1 M in Q3 2024), that of electronic table games by +11.8% to € 22.6 M (vs. € 20.2 M in Q3 2024) and that of non-electronic table games by +20.8% to € 16.0 M (vs. € 13.3 M in Q3 2024),

- Abroad, the GGR is up +5.6% to € 19.9 M (compared to € 18.8 M in Q3 2024) driven by the strong performance of Swiss online games (+19.0% to € 6.6 M compared to € 5.5 M in Q3 2024) and slot machines (+6.3% to € 10.1 M compared to € 9.5 M in Q3 2024).

At a constant scope of consolidation, excluding the acquisition of Casino Partouche Cannes 50 Croisette (in Cannes) on 28th February 2025 and the opening of the Cotonou casino (Benin) on 28th January 2025, GGR increased by +1.9% to € 182.9 M.

After Levies, the Net Gaming Revenue (NGR) progressed + 5.6% at € 83.7 M.

Non-gaming activity generated a turnover of € 31.5 M (+11.8%). Particularly noteworthy is the strong performance of the Copal Beach (ex Plage 3.14), which opened at the end of June 2024 following its renovation works (+88.1% to € 2.9 M).

Overall, turnover for the 3rd quarter 2025 stands at € 114.5 M, compared to € 106.7 M in 2024 (+7.3%).

Turnover aggregate 9 months at end of July up by +6.2 % at € 347.8 M

Over 9 months, Gross Gaming Revenue increased by +4.6% to € 550.5 M, including +3.0% at a constant scope. In France, growth over 9 months was +4.9% (to € 492.4 M) and +1.6% abroad (to € 58.1 M). Net Gaming Revenue increased by +3.9% to € 269.1 M.

The aggregate turnover for the first 9 months of 2025 financial year stands at € 347.8 M (+6.2% compared to the 9 months of 2024) thus confirming the solid trend observed since the start of the financial year under review.

Closure of the Financière Partouche safeguard plan

Following the modification on 26th May 20251, of the Financière Partouche safeguard plan and the early payment of the remaining liabilities due under the said plan established by judgment dated 30th June 20142, thanks to the drawing of the bank credit, the Commercial Court of Valenciennes was able to note on 1st September 2025, the proper execution and exit from the plan.

Sustainable development

For the fourth consecutive year, Groupe Partouche has had its extra-financial performance assessed as part of the “Pact” impact loan, taken out with ARKEA Banque. Based on a rigorous methodological framework, the Group obtained a score of 68/100, an increase of +5 points compared to the previous year and +4 points compared to the benchmark. This notable improvement underlines Groupe Partouche’s commitment to integrate environmental, social, and governance criteria into its strategy and allows it to further reduce the interest rate on this loan by 8 basis points.

Berck-sur-Mer

On 17th July 2025, in an appeal against a pre-contractual interim order annulling the consultation launched by the municipality of Berck-sur-Mer with a view to renewing its casino operating concession, the Council of State dismissed the appeal, further considering that the interim relief judge had not disregarded the principles governing so-called “returned” assets by noting that the building necessary for the casino’s operations could be transferred to the municipality at the end of the concession, particularly given the close ties between its owner and the concession holder.

This finding by the Council of State, which has no immediate legal effect, is being challenged in various ongoing and future proceedings.

Upcoming events :

Turnover 4th quarter 2025 : Tuesday 9th December 2025, following stock market closure

Income fiscal year at 31st October 2025 : Tuesday 27th January 2026, following stock market closure

Groupe Partouche was established in 1973 and has grown to become one of the market leaders in Europe in its business sector. Listed on the stock exchange, it operates casinos, a gaming club, hotels, restaurants, spas and golf courses. The Group operates 43 casinos and employs nearly 3,900 people. It is well known for innovating and testing the games of tomorrow, which allows it to be confident about its future, while aiming to strengthen its leading position and continue to enhance its profitability. Groupe Partouche was floated on the stock exchange in 1995, and is listed on Euronext Paris, Compartment . ISIN : FR0012612646 – Reuters PARP.PA – Bloomberg : PARP:FP

ANNEX

1- Consolidated turner aggegate 9 months per quarter

| In €M | 2025 | 2024 | Variation |

| 1st quarter (Nov. to Jan.) | 126.4 | 118.7 | +6.5% |

| 2nd quarter (Feb. to Apr.) | 106.9 | 101.9 | +4.9% |

| 3rd quarter (May to Jul.) | 114.5 | 106.7 | +7.3% |

| Total consolidated turnover | 347.8 | 327.3 | +6.2% |

2- Construction du chiffre d’affaires consolidé

2.1 – Troisième trimestre

| In €M | 2025 | 2024 | Variation |

| Gross Gaming Revenue (GGR) | 189.0 | 179.5 | +5.3% |

| Levies | -105.2 | -100.1 | +5.1% |

| Net Gaming Revenue (NGR) | 83.7 | 79.3 | +5.6% |

| Turnover excluding NGR | 31.5 | 28.1 | +11.8% |

| Fidelity programme | -0.7 | -0.8 | -5.2% |

| Total consolidated turnover | 114.5 | 106.7 | +7.3% |

2.2 – Cumul 9 mois

| In €M | 2025 | 2024 | Variation |

| Gross Gaming Revenue (GGR) | 550.5 | 526.4 | +4.6% |

| Levies | -281.4 | -267.4 | +5.3% |

| Net Gaming Revenue (NGR) | 269.1 | 259.0 | +3.9% |

| Turnover excluding NGR | 81.0 | 70.6 | +14.8% |

| Fidelity programme | -2.3 | -2.2 | +2.8% |

| Total consolidated turnover | 347.8 | 327.3 | 6.2% |

3- Breakdown of turnover by activity

3.1 – 3rd quarter

| In €M | 2025 | 2024 | Variation |

| Casinos | 99.3 | 93.3 | +6.4% |

| Hotels | 10.0 | 9.5 | +4.9% |

| Other | 5.2 | 3.9 | +34.3% |

| Total consolidated turnover | 114.5 | 106.7 | +7.3% |

3.2 – Cumul 9 mois

| In €M | 2025 | 2024 | Variation |

| Casinos | 315.0 | 297.1 | +6.0% |

| Hotels | 22.7 | 22.2 | +2.6% |

| Other | 10.0 | 8.1 | +24.1% |

| Total consolidated turnover | 347.8 | 327.3 | +6.2% |

4- Glossary

The “Gross Gaming Revenue” corresponds to the sum of the various operated games, after deduction of the payment of the winnings to the players. This amount is debited of the “levies” (i.e. tax to the State, the city halls, CSG, CRDS).

The «Gross Gaming Revenue» after deduction of the levies, becomes the “Net Gaming Revenue “, a component of the turnover.

1 See press release turnover 2nd quarter 2025 published on 10th June 2025 & available on Groupe Partouche.com/Finance.

2 See press release half year results 2025 published on 24th June 2025 & available on Groupe Partouche.com/Finance.

Attachment

FR0012612646

GROUPE PARTOUCHE: Solid Half-Year Income in a period of significant growth investments

Solid Half-Year Income

in a period of significant growth investments

- Turnover: € 233.3 M (+5.7 %)

- EBITDA: € 55.3 M compared to 41.0 €M at 1st Half-year 2024

- Net Income: € 12.6 M compared to € 7.1 M at 1st Half-year 2024

- Financial situation: gearing of 0.5x and leverage of 2.4x

Paris, 24th June 2025, 06:00 p.m. – During its meeting held on the 24th June 2025 and after having reviewed the management report of Groupe Partouche Executive Board, the Supervisory Board examined the audited accounts of the 1st half-year 2024-2025 (November 2024 to April 2025).

Strong Business Momentum

The positive momentum of activity over the half-year was reflected in a Gross Gaming Revenue (GGR) increase of +4.2% to € 361.5 M and a revenue increase of +5.7% to € 233.5 M.

The Group’s EBITDA increased by +35.1% to € 55.3 M (i.e. 23.7% of turnover) compared with € 41.0 M (18.6% of turnover) in the first half of 2024.

The Group’s Current Operational Income (COI) came in € 24.3 M compared to € 15.5 M in the first half of 2024 (+56.9%) with this increase occurring across all three business segments (casinos, hotels and others).

The casinos COI reached € 30.8 M, compared with € 24.3 M in the first half of 2024 (+26.7%), notably driven by strong performance from:

- The casino of Aix-en-Provence (+€ 1.9 M) following substantial work on its cost structure;

- The casinos of Annemasse (+€ 1.3 M) and La Tour-de-Salvagny (+€ 0.3 M) demonstrating the relevance of the recent improvements;

- Online gaming in Middelkerke (Belgium), in operation since 29th January 2024 (+€0.9 M).

Conversely, the Royal Palm in Cannes (formerly known as Casino 3.14), which moved to the Palm Beach site on the 2nd December 2024, was penalized by strongly seasonal activity (-€ 1.6 M) prior to the start of the summer period.

The negative COI of the hotels has improved to –€1.2 M, compared with –€ 2.7 M in H1 2024.

Finally, for the first half of 2025, the negative COI of the « others » sector improved to –€ 5.3 M, versus –€ 6.2 M in H1 2024, despite including in this sector the real estate company (SCI) that holds the building of the avenue de la Grande Armée, whose COI is also in deficit (–€ 0.9 M).

Purchases and external expenses amounting to € 77.0 M rose by +€4.3 M (+5.9 %), notably due to:

- an increase in material purchases (–8.2 %) in line with the rise in catering and hotel’s revenue, in professional fees and related expenses (services and partnerships, commissions, fees…), and in subcontracting costs;

- conversely, a decrease in advertising/marketing expenses linked to better control of this category and the cessation of sport betting activities.

Personnel expenses amounted to € 83.9 M, down by € 6.7 M, notably due to the extinction of social security liabilities (+€ 12.2 M, see Annex). Excluding the impact of this settlement, personnel expenses increased by € 6.0 M. Salaries and social security contributions increased by € 5.4 M following, on the one hand, the increase in headcount of +5.3% (including the integration of the Casino Cannes 50 Croisette and the casino of Cotonou teams) and on the other hand, an agreement on minimum collective agreements and an increase in night-shift premiums from 1st February 2025. Also noteworthy is the increase in employee participation of € 0.5 M.

Net Income amounted to € 12.6 M, compared to € 7.1 M on 30th April 2024 (+77.2%), taking into account the following items:

- a non- recurring operating loss of – € 0.5 M compared with -€ 1.0 M in H1 2024, mainly due to accelerated depreciation charges on Club Berri in anticipation of its relocation in the building of the avenue de la Grande Armée (–€ 0.4 M);

- a financial result of – € 4.1 M (compared to – € 1.0 M in H1 2024). The cost of financial debt is up in line with the Group’s gross debt evolution, while the average annual interest rate remained relatively stable. In addition, investment income declined due to the Group’s cash consumption. Furthermore, financial expenses include a mark-to-market adjustment of the interest rate swap used to hedge the financing of the acquisition of the building avenue de la Grande Armée, amounting to –€ 0.7 M;

- A tax expense (CVAE included) of -€ 6.7 M (compared to -€ 6.1 M in H1 2024) which includes the use of deferred tax assets linked to the Group’s tax consolidation for –€ 1.9 M.

With net cash (after levies) of € 75.3 M, shareholders’equity of € 370.0 and net debt of € 172.0 M (constructed in accordance with the terms of the syndicated loan agreement, according to the former IAS 17 standards, excluding IFRS 16), the Group’s financial structure remains sound. The marked increase in net debt is linked to the financing of the building avenue de la Grande Armée acquisition.

RECENT EVENTS AND PERSPECTIVES

Execution of the Financière Partouche safeguard plan

Further to the amendment of Financière Partouche’s safeguard plan which took place on 26 May 20251, Financière Partouche made an early payment, to the plan’s execution commissioner, of the outstanding liabilities due under the said plan established by judgment dated 30th June 2014, using the proceeds of a bank loan. The court has been petitioned to acknowledge the proper execution of the plan.

AVAILABILITY OF THE 2025 HALF-YEAR FINANCIAL REPORT

The 1st half-year financial report as of 30th April 2025 is available today on the Group’s website www.groupepartouche.com under the Finance section.

Upcoming events:

– 3rd quarter financial information: Tuesday 9th September 2025, after stock market closure

– 4th quarter turnover: Tuesday 9th December 2025, after stock market closure

Groupe Partouche was established in 1973 and has grown to become one of the market leaders in Europe in its business sector. Listed on the stock exchange, it operates casinos, a gaming club, hotels, restaurants, spas and golf courses. The Group operates 41 casinos and employs nearly 4,050 people. It is well known for innovating and testing the games of tomorrow, which allows it to be confident about its future, while aiming to strengthen its leading position and continue to enhance its profitability. Groupe Partouche was floated on the stock exchange in 1995, and is listed on Euronext Paris, Compartment B. ISIN: FR0012612646 – Reuters PARP.PA – Bloomberg: PARP:FP

Annex

Consolidated income

| In €M – At 30th April (6 months) | 2025 | 2024 | Difference | Var. |

| Turnover | 233.3 | 220.6 | 12.7 | +5.7% |

| Purchases & External Expenses | (77.0) | (72.6) | (4.3) | +5.9% |

| Taxes & Duties | (10.5) | (10.2) | (0.3) | +2.8% |

| Employees Expenses | (83.9) | (90.6) | 6.7 | -7.4% |

| Depreciation, amortisation & impairment of fixed assets | (29.5) | (25.2) | (4.3) | +17.0% |

| Other current, income & current operating expenses | (8.2) | (6.5) | (1.7) | +26.0% |

| Current Operating Income | 24.3 | 15.5 | (8.8) | +56.9% |

| Other non-current income & operating expenses | (0.5) | (1.0) | 0.5 | – |

| Gain (loss) on the sale of consolidated expenses | – | – | – | – |

| Impairment of non-current assets | – | – | – | – |

| Non-current Operating Income | (0.5) | (1.0) | 0.5 | – |

| Operating Income | 23.8 | 14.5 | 9.3 | +64.4% |

| Financial Income | (4.1) | (1.0) | (3.0) | – |

| Income before tax | 19.7 | 13.4 | 6.3 | +46.9% |

| Corporate Income | (6.2) | (5.6) | (0.6) | – |

| CVAE Taxes | (0.4) | (0.4) | – | – |

| Income after Tax | 13.1 | 7.4 | 5.7 | +77.6% |

| Shares in earnings of equity-accounted associates | (0.4) | (0.2) | (0.2) | – |

| Total Net Income | 12.6 | 7.1 | 5.5 | +77.2% |

| o/w Group’ share | 12.6 | 5.1 | 7.5 |

| EBITDA (*) | 55.3 | 41.0 | 14.4 | +35.1% |

| Margin EBITDA / Turnover | 23.7% | 18.6% | +5.1 pt |

(*) considering the application of IFRS 16 which has the automatic effect of improving EBITDA by € 9.5 M in H1 2025 and by € 7.6 M in H1 2024.

Taxes and Duties represent an expense of € 10.5 M compared to € 10.2 M in the first half of 2024.

After maintaining in recent fiscal years the cautious position adopted as of 31st October 2021, due to certain uncertainties regarding the treatment of aids related to social security contributions received during the Covid health crisis, Groupe Partouche has adjusted its liabilities and reduced them by € 12.2 M as of 31st March 2025, thereby increasing its EBITDA and Current Operating Income by the same amount (under “personnel expenses” in the consolidated income statement). Excluding this effect, EBITDA stands at € 43.1 M (18.5% of revenue), up € 2.2 M (+5.3%) compared to the previous year.

The increase in depreciation and amortization on fixed assets, up +17.0% to € 29.5 M, reflects the robust investment program in the Group’s establishments as well as the acquisitions of the building avenue de la Grande Armée and of the casino Cannes 50 Croisette.

Other current operating income and expenses represent a net expense of – € 8.2 M compared to – € 6.5 M in the first half of 2024.

Operating income stands at € 23.8 M compared to € 14.5 M in HY 2024 and income before tax at € 19.7 M compared to € 13.4 M in HY 2024.

The consolidated net income for the half-year is a profit of € 12.6 M compared to € 7.1 M as at 30th April 2024, of which the Group’s share is a profit of € 12.6 M compared to € 5.1 M on 30th of April 2024.

Balance Sheet

Total net assets as of 30th April 2025 represent € 942.2 M compared to € 845.1 M as of 31st October 2024. The noteworthy changes over the period are as follows:

- an increase in non-current assets of € 92.4 M, mainly due to the net rise in property, plant and equipment of € 89.6 M, notably including the acquisition of the building avenue de la Grande Armée for € 68.1 M (including work-in-progress and considering the down payment made in the previous year), the recognition of a right-of-use asset related to the amendment of the real estate lease contract of casino Meyrin in Switzerland under IFRS 16 in connection with renovation works (€ 11.2 M), the IFRS 16 recognition of Casino Cannes 50 Croisette’s lease following its inclusion in the consolidation scope (€ 11.8 M), and the volume of ongoing capital expenditures (in particular in the casinos of La Tour-de-Salvagny (€ 4.1 M), Cotonou (€ 1.7 M) and Vichy (€ 1.5 M);

- a decrease in current assets of € 2.3 M, mainly due to consumption of cash of € 7.3 M offset by an increase in the items “customers and other debtors” of € 3.2 M and “other current assets” of € 2.2 M;

- reclassification of € 7.0 M under IFRS 5 to “assets held for sale,” corresponding to the real estate asset that housed the Hotel 3.14 then the Casino 3.14 in Cannes, for which the sale agreement is expected to be signed shortly.

On the liabilities side, shareholders’ equity, including minority interests, went from € 365.0 M on 31st October 2024 to € 370.0 M on 30th April 2025, including a profit for the period of € 12.6 M.

The financial debt on 30th April 2025, increased by € 84.0 M (current & non-current shares) compared to 31st October 2024, taking into account:

- The arrangement of new bank loans for + € 80.4 M including € 60.0 M for the financing of the acquisition of the builduing avenue de la Grande Armée, € 10.0 M drawn from the revolving credit facility, and various renovation-related financings;

- The repayment of bank borrowings totaling -€13.5 M, including the two quarterly installments of the syndicated loan paid on 31st January and 30th April 2025, amounting to -€ 5.4 M;

- as well as flows related to lease contracts accounted for under IFRS 16.

Financial structure – Summary of net debt

The Group’s financial structure can be assessed using the following table (constructed in accordance with the terms of the syndicated loan agreement, based on the former IAS 17 standards, excluding IFRS 16).

| In €M | 30/04/25 | 31/10/24 | 30/04/24 |

| Equity | 370.0 | 365.0 | 367.3 |

| EBITDA * | 72.5 | 60.0 | 61.9 |

| Gross Debt | 247.4 | 185.5 | 171.0 |

| Cash less gaming levies | 75.3 | 81.4 | 89.8 |

| Net Debt | 172.0 | 104.1 | 81.2 |

| Ratio Net Debt / Equity (« gearing ») | 0.5x | 0.3x | 0.2x |

| Ratio Net Debt / Consolidated EBITDA (« leverage »)** | 2.4x | 1.7x | 1.3x |

(*) The consolidated EBITDA used to determine the “leverage” is calculated over a rolling 12-months period, according to the old IAS 17 standard (that is to say before application of IFRS 16).

(**) The gross deb includes bank borrowings, bond loans, and finance leases accounted for under the former IAS 17 standard (excluding other leases accounted for under IFRS 16), accrued interest, other borrowings and financial liabilities, bank loans, and financial instruments.

Glossary

The “Gross Gaming Revenue” corresponds to the sum of the various operated games, after deduction of the payment of the winnings to the players. This amount is debited of the “levies” (i.e. tax to the State, the city halls, CSG, CRDS).

The «Gross Gaming Revenue» after deduction of the levies, becomes the “Net Gaming Revenue “, a component of the turnover.

Turnover excluding NGR, includes all non-gaming activities i.e. catering, hotels, shows ticketing, spas, etc.

“Current Operating Income” COI includes all the expenses and income directly related to the Group’s activities to the extent that these elements are recurrent, usual in the operating cycle or that they result from specific events or decisions pertaining to the Group’s activities.

The “Non-Current Operating Income” (NCOI) includes all non-current and unusual events of the operating cycle: it therefore includes the depreciation of fixed assets (Impairments), the result from the sale of consolidated investments, the result from the sale of asset, other miscellaneous non-current operating income and expenses not related to the usual operating cycle.

Consolidated EBITDA is made up of the balance of income and expenses of the current operating income, excluding depreciation (allocations and reversals) and provisions (allocations and reversals) linked to the Group’ business activity included in the current operating income but excluded from Ebitda due to their non-recurring nature.

Gearing is the ratio of net debt to equity.

« Leverage » is the ratio of net debt to EBITDA.

1 Cf Q2 2025 turnover press release, published on 10 June 2025 and available on groupe.partouche.com/Finance.

Attachment

-

Blueprint Gaming5 days ago

Blueprint Gaming5 days agoBlueprint Gaming unleashes Frankenstein’s Fortune blending dynamic modifiers with multi-path bonus offering

-

Compliance Updates6 days ago

Compliance Updates6 days agoHow to Apply for a Finnish iGaming License: Gaming in Finland Webinar on Application Steps and Technical Standards

-

Big Daddy Gaming6 days ago

Big Daddy Gaming6 days agoBig Daddy Gaming® Expands European Footprint After MGA Licence Approval

-

Latest News4 days ago

Latest News4 days agoGGBET UA hosts Media Game – an open FC Dynamo Kyiv training session with journalists from sports publications

-

Compliance Updates5 days ago

Compliance Updates5 days agoMGA Publishes Results of Thematic Review on Self-exclusion Practices in Online Gaming Sector

-

Amusnet5 days ago

Amusnet5 days agoAmusnet Unveils Casino Engineering and Technology Milestones Achieved in 2025

-

Dan Brown5 days ago

Dan Brown5 days agoGames Global and Foxium return to the Colosseum in Rome Fight for Gold the Tiger’s Rage™

-

Latest News4 days ago

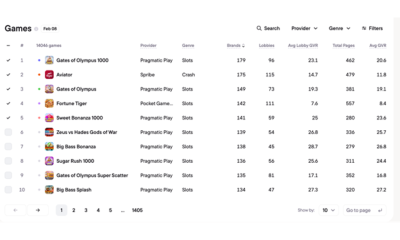

Latest News4 days agoSlots dominate Brazil’s casino catalog, but crash games capture outsized player demand,Blask data reveals