Fertitta Entertainment Inc

Tilman Fertitta Increases his Stake in Wynn Resorts

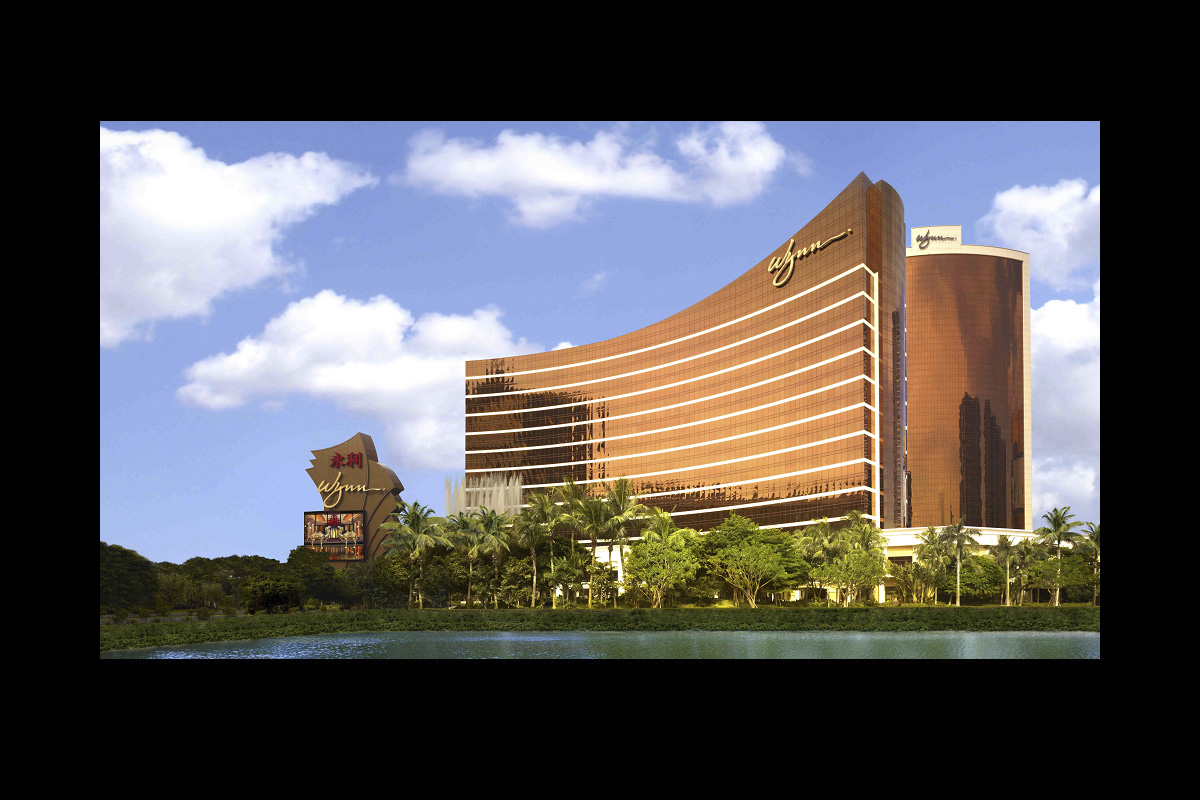

Tilman Fertitta, the largest individual shareholder of Wynn Resorts, increased his stake in the casino group with trades on April 4 and April 7.

Prior to the recent trades, disclosure records listed him as holding a 10% stake in Wynn Resorts. His latest share purchases, totaling 400,000 shares, were made at prices ranging from $67.62 to nearly $70.31 per share.

These transactions bring Fertitta’s total stake to 13 million shares, solidifying his position as the largest individual shareholder in the company.

Fertitta is the CEO of Houston-based Fertitta Entertainment with its Golden Nugget casino brand, restaurants and the NBA’s Houston Rockets. He announced plans to resign from his post at Feritta Entertainment if he is confirmed as ambassador to Italy and San Marino.

The billionaire took advantage of a steep drop in the stock market by acquiring more shares of Wynn Resorts at close to its 52-week low. Wynn saw its shares close at $67.93 on April 7, marking their lowest trading level since late 2022.

The share purchases were executed through various Fertitta-controlled entities, including Fertitta Entertainment Inc., Hospitality Headquarters, and Fertitta Entertainment LLC. As the sole proprietor of these organizations, Fertitta maintains shared beneficial ownership of the acquired securities.

Feritta has yet to file a SEC 13D form, which would allow him to have a greater influence on the company instead of remaining a silent shareholder.

The post Tilman Fertitta Increases his Stake in Wynn Resorts appeared first on Gaming and Gambling Industry in the Americas.

Canada

Landcadia Holdings Secures New Jersey Regulatory Approval for GNOG Acquisition

Landcadia Holdings II Inc. has secured regulatory approval from the New Jersey Casino Control Commission to acquire Golden Nugget Online Gaming Inc. (GNOG).

“We are appreciative of the efforts of both the New Jersey Division of Gaming Enforcement and the Casino Control Commission in approving our transaction,” Tilman J. Fertitta, Co-Chairman and CEO of Landcadia II, said.

“With this regulatory approval, we are one step closer to completing our acquisition of GNOG. We are now waiting on the SEC to approve our definitive proxy statement for mailing to our stockholders and approval from our stockholders of the transaction, which we hope will happen in the near future,” Landcadia II’s General Counsel Steven L. Scheinthal said.

Landcadia Holdings II, Inc. is a company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses that is co-sponsored by Fertitta Entertainment Inc. and Jefferies Financial Group Inc.

Powered by WPeMatico

-

Blueprint Gaming6 days ago

Blueprint Gaming6 days agoBlueprint Gaming unleashes Frankenstein’s Fortune blending dynamic modifiers with multi-path bonus offering

-

Compliance Updates7 days ago

Compliance Updates7 days agoHow to Apply for a Finnish iGaming License: Gaming in Finland Webinar on Application Steps and Technical Standards

-

Big Daddy Gaming7 days ago

Big Daddy Gaming7 days agoBig Daddy Gaming® Expands European Footprint After MGA Licence Approval

-

Latest News4 days ago

Latest News4 days agoGGBET UA hosts Media Game – an open FC Dynamo Kyiv training session with journalists from sports publications

-

Compliance Updates6 days ago

Compliance Updates6 days agoMGA Publishes Results of Thematic Review on Self-exclusion Practices in Online Gaming Sector

-

Amusnet6 days ago

Amusnet6 days agoAmusnet Unveils Casino Engineering and Technology Milestones Achieved in 2025

-

Brais Pena Chief Strategy Officer at Easygo7 days ago

Brais Pena Chief Strategy Officer at Easygo7 days agoStake Goes Live in Denmark Following Five-Year Licence Approval

-

Dan Brown6 days ago

Dan Brown6 days agoGames Global and Foxium return to the Colosseum in Rome Fight for Gold the Tiger’s Rage™