Latest News

Online Gambling Regulations in Europe

The European online gambling market is one of the most lucrative and dynamic in the world, attracting millions of players and hundreds of licensed operators. However, unlike other industries that follow uniform regulations across the European Union (EU), gambling laws differ significantly from one country to another. Each nation has the autonomy to establish its own rules, licensing procedures, and player protection measures, making the regulatory landscape both diverse and complex.

Alt text: Man playing with poker chips and cards.

For players and operators alike, understanding these legal frameworks is essential to ensuring compliance and a safe gaming experience. Whether you’re a casual player looking for licensed platforms or an investor exploring the market, knowing the ins and outs of European gambling laws is key. That’s why many prefer to play at EU casinos that adhere to strict national and international regulations, ensuring fair play and security.

The European Union’s Stance on Online Gambling

The European Union (EU) does not impose a standardized regulatory system for online gambling across its member states. Instead, each country retains the autonomy to craft and enforce its own laws governing gambling activities. This approach acknowledges the principle of subsidiarity, allowing nations to regulate gambling in a manner that aligns with their societal values and public policy objectives. Consequently, the legal status and regulatory requirements for online gambling vary significantly across the EU.

Country-Specific Regulatory Frameworks

United Kingdom

The United Kingdom maintains a comprehensive regulatory framework for online gambling, primarily governed by the Gambling Act 2005 and overseen by the UK Gambling Commission (UKGC). In April 2023, the government published a white paper titled “High Stakes: Gambling Reform for the Digital Age,” outlining significant reforms to modernize gambling regulations. One key proposal is the introduction of a statutory levy on all licensed gambling operators, set to commence in April 2025. This levy aims to fund research, prevention, and treatment of gambling-related harms, with rates varying depending on the sector and nature of the gambling activity.

Germany

Germany’s online gambling landscape has undergone significant changes with the enactment of the Interstate Treaty on Gambling (ISTG) 2021. This treaty permits the federal licensing of sports betting, virtual slot machines, and online poker. Notably, online slot stakes are capped at €1 per spin to promote responsible gambling. The regulation of traditional online casino games, such as roulette and blackjack, is delegated to individual states, resulting in varied rules and licensing requirements across the country. The Joint Gambling Authority (GGL) serves as the central regulatory body, ensuring compliance and overseeing licensed operators.

France

In France, the online gambling market is regulated by the National Gaming Authority (Autorité Nationale des Jeux – ANJ), established under the French Gambling Act 2010. The legislation permits online betting on sports, horse racing, and poker, while online casino games like slots and roulette remain prohibited. Operators must secure a license from the ANJ and comply with strict regulations to protect consumers and uphold gaming integrity.

Spain

Spain’s online gambling activities are governed by the Spanish Gambling Act, with oversight provided by the Directorate General for the Regulation of Gambling (Dirección General de Ordenación del Juego – DGOJ). The act legalizes various forms of online gambling, including sports betting, poker, and casino games. Licensed operators are required to implement measures promoting responsible gambling and ensuring the protection of vulnerable individuals.

Italy

Italy has embraced a regulated online gambling market, with the Autonomous Administration of the State Monopolies (AAMS) responsible for licensing and supervision. The regulatory framework permits a broad spectrum of online gambling activities, including poker, casino games, and sports betting. Operators must adhere to the provisions of the Finance Act, which has been amended over time to accommodate the evolving gambling landscape.

Netherlands

The Netherlands introduced the Remote Gambling Act to regulate online gambling, with the Dutch Gambling Authority (Kansspelautoriteit – KSA) serving as the regulatory body. The act allows operators to obtain licenses to offer online sports betting, casino games, and poker to Dutch residents. The KSA enforces strict guidelines to ensure player protection, game fairness, and the prevention of gambling addiction.

Malta

Malta stands out as a hub for online gambling operators, largely due to its comprehensive regulatory framework and favorable business environment. The Malta Gaming Authority (MGA), established under the Gaming Act 2018, licenses and regulates a wide array of online gambling activities. The MGA has taken decisive actions, including revoking licenses of non-compliant operators to uphold the integrity of the gaming industry.

Ireland

Ireland’s approach to online gambling regulation has been evolving, with the passage of the Gambling Regulation Act in October 2024 marking a significant milestone. This legislation led to the creation of the Gambling Regulatory Authority of Ireland (GRAI), tasked with overseeing both online and land-based gambling activities. The GRAI aims to establish a robust regulatory environment that safeguards players and ensures fair play across all gambling platforms.

Common Regulatory Themes Across Europe

Despite the diversity in regulatory approaches, several common themes emerge across European countries:

- Licensing Requirements: Operators are generally required to obtain a license from the relevant national authority to offer gambling services legally. This process involves rigorous vetting to ensure the operator’s suitability and commitment to maintaining industry standards.

- Player Protection Measures: Regulations often mandate the implementation of measures to protect players from gambling-related harm. This includes self-exclusion options, deposit limits, and access to support services for problem gambling.

- Anti-Money Laundering (AML) Compliance: Operators must adhere to strict AML protocols to prevent the misuse of gambling platforms for illicit financial activities. This involves customer verification processes and the monitoring of transactions for suspicious activity.

- Advertising and Promotion Controls: Many jurisdictions impose restrictions on the advertising of gambling services to prevent targeting vulnerable populations and to promote responsible marketing practices.

The Role of the European Gaming and Betting Association (EGBA)

The European Gaming and Betting Association (EGBA) advocates for a well-regulated and competitive online gambling market in the EU. Representing top operators, it works with national and EU authorities to align regulations and encourage industry best practices. The EGBA prioritizes consumer protection, responsible gambling, and maintaining integrity in gaming operations.

The Future of Online Gambling Regulation in Europe

The European online gambling industry is constantly evolving, with regulatory changes being introduced regularly. Some trends shaping the future include:

Tighter Responsible Gambling Controls: More countries are adopting affordability checks and restrictions on VIP programs.

Cross-Border Licensing Discussions: The EU may push for more harmonization of gambling laws, though this remains a challenge.

New Technologies: AI, blockchain, and cryptocurrency gambling may introduce new regulatory challenges in the coming years.

As European gambling laws continue to shift, both players and operators need to stay informed. Playing at licensed platforms and understanding national regulations is the best way to ensure a safe and fair gaming experience.

The post Online Gambling Regulations in Europe appeared first on Gaming and Gambling Industry in the Americas.

Affiliate World Global

Meet N1 Partners at Affiliate World Global in Dubai

N1 Partners will attend Affiliate World Global in Dubai on March 4–5, 2026. The event brings together affiliates, media buyers, and performance-focused brands for intensive networking, deal-making, and practical discussions around traffic, monetization, and scaling.

A key focus for the team will be the N1 Traffic Cups — a year-long series of traffic tournaments running throughout 2026. The opening stage, N1 SEO Traffic Cup, is now launching and will kick off the season for affiliates ready to compete, scale, and earn additional rewards. Affiliate World Global provides an ideal opportunity to discuss the N1 SEO Traffic Cup in person, connect directly with the team, and explore strategies to maximize performance within the tournament.

At the Dubai event, N1 Partners will meet with partners seeking strong brands, fast execution, and flexible deal structures across 10+ Tier-1 GEOs. The team will also share insights into upcoming 2026 projects, new launches, and strategic growth priorities for the year ahead.

Book a meeting with the team

To make the most of Affiliate World Global, partners are encouraged to arrange meetings in advance and discuss cooperation opportunities on-site. Alexey Gusarov, Team Lead of Affiliates, and Victoria Sokolenko, Affiliate Manager, will represent N1 Partners in Dubai and will be available throughout the event to discuss traffic strategies, deal structures, and participation in the upcoming N1 Traffic Cups.

Why meet N1 Partners at Affiliate World Global

Attendees can explore:

• 14+ casino and sportsbook brands with Reg2Dep up to 70%

• Top deals across 10+ Tier-1 GEOs

• CPA up to €700 for high-performing traffic, RevShare up to 45% + NNCO for top partners, and hybrid models

See you in Dubai at Affiliate World Global.

About N1 Partners

N1 Partners is a multi-brand affiliate program and direct advertiser объединing 14+ casino and sportsbook brands with high LTV and Reg2Dep conversion rates of up to 70%. Operating since 2018, the company delivers stable results and long-term value for partners worldwide. N1 Partners offers transparent terms, flexible partnership models, and a reputation as a reliable partner. With a strong product portfolio, advanced retention systems, and an experienced team, N1 Partners helps partners achieve consistent earnings across competitive Tier-1 markets.

Be number one with N1 Partners.

The post Meet N1 Partners at Affiliate World Global in Dubai appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Affiliate World Global

Meet N1 Partners at Affiliate World Global in Dubai

N1 Partners team is attending Affiliate World Global in Dubai on 4 and 5 March 2026. The event is a major meeting point for affiliates, media buyers, and performance-driven brands, known for high-intensity networking, deal-making, and practical conversations around traffic, monetization, and scaling.

One of the key focuses will be the N1 Traffic Cups series, a year-long format of traffic tournaments running throughout 2026. The first stage, N1 SEO Traffic Cup, which is just getting started and will open the season for affiliates ready to compete, scale, and earn extra rewards.

Affiliate World Global will be the perfect moment to discuss the N1 SEO Traffic Cup in person. Attendees will be able to connect directly with the team, get the details first, and explore the best strategies for their traffic to take advantage of the tournament.

In Dubai, N1 Partners will be ready to connect with partners looking for strong brands, fast execution, and flexible deals across 10+ Tier-1 GEOs. The team will also share insights into new projects planned for 2026, upcoming launches, and key growth priorities for the year ahead.

Book a Meeting with Our Affiliate Managers

To make the most of Affiliate World Global, book a meeting with N1 Partners in advance and discuss partnership opportunities directly on-site.

Alexey Gusarov, Team Lead of Affiliates and Victoria Sokolenko, Affiliate Manager, will represent N1 Partners in Dubai and will be available throughout the event to talk about traffic strategy, deal structures, and how to join the upcoming N1 Traffic Cups.

Why Meet N1 Partners at Affiliate World Global

Affiliate World Global is the right place to explore:

- 14+ casino and sportsbook brands with Reg2Dep up to 70%

- Top deals across 10+ Tier-1 GEOs

- CPA up to €700 for high-performing traffic, RevShare up to 45% + NNCO for top partners, and hybrid models

See you in Dubai at Affiliate World Global.

About N1 Partners

N1 Partners is a multi-brand affiliate program and direct advertiser, bringing together 14+ casino and sportsbook brands with high LTV and Reg2Dep conversion rates of up to 70%. Operating successfully since 2018, the company delivers stable results and long-term value for partners worldwide.

N1 Partners offers transparent terms, flexible partnership models, and a reputation as a reliable partner. With a strong product portfolio, advanced retention system, and experienced team, N1 Partners helps partners achieve consistent earnings even in highly competitive Tier-1 markets.

Be number one with N1 Partners.

The post Meet N1 Partners at Affiliate World Global in Dubai appeared first on Americas iGaming & Sports Betting News.

Latest News

Meet N1 Partners at Affiliate World Global in Dubai

N1 Partners team is attending Affiliate World Global in Dubai on 4 and 5 March 2026. The event is a major meeting point for affiliates, media buyers, and performance-driven brands, known for high-intensity networking, deal-making, and practical conversations around traffic, monetization, and scaling.

One of the key focuses will be the N1 Traffic Cups series, a year-long format of traffic tournaments running throughout 2026. The first stage, N1 SEO Traffic Cup, which is just getting started and will open the season for affiliates ready to compete, scale, and earn extra rewards.

Affiliate World Global will be the perfect moment to discuss the N1 SEO Traffic Cup in person. Attendees will be able to connect directly with the team, get the details first, and explore the best strategies for their traffic to take advantage of the tournament.

In Dubai, N1 Partners will be ready to connect with partners looking for strong brands, fast execution, and flexible deals across 10+ Tier-1 GEOs. The team will also share insights into new projects planned for 2026, upcoming launches, and key growth priorities for the year ahead.

Book a Meeting with Our Affiliate Managers

To make the most of Affiliate World Global, book a meeting with N1 Partners in advance and discuss partnership opportunities directly on-site.

Alexey Gusarov, Team Lead of Affiliates and Victoria Sokolenko, Affiliate Manager, will represent N1 Partners in Dubai and will be available throughout the event to talk about traffic strategy, deal structures, and how to join the upcoming N1 Traffic Cups.

Why Meet N1 Partners at Affiliate World Global

Affiliate World Global is the right place to explore:

- 14+ casino and sportsbook brands with Reg2Dep up to 70%

- Top deals across 10+ Tier-1 GEOs

- CPA up to €700 for high-performing traffic, RevShare up to 45% + NNCO for top partners, and hybrid models

See you in Dubai at Affiliate World Global.

About N1 Partners

N1 Partners is a multi-brand affiliate program and direct advertiser, bringing together 14+ casino and sportsbook brands with high LTV and Reg2Dep conversion rates of up to 70%. Operating successfully since 2018, the company delivers stable results and long-term value for partners worldwide.

N1 Partners offers transparent terms, flexible partnership models, and a reputation as a reliable partner. With a strong product portfolio, advanced retention system, and experienced team, N1 Partners helps partners achieve consistent earnings even in highly competitive Tier-1 markets.

Be number one with N1 Partners.

-

Asia7 days ago

Asia7 days agoBooks on Wheels: DigiPlus Foundation Brings Mobile Library to Boost Literacy Among Aurora’s Young Learners

-

Latest News6 days ago

Latest News6 days agoGGBET UA hosts Media Game – an open FC Dynamo Kyiv training session with journalists from sports publications

-

BETANO7 days ago

BETANO7 days agoCT Interactive Partners with Betano.cz for Live Rollout

-

Canada7 days ago

Canada7 days agoSt8 launches in Ontario through partnership with Tonybet

-

Latest News6 days ago

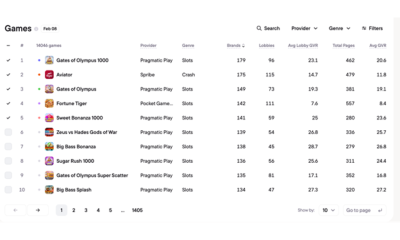

Latest News6 days agoSlots dominate Brazil’s casino catalog, but crash games capture outsized player demand,Blask data reveals

-

Baltic & Nordics Gaming Awards 20267 days ago

Baltic & Nordics Gaming Awards 20267 days agoNominations Now Open for the HIPTHER Baltic & Nordics Gaming Awards 2026

-

Ca$hline7 days ago

Ca$hline7 days agoCaesars Entertainment Launches First Proprietary Online Slot, Ca$hline

-

Latest News6 days ago

Latest News6 days agoRocketPlay won European Marketing Campaign of the Year – B2C at the 2026 EGR Europe Awards