Allied Esports Entertainment

Allied Esports Receives $100M Purchase Offer from Bally’s Corporation

Allied Esports Entertainment has confirmed that it has received an unsolicited proposal from Bally’s Corporation to acquire all of the outstanding equity interests of the Company for a total consideration of $100 million, payable, at the Company’s option, in cash, Bally’s capital stock, or a combination of both.

The Bally’s proposal would require the Company to terminate its previously announced agreement with Element Partners to sell all of the equity interests of Club Services, an indirect wholly-owned subsidiary of the Company that directly or indirectly owns the Company’s poker-related business and assets, including the entities comprising the World Poker Tour, for consideration totaling $78,250,000.

The Company’s Board of Directors, consistent with its duties and the Company’s obligations under its existing agreement with Element, will evaluate Bally’s proposal in due course. The Company and Element continue to discuss potential updates to the current terms of their agreement. There can be no assurance that the Company will enter into a definitive agreement with Bally’s or consummate any transaction with Bally’s.

Powered by WPeMatico

Allied Esports Entertainment

Allied Esports Appoints Yinghua Chen as CEO

Allied Esports Entertainment announced that the Company’s Board of Directors has appointed Yinghua Chen as Chief Executive Officer. Ms. Chen had previously served as the Company’s President, Chief Investment Officer, and Board Secretary. Given Ms. Chen’s additional responsibilities, Ms. Chen will no longer serve the Company as Chief Investment Officer or Board Secretary, and will continue to serve as President. She has served as a director of the Company since 2020.

Ms. Chen assumes the position of Chief Executive Officer from Lyle Berman, who has served as Co-Chairman of the Board and Interim Chief Executive Officer since February 2022. Mr. Berman retains his position as Co-Chairman of the Board, and has been appointed as Vice President, Mergers & Acquisition, where he will be more focused on the Company’s M&A activities. Mr. Berman has served as a director of the Company since May 2017.

Mr. Berman said: “I am pleased to pass the torch to Yinghua. As Interim CEO and as Company director, I have had the opportunity to work closely with her and I believe she is the ideal person to lead Allied Esports Entertainment’s executive operations as we move forward.”

Mr. Berman continued: “In addition, we remain focused on investing the substantial cash on our balance sheet to acquire or merge with an existing business. Looking ahead, the Board has asked me to focus my activities on sourcing and executing a transaction that drives the most possible value for AESE stockholders. We continue to explore a number of potential acquisition opportunities; however, given the current macroeconomic conditions, we are evaluating these opportunities very carefully and cautiously.”

Ms. Chen said: “I am honored to serve as Allied Esports Entertainment’s Chief Executive Officer and I am grateful to the Board for this opportunity. Along with our very capable team, I look forward to helping guide our future success and maximize stockholder value.”

Powered by WPeMatico

Allied Esports Entertainment

Allied Esports Entertainment Announces Preliminary Unaudited Fourth Quarter and Full Year 2020 Financial Results

Allied Esports Entertainment, Inc., a global esports entertainment company, announced preliminary unaudited financial results for the fourth quarter and full year ended December 31, 2020, as well as an update on several key business initiatives. This release refers to “continuing” and “discontinued” operations due to the pending sale of the Company’s subsidiaries operating our poker-related business and assets comprising the World Poker Tour® (“World Poker Tour,” or “WPT®”), which is currently in active negotiations to be sold in a transaction that is expected to close in the second quarter of 2021. Therefore, unless otherwise noted, results presented in this release relate to the continuing operations of the Company and Allied Esports, and excludes the World Poker Tour.

The Company filed a Form 12b-25 to extend the due date for filing its Annual Report on Form 10-K for the year ended December 31, 2020 until April 15, 2021. Reflected herein are selected preliminary unaudited financial results. These financial results are subject to adjustments based upon, among other things, the completion of the audit of the Company’s consolidated financial statements as of December 31, 2020 and for the year then ended.

Commenting on the preliminary fourth quarter and full year 2020 results, the Company’s CEO, Frank Ng, said, “Despite the unprecedented operating challenges and macro-economic uncertainty encountered throughout most of 2020 resulting from the COVID-19 pandemic, Allied Esports finished the year with a solid performance in the fourth quarter. The In-person pillar of our business model remains the primary near-term growth driver of our Esports business, and this activity was significantly curtailed globally during the pandemic due to operational restrictions, including limitations on social gatherings and other health and safety protocols. However, we made good progress throughout the year conceptualizing and building-out the Multiplatform Content pillar of our business. I believe the work and progress we made will serve us well in the quarters and years ahead.”

Mr. Ng continued, “Total revenues for the fourth quarter of $0.9 million declined from $2.0 million in the fourth quarter last year. During the fourth quarter, Esports generated its first meaningful revenue from Multiplatform Content, which totaled $0.2 million and comprised nearly one-quarter of our fourth quarter Esports revenue. At the bottom line, our adjusted EBITDA loss of $3.5 million for the fourth quarter improved over 3% from an adjusted EBITDA loss of $3.7 million a year ago. I am also pleased with our ability to reduce operating expenses to better align our cost structure with the lower revenues generated during the year. Additionally, we made tremendous progress in 2020 improving our capital structure, as evidenced by a 71% reduction in total bridge and convertible debt during the year and significantly enhanced financial flexibility.”

Mr. Ng concluded, “As we look ahead in 2021, our expectation is that global distribution of COVID-19 vaccines will bring the return of a normalized world—and with it—the recovery of in-person events. We are optimistic that we will soon be operating in an environment where the Company’s foundational strides made on the Multiplatform Content pillar of our business in 2020 will come together alongside the resurgence of live events and the return of maximum capacity at our various Esports venues.”

Fourth Quarter 2020 Financial Results

Revenues: Total revenues of $0.9 million decreased 52% in the fourth quarter of 2020 versus the fourth quarter one year prior. This was due to decreased In-person revenue, partially offset by revenue growth in Multiplatform Content.

Costs and expenses: Total costs and expenses for the fourth quarter of 2020 were $16.6 million, an increase of 135% compared to the fourth quarter of 2019. Costs and expenses increased due to increases in impairment of investments and property and equipment expenses that were not incurred in the prior year period. The increase was partially offset by lower expenses in In-person, selling and marketing, and online operating areas of the business.

Loss from continuing operations for the quarter was $19.7 million, compared to a loss of $5.8 million in the prior year period. Loss from continuing operations for the fourth quarter of 2020 included a non-cash extinguishment loss on acceleration of debt redemption of $1.7 million that was not incurred in the prior year period as well as a $1.8 million increase in interest expense compared to the fourth quarter of 2019.

Adjusted EBITDA loss was $3.5 million for the 2020 fourth quarter, as compared to $3.7 million in the fourth quarter of 2019. A reconciliation of the GAAP-basis net loss to adjusted EBITDA is provided in the table at the end of this press release.

Full Year 2020 Financial Results

Revenues: Total revenues of $3.2 million decreased 57% in the full year of 2020 versus 2019. This was primarily due to decreased In-person revenue, partially offset by revenue growth in Multiplatform Content.

Costs and expenses: Total costs and expenses for the full year of 2020 were $35.7 million, an increase of 63% compared to 2019. Costs and expenses rose primarily due to increases in impairment of investments and property and equipment, stock-based compensation expense and G&A expenses. The increase was partially offset by a decrease in In-person, Multiplatform content, and selling and marketing expenses.

Loss from continuing operations for the 2020 year was $46.5 million, compared to a loss of $15.5 million in 2019. Loss from continuing operations for the full year of 2020 included a non-cash conversion inducement expense of $5.2 million and a non-cash extinguishment loss on acceleration of debt redemption of $3.4 million that were not incurred in the prior year along with a $4.5 million increase in interest expense compared to 2019.

Adjusted EBITDA loss was $11.6 million for the 2020 year, as compared to $9.6 million in 2019. A reconciliation of the GAAP-basis net loss to adjusted EBITDA is provided in the table at the end of this press release.

Balance Sheet

As of December 31, 2020, the Company had a cash position of $9.1 million, including $5.0 million of restricted cash and an additional $3.6 million of cash held by the WPT business that is included in current assets of discontinued operations, but which continues to fund the Allied Esports business until the close of a WPT sale transaction. The Company had a cash position of $12.1 million at December 31, 2019, which included $3.7 million of restricted cash and $5.2 million held at WPT. The total gross principal amount of bridge and convertible debt as of December 31, 2020 was $4.0 million, as compared to $14.0 million in the prior year period. As of December 31, 2020, the Company’s common shares outstanding totaled approximately 38.5 million shares.

Operational Update

Allied Esports

In the fourth quarter of 2020, Allied Esports produced 48 events, with 41 proprietary events and 7 third-party productions, across its North American and European business units.

During the quarter, Allied Esports continued to see strong demand in both its in-arena and online proprietary offerings. Over 1,000 players from North America and Latin America competed across Fortnite, PLAYERUNKNOWN’S BATTLEGROUNDS (PUBG) Mobile and Call of Duty Mobile in Trovo Holiday Royale, a tournament which was co-organized by Trovo and Allied Esports. The event was live streamed exclusively on Trovo.Live.

Allied Esports continued to leverage its infrastructure for production services for several clients, including FaceIT, HyperX and Digi 1, among others. Services included both online productions as well as an in-person COVID-19-safe bubble environment at HyperX Esports Arena for participating teams.

Allied Esports also hosted one event on its HyperX Exports Truck in North America with partner Findlay Volkswagen in the fourth quarter.

In November, Allied Esports launched a 24-hour content strategy on Twitch, which has generated strong interest since launch. Hundreds of hours of Allied Esports’ tournament productions and exclusive original content are programmed around the clock across Allied Esports’ Twitch channels. The new 24-hour programming schedule generated nearly 3 million live views in the fourth quarter which was up 6,202% Y-on-Y. Growth in viewership also led to increased follower growth on Twitch by 7% in the fourth quarter.

Subsequent to quarter end, Allied Esports announced the renewal of their exclusive naming rights agreement for Allied Esports’ global flagship property, HyperX Esports Arena Las Vegas, located at Luxor Hotel and Casino on the Las Vegas Strip. Per the multiyear deal, HyperX will continue to receive prominent branding and signage inside and outside of the venue, as well as across all arena promotions, content and social media platforms. Additionally, both companies will continue to partner on a variety of co-branded experiences and events at the arena focused on growing their gaming and esports communities.

Corporate Developments

On March 19, 2021, the Company announced an amended definitive agreement to sell its subsidiaries operating our poker-related business and assets comprising the World Poker Tour, to Element Partners, LLC subject to closing conditions, with a total transaction value of approximately $90.5 million.

In response to an unsolicited proposal of Bally’s Corporation to acquire the World Poker Tour for $105 million, on March 29, 2021, Element and the Company further amended their definitive agreement to increase the purchase price to $105 million. The Company’s Board of Directors will evaluate any additional proposals in due course in compliance with the terms of the Element definitive agreement.

Fourth Quarter and Full Year 2020 Conference Call

The Company will host a conference call today at 2:00 p.m. Pacific Time / 5:00 p.m. Eastern Time to discuss its preliminary fourth quarter and full year 2020 financial results. Participants may join the conference call by dialing 1-877-407-0792 (United States) or 1-201-689-8263 (International).

A live webcast of the conference call will also be available on the Company’s Investor Relations site at http://ir.alliedesportsent.com. Additionally, financial information presented on the call will be available on Allied Esports’ Investor Relations site. For those unable to participate in the conference call, a telephonic replay of the call will also be available shortly after the completion of the call, until 11:59 p.m. ET on Wednesday, April 14, 2021, by dialing 1-844-512-2921 (United States) or 1-412-317-6671 (International) and entering the replay pin number: 13717880.

Powered by WPeMatico

Allied Esports Entertainment

Allied Esports Entertainment Board Determines Bally’s Corporation Revised Proposal Is Superior to Element Stock Purchase Agreement

Allied Esports Entertainment, Inc., a global esports entertainment company, announced that the Company’s Board of Directors, in consultation with its financial and legal advisors, has determined that a revised proposal from Bally’s Corporation constitutes a “Superior Proposal” under the Company’s pending stock purchase agreement with Element Partners, LLC. Under the terms of Bally’s revised proposal, Bally’s would acquire all of the equity interests of Club Services, Inc. (“CSI”), an indirect wholly-owned subsidiary of the Company that directly or indirectly owns the Company’s poker-related business and assets, including the entities comprising the World Poker Tour® (“World Poker Tour,” or “WPT®”), for consideration totaling $90,000,000 in cash at the closing.

The Company notified Element that it intends to terminate their stock purchase agreement unless, prior to 5:00 p.m. Pacific Time on March 19, 2021, the Company and Element negotiate an amendment to their pending stock purchase agreement such that the Bally’s revised proposal no longer constitutes a Superior Proposal.

Prior to making its determination regarding Bally’s revised proposal, the Company received a proposal from Bally’s to sell the outstanding capital stock of the Company for $100 million, which would include the sale of the World Poker Tour and the Company’s esports operations. After discussions, Bally’s updated its proposal to acquire only the entities comprising the World Poker Tour to more closely mirror the structure of the Company’s pending stock purchase agreement with Element.

There can be no assurance that the Company will enter into a definitive agreement with Bally’s or consummate any transaction with Bally’s.

Powered by WPeMatico

-

Latest News7 days ago

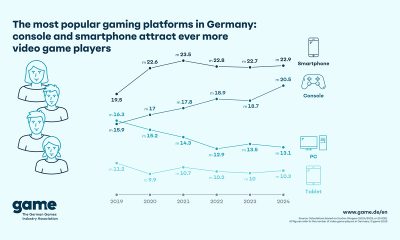

Latest News7 days agoThe Most Popular Gaming Platforms in Germany: Console and Smartphone Attract Ever More Video Game Players

-

Australia6 days ago

Australia6 days agoVGCCC: Minors Exposed to Gambling at ALH Venues

-

Balkans7 days ago

Balkans7 days agoSYNOT Partners with Efbet in Bulgaria

-

Asia7 days ago

Asia7 days agoFIFA, NBA, UFC and More Sports Events Go Live – Crypto Sportsbook BETY Offers Global Sports Betting Coverage 2025

-

EveryMatrix Press Releases7 days ago

EveryMatrix Press Releases7 days agoSlotMatrix unleashes divine riches in Fortuna Gold where gods rule the reels

-

Brazil7 days ago

Brazil7 days agoTG Lab unveils new Brazil office to further cement position as market’s most localised platform

-

Africa7 days ago

Africa7 days agopawaTech strengthens its integrity commitment with membership of the International Betting Integrity Association

-

Baltics7 days ago

Baltics7 days agoEstonian start-up vows to revolutionise iGaming customer support with AI