Canada

Exclusive Q&A with Robb Vecchio Managing Director of Jogo Global US

Jogo Global is one of the industry’s newest suppliers and is already making a name for itself. In the past month, the emerging platform provider and casino content developer announced two high-profile appointments, which highlighted the strong ambitions the company has for its future operations. Cashcade and Gaming Realms co-founder Simon Collins has become its new chairman, while the highly experienced Robb Vecchio joined as Managing Director of Jogo Global US.

Gaming Americas caught up with Robb Vecchio to understand more about what exactly Jogo Global has to offer and the company’s strategic plans for the US market.

Congratulations on your new role at Jogo Global US, Robb. What will be your initial focus over the coming months?

I’m really excited to have joined such an ambitious company. My key focus is to build the brand awareness of Jogo Global within the US casino industry and educate businesses about how our content, platforms and services will drive business growth. I’m very confident we have all the right assets and resources, and know we have a very talented team of highly experienced individuals that are developing quality products. I will be sure to tap into my digital rolodex over the coming months, as there’s a massive opportunity right now in the US as the landscape shifts from the land-based to online. We are in a unique position as a global omnichannel gaming company providing a wide range of services.

What are the types of services that Jogo Global offers in the US right now?

We can offer bespoke solutions, something that a lot of the main organizations within the industry cannot offer right now. Given that we’re a nimble and agile company, we can provide a personalised service and deliver a product that truly meets a customer’s requirements, which is very rare these days.

The localized approach is something I learned during my time at Video Gaming Technology (VGT). We successfully introduced a new foreign subsidiary, VGT Mexico, and turned it into a multi-million nationwide enterprise. That was very much driven by a localized product for the market’s needs. At Jogo, we have that ability at scale to develop bespoke content and platforms for our partners that match their individual requirements.

What can Jogo Global offer that’s different to what’s already available in the market, particularly compared to the main suppliers?

Having a scalable business is very important, even for start-ups. Companies want to know that a third-party provider can match their expectations and deliver a reliable service. We can prove that our offering is scalable to prospective new clients, which has been a driving force behind Jogo Global securing new commercial agreements both in the UK and US, which hopefully will be announced very soon. References and new customer wins are going to be key to truly establish ourselves as a business that is going places. Word of mouth is hugely valuable in helping a young company to position itself in the marketplace.

Secondly, our creative solutions have impressed a number of organizations that we’ve engaged with already. The unique overlay that our solutions can offer to their existing ecosystem is something that is highly advantageous to them.

Close relationships are key and that’s an area we’ll be working hard on to ensure partners get the best possible service. Those deep-seeded partnerships, almost like a family, go along way in this industry and help take a start-up to the next level.

In the US we’re seeing the digital iGaming industry accelerating at warp speed. Given your background in the land-based environment, how are you looking to support those companies in translating their content for online?

There’s a lot of potential in the legalized jurisdictions of both land-based and online gaming, particularly in the Class II category, which requires games to be associated as a form of bingo. Class II machines are heavily prominent in the Native American properties, and there’s an opportunity to adapt that type of content for online use.

Digital gaming has certainly grown, especially as Covid-19 forced venues to shut down and players naturally migrated to online sites. Online activity is likely to double over the next 12 months, and I think in the near future we’ll see smaller land-based casinos as a result, which only showcase the brand and top games, but eventually lead players to their online and mobile offering.

Can you give us an insight into your new business targets for the next few months?

Here in the US, we think more can be done to provide a better service to the tier 2 operators. Most of these operators aren’t being looked after properly, certainly when you compare the support that UK and European companies of a similar size receive from their suppliers, along with the big players in the industry. We have a great opportunity to showcase how nimble we are as a business and be more attentive to operators in their everyday needs. We look forward to maintaining our momentum and interest generated by attending the recent NIGA Conference and carrying it forward to the upcoming OIGA Conference later this month.

Powered by WPeMatico

Brightstar Lottery PLC

Brightstar Lottery Delivers Industry-Leading Sales Force Automation Solution to Ontario Lottery and Gaming Corporation

Brightstar Lottery PLC announced that it has deployed its Sales Wizard salesforce automation tool to the Ontario Lottery and Gaming Corporation (OLG). Brightstar’s powerful, cloud-based Sales Wizard easily integrates with OLG’s central system and equips sales representatives with actionable insights and compelling data to identify lottery retail opportunities and make every retail visit more effective.

“Brightstar’s Sales Wizard is enabling OLG’s sales force with digital access to actionable data while unlocking operational efficiencies so that our sales representatives can make the best use of every retail visit. Sales Wizard is highly configurable so OLG can leverage this product in a variety of ways to meet our evolving business needs,” said Vanessa Theoret, OLG Sr. Director Retail Sales & Account Management.

“OLG joins 24 other lotteries in using Brightstar’s Sales Wizard to help responsibly grow sales. Sales Wizard was designed to be a flexible, convenient tool for lottery sales representatives to work strategically with retailers, providing data, reports, and insights to understand sales trends and optimize as needed,” said Scott Gunn, Brightstar Chief Operating Officer North America Lottery.

Sales Wizard is the industry-leading sales force automation tool that provides sales teams with timely, relevant information and is available in user-friendly mobile apps for greater efficiency in the field. Currently supporting more than 148,000 retailers globally, Sales Wizard provides data and insights on sales, instant ticket inventory, instant ticket facings, point-of-sale equipment and signage, and much more.

Brightstar serves nearly 90 lottery customers and their players on six continents.

The post Brightstar Lottery Delivers Industry-Leading Sales Force Automation Solution to Ontario Lottery and Gaming Corporation appeared first on Americas iGaming & Sports Betting News.

Canada

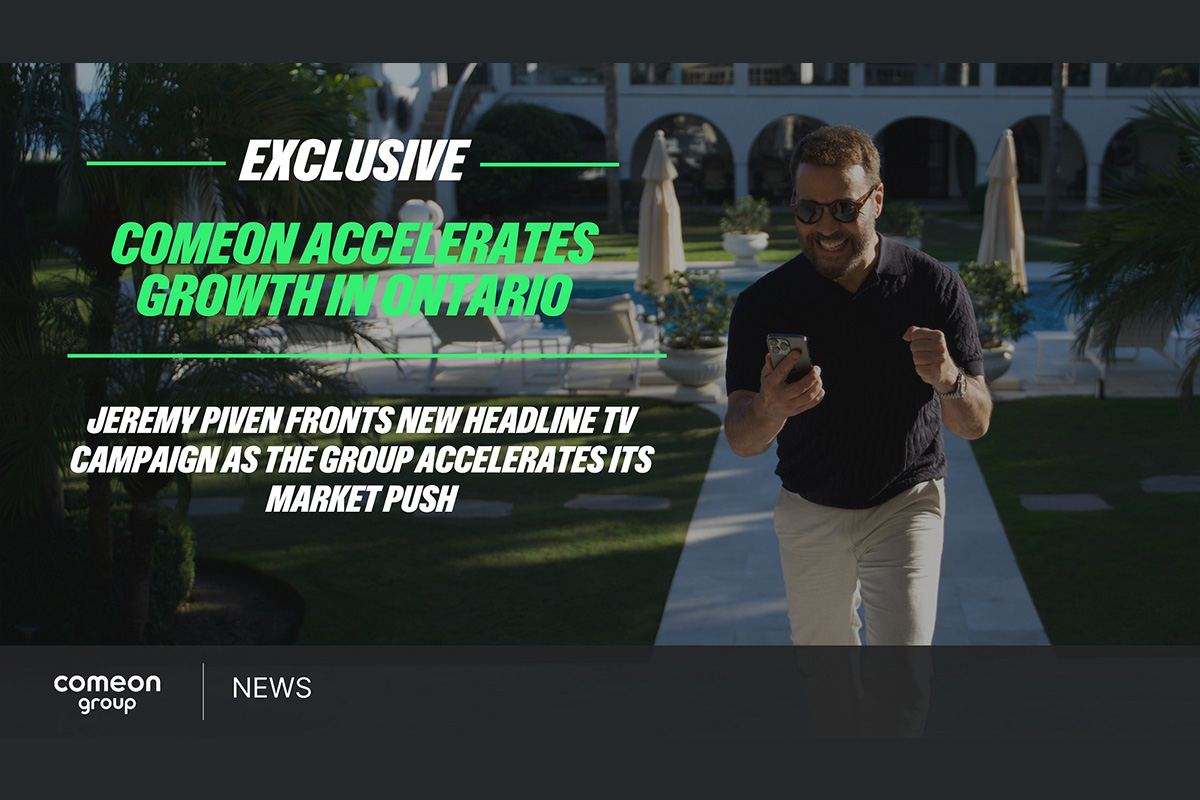

ComeOn Launches New Marketing Campaign in Ontario

ComeOn Group has launched its new marketing campaign in Ontario. The campaign underscores ComeOn Group’s long-term commitment to sustainable expansion – powered by ComeOn’s proprietary technology and a clear focus on delivering standout, personalized entertainment experiences at scale.

Since entering Ontario in 2022 with its licensed online casino offering, ComeOn Group has steadily built its presence in one of North America’s most competitive regulated markets. In late 2024, the Group reached a major strategic milestone with the launch of its full proprietary sportsbook in the province, expanding its product portfolio and strengthening its position as a full-suite iGaming operator.

The addition of sportsbook enables ComeOn to offer both casino and sports betting within a unified entertainment ecosystem. This expansion aligns with the Group’s broader global strategy to accelerate sportsbook growth, leveraging its in-house platform, trading capabilities, and risk management expertise to scale efficiently across regulated jurisdictions.

To support this next phase of growth in Ontario, ComeOn Group has shifted to an independent media planning model, activating a bold, high-frequency presence across Linear TV, Connected TV (CTV), and Digital channels. This approach reflects the Group’s product-led philosophy- pairing increased brand visibility with a seamless, personalized player journey powered by a robust, in-house technology stack built for performance and scale.

At the centre of the campaign is a series of premium television commercials starring Jeremy Piven, a long-standing ComeOn brand ambassador. Piven’s high-energy presence and authentic connection to sports reinforce the brand’s entertainment-first positioning, bringing ComeOn’s sportsbook experience to life across TV and digital. Produced by ComeOn Group’s internal creative hub, the campaign provides a cohesive creative platform that clearly differentiates the brand in a crowded market.

Efi Peleg, Chief Commercial Officer at ComeOn Group, said: “Ontario is a critical and highly competitive market for us. By shifting to independent media planning and activating a true 360-degree marketing mix, we’re not just increasing awareness – we’re demonstrating the strength of our proprietary platform and our ability to deliver a superior, personalised player experience. Our headline campaign, led by Jeremy Piven, brings our entertainment-first proposition to life and reflects our broader strategy of driving sustainable growth in key regulated markets through differentiated products and data-driven execution.”

The post ComeOn Launches New Marketing Campaign in Ontario appeared first on Americas iGaming & Sports Betting News.

Brooke Hilton Head of Casino at PointsBet Canada

Ezugi and PointsBet join forces to bring expanded live gaming to Ontario

Ezugi is excited to unveil a new collaboration with PointsBet, a leading iGaming operator in Canada.

As a division of Evolution since 2018, Ezugi keeps enhancing its foothold in the live gaming sector. This partnership will see Ezugi’s localized and unique live-dealer games incorporated into PointsBet’s online casino in Ontario through Evolution’s One Stop Shop (OSS) platform.

Established in Australia in 2015 and later branching into North America, PointsBet has quickly emerged as one of Ontario’s most rapidly expanding iGaming companies. Known for its cutting-edge sportsbook and growing casino offerings, PointsBet is committed to delivering an outstanding player experience, prioritizing Responsible Gaming to create a safe and secure space for every user.

Through this partnership, PointsBet Ontario customers will access Ezugi’s innovative live casino offerings, which include popular games like Canada Blackjack, EZ Baccarat, and Ultimate Roulette. These titles effortlessly integrate reliable, real-time live gaming with engaging digital elements that greatly attract North American players.

Brooke Hilton, Head of Casino at PointsBet Canada, said: “We’re excited to partner with Ezugi to bring their innovative live-dealer games to our Ontario players. This integration via Evolution’s platform enhances our casino offerings with dynamic, localised titles like Canada Blackjack and Ultimate Roulette, ensuring a premium, responsible gaming experience that aligns with our commitment to player safety and enjoyment.”

James Smith, Commercial Strategy Manager at Ezugi, said: “We are thrilled to team up with PointsBet in Ontario. We recognise Ontario as a key growth region and this partnership with a top tier operator marks an important step in our mission to bring Ezugi’s unique & exciting live casino content to the forefront for players in North America.”

The post Ezugi and PointsBet join forces to bring expanded live gaming to Ontario appeared first on Americas iGaming & Sports Betting News.

-

Games Global5 days ago

Games Global5 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Latest News5 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Amusnet5 days ago

Amusnet5 days agoWeek 4/2026 slot games releases

-

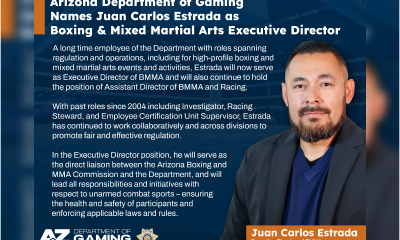

ADG6 days ago

ADG6 days agoArizona Department of Gaming Names Juan Carlos Estrada as Boxing and Mixed Martial Arts Executive Director

-

Anthony Dalla-Giacoma Chief Commercial Officer at Swintt6 days ago

Anthony Dalla-Giacoma Chief Commercial Officer at Swintt6 days agoSwintt Cruises the River of Fortune in Sun Wind Cash Boat

-

Anton Ivannikov CPO at Playson6 days ago

Anton Ivannikov CPO at Playson6 days agoPlayson’s Vegas Glitz Shines with Dual Bonus Features

-

Battle Royale6 days ago

Battle Royale6 days agoPrime Rush Goes Live in Early Access, Bringing a Brazil-First Mobile Battle Royale to Players

-

Agrupación de Plataformas de Apuesta en Línea6 days ago

Agrupación de Plataformas de Apuesta en Línea6 days agoBGC Enters Cooperation Agreement with Chile’s Online Operators’ Group