Bettormetrics

Prediction markets: The truth behind the hype

Research from Bettormetrics, the innovative sports analytics company, has shown that wagering returns from prediction markets broadly lag behind those offered by traditional sportsbooks as the disruptive marketplaces continue to boom.

As growth in the US online sports betting market begins to slow, prediction markets have emerged as one of the most closely watched developments in the history of American wagering. In a remarkably short period of time, platforms such as Kalshi and Polymarket have reached multi-billion-dollar valuations, attracted enormous traffic, and generated daily headlines for markets spanning everything from US elections to sporting events and pop-culture outcomes. Their rise has been accompanied by a growing sense that prediction markets represent something fundamentally different, and potentially disruptive, to the traditional online sports betting model.

Much of the fascination stems from how prediction markets are framed. They are often presented as purer, more transparent expressions of probability, driven by collective intelligence rather than bookmaker opinion. That ‘source of truth’ framing has made them a frequent reference point in media, finance, and political commentary, and has fuelled speculation – alongside a recent pullback in industry equities – about whether they could eventually challenge or even replace traditional sportsbooks. At the same time, the discourse has become muddled, with genuine advantages around access and market breadth often conflated with assumptions about superior pricing and fairness. Separating substance from hype is what makes prediction markets such a compelling topic of analysis right now.

How prediction markets differ from OSB – and why the exchange model is always useful

At their core, prediction markets differ from the majority of online sportsbooks in the US because they operate as exchanges. Instead of betting against a house that sets and manages prices, users trade contracts with one another, and prices move according to supply and demand. This legal structure has long been familiar in sports betting exchanges outside the US, notably in the UK, and in theory, it offers constant price discovery, reduced operator risk, and greater transparency.

However, decades of exchange history show that these advantages are highly conditional. Exchange pricing has tended to outperform sportsbooks only in very specific circumstances: in the most liquid markets, close to event start time, and in competitions that attract the greatest concentration of informed participants. Outside of those conditions, the exchange model does not magically produce better outcomes for the average user.

In practice, most retail users on exchanges, including prediction markets, are still takers, not price setters. Liquidity is provided predominantly by professional or semi-professional market makers whose role increasingly resembles that of a sportsbook. The exchange remains useful, not because it is a friendly peer-to-peer environment, but because it efficiently aggregates opinion and allows different types of participants to interact within a single pricing mechanism. That utility exists regardless of whether the end user is aware of who they are really trading against.

Will Prediction Markets always have better pricing than a sportsbook?

The liquidity problem has been well-discussed time and again as a valid rebuttal to the utility of sports betting exchanges. However, in this latest stars-and-stripes edition of the finance-ified betting model, it appears that even markets with bulletproof liquidity provide no better a prospect to the ordinary punter than they would already get at DraftKings or FanDuel.

Taking the very basic example of the pick ‘em market – where there is absolute consensus that there are exactly two equally-likely outcomes: heads or tails; yes or no; under or over. Classic sportsbook wisdom has always priced these markets at -110 in the American vernacular, or 1.91 in decimal. However, at Kalshi or Crypto.com you will instead see an equivalent wager offered in terms of a contract priced at $0.51; for each contract bought, a successful outcome will return $1.

At many of the new exchange platforms there are additional fees, whereas at DraftKings or FanDuel the price you see is the price you get. At Kalshi, the fees for any sports event contract are calculated using a particularly confusing formula equal to 7% of # of contracts x contract price x (1 – contract price). In the pick ‘em example, this equates to 0.07 x 1 x 0.51 x 0.49 = $0.017493. This must also be rounded up, so suddenly the $0.51 contract, which would ideally be $0.50, costs somewhere between $0.5275 and $0.53, depending on how many contracts are purchased. At Crypto.com, this fee is a flat $0.02, again giving a price of $0.53. At DraftKings? Well, that -110 bet is the equivalent of betting $110 to return $210. Or, $0.524 to return $1.

If this all feels somewhat opaque, the important point is that headline prices alone do not tell the full story. Once trading fees, commissions, and spreads are taken into account, the effective cost paid by the bettor can differ meaningfully across platforms. Table 1 below sets out a like-for-like comparison of representative prices and real costs across sportsbooks, exchanges, and prediction market operators.

| Price | Fees | Returns | |||||||

| Spend | Cost / $1 Payout | American Odds | Decimal Odds | Trading Fees | Commission | Win Return | Effective Cost / $1 | ||

| FanDuel | $100 | $0.5238 | -110 | 1.91 | $0.0000 | 0.00% | $190.91 | $0.5238 | |

| DraftKings | $100 | $0.5238 | -110 | 1.91 | $0.0000 | 0.00% | $190.91 | $0.5238 | |

| Sporttrade | $100 | $0.5050 | -102 | 1.98 | $0.0000 | 2.00% | $196.06 | $0.5100 | |

| Betfair Exchange | $100 | $0.5025 | -101 | 1.99 | $0.0000 | 2.00% | $197.02 | $0.5076 | |

| Kalshi | $100 | $0.5100 | -104 | 1.96 | $0.0175 | 0.00% | $189.58 | $0.5275 | |

| Crypto.com $1 | $100 | $0.5100 | -104 | 1.96 | $0.0200 | 0.00% | $188.68 | $0.5300 | |

| Crypto.com $100 | $100 | $0.5025 | -101 | 1.99 | $0.0398 | 0.00% | $184.40 | $0.5423 | |

| Polymarket | $100 | $0.5100 | -104 | 1.96 | $0.0001 | 0.00% | $196.04 | $0.5101 | |

Table 1:Representative prices, and real costs, for a 50:50 wager at various sports trading venues.

At these price points, prediction markets offer no systematic advantage over traditional sportsbooks. Despite their exchange-based structure, the effective cost paid by the bettor is no better than that available through state-licensed online sportsbooks.

The only exception is Polymarket. On its crypto-based platform, which is not available to US users and is restricted in a number of other jurisdictions, it operates without any fees or commission on trades. The new CFTC-licensed US platform is expected to launch with fees of just $0.0001 per contract. Crucially, Polymarket also employs a highly innovative approach to liquidity provision, actively incentivising retail participation through its “LP [Liquidity Provider] Rewards” mechanism. In selected markets, users are rewarded simply for providing liquidity on either side of the order book, rather than for directional risk-taking. As a result, the only meaningful cost to the ordinary bettor is typically the need to cross the spread – for example, accepting $0.51 rather than waiting for a match at $0.50.

The open question is whether this model is economically sustainable. The absence of trading fees, combined with active liquidity incentives, implies a material cost that must ultimately be borne somewhere in the system. While Polymarket’s backers may be comfortable supporting this phase of growth in the short term, it remains unclear how durable such economics are over time, particularly in light of the planned 2026 launch of the “POLY” token

Fanatics Markets, which is effectively a skin for Crypto.com with the added bonus of a unified wallet into Fanatics sportsbook, appear to be structuring their fee schedule in broad similarity to the rest of the exchanges. Similarly, it wouldn’t be a surprise should DFS+ operator Underdog follow suit in its Crypto.com partnership. However, it is as yet unclear how PrizePicks will manage a fee schedule over its agreement to host both Polymarket and Kalshi markets, which at present charge vastly different fees between them, on the same domain.

This picture should become more complete once FanDuel and DraftKings start gaining significant traction with their prediction offerings. Nonetheless, if Kalshi have set the mark already then it is tough to imagine that the traditional sportsbook duopoly will be too concerned about being forced into squeezing their margins.

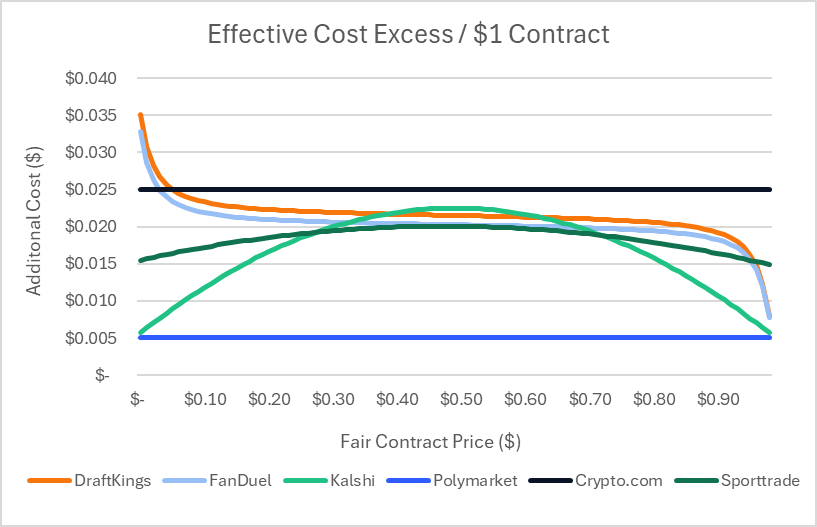

While Table 1 above focuses on a single, highly simplified 50:50 outcome, it is also useful to understand how these pricing differences scale across a broader range of markets. Figure 2 below illustrates the effective cost surplus paid per $1 contract across several major platforms, relative to a theoretical ‘fair’ price. In doing so, it highlights where fees, spreads and structural frictions accumulate – even when headline odds appear competitive.

The key takeaway here is that Crypto.com’s $0.02 fee is flat out expensive across the board and although Kalshi’s cost-based fee system reduces the additional expense at either end of the probability spectrum, the operator is still more expensive than the traditional bookmakers when an outcome is close to 50:50 (where the fair contract price is between $0.40 and $0.60). Sporttrade’s 2% commission – parallel to that we see in UK&I-facing exchanges – is far more manageable but the 2-4% spreads are currently keeping them from being truly competitive in this measure at present.

Making sense of the new swathe of data points

This is where prediction markets become relevant far beyond the individual bettor. Even when they do not offer superior value, the data they generate is uniquely informative. Prediction market prices function as real-time probability indicators, shaped by informed traders, professional liquidity providers, and rapid response to news. They offer a transparent window into collective expectation that sportsbooks, by design, tend to obscure. This is the source of truth that adds value to the world.

For operators, analysts, regulators, media, and financial observers, this data provides an additional layer of insight into how markets interpret risk and uncertainty. It can highlight sentiment shifts before they are fully reflected in sportsbook lines, reveal where opinion is fragmented, and expose where fees or liquidity constraints distort apparent probabilities.

With such wide-ranging datapoints, Bettormetrics aims to provide independent context around these emerging ‘sources of truth’ – analysing prediction market data alongside traditional sportsbook pricing, liquidity conditions and historical exchange behaviour to distinguish signal from noise. Rather than accepting the hype that prediction markets themselves represent a new “source of truth”, they play a key role in highlighting sentiment and broad market expectation, while offering significant advantages in market access despite certain structural limitations in their current guise. Prediction markets, as they exist today, are not a replacement for established models, but a powerful complementary data source. The real value of this augmented data only emerges when it is interpreted in context, and through the scale, experience and observability of a platform like Bettormetrics and its big data capabilities.

The post Prediction markets: The truth behind the hype appeared first on Americas iGaming & Sports Betting News.

-

Booming Games6 days ago

Booming Games6 days agoBooming Games and Live Play Mobile Launch “LivePlay™ Slots” with Exclusive Modo Debut

-

Arizona7 days ago

Arizona7 days agoArizona Department of Gaming Reports $44.9 Million in Tribal Gaming Contributions for the Second Quarter of Fiscal Year 2026

-

Affiliate Events6 days ago

Affiliate Events6 days agoTaking Off with N1 Partners at iGB Affiliate 2026 in Barcelona: Grand Final and a Helicopter for the N1 Puzzle Promo Winner

-

Affiliate Management6 days ago

Affiliate Management6 days agoN1 Faces: Daria Maichuk — “Communication as the Key to Strong, Effective Partnerships in Affiliate Marketing”

-

Affiliate Management6 days ago

Affiliate Management6 days agoN1 Faces: Daria Maichuk — “Communication as the Key to Strong, Effective Partnerships in Affiliate Marketing”

-

Affiliate Events6 days ago

Affiliate Events6 days agoTaking Off with N1 Partners at iGB Affiliate 2026 in Barcelona: Grand Final and a Helicopter for the N1 Puzzle Promo Winner

-

Global Expansion6 days ago

Global Expansion6 days agoProgressPlay Unveils Dual-Engine Strategy for 2026: Empowering Partners via Standalone and Sweepstakes Solutions

-

Carl Gatt Baldacchino Head of Account Management SlotMatrix3 days ago

Carl Gatt Baldacchino Head of Account Management SlotMatrix3 days agoSlotMatrix revives classic slot action with Crazy 777 U.S launch