Latest News

SCCG Announces Strategic Partnership with Magellan to Accelerate Global Treasury and Instant Payout Solutions for Gaming Operators

SCCG Management, a leading advisory firm in the global gaming industry, today announced a strategic partnership with Magellan, an intelligent cross-border treasury and payments platform.

Through this partnership, SCCG will support Magellan’s global distribution, go-to-market execution, and business development initiatives across regulated iGaming and sports betting markets, with an initial focus on the United States, Canada, Mexico, Brazil, Argentina, Australia, Asia, and key European jurisdictions.

Magellan delivers an end-to-end treasury platform designed to solve some of the most persistent operational challenges facing gaming operators expanding internationally: delayed player payouts, trapped capital, and inefficient cross-border settlement. By leveraging modern instant payment rails, intelligent FX routing, and a hybrid fiat-and-stablecoin infrastructure, Magellan enables operators to settle player withdrawals locally in minutes and repatriate revenue across borders in under 24 hours.

Unlike traditional payment processor workflows that rely on card rails and multi-day settlement cycles, Magellan provides operators with a single treasury platform that supports multi-currency collection, local instant payouts, dynamic FX conversion, stablecoin interoperability, and same-day reconciliation. The result is improved player retention, real-time visibility into cash positions, reduced FX exposure, and faster access to deployable capital across markets.

The partnership combines SCCG’s established presence and trusted relationships across global gaming markets with Magellan’s purpose-built treasury platform. SCCG will open doors to operators actively seeking solutions to payout speed, capital efficiency, and multi-currency complexity—while Magellan provides the infrastructure that transforms treasury from an operational bottleneck into a strategic advantage. This alignment allows both companies to address the market’s growing demand for instant settlement and real-time liquidity management at scale.

“Payments and treasury efficiency have become strategic differentiators for gaming operators operating across multiple jurisdictions,” said Stephen Crystal, Founder and CEO of SCCG Management. “Magellan has built a platform that directly addresses the operational reality operators face today—instant payouts, real-time treasury visibility, and faster access to capital without the friction of legacy settlement models. We’re excited to support Magellan’s global expansion and introduce this capability across our operator and platform partner ecosystem.”

Magellan’s platform is designed specifically for mid-to-large gaming operators that are too complex for consumer-grade payment tools and underserved by traditional global banks. In addition to fast settlement and transparent FX, the platform includes automated treasury workflows through an AI-driven intelligence layer that helps finance teams forecast liquidity needs, optimize cash deployment, and reduce operational overhead as they scale into new markets.

“The gaming industry has evolved faster than the financial infrastructure supporting it,” said Paiak Vaid, Founder and CEO of Magellan. “Operators expanding globally need treasury capabilities that match the speed and complexity of their business—not solutions built for a different era. Having worked across payments and gaming at scale, we’ve seen firsthand where legacy systems break down and what operators actually need to compete effectively. SCCG’s relationships and market knowledge accelerate our ability to reach operators who recognize that treasury modernization is a competitive advantage, not just a back-office function. This partnership allows us to deliver that transformation at the exact moment operators need it most.”

The partnership reflects a broader shift within the gaming industry toward infrastructure-level innovation focused on speed, transparency, and capital efficiency—particularly as operators expand across regulated markets with varying currencies, payout expectations, and banking frameworks.

The post SCCG Announces Strategic Partnership with Magellan to Accelerate Global Treasury and Instant Payout Solutions for Gaming Operators appeared first on Americas iGaming & Sports Betting News.

Dynabit Gaming

Dynabit Gaming and SOFTSWISS Game Aggregator Join Forces to Bring Fresh Slots to Operators

Nikita Keino, Head of Partnerships at SOFTSWISS Game Aggregator: “Our partnership with Dynabit Gaming perfectly showcases how the Game Aggregator’s technical performance and integration efficiency continue to be key factors for our partners. Dynabit’s lightweight, player-tested slots with flexible RTP and multi-currency support integrate seamlessly, allowing operators to deliver fast, engaging experiences without complexity.”

Vika Prudnyk, Chief Commercial Officer at Dynabit Gaming: “SOFTSWISS has built a strong reputation for reliability, scalability, and global reach, making it an ideal partner for Dynabit Gaming. Their aggregator enables our high-performing slots to reach both real money and social operators in key markets faster.”

The post Dynabit Gaming and SOFTSWISS Game Aggregator Join Forces to Bring Fresh Slots to Operators appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Adam Smart Director of Product Gaming at AppsFlyer

AppsFlyer State of Gaming Report: AI Is Flooding Mobile Gaming Marketing Channels and Raising the Cost of Standing Out

State of Gaming for Marketers 2026 reveals how AI-driven scale, global UA spend, and China-based publishers are reshaping mobile gaming competition

AppsFlyer, the Modern Marketing Cloud, today released the State of Gaming for Marketers 2026, an in-depth analysis of how AI, creative scale, and rising paid pressure reshaped mobile gaming marketing in 2025. Drawing on AppsFlyer data, the report examines how studios adapted as marketing activity expanded faster than player attention.

In 2025, AI-enabled production coincided with a sharp increase in advertising across iOS and Android. Creative output scaled rapidly across all spending tiers, with top gaming advertisers producing between 2,400 and 2,600 creative variations per quarter, up 25–30% YoY. That expansion increased pressure on paid acquisition channels. Paid install share rose 10% YoY across iOS and Android, while ad impressions increased 20%, indicating a significant rise in the number of ads competing for the same pool of players. To manage rising marketing volume and fragmentation, AI-enabled tools became a common part of daily workflows with 46% of AI assistant queries focused on reporting and performance breakdowns, reflecting the need for faster visibility as data volumes grew.

“AI has dramatically increased the speed and volume at which games and marketing assets reach the market,” says Adam Smart, Director of Product, Gaming at AppsFlyer. “The result is not a shortage of creativity, but a surplus of it. As paid activity and creative supply expand faster than player attention, marketing success depends on how effectively teams can measure, interpret, and act on an increasing volume of fragmented signals.”

Additional key insights from the State of Gaming for Marketers 2026

- Global gaming app UA spend reached $25B in 2025. Midcore UA spend increased 28% YoY on iOS, while Android spend remained largely flat.

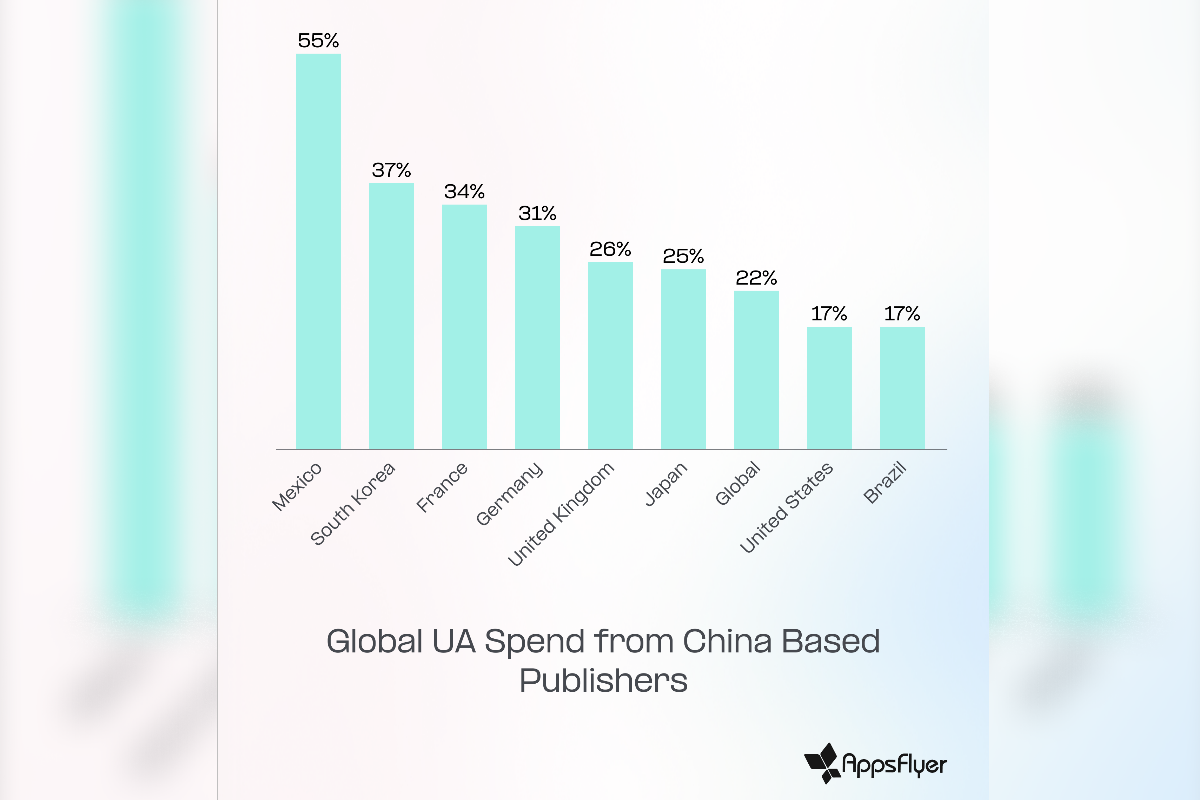

● China-headquartered publishers increased their share of global gaming UA spend. Their share grew by 26% YoY in the UK, and 22% globally, with gains strongest on Android.

● iOS paid installs reached record highs. Share in the UK rose across Casino (+13%), Hypercasual (+10%), and Midcore (+30%).

● iOS advertisers expanded media mix to find incremental scale. iOS gaming advertisers increased the number of media sources they used by up to 15% YoY, reflecting growing fragmentation and the need to diversify beyond core channels.

● AI is still used primarily to manage marketing scale, not strategy. With 46% of AI assistant queries focused on reporting and performance breakdowns, teams are using AI to keep pace with rising data volumes rather than replace decision-making, but some genres are already employing more complex tasks and asks.

Methodology

AppsFlyer’s State of Gaming for Marketers 2026 is based on anonymized, aggregated data from 9.6 thousand gaming apps worldwide, analyzing 24.8 billion total installs, including 14.1 billion paid installs, alongside ad spend, creative production, monetization, AI-assisted workflows, and media source usage across iOS and Android during 2025.

The full report is available at: appsflyer.com/resources/reports/gaming-marketers/

The post AppsFlyer State of Gaming Report: AI Is Flooding Mobile Gaming Marketing Channels and Raising the Cost of Standing Out appeared first on Americas iGaming & Sports Betting News.

Casino Content Strategy

Slot Game Portfolio Valuation and What High-Performing Content Means for Operator Valuations

Slot portfolios have moved from background assets to headline valuation drivers.

Content quality, consistency and player response now shape how gaming businesses are priced.

The way operator value is assessed has become more nuanced. Revenue still matters, but it no longer tells the full story. Attention has shifted toward what generates that revenue and how reliably it can continue to do so. Slot game portfolios now sit at the centre of that conversation.

If the content keeps players engaged without heavy intervention, confidence grows. That confidence influences how lenders, buyers and partners view long-term stability and growth potential.

Slot Portfolios Are No Longer Secondary Assets

Slot games generate a large share of casino revenue across most regulated markets. That reality has forced valuation models to evolve. Slot content is no longer treated as a supporting feature. It is viewed as a core operational asset.

When reviewing an operator, analysts now ask direct questions about slot performance. How concentrated is revenue around a small group of titles? How quickly do new releases gain traction? How stable is engagement across the year? These answers help determine whether earnings are sustainable.

In the first third of many valuation discussions, online slots appear alongside metrics like player retention and average revenue per user. That placement reflects how closely content performance is tied to perceived business strength.

What Separates High-Performing Slot Content From the Rest

A large library alone does not impress experienced evaluators. Performance matters more than volume. High-performing portfolios convert interest into repeat play and steady revenue over time.

Several traits tend to stand out:

- A mix of volatility levels that supports both casual and higher-value players

- Titles that remain relevant months after launch

- Smooth mobile performance that avoids friction

- Consistent technical reliability

When these elements are present, revenue patterns become easier to forecast. Predictability reduces perceived risk, directly influencing valuation outcomes.

This is where online slots play a defining role. They offer frequent engagement and repeat sessions that are easier to measure than one-off betting activity.

Content Diversity as a Risk Management Tool

From a valuation perspective, concentration risk is a red flag. Portfolios that rely too heavily on a narrow theme or a small group of titles can suffer sudden drops in performance.

Diverse slot libraries spread that risk. Different themes, mechanics and pacing styles attract different player types. If interest fades in one area, activity often shifts rather than disappears.

This diversification stabilizes revenue without the need for constant promotional pressure. That stability matters during due diligence. It signals that earnings are supported by structure rather than short-term incentives.

For many investors, a well-balanced online slots portfolio suggests disciplined content planning rather than reactive decision-making.

Player Retention Tells a Clearer Valuation Story

Retention has become one of the clearest signals of portfolio health. High-performing slot content keeps players returning because the experience feels rewarding and familiar.

When session frequency remains steady and average playtime holds, operating efficiency improves. Marketing spend stretches further. Margins become easier to protect.

Retention driven by slot play also strengthens cross-activity behaviour. Players who trust the slot experience are more likely to explore other offerings. This reinforces platform stickiness, which valuation models increasingly reward.

Repeated engagement with online slots often signals long-term value rather than temporary spikes in activity.

Why Buyers Look Closely at Slot Performance Data

During acquisition talks, slot data is rarely skimmed. Buyers want clarity. They want to know which titles carry weight and how performance changes over time.

Clear documentation makes a difference. Strong portfolios come with transparent performance histories, consistent contribution margins and evidence of player loyalty.

This clarity reduces integration risk. Content that already resonates with players tends to maintain momentum even when ownership changes. That continuity supports stronger pricing discussions.

In markets where online slots dominate revenue mix, content quality can outweigh short-term earnings swings when final valuations are set.

Long-Term Market Confidence and Content Quality

Positive sentiment around online casino gaming and sports betting continues to support content-led valuation models. Slot games, in particular, scale efficiently across regions and devices.

When platforms expand, slot libraries often deliver immediate engagement without complex onboarding. That ability reinforces confidence in future earnings.

Mentions of online slots in valuation commentary are no longer incidental. They reflect a broader shift in how value is understood. Content strength now acts as proof of operational maturity.

Why Slot Content Now Shapes Valuation Outcomes

The logic of valuations has evolved. Financial performance remains important, but the quality of content goes a long way toward explaining why companies with similar performance earn such different valuations, especially when revenue performance looks similar on paper.

Effective slot portfolios are stable, flexible and trusted by their players. These attributes carry as much weight as balance sheets because they indicate how well an operation can adapt to different market and patron demands.

The implications for operators with expansion and exit plans could not be clearer. High-quality slot content is not something that sits behind the scenes. It is perhaps the most obvious determinant of value and the key to building and maintaining investor confidence and sustainable performance.

The post Slot Game Portfolio Valuation and What High-Performing Content Means for Operator Valuations appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

16-Reel Slot7 days ago

16-Reel Slot7 days agoMighty Wild™: Gorilla Unleashed – Wazdan Scales New Heights in Jungle Series

-

Alex Lorimer6 days ago

Alex Lorimer6 days agoMega Mammoth – Multiplier Mayhem Charges into the Gaming Corps Portfolio

-

Arizona6 days ago

Arizona6 days agoArizona Department of Gaming Reports $44.9 Million in Tribal Gaming Contributions for the Second Quarter of Fiscal Year 2026

-

Argentina Gambling7 days ago

Argentina Gambling7 days agoBETER names Matias Tapia Gomez as LatAm Business Development Manager

-

Booming Games5 days ago

Booming Games5 days agoBooming Games and Live Play Mobile Launch “LivePlay™ Slots” with Exclusive Modo Debut

-

Big Hot Flaming Pots6 days ago

Big Hot Flaming Pots6 days agoBig Hot Flaming Pots: Tasty Treasures – Lightning Box Brings Land-Based Hit Online

-

Candy Crazed Pandas DoubleMax7 days ago

Candy Crazed Pandas DoubleMax7 days agoCandy Crazed Pandas DoubleMax: Reflex Gaming Unleashes Sweet, High-Volatility Chaos

-

Blask Index6 days ago

Blask Index6 days agoHow Venezuela’s iGaming market is reacting to US pressure