Latest News

Money and Mental Health Launches New Three-year Programme to Help Banks Tackle Gambling Harms

The Money and Mental Health Policy Institute, the charity founded and chaired by Martin Lewis, has launched the Gambling Harms Action Lab — a three-year programme working with current account providers to develop and implement new tools to address gambling related harm.

Nationwide is the first financial services firm to sign up to the programme, signalling the organisation’s support for a collaborative approach to addressing gambling harms

The programme, funded from a regulatory settlement approved by the Gambling Commission, will bring together a group of five to seven financial services firms for an 18-month period, to explore and address common challenges to improving support for people experiencing gambling harm.

This will include a focus on how improving support and outcomes for customers experiencing gambling harms can help banks meet their requirements under the Financial Conduct Authority’s Consumer Duty, which came into effect in 2023.

The Duty requires firms to take a more consumer-centred approach to banking. Money and Mental Health’s programme will support firms to develop and test new tools and interventions aimed at improving outcomes, with direct input from the charity’s Research Community of people with experience of mental health problems and gambling harms.

Nationwide has become the first financial services firm to join the Gambling Harms Action Lab programme, signalling its commitment to progress and improve its offering for tackling gambling harms and work alongside other banks in the sector to tackle this ongoing challenge.

The Money and Mental Health Policy Institute has also released new research, looking at gambling harms in Britain and the role of current account providers to support the launch of the new programme of work.

Shining a light: Exploring the role of financial services in tackling gambling harms finds that there is a huge gap between the number of people in need of support for gambling harms and the number of people regularly accessing these services.

The report also found that under the Consumer Duty framework, there is more action that current account providers can and should be taking to address gambling harms. The Gambling Harms Action Lab will support innovation and the roll out of new interventions to ensure firms are meeting their obligations under this new framework.

Helen Undy, chief executive of the Money and Mental Health Policy Institute, said: “Gambling problems can cause catastrophic harms for those affected by them. Financial services are in a unique position to help, and it’s been great to see the progress made in recent years — particularly with the introductions of gambling blocking tools, which almost every current account provider now offers.

“But there is still a lot more to be done. We want to work with banks and other financial services to share ideas, overcome the challenges that might exist to improve support for customers, and to spread best practice across the sector. The Gambling Harms Action Lab is an important opportunity for firms to help drive that progress, no matter how advanced they are or otherwise in this work.

“We’re delighted that Nationwide have come on board with the programme, and we’re urging more firms to get involved so that we can continue the momentum in tackling gambling harms that we’ve seen in recent years.”

Kathryn Townsend, Head of Customer Vulnerability and Accessibility at Nationwide said: “Greater collaboration is essential if we are to truly tackle financial harm caused by excessive or problem gambling. It’s great to see the Money and Mental Health Policy Institute leading the charge on this with the launch of its Gambling Harms Action Lab. We are delighted to be the first financial services organisation to sign up to it and look forward to working alongside them and the wider industry to make a positive difference to people’s finances, relationships and mental health.”

The post Money and Mental Health Launches New Three-year Programme to Help Banks Tackle Gambling Harms appeared first on European Gaming Industry News.

Champions League

Flashscore reveals data behind thrilling night of Champions League action

New data from Flashscore, the world’s leading platform for live scores and sports content, reveals that almost 34,000,000 users tuned in yesterday for one of the most dramatic nights in UEFA Champions League history.

The intensity of the matches generated a massive wave of digital engagement, with 18 matches all taking place at the same time on the final day of the league format.

From the football-mad streets of Brazil to the frozen research stations of Antarctica, fans across 239 countries and territories checked their phones as Benfica’s goalkeeper scored a 98th-minute header and Real Madrid crashed into the playoffs.

Martin Matejka, Marketing Director of Flashscore, said: “Yesterday wasn’t just a matchday; it was a global event and we were well prepared. When game-changing moments decide matches – from a goalkeeper’s stoppage-time header against Real Madrid to last-minute winners across Europe – the world doesn’t just watch, it reacts. Flashscore sent out over 700 million push notifications to our users as drama unfolded across the continent.

“Our data shows unprecedented engagement from all over the world, and I am glad we could bring these extraordinary moments to fans from Brazil to Antarctica.”

TOP MATCHES ranked by number of users

The drama at the Estádio da Luz dominated the global conversation, with nearly 10 million users following the Benfica-Madrid clash alone.

1 Benfica vs. Real Madrid (9,7M users): The undisputed main event. Fans flocked to the match detail as Benfica goalkeeper Anatoliy Trubin scored a historic 98th-minute header to seal a 4-2 win, sending Real Madrid to the playoffs.

2 Barcelona vs. FC Copenhagen (8,3M users): Massive interest as Barcelona thrashed the Danes 4-1 to secure direct qualification to the Round of 16.

3 Napoli vs. Chelsea (5,9M users): A rollercoaster in Naples. Chelsea fought back to win 3-2, eliminating Napoli despite a stunning “Maradona-esque” pirouette goal from Antonio Vergara.

TOP PLAYERS ranked by number of users

1. Jorginho (995K users): The Kairat Almaty midfielder trended globally after scoring a penalty against his former club, Arsenal, at the Emirates Stadium—a major talking point that drove nearly 1 million profile views.

2. Anatoliy Trubin (725K users): The unlikeliest hero. The Benfica goalkeeper’s stoppage-time header against Real Madrid sent his profile traffic into the stratosphere.

3. Andreas Schjelderup (368K users): The 21-year-old Norwegian announced himself to the world with a brace against Real Madrid.

4. Kylian Mbappé (317K users): Even in defeat, the superstar commanded attention and ranked 4th. He scored twice for Madrid, but his team’s collapse was the bigger story.

TOP TEAMS ranking by users:

1. Real Madrid (1,6M users): The “Kings of Europe” falling into the playoff round after a chaotic 4-2 loss drove massive traffic.

2. Benfica (1,1M users): The victors of the night. Their miraculous comeback and “goalkeeper goal” made them the second most-clicked team worldwide.

3. Barcelona (930K users): Solid interest as they cruised to victory and the next round.

Flashscore Global Reach

While Brazil was the single most active nation, the traffic was evenly split across continents: In Europe the huge engagement was driven by fans in Italy, France, Poland, United Kingdom, Spain, Portugal, and Germany.

Africa’s continent showed massive interest, led by Nigeria, Ghana, and Ivory Coast. Football fever also swept across Asia, with significant user numbers from Indonesia, Kazakhstan, South Korea, and Uzbekistan.

The obsession reached the most remote corners of the Earth. Flashscore recorded active users from Antarctica and Christmas Island, proving that even in the most isolated locations, fans refused to miss the drama.

The post Flashscore reveals data behind thrilling night of Champions League action appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Claire Osborne Managing Director of Interactive at Inspired Entertainment

Two new slots from Inspired — Coin Inferno Step ‘N’ Stack™ and Mummy It Up™

Inspired Entertainment, Inc. is thrilled to unveil the release of two entertaining online and mobile slots: Coin Inferno Step ‘N’ Stack and Mummy It Up

and Mummy It Up , in the UK and Maltese iGaming markets.

, in the UK and Maltese iGaming markets.

Inspired is excited to unveil the release of their new two slot games, broadening the popular Cash Bank series.

Coin Inferno Step ’N’ Stack introduces a fiery twist to traditional slot gameplay with a 3×3 reel setup, five heated win-lines, and casino-themed symbols amidst a background of a raging sea of flames. Central to the base game are Cash Collector symbols that gather visible cash values, generating excitement and forming a pseudo-progressive coin stack that remains on the reels, amplifying the thrill with each spin. The thrill intensifies with the Win & Spin Bonus, where locked collectors, expanding reel rows, and resettable spins merge to form an exhilarating, continually escalating chase for hot cash prizes. For gamers seeking greater control and increased volatility, Fortune Spins, Fortune Bet, Gamble, and Bonus Buy choices offer exciting opportunities to intensify the action and pursue potentially larger payouts.

Mummy It Up with Cash Bank immerses players in a realm of ancient Egyptian magnificence, showcasing glimmering gold and timeless enigma. Nestled within opulent palaces embellished with scarabs, favorable beings, and treasures fit for Pharaohs, each spin ignites a spirit of exploration and the quest for exhilarating Cash Bank victories. The game expands its well-liked Cash Collection features through Cash Bank Free Spins, pseudo-persistence Scarab collections, and a Wheel Bonus Game that can grant free spins, bonus entry, or access to one of four shining Prize Pots: Mini, Minor, Major, or Grand. The game is additionally improved with enjoyable character reel modifiers and customizable gameplay features like Fortune Spins, Fortune Bet, Bonus Buy, and Gamble choices.

Claire Osborne, Managing Director of Interactive at Inspired Entertainment, said: “Inspired is starting 2026 with strong momentum, and these two launches set the tone for the year ahead. Coin Inferno Step ’N’ Stack and Mummy It Up both deliver fun and big win excitement for players, while supporting sustained player engagement and strong performance for operators. With a roadmap packed full of exciting new content, Inspired is well positioned to drive continued growth across the iGaming landscape.”

The post Two new slots from Inspired — Coin Inferno Step ‘N’ Stack™ and Mummy It Up™ appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

ELA Games

Following ICE 2026 Triumph, ELA Games Officially Releases “Wealth of the East”

ELA Games is excited to announce the official B2B launch of Wealth of the East. The game, now accessible to partners, was initially introduced to the industry as the studio’s highlight during the three-day event in Barcelona, where it attracted the attention of numerous operators and aggregators because of its unique combination of slot mechanics and tabletop gaming.

The unique unveiling at ICE turned out to be a significant triumph, paving the way for the complete rollout. The ELA Games exhibit gathered industry representatives to engage with the game’s distinctive selling proposition: a twenty-sided Dice (D20) element that adds a tactile, physical sensation to digital slot gaming.

A Festivity of Wealth

The reels of Wealth of the East sparkle with the vibrant essence of an Eastern celebration. The gameplay is centered around the charming figure God Fu, a god of wealth serving as the Wild symbol in the game. He may arrive at any moment, and when he shows up, all Dice on the display spring to life, uncovering multipliers that enhance every coin visible or activate instant Jackpots. These empowered coins provide instant payouts, rewarding players as soon as they appear.

Sparking the Hold & Win Safe

The game showcases a visually impressive progression system crafted to uphold the festive theme and decorated with vibrant reds and golds. Every gathered coin also flies upward into the Golden Pot located above the reels, gradually enriching it with festive treasure that players can see and experience.

As the pot overflows, the screen bursts into red and gold as the Hold & Win game starts. Players receive 3 respins and a setup prepared to collect gold. In this intense feature, the elusive Imperial Lotus can appear, boosting multiple rewards simultaneously and elevating the entire round to new levels.

Game Stats:

● Reels: 5×3

● Lines: 10

● Max Win: x5,000

● Max Exposure: €250,000

● Buy Bonus: Yes

● Volatility: Mid

● RTP: 93.97% / 96.06%

Marharyta Yerina, Managing Director of ELA Games, commented: “Wealth of the East was the perfect title for us to showcase at ICE 2026. We took the classic t’Eastern Celebration’ theme and gave it a distinct twist with the God Fu character and his twenty-sided dice. It adds an original, tactile layer of excitement that players really respond to. The ‘Rising Pot’ visualizes the journey toward the bonus, keeping the excitement building spin after spin. We can’t wait for the industry to see the celebration in action.”

The post Following ICE 2026 Triumph, ELA Games Officially Releases “Wealth of the East” appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Games Global6 days ago

Games Global6 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Latest News6 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Amusnet6 days ago

Amusnet6 days agoWeek 4/2026 slot games releases

-

Asia7 days ago

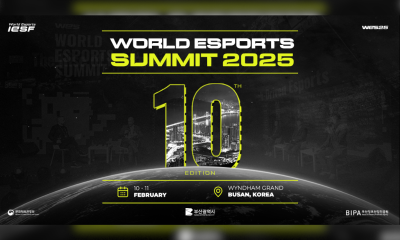

Asia7 days agoWorld Esports Summit Celebrates Its 10th Edition in Busan

-

AFCON 20257 days ago

AFCON 20257 days agoAFCON’s month of football did not lift iGaming demand — Blask data analysis

-

affiliate marketing6 days ago

affiliate marketing6 days agoN1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Compliance Updates6 days ago

Compliance Updates6 days agoDutch Regulator Outlines 5 Key Supervisory Priorities for 2026 Agenda

-

BetPlay3 days ago

BetPlay3 days agoBlask Awards 2025: Betano, Caliente, BetPlay, Betsson and others define Latin America’s iGaming landscape