Asia

Fintechs in Kazakhstan Raises Concerns Over Proposed Gambling Regulation

Fintech companies in Kazakhstan are urging greater scrutiny of a proposed law intended to regulate betting transactions in the country.

The submitted legislation, currently in its final reading, would form a monopoly entity, the Unified Accounting System (UAS), the firms said in a joint press release. The UAS would be used to determine market participants, process payments, maintain a single “electronic wallet” and make settlements with clients. A critical concern is that it could charge up to 1.5% in commissions on all market transactions, within a market where regulated transactions exceed KZT1.2tn ($2.6bn) annually.

Irina Davidenko, a spokesperson for Kazakhstan’s payments industry, commented: “The proposed legislation would be a step backwards for Kazakhstan, harming competition in the country’s vital payments sector and signaling to the outside world that necessary business reform is being driven by shadowy interests, rather than what’s right for industries and consumers.”

The proposal, partly billed as a public health move against problem gambling, resembles a previous initiative, the Betting Accounting Centre (BAC). It was shelved in 2021 after a scandal involving a deputy minister who was dismissed for accepting bribes from BAC lobbyists, according to the press release.

The lack of transparency on the UAS structure and ownership as outlined in the legislation is another aspect of the change that is seen by critics as troubling.

The reintroduction of a UAS model occurred as late as the second reading of the legislation. If passed by parliament, it will become law without the comprehensive impact analysis and scrutiny typical for such significant regulatory change.

Observers argue the new regulation duplicates existing regulatory functions already managed by Kazakh state bodies and was proposed without the cooperation of the National Bank of Kazakhstan. The central bank has previously developed its own reform proposal that avoids introducing a monopolistic entity.

Opponents further contend that the regulation could cause “significant economic damage”. National Bank of Kazakhstan representatives and the payments industry have sounded alarm bells, but the issues have not been adequately addressed, the press release added.

The concerned fintech and payment companies want the legislation to be reconsidered. They are advocating for it to be sent back to the lower house of the legislature for a full regulatory impact analysis and thorough examination to ensure that it does not adversely affect industry or the economy.

Ilya Efimenko, commercial director of the payment organisation PayDala, said: “I appeal to the Senators, who need to know the true purpose of why the UAS has made a comeback in the bill.

“This is a re-emergence of the ‘Betting Accounting Center’ (BAC), a strikingly similar entity that was withdrawn before, and behind which, as the deputy from the Amanat party Elnur Beisenbayev said, are the powerful forces of ‘Old Kazakhstan.’

“Before our eyes, a monopolist, a private operator, is being created. The emergence of monopolies such as the UAS threatens the principles of a Fair Kazakhstan. Now everything is being done to break the financial system of Kazakhstan, recognized by experts as one of the best in Central Asia.”

The post Fintechs in Kazakhstan Raises Concerns Over Proposed Gambling Regulation appeared first on European Gaming Industry News.

Asia

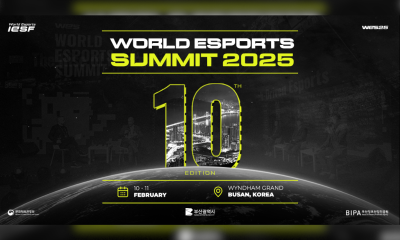

World Esports Summit Celebrates Its 10th Edition in Busan

The World Esports Summit returns to Busan, South Korea, for its 10th edition, taking place on 10–11 February 2025.

Hosted at the Wyndham Grand Busan, the Summit will bring together 40+ speakers from the international esports ecosystem, including representatives from federations, publishers, global brands, sports organizations, technology companies, and public institutions.

Over the past decade, the World Esports Summit has provided a platform for dialogue and cooperation among stakeholders shaping the world of esports. The 2025 edition will continue this role, offering space for discussion on current developments, industry challenges, and future directions.

The Summit will feature contributions from a wide range of organizations, including Alibaba, FIBA, FIFAe, Tencent, Moonton, NetEase, FIA, Sportradar, EFG, Good Game, Telekom, among others.

Across two days, participants will take part in keynote sessions and panel discussions addressing topics such as esports governance, international collaboration, industry development, integrity, and the continued convergence of esports and traditional sports.

Further information on the program, speakers, and registration is available on the official World Esports Summit website.

The post World Esports Summit Celebrates Its 10th Edition in Busan appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Asia

Insurgence Gaming Company Expands Grassroots Vision with MOBA Legends 5v5 Discord Play-Ins

Following the launch of its inaugural women-focused VALORANT tournament La Imperia, the Insurgence Gaming Company has announced its second competitive initiative, MOBA Legends 5v5 Discord Play-Ins, a series of open community tournaments created to make organised competition more accessible to emerging players.

While La Imperia introduced a visibility-led invitational format, the MOBA Legends 5v5 Discord Play-Ins take a different approach. The series is built around open participation and will be hosted entirely online, with all tournament operations managed through Discord. This allows teams from across India to compete in a structured setting without the restrictions often associated with invite-only events.

The Play-Ins are designed as a starting point for players and teams who want to experience organised competition. Matches will be played in a 5v5 MOBA Draft Pick format, with scheduling, match reporting, and communication handled through dedicated Discord channels.

The announcement continues Insurgence Gaming Company’s early focus on grassroots esports. The company was created to address gaps in India’s competitive ecosystem, particularly at the amateur and semi-professional level where consistent tournament opportunities are still limited.

Speaking on the launch, Jasper Shabin, Founder of the Insurgence Gaming Company, said: “With La Imperia, we focused on visibility. With the Discord Play-Ins, the focus shifts to access. Competitive players need regular places to play, improve, and test themselves, not just one-off tournaments. MOBA Legends 5v5 is one of the most accessible competitive titles on mobile, which makes it a strong fit for an open, community-driven format.”

Beyond competition, the Discord Play-Ins are also intended to build a sense of continuity. Players will have access to channels dedicated to match coordination, tournament updates, and post-game discussion, helping teams stay connected beyond a single tournament run.

With the MOBA Legends 5v5 Discord Play-Ins, the Insurgence Gaming Company continues to shape its identity around community-first formats, pairing visibility-led initiatives like La Imperia with open competitive pathways that support long-term grassroots growth in Indian esports.

The post Insurgence Gaming Company Expands Grassroots Vision with MOBA Legends 5v5 Discord Play-Ins appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

ALGS 2026 Championship

S8UL Esports secures historic top five finish at ALGS 2026 Championship; bags INR 1 crore in prize money

S8UL Esports, a global powerhouse in esports and gaming content, delivered a landmark performance by finishing among the top five teams globally at the Apex Legends Global Series (ALGS) 2026 Championship, held in Sapporo, Japan from January 15 to 18. This result represents the best ever finish by an Indian organization on the Apex Legends global stage, setting a new benchmark for Indian esports at the highest level of international competition.

The ALGS 2026 Championship, the crowning event of the Apex Legends competitive calendar, brought together 40 of the world’s most consistent and high-performing teams from the year-long global circuit. S8UL’s all-Australian roster featuring Rick Wirth (Sharky), Benjamin Spaseski (Jesko), and Tom Canty (Legacy), led by head coach Harrison Rogers (Rogers), delivered a standout campaign and emerged as the only South Asian team to secure a Top 5 finish at the premier international Apex Legends event. The team earned USD 120,000 (approximately INR 1 crore) from the tournament’s USD 2,000,000 (approximately INR 18.14 crore) total prize pool.

Commenting on the achievement, Animesh Agarwal, Co-founder and CEO, S8UL, said, “Over the years, we have built one of India’s strongest gaming creator ecosystems and a solid foundation in content. In the last 18 months, we have deliberately expanded our focus to global esports investments across multiple titles, and performances like this validate that vision. Our ambition is to compete and win at the highest level worldwide. We are investing deeply, assembling world-class international rosters, and representing S8UL on the global stage from India. A top five finish at ALGS is a major milestone, and it marks only the beginning of what we believe will be a very strong future for S8UL in esports.”

S8UL began their campaign in Group B, navigating a demanding round-robin stage where all 40 teams were divided into four groups of 10. The team’s consistent performances saw them finish among the top 20 teams, earning a spot in the Winners Bracket and keeping them firmly in title contention.

From there, S8UL qualified for the Grand Finals, where the remaining 20 teams competed under the high-pressure Match Point Format. Under this system, a team must reach 50 points and then secure a match win to claim the championship, with the remaining teams ranked by total points. Across nine final matches, S8UL accumulated 64 points to finish fifth overall, just one point behind fourth-placed GROW Gaming, underlining how closely contested the championship was.

“The margins at this level are extremely fine, and the team showed tremendous composure throughout the tournament. From the group stage through to the finals, the players displayed adaptability, trust, and resilience. Finishing in the top five globally is a major milestone, and it reinforces our confidence in this roster’s ability to contend for championships in the future,” commented Harrison Rogers, coach of S8UL’s Apex Legends team.

S8UL’s performance at the ALGS 2026 Championship builds on the organisation’s growing presence in international Apex Legends competition. In 2025, S8UL competed at the ALGS Midseason Playoffs as part of the Esports World Cup in Riyadh, where the organisation also became the first Indian team to be selected as a Club Partner for the tournament. With consecutive appearances at Apex Legends’ premier global events, S8UL continues to establish itself as a consistent contender on the world stage and a flagbearer for Indian esports internationally.

The post S8UL Esports secures historic top five finish at ALGS 2026 Championship; bags INR 1 crore in prize money appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Games Global6 days ago

Games Global6 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Latest News6 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Amusnet6 days ago

Amusnet6 days agoWeek 4/2026 slot games releases

-

AFCON 20257 days ago

AFCON 20257 days agoAFCON’s month of football did not lift iGaming demand — Blask data analysis

-

Asia7 days ago

Asia7 days agoWorld Esports Summit Celebrates Its 10th Edition in Busan

-

affiliate marketing6 days ago

affiliate marketing6 days agoN1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Compliance Updates6 days ago

Compliance Updates6 days agoDutch Regulator Outlines 5 Key Supervisory Priorities for 2026 Agenda

-

BetPlay3 days ago

BetPlay3 days agoBlask Awards 2025: Betano, Caliente, BetPlay, Betsson and others define Latin America’s iGaming landscape