Brazil

Where does the Sport of Kings fit into the Brazilian market?

With a regulated Brazil now in sight, Richard Duncan, Head of Business Development at racing odds and data provider PA Betting Services, assesses the potential for the sport to become a key product in this emerging market

With the last few months having seen Brazil’s sports betting bill clear all the hurdles needed to finally be signed into law, many in the sports betting world have understandably taken a keen interest in the possibilities offered by South America’s largest country.

The home of footballing greats Pelé and Ronaldo and boasting more World Cup titles than any other country, Brazil’s passion for and the resulting potential of football betting is clear. There are a number of parallels to be drawn between a market such as the UK and Brazil when it comes to football. For one thing, the similar level of devotion among the fan base looks set to ensure that football will easily remain the biggest betting turnover generator in Brazil, as it is in the UK.

What’s less clear is how likely racing is to come anywhere near the second place it holds in the UK market, where it accounted for 36% of remote betting turnover in the last set of official Gambling Commission statistics. However, there are a number of comparisons that can be made between the UK and Brazil when it comes to racing. For example, there’s a hardcore fraternity of racing fans and many more casual racegoers, those who are likely to view a day at the races as much in terms of the experience as the opportunity to have a flutter. Not to mention that Brazil boasts the third-largest horse population globally. The thoroughbred industry has been growing steadily since the 1990s, with notable group one winners such as Siphon, Sandpit and, more recently, Bal a Bali elevating the breed’s prominence.

But there’s a huge difference in the local availability of racing. While Brazil’s enormous size makes it the fifth largest country in the world and its population of more than 215 million makes it the seventh most populated, it has just four racetracks, albeit these are well-attended on race days. The UK, ranked 80th by land area and 21st by population, meanwhile, is home to 59 racecourses.

This disparity goes some way to explaining why football is taking the lion’s share of sports betting turnover in Brazil despite currently being unregulated, while racing takes a fraction of this even though it’s been legal for many years.

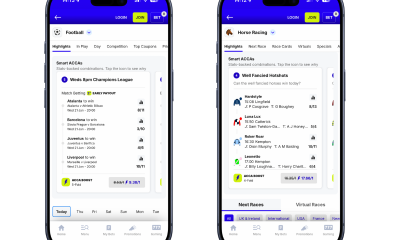

Online operators could be doing more to cash in on local racing than they currently are. The key to making the most of the Brazilian opportunity is educating the local population on the benefits of betting opportunities that the sheer volume of international races affords and cross-selling this to keen sports bettors.

Filling the gaps

Because while football is unlikely to lose its crown as the most popular sport among Brazilian bettors, the problem with football, NFL, basketball, MMA, golf, tennis and everything else, is that there are so many gaps in the schedule. And once the significant licence fees outlined in the new law have been paid, both local and foreign operators are likely going to need to optimise their product with as little downtime as possible in order to justify their investment.

Racing has the edge over all other sports because on a global basis there exists a full calendar where there is always something to bet on.

In the UK and Ireland we’ve already seen this approach used to great effect with the relatively recent introductions of North American, French, South African, Australian and Asian racing for domestic audiences. This secondary content does well as it lands in either prime leisure hours or is filler at weekends or for poor weather conditions. The increasing globalisation of racing was, in fact, one of the key reasons for our acquisition of Asian racing data provider iRace Media in the second half of last year.

In this respect, foreign operators, some of which have established a foothold in Brazil prior to a regulatory regime and are savvy with this approach used in established markets, may have an edge over others, simply because they’re experienced with the product.

Brazil is likely to be the same as any other fledgling market in the sense that if a company has just started offering a legal gambling product, they are likely going to have greater comfort in offering products to bet on that they are familiar with.

Mitigating the risk

In conversations our team has had with operators in emerging markets such as Brazil, Latam and Africa, the racing knowledge gap is an issue that’s come up repeatedly. They could easily integrate with a data provider such as ourselves from a technical perspective, but they may not fully understand the data they are looking at and some worry this leaves them overexposed.

There are a number of things that make racing more challenging than other sports to trade. For a start, the vernacular used in racing is not something that everyone understands if they’ve not been exposed to it before. In addition, a lot of operators fear racing because while they believe it can make them good money, they know there are people out there, professional punters and big racing syndicates, that know more about racing than their own traders.

This view is not unique to Brazil or even new markets, it’s something we also hear in our core markets and it possibly goes some way to explaining why new operators sometimes take every sport on offer before they get to racing. But inevitably, most take racing at some point because the volume on offer is too great to ignore. However, one recent shift worth mentioning is that more operators new to racing are opting for a platform partner or pricing partner to avoid being exposed to risks they aren’t comfortable with.

This is something that may be even more attractive to operators in emerging markets like Brazil given their lack of experience with global fixed odds racing to date. One thing that may work in their favour is that the country’s bettors would also appear to lack the maturity shown in established markets when it comes to the type of bets they are placing.

For instance, virtually all of the bets taken on football in Brazil are multis, which are bad for punters but which operators love as they are high margin and low risk. A diverse racing portfolio similarly has the potential to deliver high margins for operators and keep players engaged year-round, meaning the product could be just as successful in Brazil as it is in many more established markets.

Richard Duncan is Head of Business Development at PA Betting Services. He has been with parent company PA Media Group since 2002, with the bulk of his career having been spent working in its racing team.

Brazil

Esportes da Sorte launches “Summon the Fun” for Carnival 2026

Leading Brazilian iGaming company Esportes da Sorte has launched its national Carnival 2026 campaign, built around the messaging “There’s no doubt you’ll have fun” and the tagline “Summon the Fun.”

The campaign, which runs throughout February, employs a multi-platform strategy, with a presence on broadcast TV, radio, digital media and out-of-home (OOH) advertising. The objective is to expand reach and reinforce brand awareness during one of the most culturally significant periods in Brazil.

Beyond institutional positioning, the campaign organically integrates product communication into the creative narrative, connecting the platform to the Carnival experience lived both in the streets and through media content.

“Carnival is a central part of Brazilian culture and one of the most powerful expressions of our diversity. More than just talking about fun, Esportes da Sorte positions itself as an investor in popular culture, plurality and the experiences that make Carnival happen on the streets. We go beyond the platform: we seek to deliver an experience for the customer and contribute to the reveller’s experience, connecting brand, culture and entertainment in a genuine way,” says Marcela Campos, vice president of the Esportes Gaming Brasil Group.

The campaign is the result of a co-creation process directly involving the group’s marketing team, with creative development by the Brenda agency and media strategy conducted by the Avesso agency, both based in Recife. The concept uses Carnival as a territory of identity, encounter, and tradition to support the narrative of a brand that is strengthening itself in the field of popular entertainment, expanding its connection with different audiences and cultural expressions.

“The Esportes da Sorte campaign dives headfirst into this celebration where everything blends together: reality and fantasy, people from all corners of the world, colors, music, and endless movement. The proprietary illustrations reinforce the diversity of Brazil, its people, and the cities where Esportes da Sorte is present, creating a vibrant, popular, and unique identity within the segment,” explains Raphael Pinteiro, partner at Brenda.

The media plan prioritizes historically central Carnival destinations such as Recife, Olinda, and Salvador, while also including strategic insertions in markets like São Paulo and Rio de Janeiro, as well as capitals including Natal, Maceió, and Belo Horizonte. The combination of mass media and street-level formats increases presence and frequency throughout the Carnival period, reinforcing the brand’s connection with the festival and with Brazilian popular culture.

The post Esportes da Sorte launches “Summon the Fun” for Carnival 2026 appeared first on Americas iGaming & Sports Betting News.

Andre Medeiros

Greentube expands Latin American footprint with Brazino777 partnership

Greentube, the NOVOMATIC Digital Gaming and Entertainment division, has strengthened its presence in Latin America after partnering with Brazino777, an online casino and sports betting brand known for its player-first experience and fast withdrawals, to roll out a selection of its top-performing titles to the Brazilian market.

Following the agreement, Greentube’s platform is now live with Brazino777 in Brazil, marking an important milestone in the supplier’s regional growth strategy and reinforcing its commitment to delivering market-relevant content in newly regulated jurisdictions.

As part of the collaboration, Brazino777 players can enjoy some of Greentube’s most popular new releases, including Piggy Prizes :Wand of Riches

:Wand of Riches 2, Trinity Treasures

2, Trinity Treasures Wukong Buy Bonus, and Caichen Triple Blossom.

Wukong Buy Bonus, and Caichen Triple Blossom.

Alongside these titles, a curated selection of Greentube’s iconic classic games have also been integrated, including Book of Ra deluxe, Diamond Link

deluxe, Diamond Link : Mighty Sevens, and Cash Connection

: Mighty Sevens, and Cash Connection – Golden Sizzling Hot

– Golden Sizzling Hot .

.

These games were selected for their proven performance in regulated markets and their strong appeal to Brazilian players, making them an ideal fit for Brazino777’s growing casino offering.

Now, with Brazil’s regulated online gaming landscape offering fresh opportunities, the collaboration is well positioned to reach new heights as the region continues to thrive.

Greentube’s latest Brazilian partnership further reinforces its strategic focus on Latin America as a key growth market. With a diverse portfolio of innovative slots and well-established fan favourites, the company continues to strengthen its position as a leading supplier worldwide.

Wilson Francisco, Sales and Key Account Manage at Greentube, said: “Our launch with Brazino777 is a major step forward for our strategy in Brazil. Their deep understanding of the local audience, paired with Greentube’s commitment to delivering top-performing, culturally relevant content, is a powerful combination.

“We’re confident that this partnership will elevate the player experience and help set new standards in the market.”

Andre Medeiros, Country Manager for Brazil at Brazino777, said: “Greentube’s portfolio is recognised globally for its quality, performance and player appeal. As a brand rooted in Brazilian culture, Brazino777’s focus is simple: a fun, smooth experience our community can enjoy every day.

“Partnering with Greentube reinforces that promise by expanding the entertainment options available to our players in Brazil.”

The post Greentube expands Latin American footprint with Brazino777 partnership appeared first on Gaming and Gambling Industry Newsroom.

Andre Medeiros

Greentube expands Latin American footprint with Brazino777 partnership

Greentube, the NOVOMATIC Digital Gaming and Entertainment division, has strengthened its presence in Latin America after partnering with Brazino777, an online casino and sports betting brand known for its player-first experience and fast withdrawals, to roll out a selection of its top-performing titles to the Brazilian market.

Following the agreement, Greentube’s platform is now live with Brazino777 in Brazil, marking an important milestone in the supplier’s regional growth strategy and reinforcing its commitment to delivering market-relevant content in newly regulated jurisdictions.

As part of the collaboration, Brazino777 players can enjoy some of Greentube’s most popular new releases, including Piggy Prizes :Wand of Riches

:Wand of Riches 2, Trinity Treasures

2, Trinity Treasures Wukong Buy Bonus, and Caichen Triple Blossom.

Wukong Buy Bonus, and Caichen Triple Blossom.

Alongside these titles, a curated selection of Greentube’s iconic classic games have also been integrated, including Book of Ra deluxe, Diamond Link

deluxe, Diamond Link : Mighty Sevens, and Cash Connection

: Mighty Sevens, and Cash Connection – Golden Sizzling Hot

– Golden Sizzling Hot .

.

These games were selected for their proven performance in regulated markets and their strong appeal to Brazilian players, making them an ideal fit for Brazino777’s growing casino offering.

Now, with Brazil’s regulated online gaming landscape offering fresh opportunities, the collaboration is well positioned to reach new heights as the region continues to thrive.

Greentube’s latest Brazilian partnership further reinforces its strategic focus on Latin America as a key growth market. With a diverse portfolio of innovative slots and well-established fan favourites, the company continues to strengthen its position as a leading supplier worldwide.

Wilson Francisco, Sales and Key Account Manage at Greentube, said: “Our launch with Brazino777 is a major step forward for our strategy in Brazil. Their deep understanding of the local audience, paired with Greentube’s commitment to delivering top-performing, culturally relevant content, is a powerful combination.

“We’re confident that this partnership will elevate the player experience and help set new standards in the market.”

Andre Medeiros, Country Manager for Brazil at Brazino777, said: “Greentube’s portfolio is recognised globally for its quality, performance and player appeal. As a brand rooted in Brazilian culture, Brazino777’s focus is simple: a fun, smooth experience our community can enjoy every day.

“Partnering with Greentube reinforces that promise by expanding the entertainment options available to our players in Brazil.”

The post Greentube expands Latin American footprint with Brazino777 partnership appeared first on Americas iGaming & Sports Betting News.

-

BetPlay6 days ago

BetPlay6 days agoBlask Awards 2025: Betano, Caliente, BetPlay, Betsson and others define Latin America’s iGaming landscape

-

Canada6 days ago

Canada6 days agoComeOn Launches New Marketing Campaign in Ontario

-

iGaming6 days ago

iGaming6 days agoMajestic Claws Hold & Hit leaps into Spinomenal’s slots portfolio

-

Latest News6 days ago

Latest News6 days agoThrillTech partners with Nordplay Group to launch ThrillPots across Nordic-facing casino brands

-

DEGEN Studios6 days ago

DEGEN Studios6 days agoDEGEN Studios brings Wild West chaos to the reels with Sunset Showdown

-

bingo halls5 days ago

bingo halls5 days agoBingo Halls and Casinos in Colombia Increased Their Contributions to Healthcare System by 9.3% in 2025

-

Brightstar Lottery PLC5 days ago

Brightstar Lottery PLC5 days agoBrightstar Lottery Delivers Industry-Leading Sales Force Automation Solution to Ontario Lottery and Gaming Corporation

-

Compliance Updates4 days ago

Compliance Updates4 days agoFinland Govt Looks at Whether Scratchcards can be Gifted Again