Compliance Updates

Anger in the Industry After the Swedish Gambling Authority’s Acquittal of Infiniza

Last Friday, Di wrote about how the Swedish Gambling Authority closed an investigation into the Malta-based casino operator Infiniza, whose online casino, according to the authority’s assessment, is not aimed at Swedes. This is after the company changed the payment operator, i.e. who manages the transfer of gambling money from bank accounts to the casino, and the criteria that determine whether someone directs gambling at Swedes are not considered fulfilled.

Actions Did The Trick For Infiniza

“In light of the measures Infiniza Limited has taken regarding the company’s marketing as well as the payment options and/or payment service providers that were the subject of the current supervisory case, the Swedish Gambling Inspectorate assesses that the company, based on what emerged in the case, ceased to provide gambling aimed at the Swedish market without necessary license”

From the Gambling Authority’s decision that Infiniza review ceases, 21/2 2024.

Gustaf Hoffstedt, general secretary of the licensed gambling operators’ association The Swedish Trade Association for Online Gambling (Bos), is upset.

“It is offensive, and endangers the entire safety and security of the Swedish gambling license system,” he told Di about the Spelinspektionen’s decision, which he read about “with dismay” in Di.

According to Gustaf Hoffstedt, who refers to web traffic statistics that Di has taken part in, Infiniza is one of Sweden’s largest players in online casinos.

“They are estimated to have a significant operation in Sweden, in fact a large part of it is intended to receive Swedish consumers. It is of course extremely profitable, as they do not pay any Swedish gambling tax.”

The Swedish Gambling Authority’s decision has been made after Infiniza’s casinos changed their payment provider to one based in Lithuania. In the past, the Swedish-registered payment services Finshark and Zimpler reviewed by Di have been used.

“That’s exactly how it goes: if someone shines a spotlight on the fact that payment intermediaries ‘blue’ are not okay, payment intermediaries become ‘red’, then ‘green’, then ‘purple’ – and it goes on forever.”

Gustaf Hoffstedt calls for stricter legislation similar to that in the Netherlands, where it is forbidden to even accept domestic players – whereby more people play with the licensed players.

“The basic problem is the scope of the Swedish law, that is to say that unlicensed gambling companies are not explicitly prohibited from passively accepting Swedish players, provided that the company does not target them,” he says.

For several years, BOS has addressed the problem to both governments, investigators and the Gambling Authority and called for the Netherlands’ example to be followed, with the criminalization of passively accepting and enabling Swedish players.

However, the organization has cut stone in stone, and has not received a hearing for its proposal.

“The government does not want this. It claims that the channelization (the percentage of licensed gamblers, Di’s note) is good in Sweden, which unfortunately is not true, that the gambling market is stable, which is also not true, and that this is not a path that Sweden should follow.”

Marcus Aronsson, investigator at Spelinspektionen, told Di that the decision from last Friday only concerns Infiniza’s use of Zimpler, and that the just concluded case was already started in 2021.

He cannot comment on whether the payment company or companies used thereon means that Infiniza can be considered to target Swedes, nor whether a new review of the operator has been initiated after the Zimpler case.

In the decision, however, it is explicitly mentioned that the Swedish Gambling Authority can initiate a new supervisory case if Infiniza can again be considered to target the Swedish market without the necessary license.

ADG

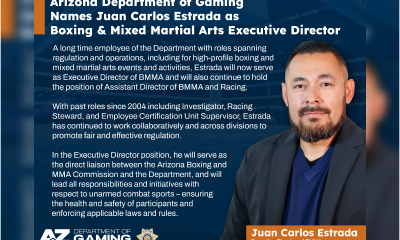

Arizona Department of Gaming Names Juan Carlos Estrada as Boxing and Mixed Martial Arts Executive Director

The post Arizona Department of Gaming Names Juan Carlos Estrada as Boxing and Mixed Martial Arts Executive Director appeared first on Americas iGaming & Sports Betting News.

Compliance Updates

Cyprus Betting Authority Deploys 150 Secret Agents to Conduct Raids on Betting Agencies

The Cyprus NBA is significantly ramping up its regulatory oversight for 2026. Raids on betting agencies are being carried out by “undercover” agents as part of stepped-up checks by the NBA to ensure compliance with the law.

The NBA has procured inspection services from the private sector, deploying 150 undercover agents who pose as customers and enter betting premises unannounced.

While on site, the agents monitor staff conduct, check whether illegal bets are being placed and verify that minors are not present.

Alongside these surprise visits, NBA officers also carry out on-site inspections and monitor betting websites used by hundreds of players, while inspections are also conducted to identify potential money-laundering activity.

The issues related to the violations of rules were raised during a meeting of the House Finance Committee, where an NBA representative said the Authority imposed fines totalling €46,000 last year.

Of that amount, €26,000 related to breaches linked to the lack of required licences, with the remainder stemming from the presence of minors on premises and other violations of the legislation.

At the same time, data submitted to parliament showed that bets worth €1.3 billion were placed last year, with players receiving €1.17bn in winnings.

Against that backdrop, and following an increase in the betting tax, state revenue from betting rose to €6 million, up from €3.2m a year earlier.

During the discussion, it was also noted that a draft bill has been pending at the Ministry of Finance for around a year.

The bill provides for new products and services, as well as enhanced safeguards for responsible gaming and the protection of minors.

A representative of the ministry clarified that there are no plans to introduce online casino games.

Expected revenue from betting activity is projected at €71.85m this year, an increase of 28.03 per cent, or €15.73m, compared with 2025.

Revenue is forecast to rise further to €75.27m in 2027 and €78.59m in 2028.

Breaking down the figures, betting tax is expected to generate €53m, licence fees €8.2m and betting activity contributions €10m.

Class A and Class B licence holders pay tax at a rate of 10 per cent on net betting earnings, with Class A covering land-based betting and Class B online betting.

In addition, €32m relates to betting tax on Opap’s Cyprus’ gross profits under the new contract, while licences for Class A and B operators, authorised representatives and premises are expected to bring in €2.8m.

A further €5m concerns Opap’s Cyprus’ licence fee and €0.4m its supervision contribution, also under the revised agreement.

The post Cyprus Betting Authority Deploys 150 Secret Agents to Conduct Raids on Betting Agencies appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Attorney General Andrea Joy Campbell

AG Campbell Secures Court Order That Will Block Kalshi from Offering Unlawful Sports Wagers in Massachusetts

Massachusetts Attorney General Andrea Joy Campbell released the following statement after securing a preliminary injunction in her lawsuit against KalshiEX LLC (Kalshi), a self-described online “prediction market”. The court’s order will allow a preliminary injunction to take effect, prohibiting Kalshi from accepting online sports wagers and related events contracts from Massachusetts customers until the company follows the state laws that govern sports gaming, including licensure by the Massachusetts Gaming Commission (MGC). The order also denied Kalshi’s motion to dismiss the AGO’s lawsuit filed against them in September 2025.

“The Court has made clear that any company that wants to be in the sports gaming business in Massachusetts must play by our rules – no exceptions. Today’s victory marks a major step toward fortifying Massachusetts’ gambling laws and mitigating the significant public health consequences that come with unregulated gambling, “ said AG Campbell.

In September, AG Campbell filed a lawsuit against Kalshi, alleging that the company uses an online “exchange” to offer sports wagering under the guise of “event contracts,” which allow bettors to place wagers connected to sports, such as the likelihood of a certain team winning a game or a certain player scoring a particular number of points. Kalshi’s platform offers “event contracts” on sporting events, including moneyline contracts, point spread contracts, and over-under contracts. These “event contracts” closely resemble sports wagers offered by licensed operators. The platform actively promotes its sports wagering offerings on television, social media, and online. Kalshi has neither applied for nor received a Massachusetts sports wagering license from the MGC, as required by law.

This matter is representative of AG Campbell’s ongoing efforts to combat the public health harms associated with sports betting and gambling, especially among young people. In June 2025, AG Campbell issued cease-and-desist letters to two online gaming operators for offering online gambling and betting products without obtaining a license. In March of 2024, AG Campbell announced the formation of the Youth Sports Betting Safety Coalition, a private-public partnership to raise awareness about the laws and risks surrounding youth online sports gambling.

The post AG Campbell Secures Court Order That Will Block Kalshi from Offering Unlawful Sports Wagers in Massachusetts appeared first on Americas iGaming & Sports Betting News.

-

Austria6 days ago

Austria6 days agoEU Court Ruling on Online Gambling Liability: Players Can Sue Foreign Operators’ Directors Under Their Home Country Law (Case C-77/24 Wunner)

-

Latest News6 days ago

Latest News6 days agoSKIP THE QUEUE WITH THE MIDNITE SHUTTLE: MIDNITE TEAMS UP WITH SNOOKER LEGEND TO OFFER FANS A FREE SHUTTLE SERVICE FROM ALLY PALLY STATION

-

Continent 8 Technologies6 days ago

Continent 8 Technologies6 days agoContinent 8 and CEO Michael Tobin claim number one spot in GamblingIQ’s global ‘Security 10’ rankings

-

000x7 days ago

000x7 days agoPragmatic Play Sweetens Slots with Sugar Rush Super Scatter and Massive 50,000x Wins

-

Latest News7 days ago

Latest News7 days agoXSOLLA LAUNCHES MERCADO PAGO IN URUGUAY GIVING DEVELOPERS ACCESS TO 60M+ ACTIVE USERS

-

10 Alebrijes Eternal6 days ago

10 Alebrijes Eternal6 days agoAmusnet Releases “10 Alebrijes Eternal” Slot

-

CGCC6 days ago

CGCC6 days agoADVISORY: ILLEGAL GAMBLING OPERATION USING FORGED COMMISSION CREDENTIALS

-

BetCity.nl6 days ago

BetCity.nl6 days agoBragg Gaming Group Signs Deal with SuomiVeto