Latest News

Notice of Kambi Group Plc Extraordinary General Meeting 2022

In terms of Articles 41 and 42 of the Articles of Association of the Company

NOTICE IS HEREBY GIVEN that that AN EXTRAORDINARY GENERAL MEETING (the “Meeting”) of Kambi Group plc, company number C 49768 (the “Company”) will be held on Thursday 30 June 2022 at 11.00 CEST at Kambi, Hälsingegatan 38, 113 43 Stockholm, Sweden, to consider the following Agenda. The registration of shareholders starts at 10.30 CEST.

Right to attendance and voting

- To be entitled to attend and vote at the Meeting (and for the purpose of the determination by the Company of the number of votes they may cast), shareholders must be entered on the Company’s register of members maintained by Euroclear Sweden AB by Thursday 9 June 2022.

- Shareholders whose shares are registered in the name of a nominee should note that they may be required by their respective nominee/s to temporarily re-register their shares in their own name in the register of members maintained by Euroclear Sweden AB in order to be entitled to attend and vote (in person or by proxy) at the Meeting. Any such re-registration would need to be effected by Thursday 9 June 2022. Shareholders should therefore liaise with and instruct their nominees well in advance thereof.

- To be entitled to attend and vote in person at the Meeting, shareholders must notify Euroclear Sweden AB of their intention to attend the Meeting by Thursday 9 June 2022 and can do so by (i) e-mail to Generalmeetingservice@euroclear. com or (ii) mail to: Kambi Group plc, c/o Euroclear Sweden AB, Box 191, SE-101 23 Stockholm, Sweden or (iii) by phone on +46 8 402 9092 during the office hours of Euroclear Sweden AB. Notification should include the shareholder’s name, address, email address, daytime telephone number, personal or corporate identification number, number of shares held in the Company, as well as details of any proxies (if applicable, in the case that the shareholder has appointed a third party representative to attend the Meeting in their stead). Information submitted in connection with the notification will be computerised and used exclusively for the Meeting. See below for additional information on the processing of personal data.

Shareholders’ right to appoint a proxy

- A shareholder who is entitled to attend and vote at the Meeting, is entitled to appoint one or more proxies to attend and vote on his or her behalf. A proxy need not also be a shareholder. If the shareholder is an individual, the proxy form must be signed by the appointer (or his authorised attorney) or comply with Article 126 of the Articles. If the shareholder is a corporation, the proxy form must be signed on its behalf by an authorised attorney or a duly authorised officer of the corporation or comply with Article 126 of the Articles.

- Proxy forms must clearly indicate whether the proxy is to vote in their discretion or in accordance with the voting instructions sheet attached to the proxy form. Your proxy shall vote as you have directed in respect of the resolutions set out in this notice or on any other resolution that is properly put to the meeting. If the proxy form is returned to the Company without any indication as to how the proxy shall vote, generally or in respect of a particular resolution, the proxy shall exercise their discretion as to how to vote or whether to abstain from voting, generally or in respect of that particular resolution (as applicable).

- Where the shareholder is a corporation, a document evidencing the signatory right of the officer signing the proxy form, must be submitted with the proxy form. Where the proxy form is signed on behalf of the shareholder by an attorney (rather than by an authorised representative, in the case of a corporation), the original power of attorney or a copy thereof certified or notarised in a manner acceptable to the Board of Directors must be submitted to the Company, failing which the appointment of the proxy may be treated as invalid.

- The original signed proxy form and, if applicable, other supporting documents (required pursuant to the above instructions), must be received by Euroclear Sweden AB no later than Thursday 9 June 2022 by (i) e-mail to Generalmeetingservice@euroclear .com or (ii) mail to: Kambi Group plc, c/o Euroclear Sweden AB, Box 191, SE-101 23 Stockholm, Sweden. Shareholders are therefore encouraged to submit their proxy forms (and other supporting documents, if any) as soon as possible.

- Proxy forms are available on the Company website under the General Meetings section.

- Aggregated attendance notifications and proxy data processed by Euroclear Sweden AB must be transmitted to and received by the Company by email at Mia.Nordlander@kambi .com not less than 48 hours before the time appointed for the Meeting and in default shall not be treated as valid.

Agenda

1. Opening of the Meeting

2. Election of Chairman of the Meeting

3. Drawing up and approval of the voting list

4. Approval of the Agenda

5. Determination that the Meeting has been duly convened

6. Election of two persons to approve the minutes

Special Business (Extraordinary Resolutions)

7. THAT the Directors be and are hereby duly authorised and empowered in accordance with Articles 85(1) and 88(7) of the Companies Act and Article 3 of the Articles, on one or several occasions prior to the date of the next Annual General Meeting of the Company, to issue and allot up to a maximum of 3,106,480 Ordinary ‘B’ shares in the Company of a nominal value of €0.003 each (corresponding to a dilution of 10% of total shares as at the date of the notice to the 2022 Annual General Meeting) for payment in kind or through a direct set-off in connection with an acquisition, and to authorise and empower the Directors to restrict or withdraw the right of pre-emption associated to the issue of the said shares. This resolution is being taken in terms and for the purposes of the approvals necessary in terms of the Companies Act and the Articles of Association of the Company. (Resolution a)

8. WHEREAS (i) at a meeting of the Board of Directors of the Company held on 30 March 2022, the Directors resolved to obtain authority to buy back Ordinary ‘B’ shares in the Company having a nominal value of €0.003 each; and

(ii) pursuant to Article 5 of the Articles and Article 106(1) (b) of the Companies Act a company may acquire any of its own shares otherwise than by subscription, provided inter alia authorisation is given by an extraordinary resolution, which resolution will need to determine the terms and conditions of such acquisitions and in particular the maximum number of shares to be acquired, the duration of the period for which the authorisation is given and the maximum and minimum consideration.

NOW THEREFORE the members of the Company resolve that the Company be generally authorised to make purchases of Ordinary ‘B’ shares in the Company of a nominal value of €0.003 each in its capital, subject to the following:

(a) the maximum number of shares that may be so acquired is 3,106,480 which is equivalent to 10% of total shares as at the date of the notice to the 2022 Annual General Meeting;

(b) the minimum price that may be paid for the shares is SEK1 per share;

(c) the maximum price that may be paid for the shares is SEK1,000 per share;

(d) the maximum aggregate number of shares that can either be i) issued and allotted under Resolution a and, ii) bought back under this Resolution b, shall not exceed 3,106,480; and

(e) the authority conferred by this resolution shall expire on the date of the 2023 Annual General Meeting, but in any case shall not exceed the period of 18 months, but not so as to prejudice the completion of a purchase contracted before that date. (Resolution b)

9. Closing of the Extraordinary General Meeting

Information about proposals related to Agenda items

Both extraordinary Resolutions, Resolutions a and b, were presented in their entirety to the Annual General Meeting held on 17 May, 2022 (which resolutions were referred to therein as resolutions m and n respectively), and obtained one majority of two required in terms of article 135 of the Companies Act (Cap 386), and in terms of Articles 48B.2(b) of the Articles of Association of the Company. To this end, this Extraordinary General Meeting is being convened within 30 days of the Annual General Meeting, in accordance with the aforementioned provisions of the Companies Act and the Articles, in order to take a fresh vote on the proposed extraordinary resolutions.

Agenda item 7 (Resolution a)

The objectives of the authorisation are to increase the financial flexibility of the Company and to enable the Company to use its own financial instruments for payment in kind or through a directed set-off to a selling partner in connection with any business acquisitions the Company may undertake or to settle any deferred payments in connection with business acquisitions. The market value of the shares on each issue date will be used in determining the price at which shares will be issued. For the purposes of Article 88(7) of the Companies Act, through this resolution the members of the Company are also authorising the Board of Directors to restrict or withdraw the members’ right of pre-emption that would normally entitle members to be offered the newly issued shares in the Company in proportion to their shareholding before such new shares are offered to third parties.

Agenda item 8 (Resolution b)

The Board of Directors proposes that the acquisition by the Company of its own shares shall take place on First North Growth Market at Nasdaq Stockholm or via an offer to acquire the shares to all members of the Company. Such acquisitions of own shares may take place on multiple occasions and will be based on market terms, prevailing regulations and the capital situation at any given time. Notification of any purchase will be made to First North Growth Market at Nasdaq Stockholm and details will appear in the Company’s annual report and accounts. Any resolution to repurchase own shares will be publicly disclosed. The objective of the buyback and transfer right is to ensure added value for the Company’s shareholders and to give the Board increased flexibility with the Company’s capital structure.

Following such buybacks, the intention of the Board would be to either cancel, use as consideration for an acquisition or transfer to employees under a company share incentive plan. Once repurchased, further shareholder and Bondholder approval would be required before those shares could be cancelled.

If used as consideration for an acquisition the intention would be that they would be issued as shares and not sold first.

Powered by WPeMatico

BOYLE Sports

BOYLE Sports deploys automated acca technology as bookmakers accelerate shift to pre-configured betting

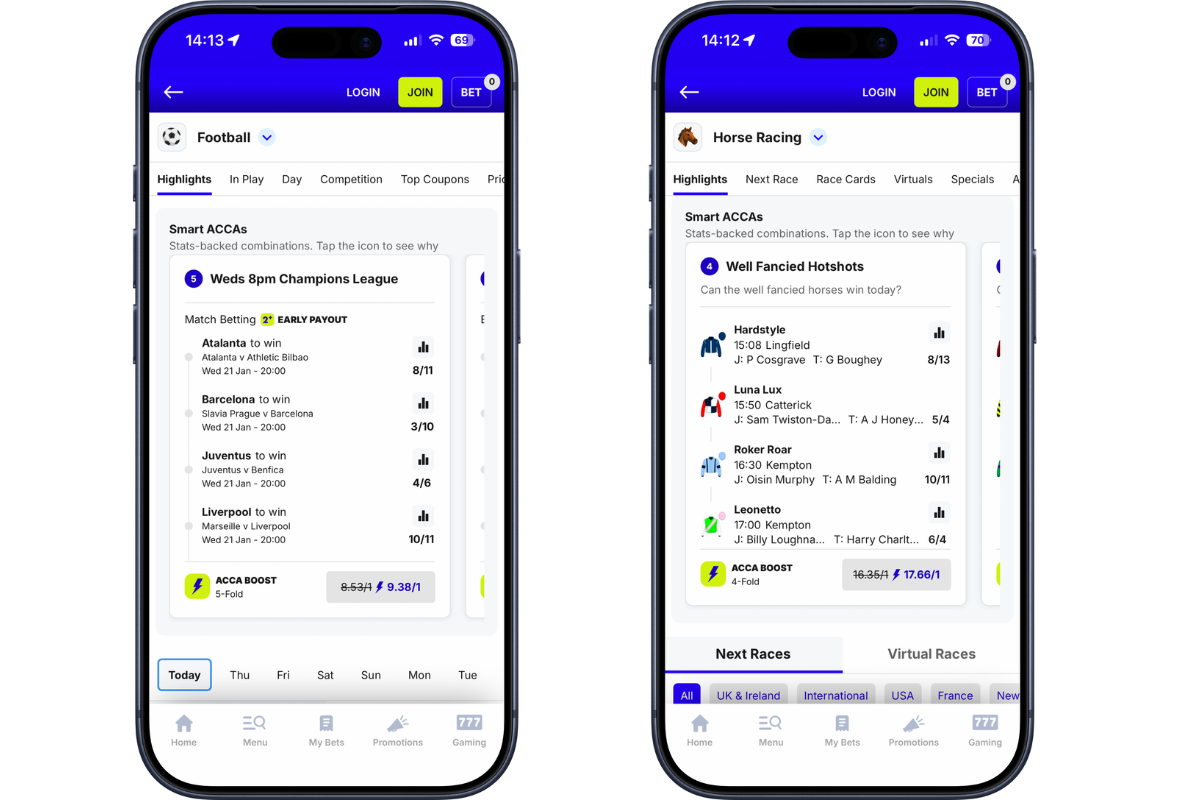

BOYLE Sports has become the latest major bookmaker to deploy automated accumulator technology, following a new two-year agreement with Checkd Dev that will see the operator roll out pre-configured, one-click acca products across football and horse racing.

The partnership sees BOYLE Sports integrate Checkd Dev’s Automated Betting System (ABS) into its sportsbook, enabling the automated creation and presentation of pre-match football and UK and Irish horse racing accumulator bets. The deployment forms part of a broader update to BOYLE Sports’ betting proposition, aimed at delivering scalable, consistent acca products while retaining full control over pricing and risk.

Through the integration, BOYLE Sports has launched two carousels containing packaged accumulator bets, generated using predefined logic and historical performance data. All pricing remains aligned with BOYLE Sports’ internal trading models, with probabilities informed by historic form rather than external odds feeds.

From an operational standpoint, ABS provides BOYLE Sports’ trading team with backend tooling to automate bet creation, updates, and settlement, significantly reducing manual intervention while supporting a consistent pre-match offering across key markets. The solution also integrates BOYLE Sports’ existing Acca Boost mechanics, available to customers from launch.

ABS is built on Checkd Dev’s proprietary BRUNO platform and has evolved over a two-year development cycle. Initially designed as a statistics-led conversion tool, the system has expanded into a fully automated betting solution in response to growing operator demand for scalable, pre-configured wagering products within regulated markets. The product is integrated with the operator’s front end and bet slip, resulting in a frictionless experience for end users.

The BOYLE Sports deployment follows a series of recent commercial agreements for Checkd Dev, including partnerships with Betfred, William Hill, and OpenBet. Collectively, these integrations reflect a wider trend among established bookmakers toward automation-led betting products designed to improve efficiency, consistency, and user experience across football betting.

Adam Matues, Head of Sportsbook at BOYLE Sports, commented: “Pre-configured accas continue to play an important role in how customers engage with football and racing, but they need to be delivered in a way that is both scalable and commercially robust. Checkd Dev’s automated approach allows us to expand our acca offering efficiently, while maintaining full control over pricing, performance, and risk.”

Andrew Grimshaw, Commercial Director at Checkd Dev, added: “We’re seeing increasing demand from tier-one and tier-two operators for automated betting products that enhance UX while remaining fully aligned with existing trading frameworks. BOYLE Sports’ decision to deploy our ABS reflects that shift, and we’re looking forward to supporting the team on both sports as the product scales over the coming seasons.”

The post BOYLE Sports deploys automated acca technology as bookmakers accelerate shift to pre-configured betting appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Knockout Poker League

Stretch Network Announces the Return of the Knockout Poker League with a €910,000 Prize Pool

Stretch Network is bringing back the Knockout Poker League (KPL), offering players an expanded schedule and a wide variety of tournaments designed to drive engagement. Following the strong performance and positive feedback from last year’s edition, the series features popular knockout formats to keep players active throughout the campaign.

The Knockout Poker League series will run across two separate seasons:

- Season 1: February 6 – March 1

- Season 2: March 13 – April 5

Tournament details

- Total guarantee: Over €910,000

- Leaderboards: Two tournament leaderboards with a combined prize pool of €10,000

Headliners

- Two Main Events with €50,000 prize pools each

- Two Mini Main Events with €8,000 prize pools each

- Two Omaha Main Events with €5,000 prize pools each

- Daily headliners with guarantees of up to €20,000

- Mystery Bounty and Mini Mystery Bounty tournaments, combining PKO and Mystery Bounty mechanics familiar to players

- Weekend Centroll tournaments with a €0.01 buy-in and a €2,000 guarantee, offering near-freeroll accessibility

With the latest platform releases and updates now live, KPL provides players with the opportunity to enjoy their favorite poker formats within a structured, long-running series. Stretch Network expects that this combination of proven formats and solid guarantees will support sustained engagement across its partner network.

The post Stretch Network Announces the Return of the Knockout Poker League with a €910,000 Prize Pool appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Carl Gatt Baldacchino Head of Account Management SlotMatrix

SlotMatrix Unleashes Fiesta-Fueled Thrills with Muertos Fortune

SlotMatrix, the leading global casino content aggregator, has incorporated Muertos Fortune into its unique collection, a vibrant slot drawing inspiration from the lively energy and festivities of Day of the Dead customs.

Muertos Fortune welcomes players to a vibrant realm filled with music and color, where each spin leads to grander moments and more exciting rewards.

The Money Collector function centers on the Muertos symbol that shows up on reel five, serving as the chief collector by retrieving cash values from piñata prizes positioned throughout the reels to enhance winnings and enable extra rewards.

A significant feature of the gameplay is its Perceived Persistence mechanic, enabling piñata rewards that fall uncollected to fill the giant skull above the reels.

As the skull fills up, it explodes, activating the Free Spins feature filled with Muertos’ collections, greater piñata values, and opportunities for several retriggers, transforming growing excitement into massive payout possibilities.

Muertos Fortune can only be accessed via SlotMatrix and is upgraded by EveryMatrix’s sophisticated gamification features, such as free spins, tournaments, and leaderboards. It can additionally be combined with EngageSuite, the all-in-one player loyalty solution.

Carl Gatt Baldacchino, Head of Account Management, SlotMatrix, said: “Muertos Fortune is all about the renowned Mexican tradition. It’s a vibrant, high-energy title that fits perfectly in our growing portfolio.”

The post SlotMatrix Unleashes Fiesta-Fueled Thrills with Muertos Fortune appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

-

Latest News7 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

affiliate marketing7 days ago

affiliate marketing7 days agoN1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

BetPlay4 days ago

BetPlay4 days agoBlask Awards 2025: Betano, Caliente, BetPlay, Betsson and others define Latin America’s iGaming landscape

-

AI gaming platforms7 days ago

AI gaming platforms7 days agoBetConstruct AI Sets the Tone for 2026 iGaming with Harmony Choice Event in Barcelona

-

affiliate marketing7 days ago

affiliate marketing7 days agoN1 Partners Takes Flight in Barcelona: Helicopter Awarded at iGB Affiliate 2026 Finale

-

iGaming4 days ago

iGaming4 days agoMajestic Claws Hold & Hit leaps into Spinomenal’s slots portfolio

-

Canada4 days ago

Canada4 days agoComeOn Launches New Marketing Campaign in Ontario

-

Latest News4 days ago

Latest News4 days agoThrillTech partners with Nordplay Group to launch ThrillPots across Nordic-facing casino brands