Betway

Super Group’s Betway become Official Sponsor of Stock Car Pro Series Brazil

Betway, has announced an exclusive partnership for the betting sector with Brazil’s touring car auto racing series, Stock Car Pro Series Brazil.

The deal is Betway’s first Motorsport sponsorship and will give the brand widespan TV exposure through the year, with each of the races broadcast on free-to-air channel Band and on SportTV.

Betway’s branding will be in-view at each of the racetracks for both fans who will be attending the series live for the first time since 2019 and for those at home watching on television.

Betway and Stock Car Pro Series will also be producing and delivering exclusive content that will be shared across their social media channels on each of the race days.

The twenty-four races series that will be divided into 12 stages, commences on 11 February at Autodromo Interlagos and concludes at the Aurodromo International Nelson Piquet over the weekend of 18 to 20 November.

Stock Car Pro Series will involve some of the world’s biggest motorsport names that include Stock Car Pro Series regulars such as Caca Bueno, Daniel Serra, Ricardo Mauricio, Thiago Camilo and Gabriel Casagrande alongside former F1 drivers Rubens Barrichello, Felipe Massa, Ricardo Zonta and Nelson Piquet Jnr.

Anthony Werkman, CEO of Betway, said:

“Our agreement with the Stock Car Pro Series in not only the Betway brand’s first in Motorsport but it’s also our first sports deal in the country of Brazil.

“The Stock Car Pro Series is one of the most supported and viewed sports in Brazil with it being broadcast on their free-to-air television channel Band.

“We’re excited by this partnership that will no doubt help grow our brand awareness in South America.”

Arthur Silva, Head of Marketing for Betway in Brazil, said:

“We are very happy to be together as sponsors of one of the biggest categories of Brazilian motor racing.

“We strongly believe that this sport, which is already the passion of many, still has great growth potential in Brazil.”

Fernando Julianelli, CEO of Stock Car Pro Series Brazil, said:

“We are very proud to have Betway as Stock Car Pro Series Sponsor.

“One of the world leaders in this segment, which has been constantly investing in major sports competitions and especially, that supports and defends the responsible gambling.

“We will be together with Betway, believing in the growth of this market in Brazil.”

Powered by WPeMatico

bet365

Blask Awards 2025: Betano, Bet365, Betway and others lead global iGaming

The global results of the Blask Awards 2025 mark a decisive shift in how leadership is defined in the iGaming industry. Instead of juries, submissions or sponsorship packages, the awards rely entirely on data, measuring real demand, competitive strength and scalable performance across regulated markets worldwide.

At the center of this year’s global rankings stands Betano, which emerged as the most consistently dominant licensed operator across multiple continents. But the broader picture is more complex: a market where leadership fragments by region, speed of growth matters as much as scale, and games increasingly outperform brands in cross-border reach.

“Data is the jury,” said Max Tesla, co-founder and CEO of Blask. “In Blask Awards, brands don’t compete with those who submitted a form, they compete with the entire market”

Global operator rankings

Across worldwide categories, Betano claimed a commanding share of top honors:

- Leader of the Blask Year, awarded to the operator with the highest total number of Blask Awards in 2025

- Top CEB Performer, recognizing the strongest aggregate revenue baseline across regulated markets

- Blask Index Leader, reflecting the highest cumulative demand across licensed geographies

- Demand Surge of the Year, for the single largest 30-day demand increase recorded globally

Other global distinctions highlight how varied leadership has become:

- Fastest-Growing Brand: MrQ, posting the strongest year-over-year growth in demand

- Baseline Breakout: LakiWin, delivering the fastest increase in revenue baseline

- Top #1 Footprint: betPawa, holding the largest number of #1 market positions globally

- The Monopolist: Singapore Pools, achieving the single highest market power concentration in a regulated market

Together, the results show that global leadership is no longer defined by size alone. Momentum, efficiency and consistency increasingly matter as much as footprint.

Games and providers: global reach beats local borders

If operator leadership fragments by geography, games tell a different story.

In provider and game categories, Pragmatic Play dominated the global rankings, driven by the extraordinary reach of Gates of Olympus 1000, which won: Operator Footprint Champion, Lobby Legend, Slot of the Year

Pragmatic Play also secured Largest Catalog Provider and Full-Shelf Takeover, reflecting unmatched breadth and distribution.

Other game-level winners highlight emerging dynamics:

- Game Demand Leader: Chicken Road by InOut Games

- Breakout Game of the Year: Roulette European by 7777 gaming

Crash Game of the Year: Aviator by Spribe

Unlike operators, games increasingly scale globally, with player preferences converging across continents.

A different kind of award — and a long-term play

Blask Awards operate without applications, fees, sponsorships or jury voting. Winners are identified algorithmically, using Blask’s proprietary metrics — including Blask Index, BAP and CEB — across regulated markets only.

“This isn’t about trophies,” Tesla said. “It’s about creating a shared, verifiable language for the industry: one where anyone can open the data and see why a brand won. We’re not stopping here. Each year, the coverage gets wider, the benchmarks sharper, and the comparison fairer.”

The post Blask Awards 2025: Betano, Bet365, Betway and others lead global iGaming appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Aviram Alroy

SCCG Management Names Aviram Alroy as New Head of iGaming

SCCG Management, the premier global advisory firm for the gambling and sports betting sectors, has announced the appointment of Aviram (Avi) Alroy as Head of iGaming.

A veteran executive with over 15 years of leadership in regulated markets, Alroy will lead SCCG’s iGaming strategy. His focus will be on helping operators, suppliers, and investors navigate the complex regulatory landscapes of North America, EMEA, and beyond.

A Track Record of Global Scale and Success

Alroy’s career is defined by his ability to take iGaming operations from inception to massive commercial success. He has a proven history of building high-performing teams and securing market access in some of the world’s most competitive jurisdictions.

Key Career Highlights:

-

Hard Rock Digital: Served as SVP of International Markets, where he spearheaded international expansion through organic growth and strategic M&A.

-

Digital Gaming Corporation (Betway): As VP of U.S. State Management, he managed state-by-state P&Ls and led the launch of high-ROI loyalty programs.

-

Mohegan Gaming & Entertainment: Spent nearly a decade as VP of Interactive Games. He was the architect behind the digital transformation of the Mohegan Sun brand, creating seamless omnichannel synergies between their brick-and-mortar resorts and online platforms.

-

Playtech: Began his iGaming career at the industry’s largest B2B software provider, managing key accounts across the EMEA region.

Strategic Vision for SCCG in 2026

In his new role, Alroy will leverage SCCG’s extensive international network—which includes offices in Europe, Africa, Asia, and Latin America—to provide clients with a “one-stop-shop” for global expansion.

“Aviram’s track record speaks for itself,” said Stephen Crystal, Founder and CEO of SCCG Management. “As SCCG continues to expand its iGaming advisory services globally, Avi’s experience across product, operations, and market access will be a tremendous asset to our clients.”

Alroy’s core focus areas at SCCG will include:

-

Market Entry & Licensing: Navigating the specific regulatory requirements of newly legalized U.S. states and international markets.

-

Product Positioning: Helping B2B suppliers tailor their content for maximum operator appeal.

-

Loyalty & CRM Optimization: Building retention engines that increase player lifetime value (LTV).

-

Omnichannel Engagement: Integrating digital gaming solutions with physical casino operations to drive cross-platform growth.

The post SCCG Management Names Aviram Alroy as New Head of iGaming appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Aviram Alroy

SCCG Management Announces Appointment of Aviram Alroy as Head of iGaming

SCCG Management, a leading global advisory firm specializing in gaming, sports betting, and iGaming, today announced the appointment of Aviram (Avi) Alroy as Head of iGaming. In this role, Alroy will lead SCCG’s iGaming strategy and advisory efforts, supporting operators, suppliers, and investors as they navigate regulated markets across North America and beyond.

Alroy brings more than 15 years of executive leadership experience across iGaming, sports betting, social casino, and e-commerce. He has launched and scaled multiple North American operations from inception to more than $75 million in revenue, with a proven record of securing market access, driving corporate development, and building high-performing teams in highly regulated environments. His expertise spans P&L management, product innovation, loyalty programs, omnichannel engagement, and both B2B and B2C growth strategies—consistently turning new market entries into profitable, scalable businesses.

Alroy served as SVP of International Markets at Hard Rock Digital, where he oversaw international expansion initiatives through organic growth and M&A, developed market-specific GTM strategies, and built operating structures and P&Ls across emerging and mature jurisdictions. Prior to that, he was VP of U.S. State Management at Digital Gaming Corporation (Betway), leading state-by-state strategy, operations, and marketing, managing market-level P&Ls, and launching loyalty programs and partnerships that delivered sustained ROI.

Earlier in his career, Alroy spent nearly a decade with Mohegan Sun as VP of Interactive Games, where he led online wagering, social, and mobile gaming initiatives, built e-commerce and digital marketing strategies, and created loyalty-driven synergies between online and brick-and-mortar operations across multiple jurisdictions. He began his iGaming career at Playtech, managing B2B account teams responsible for a significant share of annual revenue in the EMEA region.

“Aviram’s track record speaks for itself,” said Stephen Crystal, Founder and CEO of SCCG Management. “He has repeatedly demonstrated the ability to enter complex regulated markets, build winning teams, and scale operations profitably. As SCCG continues to expand its iGaming advisory services globally, Avi’s experience across product, operations, and market access will be a tremendous asset to our clients and partners.”

As Head of iGaming, Alroy will work closely with SCCG’s global team to advise on market entry, licensing and regulatory strategy, product positioning, loyalty and CRM optimization, partnerships, and M&A—helping clients accelerate growth while managing risk in an evolving regulatory landscape.

“I’m excited to join SCCG at a time when iGaming is entering its next phase of maturation and global expansion,” said Alroy. “SCCG has built a unique platform at the intersection of strategy, regulation, and execution. I look forward to working with Stephen and the team to help operators and technology providers build sustainable, scalable businesses in regulated markets.”

The post SCCG Management Announces Appointment of Aviram Alroy as Head of iGaming appeared first on Americas iGaming & Sports Betting News.

-

Games Global5 days ago

Games Global5 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Latest News5 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Amusnet5 days ago

Amusnet5 days agoWeek 4/2026 slot games releases

-

ADG6 days ago

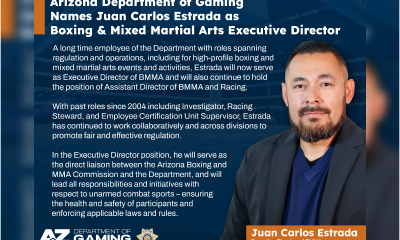

ADG6 days agoArizona Department of Gaming Names Juan Carlos Estrada as Boxing and Mixed Martial Arts Executive Director

-

Anthony Dalla-Giacoma Chief Commercial Officer at Swintt6 days ago

Anthony Dalla-Giacoma Chief Commercial Officer at Swintt6 days agoSwintt Cruises the River of Fortune in Sun Wind Cash Boat

-

Anton Ivannikov CPO at Playson6 days ago

Anton Ivannikov CPO at Playson6 days agoPlayson’s Vegas Glitz Shines with Dual Bonus Features

-

Battle Royale6 days ago

Battle Royale6 days agoPrime Rush Goes Live in Early Access, Bringing a Brazil-First Mobile Battle Royale to Players

-

Agrupación de Plataformas de Apuesta en Línea6 days ago

Agrupación de Plataformas de Apuesta en Línea6 days agoBGC Enters Cooperation Agreement with Chile’s Online Operators’ Group