Baltics

PRAGMATIC PLAY BRINGS ITS LIVE CASINO PRODUCTS TO LATVIA WITH ENLABS DEAL

Pragmatic Play, a leading content provider to the iGaming industry, is to offer its full suite of Live Casino products to customers of Optibet and other brands across Latvia belonging to Enlabs, part of Entain, the global sports-betting, gaming and interactive entertainment group.

Founded in 2005, Enlabs is a leader in the provision of gaming services across the Baltics and Nordics, notably under the Optibet brand. The renowned operator serves as a one-stop shop for all types of players, offering customers a comprehensive range of iGaming and sports betting products.

Pragmatic Play’s partnership with Enlabs marks the first time an operator has rolled out its Live Casino products in Latvia, enabling the provider to push its valued games collection further than ever before and cement its presence across both the Baltic and Nordic regions.

Customers of Enlabs’ brands will gain full access to Pragmatic Play’s Live Casino products, including ONE Blackjack, Mega Roulette, and Pragmatic Play’s two-card version of baccarat, Dragon Tiger.

Pragmatic Play’s esteemed Live Casino collection continues to go from strength to strength, going live with several prominent operators across Europe and Latin America in recent months, proving the brand’s expansion strategy to be most effective.

Marko Ilic, Vice President of Belgrade Operations at Pragmatic Play, said: “We are thrilled to be entering Latvia with one of its most respected and trusted operators as a partner.

‘Enlabs’ wide-reaching platform provides us with an incredible opportunity to push our latest and most valued Live Casino products, and we expect them to go down a treat with its customers.

Chris Davis, CPO at Enlabs, said: “Our priority is to ensure customers of all our brands benefit from the best choice and products in the market, where applicable through deals like this. Live Casino is hugely popular with our customers and these products will be an asset in our portfolio.”

Pragmatic Play currently produces up to five new slot titles a month, while also delivering Live Casino and Bingo games as part of its multi-product portfolio, available through one single API.

Powered by WPeMatico

Baltic Tech Week

HIPTHER Baltics Announces Riga Event and Strategic Partnership with LexLegas

HIPTHER is thrilled to reveal Lex Legas as a Strategic Partner for the HIPTHER Baltics conference series, which includes Vilnius, Riga, and Tallinn. The collaboration incorporates LexLegas’s extensive knowledge in cross-border regulation, compliance, and high-risk legal structures into the targeted Baltic series.

Updated Date for Riga – Baltic Tech Week

The date for the Riga conference has been officially updated to 11 May 2026 (instead of the previously stated 12 May). The conference will remain the inaugural event of Baltic Tech Week in Riga.

After a robust debut set for 21 April 2026 in Vilnius, and prior to the Tallinn edition later in the series, HIPTHER Baltics: Riga strengthens HIPTHER’s dedication to locally anchored, high-quality discussions throughout the Baltic region, uniting regulatory, legal, fintech, and gaming participants around the most significant issues.

A Tactical Alignment: Lex Legas

Lex Legas is a specialized legal consultancy and research-oriented legal brand focusing on iGaming, fintech, payments, AML/CTF, and international regulatory frameworks, emphasizing Baltic, EU, and high-risk regions.

Integrating practical legal experience with regulatory investigation and strategic guidance, Lex Legas collaborates closely with operators, payment processors, software vendors, and international advisors engaged in regulated and semi-regulated sectors. Their expertise spans:

- iGaming & betting regulation (EU & non-EU jurisdictions)

- AML/CTF frameworks, risk assessments, and compliance structuring

- Payment solutions, PSP integrations, and fintech regulatory analysis

- Licensing, corporate structuring, and operational legal support

- Regulatory trends, enforcement practices, and supervisory expectations

- Cross-border legal risk management for high-risk business models

“At Lex Legas, we work daily at the intersection of regulation, technology, and high-risk business models, exactly where today’s iGaming, fintech, and payments industries are being shaped.

HIPTHER Baltics stands out as a rare platform that goes beyond surface-level discussions and creates space for real, jurisdiction-specific conversations around compliance, licensing, player protection, and operational risk.

Partnering with HIPTHER for the Baltics series feels like a natural extension of our mission: translating complex regulatory frameworks into practical, business-ready solutions. We’re excited to contribute our research-driven perspective and hands-on experience to the dialogue in Vilnius, Riga, and Tallinn, and to help shape meaningful cross-border discussions across the region in 2026” – The Legal Experts of “Lex Legas” Team

HIPTHER Baltics 2026 – Three Capitals, One Vision

The HIPTHER Baltics series brings HIPTHER’s signature focus on regulation, compliance, fintech, and innovation to the heart of the Baltic region through three targeted, one-day conferences each hosted in a Baltic capital and built around locally-relevant themes with regional and cross-border impact.

“HIPTHER Baltics is built as a focused conference series for the region — not just a one-off event. From Vilnius to Riga and Tallinn, our goal is to create a high-level platform where regulators, legal experts, fintech leaders, and gaming stakeholders can connect around the real topics shaping the market: compliance, licensing, payments, player protection, and cross-border operations.

That’s why partnering with Lex Legas feels like a perfect match. Their research-driven approach and hands-on expertise in iGaming, fintech, and regulatory frameworks across the Baltics and beyond brings exactly the depth and clarity we want to deliver through the entire series. We’re proud to welcome them as a Strategic Partner and look forward to building meaningful, practical conversations together in 2026.” — Zoltan “Hawkie” Tundik, Co-Founder & Head of Business, HIPTHER

More information & tickets: https://hipther.com/events/baltics/

The post HIPTHER Baltics Announces Riga Event and Strategic Partnership with LexLegas appeared first on Eastern European Gaming | Global iGaming & Tech Intelligence Hub.

Baltics

DATA.BET Now Powers Esports for Entain NCE Across Baltics & Nordics

Reading Time: 2 minutes

DATA.BET, a leading sportsbook solution supplier, has signed a content deal with Entain NCE, to strengthen the esports betting offer of their brands (Optibet and Klondaika) across the Baltics and Nordics – with Estonia as a key rollout market.

Through the collaboration, Entain and its portfolio of brands will receive DATA.BET’s premium esports coverage. The package includes a comprehensive Odds Feed, Risk Management, Bet Builder and a suite of engagement Widgets – Pitch Tracker (interactive 2D map), Scoreboards (visual representation of player statistics), live Video Streaming, Statistical Widgets (team history and game stats) and a Multi Widget that unites all these tools within one screen. The partnership is designed to help Entain brands and their clients increase profitability in esports by combining precise pricing and risk controls with engagement tools that lift turnover and margin.

With the deal, Entain’s customers get access to DATA.BET’s 30+ disciplines and over 10,000 monthly events, delivered with a down-to-the-second bet delay across leading titles such as Counter-Strike 2, Dota 2, Valorant, League of Legends and others. A phased expansion of additional disciplines and features will follow to meet Entain’s demand.

“This partnership sets a high bar for product excellence. Our role is to power that ambition with an esports layer that’s rich in content and strong on risk, enabling consistent margins and a best-in-class customer experience. We’ve aligned on a clear roadmap to scale, with more Entain brands scheduled to join the rollout next,” said Otto Bonning, Head of Sales at DATA.BET.

“We are thrilled to partner with DATA.BET who are renown for being the leading Esports provider and who share the same passion and commitment for Esports as we do. DATA.BET’s deep understanding of the esports ecosystem and its growing influence among modern audiences makes the collaboration a perfect fit. Together, we aim to elevate esports and deliver the best experience and entertainment to the fans across Baltics and Nordics regions,” said Hendrik Ahuna, Director of Sportsbook at Entain NCE.

The post DATA.BET Now Powers Esports for Entain NCE Across Baltics & Nordics appeared first on European Gaming Industry News.

Baltics

SYNOT Games Announces Strategic Partnership with Boost Casino

Reading Time: 2 minutes

In a move that further reinforces its footprint across regulated European markets, SYNOT Games has announced a new partnership with Boost Casino, a prominent platform in Estonia. The collaboration brings certified SYNOT titles, including some of the studio’s latest and most innovative releases, to the casino’s rapidly growing grid.

Players on Boost Casino can now enjoy brand-new titles such as the mystical Respin Multi Joker, 40 Coins of Chance, or Rio Mystery Night. These additions expand Boost Casino’s offering with a spectrum of engaging mechanics, premium design, and mobile-first performance, ensuring the highest-quality entertainment for the Estonian audience.

The agreement is part of SYNOT Games’ strategic initiative to solidify its presence in licensed, regulated markets, providing innovative content through partnerships with established and trusted regional operators.

Martin Krajčí, Chief Commercial Officer at SYNOT Games, said: “We are excited to bring our portfolio to Estonian players through this strategic alliance with Boost Casino. Estonia represents a market with great potential and an audience that appreciates quality, variety, and innovation. Boos Casino’s agility and commitment to delivering premium entertainment make them an ideal partner for our continued Baltic expansion.”

Boost Casino, known for its user-centric approach and cutting-edge platform, views the addition of SYNOT Games content as a key enhancement to its offering and a testament to its mission of hosting best-in-class gaming experiences.

Janis Bariss, Head of Gaming, Entain Baltics & Nordics at Boost Casino, said: “Teaming up with SYNOT Games is an exciting opportunity to enhance our content library with vibrant, engaging titles that truly connect with today’s audience players. Their blend of storytelling, striking visuals, and proven game performance perfectly complements our vision for the future of digital gaming in Estonia.”

This collaboration not only empowers Boost Casino to further differentiate its portfolio but also underscores SYNOT Games’ long-term commitment to regulated growth, responsible gaming and working exclusively with trusted local operators—a model increasingly valued by players and regulators.

The post SYNOT Games Announces Strategic Partnership with Boost Casino appeared first on European Gaming Industry News.

-

Games Global6 days ago

Games Global6 days agoGames Global and Stormcraft Studios extend the supernatural franchise with Immortal Romance: Sarah’s Secret Power Combo

-

Latest News6 days ago

N1 Partners Hosts the N1 Puzzle Promo Grand Final and Reveals the Helicopter Winner at iGB Affiliate 2026 in Barcelona

-

Amusnet6 days ago

Amusnet6 days agoWeek 4/2026 slot games releases

-

Anthony Dalla-Giacoma Chief Commercial Officer at Swintt7 days ago

Anthony Dalla-Giacoma Chief Commercial Officer at Swintt7 days agoSwintt Cruises the River of Fortune in Sun Wind Cash Boat

-

ADG7 days ago

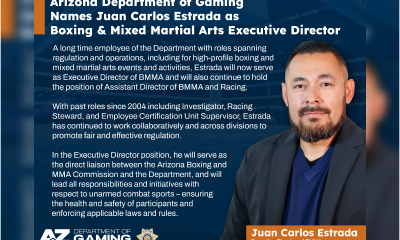

ADG7 days agoArizona Department of Gaming Names Juan Carlos Estrada as Boxing and Mixed Martial Arts Executive Director

-

Anton Ivannikov CPO at Playson7 days ago

Anton Ivannikov CPO at Playson7 days agoPlayson’s Vegas Glitz Shines with Dual Bonus Features

-

Battle Royale7 days ago

Battle Royale7 days agoPrime Rush Goes Live in Early Access, Bringing a Brazil-First Mobile Battle Royale to Players

-

Attorney General Andrea Joy Campbell7 days ago

Attorney General Andrea Joy Campbell7 days agoAG Campbell Secures Court Order That Will Block Kalshi from Offering Unlawful Sports Wagers in Massachusetts